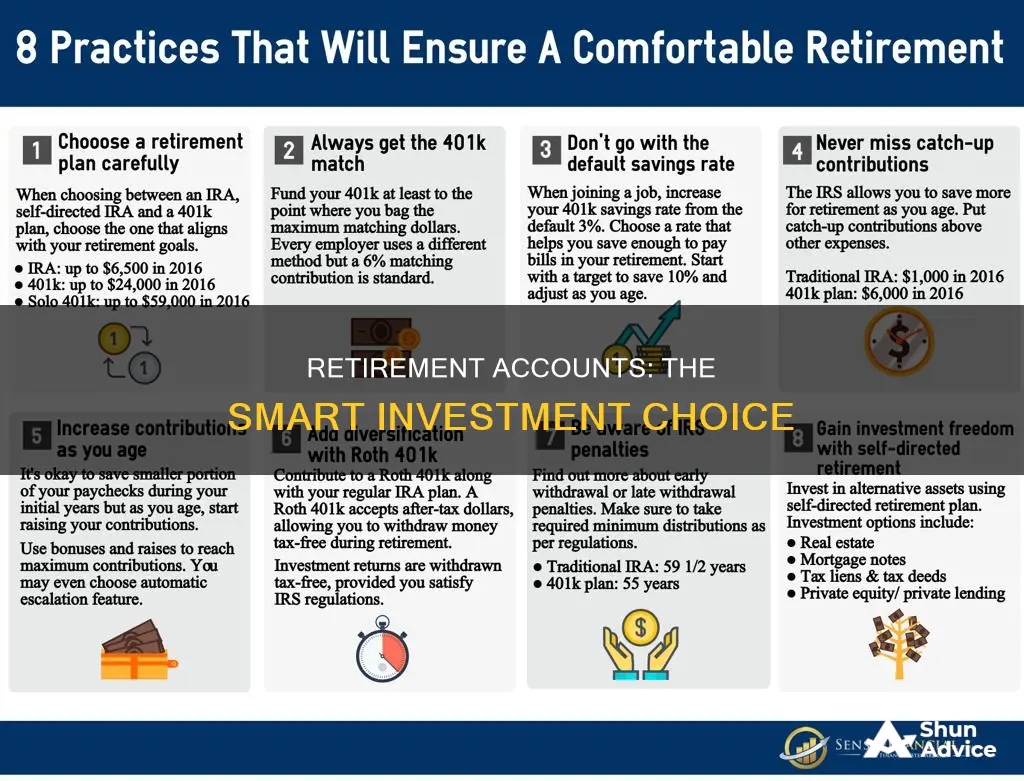

Retirement accounts are a great investment option, especially if your employer offers a 401(k) plan. While investing in stocks and picking your own stocks can be tempting, retirement accounts like 401(k)s and IRAs offer significant tax advantages and sometimes even free money in the form of employer contributions.

For example, a 401(k) contribution is based on pre-tax income, lowering your immediate tax bill, and many employers match their employees' contributions up to a certain percentage. Additionally, retirement accounts can be a more stable investment option, as they allow you to invest in a diverse range of assets with less risk. This diversification helps decrease overall investment risk while increasing the potential for an overall return.

However, it's important to note that retirement accounts may have limitations on when you can access your money and typically have restrictions on investment choices. Therefore, it's essential to carefully consider your options and consult a financial professional to determine the best investment strategy for your retirement.

What You'll Learn

401(k)s and other employer-sponsored plans

A 401(k) is a retirement savings plan that provides tax advantages to savers. It is a company-sponsored retirement account in which employees can contribute a percentage of their income, and employers often match these contributions. There are two basic types of 401(k)s: traditional and Roth. With a traditional 401(k), employee contributions are pretax, meaning they reduce taxable income, but withdrawals in retirement are taxed. On the other hand, employee contributions to Roth 401(k)s are made with after-tax income, so there is no tax deduction in the contribution year, but withdrawals are tax-free.

The main benefit of a 401(k) is that it lets you reduce your tax burden while saving for retirement. Contributions are automatically subtracted from your paycheck, and many employers will match part of their employee's 401(k) contributions, effectively giving them a free boost to their retirement savings. Additionally, 401(k)s offer tax-deferred growth, meaning you don't have to pay taxes on investment gains, interest, or dividends until you withdraw the money after retirement. For a Roth 401(k), you won't have to pay any taxes on qualified withdrawals when you retire, as contributions are made with after-tax dollars.

The amount you can contribute to a 401(k) is limited. For 2024, the annual limit on employee contributions is $23,000 for workers under 50, and $30,500 for those aged 50 and over. It is important to note that if you withdraw money from your 401(k) before the age of 59 1/2, you will likely have to pay a penalty in addition to any taxes owed.

