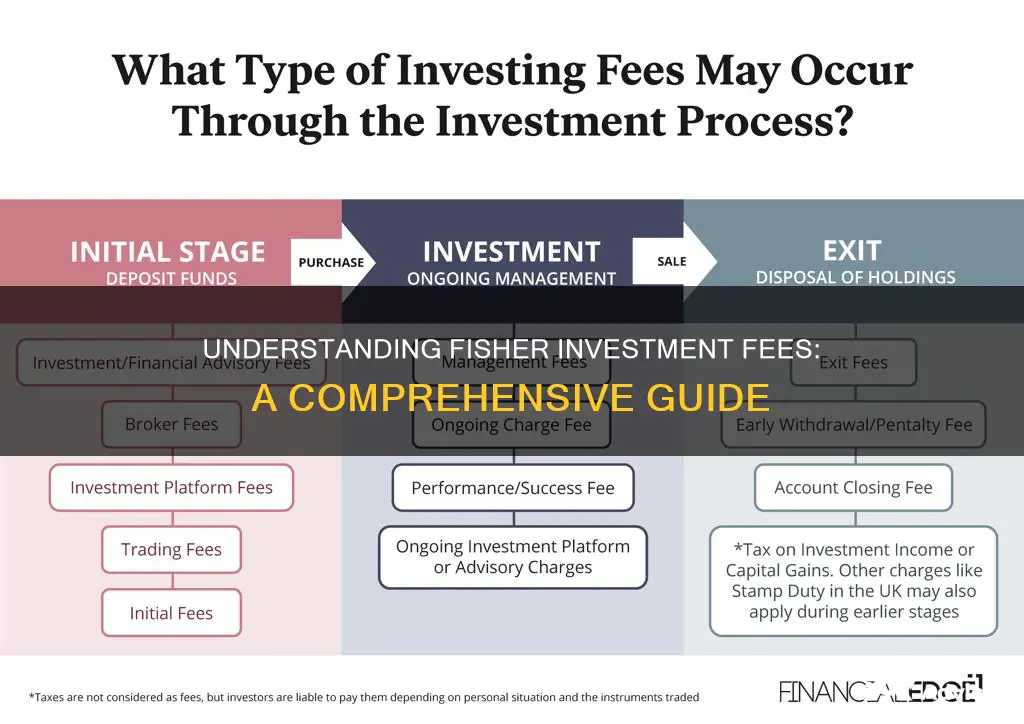

Understanding investment fees is crucial for investors, especially when navigating the world of Fisher Investments. Fisher Investment fees are structured to provide investors with a transparent and competitive approach to managing their portfolios. These fees typically include management fees, which cover the cost of professional investment management, and performance fees, which are earned based on the positive returns generated for the investors. The management fee is usually a percentage of the assets under management, and it covers the day-to-day operations and research required to make informed investment decisions. Performance fees, on the other hand, are a share of the profits and are designed to incentivize the investment team to deliver strong performance. It's important for investors to carefully review and understand these fee structures to ensure they align with their financial goals and risk tolerance.

What You'll Learn

- Fee Structure: Fisher Investments charges fees based on assets under management (AUM)

- Performance Fees: These are charged only if the fund outperforms a benchmark

- Management Fees: Annual fee for portfolio management and research

- Transaction Costs: Includes trading fees and commissions for buying/selling securities

- Expense Ratios: Measures the total costs as a percentage of AUM

Fee Structure: Fisher Investments charges fees based on assets under management (AUM)

Fisher Investments operates on a fee structure that is directly tied to the assets under management (AUM), which is a common practice in the investment management industry. This means that the fees charged by Fisher are calculated as a percentage of the total value of the client's portfolio that they manage. The AUM-based fee model is a transparent and straightforward approach, ensuring that clients understand the cost of their investment management services.

When you invest with Fisher, the fees are typically structured as an annual management fee, which is a fixed percentage of the AUM. This percentage rate can vary depending on the type of account and the investment strategy employed. For example, a client with a large portfolio might be charged a lower percentage rate compared to someone with a smaller investment, as the fees are proportional to the assets under management. This proportional fee structure encourages Fisher to manage and grow the client's assets, as it directly impacts their revenue.

The AUM-based fee structure provides a clear incentive for Fisher Investments to deliver strong investment performance. As the assets under management grow, so do the fees earned. This aligns the interests of the investment firm with those of its clients, as both parties benefit from successful portfolio growth. Clients can expect to pay a consistent fee that reflects the value of the services provided, and Fisher has a strong motivation to ensure the portfolio's performance and longevity.

