Tiger Global Management, LLC (Tiger Global) is an American investment firm deploying capital in both public and private markets. The company was founded by Chase Coleman III in 2001 and is headquartered in New York. Tiger Global's investment strategy focuses on the global internet, technology, telecom, media, consumer, and industrial sectors. The firm has a long-term investment horizon, seeking superior risk-adjusted returns for its investors. With a presence in venture capital and private equity, Tiger Global has been one of the most active global tech investors, managing billions of dollars in assets.

What You'll Learn

Tiger Global Management's investment strategy

Tiger Global Management is an American investment firm founded by Chase Coleman III in 2001. The firm deploys capital globally in both public and private markets, with a focus on internet, software, consumer, and financial technology companies.

Tiger Global's investment strategy can be characterized as extremely aggressive. The firm has a reputation for pouncing on deals early and moving swiftly to close them, often stunning with sky-high valuations. They focus on earning superior risk-adjusted returns for their investors over the long term. Their investments primarily target the global internet, technology, telecom, media consumer, and industrial sectors.

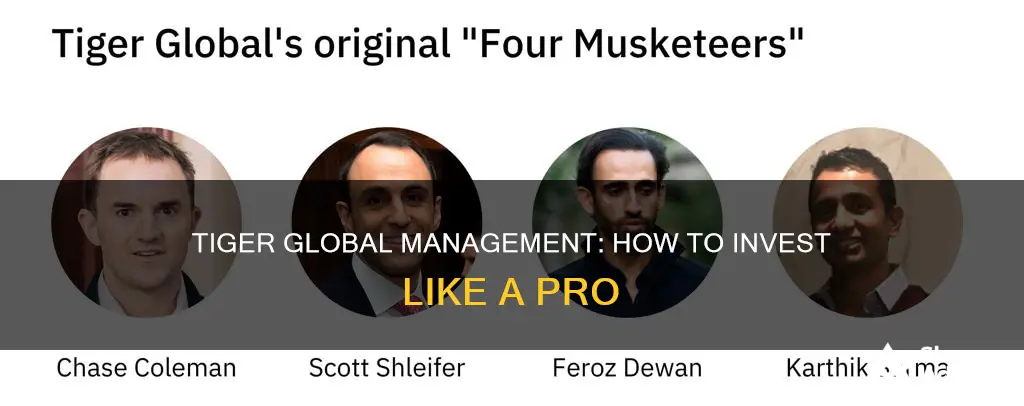

The firm's private equity strategy, led by Scott Shleifer, has a ten-year investment horizon and targets growth-oriented private companies. In 2021, Tiger Global significantly increased its investment pace, investing in 118 companies, with 90 of those being new to their portfolio. The firm's investments in 2021 totalled $10.5 billion in deals they led or co-led, and they participated in rounds that totalled a further $11.5 billion.

Tiger Global's public equity efforts emphasize deep due diligence on individual companies and long-term secular themes. Their public equity business uses equity strategies to invest in publicly traded companies, including their flagship long-short fund and long-only fund.

Overall, Tiger Global Management's investment strategy is characterized by its aggressiveness, focus on technology and internet-related companies, and commitment to long-term returns through investments in both public and private markets.

Maximizing Your Savings: Safe Investment Strategies for Beginners

You may want to see also

The firm's history and background

Tiger Global Management, LLC, formerly known as Tiger Technology, is an American investment firm founded by Chase Coleman III, a former Tiger Management employee, in March 2001. Coleman was a protégé of Julian Robertson, the founder of Tiger Management, and worked as a technology analyst for the firm from 1997 to 2000. When Robertson closed Tiger Management in 2000, he entrusted Coleman with over $25 million to manage, making him one of the 30 or so-called "Tiger Cubs", fund managers who began their careers at Tiger Management.

In 2001, Coleman established Tiger Technology, which later became Tiger Global Management, as a hedge fund to invest in the public equity market. Two years later, in 2003, Scott Shleifer helped the firm expand into investing in the private equity market. From 2007 to 2017, according to the Preqin Venture Report, Tiger Global raised the highest amount of capital among venture capital firms.

The firm's investment strategy focuses on earning superior risk-adjusted returns for its investors over the long term. Its investments primarily target the global Internet, technology, telecom, media consumer, and industrial sectors. Tiger Global's private equity strategy has a ten-year investment horizon and focuses on growth-oriented private companies, while its public equity efforts emphasize deep due diligence on individual companies and long-term secular themes.

