If you want to change your 401k investment at Vanguard, you can exchange funds inside a tax-advantaged account without any tax consequences. You can only exchange into funds offered by your 401k plan. Making changes to your Vanguard 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals. Here are the steps to change your Vanguard 401(k) portfolio:

1. Log in to Vanguard and select the account you’re looking for.

2. Click on “Manage my money” and then “Investments”.

3. Scroll down and click on “change how your money is invested”.

4. Change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

5. Change your investment elections for any future contributions by clicking on “Change paycheck investment mix”.

6. Click on “Select new fund”.

7. Check off any funds that you want to add to your portfolio.

| Characteristics | Values |

|---|---|

| Before making changes, consider all investment options in your 401(k) plan | Your employer usually chooses around 20 options |

| Log in to Vanguard and select the account you’re looking for | Click on “Manage my money” and then “Investments” |

| Scroll down and click on “change how your money is invested” | Change the current investments in your portfolio |

| Change investment elections for any future contributions | Click on “Change paycheck investment mix” |

| Click on “Select new fund” | Check off any funds that you want to add to your portfolio |

| Exchange funds inside a tax-advantaged account (like a 401k) without any tax consequences | Only exchange into funds offered by your 401k plan |

| Making changes to your Vanguard 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals | Consider adding International index funds and perhaps bonds appropriate to your age to make a three-fund portfolio |

What You'll Learn

Change investment elections for future contributions

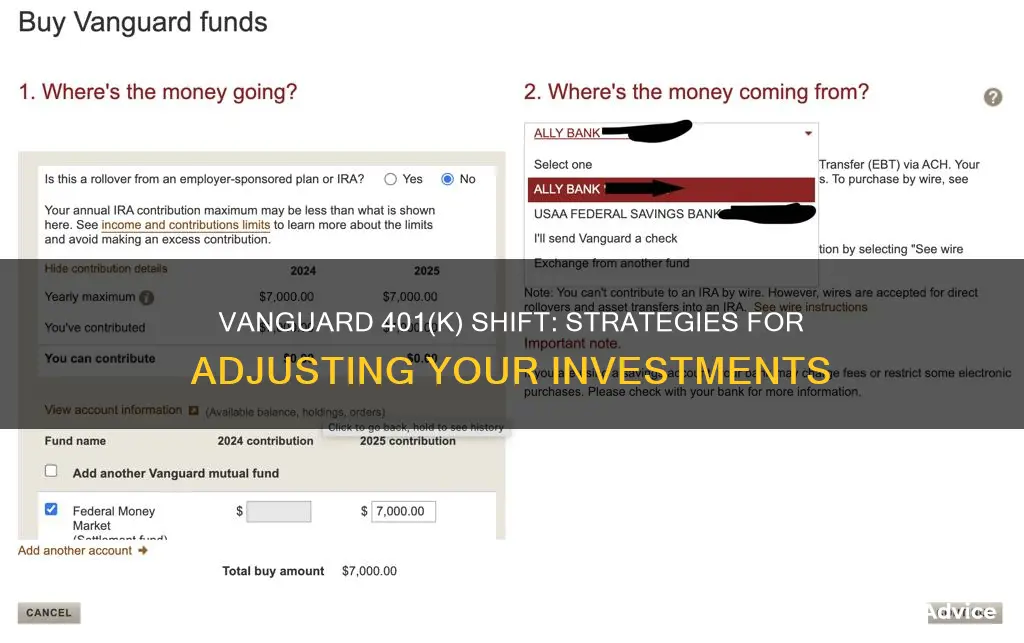

To change your investment elections for future contributions, log in to Vanguard and select the account you’re looking for. Click on “Manage my money” and then “Investments”. Scroll down and click on “change how your money is invested”. You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

Start by changing your investment elections for any future contributions by clicking on “Change paycheck investment mix”. Click on “Select new fund”. Check off any funds that you want to add to your portfolio.

You can exchange funds inside a tax-advantaged account (like a 401k) without any tax consequences. You can only exchange into funds offered by your 401k plan. If you're moving from a target date fund to an S&P 500 fund, you're giving up a little diversification. Consider also adding International index funds and perhaps bonds appropriate to your age to make a three-fund portfolio.

Making changes to your Vanguard 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals.

As a general principle, financial planning experts suggest investors should be more aggressive when you have a long time horizon until retirement, because you’ll be able to ride out market fluctuations to increase your potential for higher returns.