It's important to note that Fisher Investments offers a range of investment strategies and account types, each with its own fee structure. For instance, they provide traditional mutual funds, exchange-traded funds (ETFs), and separately managed accounts, each with different fee arrangements. Understanding the specific fee structure of your chosen investment product is essential to making informed decisions about your financial portfolio.

In summary, Fisher Investments' fee structure is designed to be fair and transparent, with fees directly proportional to the assets under management. This approach allows clients to understand their costs and encourages Fisher to deliver exceptional investment results, ultimately benefiting both parties in the long term.

Rich People's Role in Economic Development

You may want to see also

Performance Fees: These are charged only if the fund outperforms a benchmark

Performance fees are a unique aspect of Fisher Investments' fee structure, designed to align the interests of the fund manager and investors. This fee model is a percentage of the profits generated when the investment fund surpasses a predefined benchmark, typically an index or a specific market performance indicator. The key feature is that performance fees are only applicable when the fund's performance is superior to the benchmark, ensuring that investors benefit from the fund manager's expertise and strategies.

When a Fisher investment fund outperforms the benchmark, the performance fee is calculated as a percentage of the net asset value (NAV) of the fund. This percentage is agreed upon by the fund manager and the investors and can vary depending on the fund's strategy and performance. For instance, a common structure is to charge a performance fee of 20% of the excess return over the benchmark, ensuring that the fund manager is incentivized to deliver above-average results.

The performance fee structure is a powerful tool to motivate fund managers to strive for superior performance. It provides a clear incentive for the investment team to make strategic decisions that can potentially boost returns. However, it's important to note that this fee structure also carries a risk for investors. If the fund underperforms, no performance fee is charged, but investors may still incur other fees, such as management fees, which are typically charged regardless of the fund's performance.

This fee model is particularly attractive to investors who want to ensure that the fund manager's interests are aligned with their own. By linking fees to performance, investors can be confident that the fund manager is working towards the same goal: maximizing returns. This alignment of interests can be a significant factor in attracting investors to Fisher Investments.

In summary, performance fees are a critical component of Fisher Investments' fee structure, providing a strong incentive for fund managers to outperform benchmarks. This fee model is a transparent and direct way to reward investors when the fund's performance exceeds expectations, while also carrying the risk that no fee is charged if the fund underperforms. Understanding this fee structure is essential for investors to make informed decisions about their investments with Fisher Investments.

Retirement Investments: A Secure Future or a Money Pit?

You may want to see also

Management Fees: Annual fee for portfolio management and research

Fisher Investments is a well-known investment management firm that offers a range of financial services, including portfolio management and research. One of the key components of their fee structure is the management fee, which is an annual charge for the services provided by the firm. This fee is designed to cover the costs associated with managing and researching investment portfolios on behalf of clients.

The management fee is typically calculated as a percentage of the total assets under management (AUM). This means that the fee is directly proportional to the value of the investments held in the portfolio. For example, if a client has $100,000 in assets with Fisher Investments, the annual management fee might be 0.75% of that amount, which equates to $750 per year. This fee is charged regardless of the performance of the portfolio, as it is a fixed cost associated with the ongoing management of the investments.

This fee covers a wide range of services, including portfolio strategy and management, research and analysis, trading and execution, and client support. It ensures that Fisher Investments has the resources to provide ongoing care and attention to each client's portfolio. The firm's investment professionals use this fee to cover their salaries, research costs, technology infrastructure, and other operational expenses required to maintain a high level of service.

It's important to note that Fisher Investments also offers a range of other fees and services, such as transaction fees, performance fees, and advisory fees, which may vary depending on the specific investment products and services offered. However, the management fee is a critical component of the overall cost structure, providing a consistent and predictable expense for investors. Understanding these fees is essential for investors to make informed decisions about their investment choices and to ensure they are aware of the total costs associated with their investment portfolios.

The Next Big Thing: Forecasting the Hottest Investment Segment

You may want to see also

Transaction Costs: Includes trading fees and commissions for buying/selling securities

Transaction costs are an essential component of Fisher Investment's fee structure, representing the expenses incurred when buying or selling securities. These costs are directly tied to the trading activities and can vary depending on market conditions and the specific securities involved. When an investor engages in the purchase or sale of assets, they must consider the associated fees, which can include trading commissions and other associated expenses.