In addition to 401(k)s, there are other employer-sponsored retirement plans available, such as the Federal Thrift Savings Plan (TSP) and the solo 401(k). The TSP is similar to a 401(k) but is offered to government workers and members of the uniformed services. It provides a range of low-cost investment options and offers a 5% employer contribution. The solo 401(k) is designed for business owners and their spouses, allowing elective deferrals of up to $23,000 in 2024, plus additional contributions.

Jet Airways: Invest or Avoid?

You may want to see also

IRAs

An Individual Retirement Account (IRA) is a tax-advantaged investment account that helps you save for retirement. Anyone with an income can open a traditional IRA, including those with a 401(k) account through work, a non-working spouse whose partner is earning an income, or even a minor making their own money. IRAs can be opened through a bank, broker, or robo-advisor.

- Traditional IRA: You may get a tax deduction on your contributions the same year you make them; you'll then pay taxes when you take distributions in retirement.

- Roth IRA: You do not receive an immediate tax deduction or benefit, but your retirement distributions are tax-free.

However, annual contributions to IRAs are limited. In 2024, the maximum you can contribute among all your IRAs is $7,000 ($8,000 for those aged 50 or older). While you can have more than one IRA, the contribution limit is combined. In contrast, you can contribute up to $23,000 to a 401(k) in 2024 and take advantage of an employer match if it's offered.

There are several other types of IRAs, including:

- SEP IRA: For self-employed people or small business owners with few or no employees. Contributions are tax-deductible, and investments grow tax-deferred until retirement when distributions are taxed as income.

- SIMPLE IRA: For small businesses with fewer than 100 employees. Contributions are tax-deductible, and investments grow tax-deferred until retirement, when distributions are taxed as income.

- Rollover IRA: Not exactly a type of IRA account, but a process in which you transfer eligible assets from an employer-sponsored plan, such as a 401(k), into an IRA.

Monthly Cash Flow: Exploring Regular-Income Investments

You may want to see also

Self-employed and small-business plans

Self-employed and small-business retirement plans

Retirement plans for the self-employed or small business owners include a solo 401(k), a SIMPLE IRA, and a SEP IRA. These plans offer higher contribution limits than a typical 401(k) plan, allowing participants to contribute to the employee limit and add an extra helping of profits as an employer contribution. They also reduce the amount of regulation required compared to a standard plan and can be invested in higher-return assets, such as stocks or stock funds.

Solo 401(k)

A solo 401(k) is designed for a business owner and their spouse. As the business owner is both the employer and employee, elective deferrals of up to $23,000 can be made in 2024, plus a non-elective contribution of up to 25% of compensation, up to a total annual contribution of $69,000 for businesses, not including catch-up contributions of $7,500 for 2024. The plan can be set up as a Roth 401(k), allowing participants to pay income taxes upfront and withdraw money tax-free in retirement. However, it is more complicated to set up than a SEP IRA, and once assets exceed $250,000, an annual report must be filed. Additionally, if you plan to expand and hire employees, this plan will no longer work, as they will need to be included in the plan per IRS regulations.

SIMPLE IRA

A SIMPLE IRA is suitable for self-employed individuals or businesses with 100 or fewer employees. It has a lower contribution limit of up to $16,000 in 2024, plus a catch-up contribution of $3,500 if the participant is 50 or older. The plan allows both employees and employers to contribute. Employers are generally required to make either matching contributions of up to 3% of employee compensation or fixed contributions of 2%. It is easy to set up and the accounts are owned by the employees. However, SIMPLE IRAs have lower contribution limits than solo 401(k)s and SEP IRAs, and mandatory contributions to employee accounts can be expensive if many employees participate. Additionally, early withdrawals are subject to a 10% penalty, or 25% if made within the first two years of participation.

SEP IRA

A SEP IRA is similar to a traditional IRA but is designed for small business owners and their employees. Only the employer can contribute to this plan, and contributions go into a SEP IRA for each employee rather than a trust fund. Self-employed individuals can also set up a SEP IRA, with contribution limits in 2024 of 25% of compensation or $69,000, whichever is less. Figuring out contribution limits for self-employed individuals can be complicated. While this plan is easy to maintain and has a high contribution limit, there is uncertainty about how much employees will accumulate, and the money is more easily accessible, which can be viewed as a positive or negative. Additionally, there is no Roth version of a SEP IRA.

Apple Pay: Unlocking Investment Opportunities

You may want to see also

Tax-advantaged accounts

Tax-advantaged retirement accounts are designed to help you invest funds for retirement while minimising tax liabilities. These accounts can be employer-sponsored, such as a 401(k) or 403(b), or privately held, like an Individual Retirement Account (IRA).

