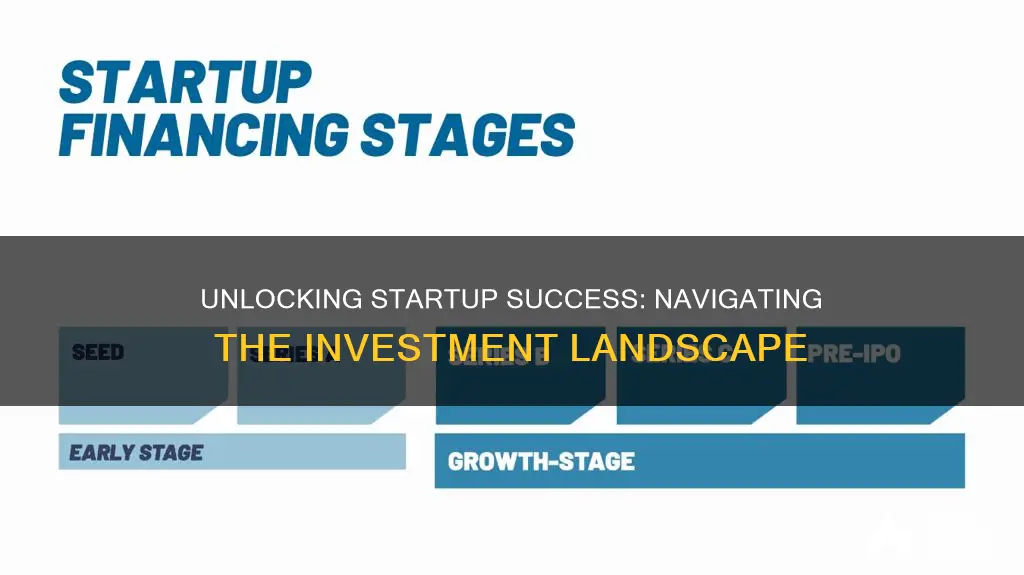

Business startup investment is a crucial aspect of the entrepreneurial ecosystem, providing the necessary capital for new ventures to launch and grow. It involves a complex process where investors, often in the form of venture capitalists, angel investors, or crowdfunding platforms, provide funding in exchange for equity or ownership in the startup. This investment can take various forms, including seed funding, series A rounds, and later-stage investments, each with its own set of terms and conditions. Understanding the mechanics of startup investment is essential for entrepreneurs seeking to secure the financial backing needed to turn their ideas into successful businesses.

What You'll Learn

- Angel Investors: Individuals providing capital in exchange for equity in startups

- Venture Capital (VC): Firms investing in high-growth companies with high-risk potential

- Bootstrapping: Self-funding a business without external investors

- Crowdfunding: Raising capital from a large number of people via online platforms

- Incubators & Accelerators: Programs supporting startups with mentorship, resources, and funding

Angel Investors: Individuals providing capital in exchange for equity in startups

Angel investors are high-net-worth individuals who invest their own capital in early-stage startups, often in exchange for equity in the company. They play a crucial role in the startup ecosystem by providing not just financial support but also mentorship, industry connections, and strategic guidance. These investors typically have extensive business experience and a strong network within their respective industries, which they leverage to help startups navigate the challenges of growth and expansion.

The process of angel investment often begins with an investor identifying a promising startup that aligns with their investment criteria. This could be a company with a unique value proposition, disruptive technology, or a team with a strong track record. Angels may conduct thorough due diligence, including reviewing financial projections, market analysis, and the startup's business plan. They might also assess the team's capabilities, the competitive landscape, and the potential risks and rewards of the investment.

Once an angel investor decides to invest, they typically negotiate the terms of the deal, which primarily involves the percentage of equity they will receive in return for their capital. This equity stake represents a share of the company's ownership and, consequently, a portion of its future profits and value. The valuation of the startup is a critical aspect of this negotiation, as it determines the amount of equity exchanged. Angels often seek a significant return on their investment, which may be achieved through an exit strategy such as an acquisition or an initial public offering (IPO).