Investment Casting: Creating Complex Metal Shapes and Parts

You may want to see also

Select new funds to add to portfolio

To change your 401k investment at Vanguard, you can follow these steps:

Log in to Vanguard and select the account you’re looking for. Click on “Manage my money” and then “Investments”. Scroll down and click on “change how your money is invested”. You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

Start by changing your investment elections for any future contributions by clicking on “Change paycheck investment mix”. Click on “Select new fund”. Check off any funds that you want to add to your portfolio.

You can exchange funds inside a tax-advantaged account (like a 401k) without any tax consequences. You can only exchange into funds offered by your 401k plan. If you're moving from a target date fund to an S&P 500 fund, you're giving up a little diversification. Consider also adding International index funds and perhaps bonds appropriate to your age to make a three-fund portfolio.

Making changes to your Vanguard 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals.

As a general principle, financial planning experts suggest investors should be more aggressive when you have a long time horizon until retirement, because you’ll be able to ride out market fluctuations to increase your potential for higher returns.

Unlocking 401(k) Potential: Beyond the Plan Options

You may want to see also

Consider adding international index funds and bonds

Consider adding international index funds and perhaps bonds appropriate to your age to make a three-fund portfolio.

Financial planning experts suggest investors should be more aggressive when you have a long time horizon until retirement, because you’ll be able to ride out market fluctuations to increase your potential for higher returns.

You can exchange funds inside a tax-advantaged account (like a 401k) without any tax consequences. You can only exchange into funds offered by your 401k plan. If you're moving from a target date fund to an S&P 500 fund, you're giving up a little diversification.

Before making changes, make sure you’ve considered all of the investment options in your 401(k) plan (your employer usually chooses around 20 options).

Start by changing your investment elections for any future contributions by clicking on “Change paycheck investment mix”. Click on “Select new fund”. Check off any funds that you want to add to your portfolio.

Log in to Vanguard and select the account you’re looking for. Click on “Manage my money” and then “Investments”. Scroll down and click on “change how your money is invested”. You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

Portfolio Investment Increase: Global Economic Growth and Diversification

You may want to see also

Make changes to your portfolio

To make changes to your Vanguard 401(k) portfolio, you can follow these steps:

Log in to Vanguard and select the account you’re looking for. Click on “Manage my money” and then “Investments”. Scroll down and click on “change how your money is invested”. You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

Start by changing your investment elections for any future contributions by clicking on “Change paycheck investment mix”. Click on “Select new fund”. Check off any funds that you want to add to your portfolio.

You can exchange funds inside a tax-advantaged account (like a 401k) without any tax consequences. You can only exchange into funds offered by your 401k plan. If you're moving from a target date fund to an S&P 500 fund, you're giving up a little diversification. Consider also adding International index funds and perhaps bonds appropriate to your age to make a three-fund portfolio.

Making changes to your Vanguard 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals.

As a general principle, financial planning experts suggest investors should be more aggressive when you have a long time horizon until retirement, because you’ll be able to ride out market fluctuations to increase your potential for higher returns.

MassMutual SAGIC: A Safe Investment Strategy?

You may want to see also

Review investment options in your 401(k) plan

To review investment options in your 401(k) plan, log in to Vanguard and select the account you’re looking for. Click on “Manage my money” and then “Investments”. Scroll down and click on “change how your money is invested”. You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

Start by changing your investment elections for any future contributions by clicking on “Change paycheck investment mix”. Click on “Select new fund”. Check off any funds that you want to add to your portfolio.

Making changes to your Vanguard 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals. As a general principle, financial planning experts suggest investors should be more aggressive when you have a long time horizon until retirement, because you’ll be able to ride out market fluctuations to increase your potential for higher returns.

You can exchange funds inside a tax-advantaged account (like a 401k) without any tax consequences. You can only exchange into funds offered by your 401k plan. If you're moving from a target date fund to an S&P 500 fund, you're giving up a little diversification. Consider also adding International index funds and perhaps bonds appropriate to your age to make a three-fund portfolio.

Lithium Investment Guide for Indians: Getting Started

You may want to see also

Frequently asked questions

Before making changes, make sure you’ve considered all of the investment options in your 401(k) plan. Log in to Vanguard and select the account you’re looking for. Click on “Manage my money” and then “Investments”. Scroll down and click on “change how your money is invested”. You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account.

Start by changing your investment elections for any future contributions by clicking on “Change paycheck investment mix”. Click on “Select new fund”. Check off any funds that you want to add to your portfolio.

You can exchange funds inside a tax advantaged account (like a 401k) without any tax consequences. You can only exchange into funds offered by your 401k plan. If you're moving from a target date fund to an S&P 500 fund, you're giving up a little diversification. Consider also adding International index funds and perhaps bonds appropriate to your age to make a three-fund portfolio.