Trading fees are a significant aspect of transaction costs and are typically charged by brokers or financial institutions for executing trades. These fees can vary based on the type of security, the trading volume, and the market's liquidity. For instance, trading stocks on a major exchange might incur a fixed commission per share, while trading derivatives or options could involve a percentage-based fee. It is crucial for investors to understand these fee structures to estimate the overall cost of their transactions accurately.

Commissions are another critical element of transaction costs and are often a fixed amount charged per trade. These commissions can vary depending on the brokerage firm and the investor's account type. Some brokers offer tiered commission structures, where the fee decreases as the trading volume increases. For example, a high-volume trader might benefit from reduced commissions, while a smaller investor may pay a standard rate. Understanding these commission schedules is vital for managing investment expenses effectively.

In addition to commissions, transaction costs can also include other expenses such as market impact costs and slippage. Market impact costs refer to the price change a trade causes in the security's market price, which can vary depending on the size of the transaction relative to the market's liquidity. Slippage occurs when the execution price of a trade differs from the expected price due to market conditions or timing. These factors can influence the overall transaction cost and should be considered when assessing the fees associated with Fisher Investment's services.

Managing transaction costs is essential for investors as it directly impacts their overall investment returns. By understanding the various components of transaction costs, including trading fees and commissions, investors can make informed decisions to optimize their investment strategies. Fisher Investment's fee structure aims to provide transparency, ensuring that clients are aware of the costs associated with their trading activities, allowing them to manage their portfolios more effectively.

Wealth's Longevity: Unlocking the Power of Patient Capital

You may want to see also

Expense Ratios: Measures the total costs as a percentage of AUM

Expense ratios are a critical metric used to understand the cost structure of investment funds, particularly those offered by Fisher Investments. This ratio provides a clear picture of the total expenses incurred by a fund as a percentage of its total assets under management (AUM). By calculating the expense ratio, investors can gain valuable insights into the operational efficiency and potential impact on their returns.

When evaluating investment funds, the expense ratio is a key factor to consider alongside other fees and charges. It represents the annual cost of managing the fund, including administrative, management, and operational expenses. These costs are typically deducted from the fund's assets, directly impacting the net asset value (NAV) and, consequently, the investor's returns. A lower expense ratio indicates more efficient management and potentially higher net returns for investors.

To calculate the expense ratio, you divide the total expenses incurred by the fund during a specific period by the average AUM for that period. The result is then expressed as a percentage. For example, if a fund's total expenses for the year amount to $100,000 and its average AUM for the year is $1 million, the expense ratio would be 1%. This means that 1% of the fund's assets is used to cover management and operational costs.

It's important to note that expense ratios can vary significantly between different investment funds and management firms. Fisher Investments, for instance, offers a range of funds with different expense ratios, allowing investors to choose options that align with their risk tolerance and financial goals. Lower expense ratios are generally preferred as they leave more room for investment growth and can result in higher overall returns for investors.

Understanding expense ratios is essential for investors as it provides a transparent view of the costs associated with their investments. By comparing expense ratios across different funds, investors can make informed decisions and select the most cost-effective options. Additionally, monitoring expense ratios over time can help investors assess the performance and efficiency of their chosen investment strategy.

Shares Simplified: Navigating the Optimal Quantity for Investment Success

You may want to see also

Frequently asked questions

Fisher Investments typically charges management fees, performance fees, and transaction fees. Management fees are a percentage of the assets under management and cover the operational costs of the investment firm. Performance fees are a percentage of the profits generated and are only charged when the investment strategy outperforms a predefined benchmark. Transaction fees may apply to trades executed, especially in mutual funds, and can vary depending on the account type and investment strategy.

Management fees are usually calculated as a daily or annual rate, expressed as a percentage of the total assets held in the investment account. For example, if the management fee is 0.5% per year, and you have $10,000 invested, the annual fee would be $50. These fees are typically deducted directly from the investment account and are used to cover the costs of portfolio management, research, and other administrative expenses.

Performance fees are charged when the investment strategy has outperformed a specific benchmark or target return. This fee is designed to compensate the investment manager for their performance and expertise. The fee structure can vary, but it is often a percentage of the profits generated, typically ranging from 10% to 20% of the profits above a certain threshold.

In addition to management and performance fees, Fisher Investments may also charge other expenses, such as custodial fees, which are associated with holding and safeguarding the assets in your account. There might also be transaction costs for buying or selling investments, especially in active trading strategies. It's important to review the fee schedule provided by Fisher Investments to understand all the associated costs and how they are calculated.