Angel investors often provide more than just financial support. They bring valuable expertise and connections to the table. Many angels are willing to offer mentorship and guidance, helping startups navigate challenges and make strategic decisions. They may also introduce the startup to potential customers, partners, or other investors, expanding the company's network and increasing its chances of success. This aspect of angel investment is particularly beneficial for startups that lack experience in certain areas, such as sales, marketing, or business development.

In summary, angel investors are a vital component of the startup funding landscape, offering financial support and strategic guidance in exchange for equity. Their involvement can significantly impact a startup's growth and success, providing the necessary resources and connections to navigate the competitive business environment. For entrepreneurs seeking investment, understanding the angel investment process and the value these investors bring can be key to securing the funding needed to turn their ideas into successful ventures.

Paying it Forward: Honoring Those Who Invest in Us

You may want to see also

Venture Capital (VC): Firms investing in high-growth companies with high-risk potential

Venture capital (VC) is a crucial aspect of the startup ecosystem, providing the necessary funding and expertise to fuel the growth of high-potential companies. VC firms are typically early-stage investors who seek to identify and support innovative businesses with significant growth potential. These firms play a pivotal role in the startup journey, offering not just financial resources but also strategic guidance and industry connections.

The investment process for VC firms involves a meticulous evaluation of startups, focusing on their unique value propositions, market opportunities, and growth potential. These firms often have a specific investment thesis or sector focus, which guides their decision-making. For instance, a VC firm might specialize in investing in tech startups, particularly those developing artificial intelligence or blockchain solutions. When considering an investment, they assess the startup's team, product, market fit, and competitive advantage. This due diligence process is rigorous and often involves multiple rounds of negotiations and discussions.

VC firms typically invest in exchange for equity, becoming part-owners of the startup. This arrangement provides them with a stake in the company's success and a potential return on their investment. The amount of equity offered varies based on the stage of the startup and its valuation. Early-stage startups might receive a higher equity stake in exchange for a smaller investment, while later-stage companies may attract lower equity percentages for larger funding rounds.

The high-risk nature of VC investments is an inherent part of the game. Startups, by their very nature, are risky propositions, and many fail to reach their full potential. VC firms understand this risk and carefully manage their portfolios to balance potential returns with the likelihood of success. They often invest in multiple startups, diversifying their portfolio to mitigate risk. This approach allows them to benefit from the success of a few high-performing companies while minimizing the impact of failures.

In addition to financial investment, VC firms provide valuable support to the startups they back. This includes strategic advice, industry connections, and access to a network of potential partners and customers. Many successful startups credit their VC investors for providing the necessary guidance and resources to navigate the challenges of scaling a business. This symbiotic relationship is at the heart of the VC model, where investors and entrepreneurs collaborate to build and grow successful companies.

The Great Debate: Invest in Your House or Pay Off Debt?

You may want to see also

Bootstrapping: Self-funding a business without external investors

Bootstrapping is a strategy for funding a business without seeking external investors, allowing entrepreneurs to maintain full control over their venture. This approach involves utilizing personal savings, personal credit, and other resources to cover initial costs and sustain the business until it becomes profitable. It's a challenging but rewarding path that requires discipline, creativity, and a strong commitment to the business's success.

The first step in bootstrapping is to identify and prioritize essential expenses. This includes covering the costs of essential resources like office space, equipment, and software, as well as initial marketing and sales efforts. It's crucial to differentiate between needs and wants, ensuring that only the most critical expenses are prioritized. For instance, instead of investing in expensive office furniture, consider working from a co-working space or setting up a home office to minimize costs.