Traditional Accounts

Traditional accounts allow you to deduct your contributions from your taxable income in the year you make them. You then pay taxes on the disbursements received in retirement. The money in these accounts has not yet been taxed, so there are strict rules about how you can use it. There are steep penalties for withdrawing money early. You must take Required Minimum Distributions starting at age 70 1/2.

Roth Accounts

Roth accounts allow you to pay tax on your contributions in the year that you make them. Your disbursements in retirement are then tax-free. The money in a Roth account has already been taxed, so the rules on how you use it are generally less strict. You can make tax-free, penalty-free withdrawals of your contributions. There are no Required Minimum Distributions, so they are ideal for reserving funds for late in retirement. However, penalty-free withdrawals may tempt you to spend your retirement funds.

K)s

A 401(k) is a tax-advantaged retirement account offered by your employer. What you contribute and earn is tax-deferred. Some employers will match a portion of your 401(k) salary deductions, and you only pay taxes on your contributions and earnings when you retire and withdraw the funds. No-choice of providers: your employer does that and some 401(k) plans have limited investment options and high management fees. Some employers impose vesting schedules: you can only get your matching contributions if you work for the company for a minimum period.

Self-Directed IRA

This type of IRA allows you to invest in more diversified portfolios. You will have more control over your investments, which can mean more profits, but it also comes with more risk. Self-directed IRAs offer a huge variety of investment instruments, including stocks, bonds, mutual funds, real estate, precious metals, or even digital assets like cryptocurrency.

Health Savings Account (HSA)

An HSA is common with high-deductible health plans and is meant as a way to pay for medical expenses tax-free. However, an HSA also works well as a retirement savings vehicle. Savings into the account are tax-deductible like a 401(k) and IRA, funds grow tax-free and funds can be withdrawn tax-free like a Roth IRA.

Pelosi's Portfolio: What's She Buying?

You may want to see also

Investment options

There are many investment options available to those saving for retirement, each with its own advantages and disadvantages. Here are some of the most common types of investments for retirement:

- Income-producing equities: Some stocks pay dividends, providing a regular income stream. Stocks with a history of consistent or increasing dividend payouts are attractive for this purpose. Utility stocks and real estate investment trusts (REITs) are also options for investors seeking income-producing equities.

- Bonds: Fixed-income instruments such as bonds can provide a stream of income. There are various types of bonds available, including U.S. Treasury securities, corporate debt instruments, government-issued bonds, mortgage-backed securities, and bonds from overseas markets. Bond yields tend to follow changes in interest rates, so they can be an attractive option when rates are high.

- Annuities: Annuities are contracts between an individual and an insurance company, providing regular income payments in exchange for a sum of money. They can be structured to provide income for a certain period or for life and can be set up to cover one or two people (e.g., a spouse). Annuities offer a steady, predictable source of income, tax advantages, and the potential for payments to continue for beneficiaries. However, they may have limited liquidity, and withdrawals before a certain age may be subject to penalties.

- Total return investment approach: This strategy involves investing in a diverse mix of stock and bond funds, adjusted for the investor's risk tolerance. It aims to provide income in the form of interest, dividends, and capital gains and can offer a potentially more tax-efficient form of income. However, there is no guarantee that the funds will last throughout retirement, and the value of returns can vary from year to year.

- Target-date funds: These funds automatically adjust their asset allocation over time based on a specified target date for retirement. They are a low-maintenance way to maintain an appropriate asset allocation.

- Mutual funds: Actively managed by professional fund managers, mutual funds invest in a selection of stocks that are expected to outperform.

- Index funds: A type of mutual fund that purchases shares of all the securities in a particular index, such as the S&P 500. Index funds have gained popularity due to their lower costs and passive management approach.

- Exchange-traded funds (ETFs): ETFs are similar to mutual funds but can be traded on exchanges throughout the day, like individual stocks. They often have lower share prices than comparable mutual funds, making them more accessible to investors.

- Individual stocks and bonds: Some investors prefer to research and select individual stocks and bonds for their portfolios. This approach can provide a steady income stream through dividend-paying stocks and bond ladders, helping to manage interest rate risk.

- Robo-advisors: Robo-advisors use computer models and algorithms to provide low-cost investment advice and portfolio customization.

When choosing investment options for retirement, it is essential to consider your goals, risk tolerance, and time horizon. Diversification is also key to minimizing risk and maximizing potential returns.

Savings Indirectly Matched with Investors

You may want to see also

Frequently asked questions

If your employer offers a 401(k) plan, it's usually a good idea to contribute at least enough to get the maximum employer match. After that, you may want to consider an IRA, which gives you more control over your investments.

401(k) plans offer tax advantages, and about half of employers match their employees' contributions. They're also a good option if you don't want to pick your own stocks.

IRAs give you more control over your investments than a 401(k) plan. They also usually provide a wider range of investment choices.