Tiger Global Management is headquartered in New York, New York, United States, and operates as a hedge fund, private equity firm, and venture capital firm. It invests in early-stage ventures, late-stage ventures, post-IPO, private equity, and the secondary market.

Savings, Investment, and Productivity: The Interplay for Economic Growth

You may want to see also

Tiger Global's investment pace

Tiger Global Management, LLC, is an American investment firm deploying capital globally in both public and private markets. It was founded by Chase Coleman III in 2001 with $25 million in funding from Julian Robertson of Tiger Management. The firm's focus is on internet, software, consumer, and financial technology companies.

The firm's two primary investment strategies are public equity and private equity. The public equity business uses equity strategies to invest in publicly traded companies, while the private equity strategy targets growth-oriented private companies. Tiger Global's private equity business has grown significantly in recent years, with $35 billion in assets under management as of 2021, compared to $30 billion for its public equities business.

The PVF Savings Investment: A Smart Financial Move

You may want to see also

The industries and sectors the firm invests in

Tiger Global Management, LLC (often referred to as Tiger Global and formerly known as Tiger Technology) is an American investment firm founded by Chase Coleman III, a former Tiger Management employee, in March 2001. The firm deploys capital globally in both public and private markets, focusing on the global internet, technology, telecom, media consumer, and industrial sectors.

Tiger Global Management primarily invests in internet, software, consumer, and financial technology companies. The firm has a particular interest in startups, becoming one of the most voracious investors in this space in recent years. In 2021, Tiger Global invested in 118 companies, with 90 of those being new to their portfolio. The firm is also known for its aggressive deal-making approach, moving very early and extremely fast to close deals and offering sky-high valuations.

In terms of specific sectors, Tiger Global Management has made significant investments in the technology sector, including in well-known companies like Facebook, LinkedIn, and Peloton. The firm was an early investor in Peloton, leading its Series B in 2014 and co-leading its Series C in 2015. By the time of Peloton's IPO in 2019, Tiger Global had amassed a 20% stake, more than any other institutional investor. The firm has also invested in the online gaming platform Roblox, the restaurant delivery platform Olo, and the corporate credit card issuer Brex, among others.

In addition to its focus on technology, Tiger Global Management has also invested in companies in the industrial and consumer sectors. The firm has a global presence, with core markets in the US, China, and India, and additional investments in Europe and Latin America.

Asset Managers: Brokers or Advisors?

You may want to see also

The firm's notable investments

Tiger Global Management, LLC is an American investment firm founded by Chase Coleman III, formerly of Tiger Management. It primarily focuses on internet, software, consumer, and financial technology companies.

Tiger Global Management's notable investments include:

- In 2020, Tiger Global earned its investors $10.4 billion, making it the most profitable hedge fund on the annual list of the top 20 managers compiled by LCH Investments.

- In March 2022, the company raised $12.7 billion for a new fund to support fast-growing technology companies in their early stages. The firm reported that 900 investors were involved in this fund.

- From 2007 to 2017, according to the Preqin Venture Report, Tiger Global raised the highest amount of capital among venture capital firms.

- The firm's notable funds include Tiger Global Investments (its flagship long-short fund) and Tiger Global Long Opportunities (long-only).

- Tiger Global's private equity strategy is led by Scott Shleifer and has a ten-year investment horizon. It targets growth-oriented private companies.

Managing Your Own Investment Portfolio: Is It Worth It?

You may want to see also

Frequently asked questions

Tiger Global Management, LLC (often referred to as Tiger Global and formerly known as Tiger Technology) is an American investment firm founded by Chase Coleman III in March 2001. It is a global investment firm that deploys capital in both public and private markets, focusing on internet, software, consumer, and financial technology companies.

Unfortunately, I cannot find the specific information on how to invest in Tiger Global Management. However, the firm is a private equity and venture capital investor, and its website provides contact details for its New York headquarters.

Tiger Global Management seeks to generate superior risk-adjusted returns for its investors over the long term. The firm's investments primarily focus on the global internet, technology, telecom, media consumer, and industrial sectors. They have a ten-year investment horizon and target growth-oriented private companies. They also employ a hands-off approach with their portfolio companies, providing access to consultants instead of working closely with founders.