Personal savings play a significant role in bootstrapping. Entrepreneurs should evaluate their financial situation and determine how much they can afford to invest in their business. This may involve dipping into personal retirement funds or using credit cards, but it's essential to have a clear plan for repayment and to ensure that the business generates enough revenue to cover these initial investments. Additionally, personal networks can be a valuable resource. Friends and family may be willing to provide financial support or offer their skills and resources in exchange for equity or a share in the business's success.

Another key aspect of bootstrapping is the ability to think creatively and adapt to changing circumstances. This might involve exploring alternative revenue streams, such as offering consulting services or selling products online while the physical store is still in the planning stages. It also includes being open to feedback and making adjustments to the business model as needed. For example, if initial marketing efforts fall short, be prepared to pivot and try a different approach, such as leveraging social media or influencer marketing.

Bootstrapping also requires a strong focus on financial management and cost-cutting measures. This includes negotiating better terms with suppliers, optimizing inventory management to reduce waste, and regularly reviewing expenses to identify areas where costs can be reduced without compromising the business's operations. Additionally, entrepreneurs should aim to build a strong team by hiring only when necessary and outsourcing tasks to freelancers or contractors, which can help manage cash flow more effectively.

In summary, bootstrapping is a powerful strategy for entrepreneurs who want to maintain control over their business and its direction. It requires a combination of personal sacrifice, creativity, and financial discipline. By carefully managing expenses, utilizing personal resources, and adapting to market changes, entrepreneurs can successfully launch and grow their businesses without the need for external funding. This approach can be particularly appealing to those who value independence and are willing to take on the challenges of building a business from the ground up.

Rolex Watch Investment: Navigating the Timeless Market

You may want to see also

Crowdfunding: Raising capital from a large number of people via online platforms

Crowdfunding has emerged as a powerful and innovative way for startups to raise capital by tapping into a large network of individuals, often referred to as the crowd. This method of funding has gained significant popularity, especially with the rise of online platforms dedicated to facilitating these transactions. The concept is simple: instead of relying solely on traditional investors or banks, startups can present their ideas and projects to a wide audience, attracting multiple small investments from people who believe in their vision.

Online crowdfunding platforms act as intermediaries, providing a space where entrepreneurs can showcase their business ideas, often with detailed project descriptions, videos, and even prototypes. These platforms typically offer various reward-based, equity-based, or donation-based models to cater to different investor preferences. Reward-based crowdfunding, for instance, allows investors to receive rewards or perks in exchange for their financial contributions, which can range from early access to the product to exclusive merchandise. Equity-based crowdfunding, on the other hand, enables investors to become partial owners of the startup by purchasing shares, while donation-based models are popular for non-profit initiatives.

The process of crowdfunding involves several key steps. Firstly, entrepreneurs need to identify a suitable platform that aligns with their industry and funding goals. These platforms often have specific criteria for project eligibility, and startups must carefully prepare and present their business plans to meet these requirements. Once on the platform, entrepreneurs actively promote their campaigns, engaging with potential investors and addressing any concerns or questions. This interactive process allows for a more personalized and transparent funding experience.

One of the significant advantages of crowdfunding is its ability to foster a sense of community and engagement. Startups can build a dedicated fan base and create a network of supporters who believe in their mission. This community-driven approach can lead to valuable feedback, brand awareness, and even potential customers. Additionally, crowdfunding campaigns often provide an opportunity for startups to gauge market interest and refine their business strategies based on investor feedback.

However, it's important to note that crowdfunding is not without its challenges. Startups must carefully manage investor expectations and ensure they provide regular updates and transparency throughout the campaign. The success of a crowdfunding campaign often relies on effective communication, a well-defined target, and a unique value proposition that resonates with the crowd. Furthermore, legal considerations are essential, as crowdfunding regulations vary by jurisdiction, and startups should seek professional advice to ensure compliance.

Investing: Control, Returns, and Excitement

You may want to see also

Incubators & Accelerators: Programs supporting startups with mentorship, resources, and funding

Incubators and accelerators are specialized programs designed to nurture and accelerate the growth of startups, offering a unique blend of mentorship, resources, and funding opportunities. These programs play a crucial role in the business startup ecosystem, providing a structured environment for entrepreneurs to refine their ideas, develop their businesses, and gain access to valuable connections and networks.

Incubators typically offer a more comprehensive and long-term support system for startups in their early stages. They provide a nurturing environment where entrepreneurs can receive guidance, resources, and access to a network of mentors and industry experts. Incubators often offer office space, mentorship programs, and access to a community of like-minded individuals. They focus on helping startups refine their business models, develop products, and gain traction in the market. During their tenure, startups can receive funding, often in the form of grants or equity investments, to fuel their growth and development. Incubators also provide valuable feedback and insights, helping entrepreneurs navigate challenges and make informed decisions.

Accelerators, on the other hand, are more intensive and fast-paced programs that cater to startups with proven business models and a clear path to market. These programs offer a shorter but more intense period of support, typically lasting a few months. Accelerators provide a rigorous curriculum, including mentorship, networking opportunities, and access to industry experts. They focus on scaling startups rapidly by addressing specific challenges and providing resources to accelerate growth. Accelerators often offer seed funding or equity investments to support the expansion of the startup's operations. The competitive nature of accelerators means that startups must demonstrate exceptional potential and a well-defined strategy to secure a spot in the program.

Both incubators and accelerators provide a structured framework for startups to receive guidance and support. They offer mentorship programs where experienced entrepreneurs and industry leaders share their knowledge and provide valuable insights. These mentors help startups navigate challenges, make strategic decisions, and connect with potential partners or investors. Additionally, incubators and accelerators provide access to resources such as legal and financial advice, marketing support, and industry-specific tools, which can be crucial for a startup's success.

The funding aspect is a significant benefit of participating in these programs. Incubators and accelerators often provide financial support to startups, which can be in the form of grants, loans, or equity investments. These funds can be used to develop products, hire talent, improve infrastructure, or expand market reach. The investment also provides a valuable validation of the startup's idea and progress, attracting further interest from investors and fostering confidence in the business's potential.

In summary, incubators and accelerators are vital components of the startup ecosystem, offering a comprehensive support system for entrepreneurs. These programs provide mentorship, resources, and funding opportunities, enabling startups to refine their business models, gain market traction, and scale their operations. By participating in these initiatives, startups can increase their chances of success and contribute to the overall growth of the business community.

Unraveling the Mystery: Do Investment Apps Deliver Real Results?

You may want to see also

Frequently asked questions

Securing investment for a startup can be a challenging process, but there are several common methods. Many startups seek funding through angel investors, venture capitalists, or crowdfunding platforms. These investors provide capital in exchange for equity in the company. It's crucial to prepare a compelling business plan, showcase a unique value proposition, and network within the startup ecosystem to attract potential investors.

Startup investments can take various forms. Angel investments are typically made by high-net-worth individuals who provide capital and mentorship. Venture capital (VC) firms invest in startups with high growth potential, often in exchange for a small stake in the company. Incubator and accelerator programs also offer funding and resources to early-stage startups. Crowdfunding platforms enable startups to raise funds from a large number of people, often in exchange for rewards or equity.

Pitching your startup idea effectively is crucial to attracting investors. Prepare a concise and engaging pitch deck that highlights your unique value, market opportunity, and growth strategy. Practice your pitch and be ready to answer common questions. Focus on the problem your startup solves, the competitive advantage, and the potential impact on the market. Investors are looking for passion, expertise, and a clear understanding of the business.

Investing in startups carries both risks and potential rewards. Startups are high-risk, high-reward propositions. Investors may face the risk of losing their investment if the startup fails to meet its growth targets or faces unforeseen challenges. However, successful startups can offer significant financial returns and the opportunity to become early shareholders in a potentially valuable company. Due diligence and thorough research are essential to mitigate risks and identify promising investment opportunities.