A health savings account (HSA) is a great way to save for future medical expenses and comes with a triple tax benefit. Contributions to HSAs are tax-deductible, with individuals able to contribute $4,150 in 2024 and families able to put in $8,300. Those aged 55 and older can contribute an additional $1,000 as a catch-up contribution. Any earnings on the account remain tax-free as long as the money is used for qualified medical expenses, and the money can be withdrawn tax-free at any time to pay for these expenses.

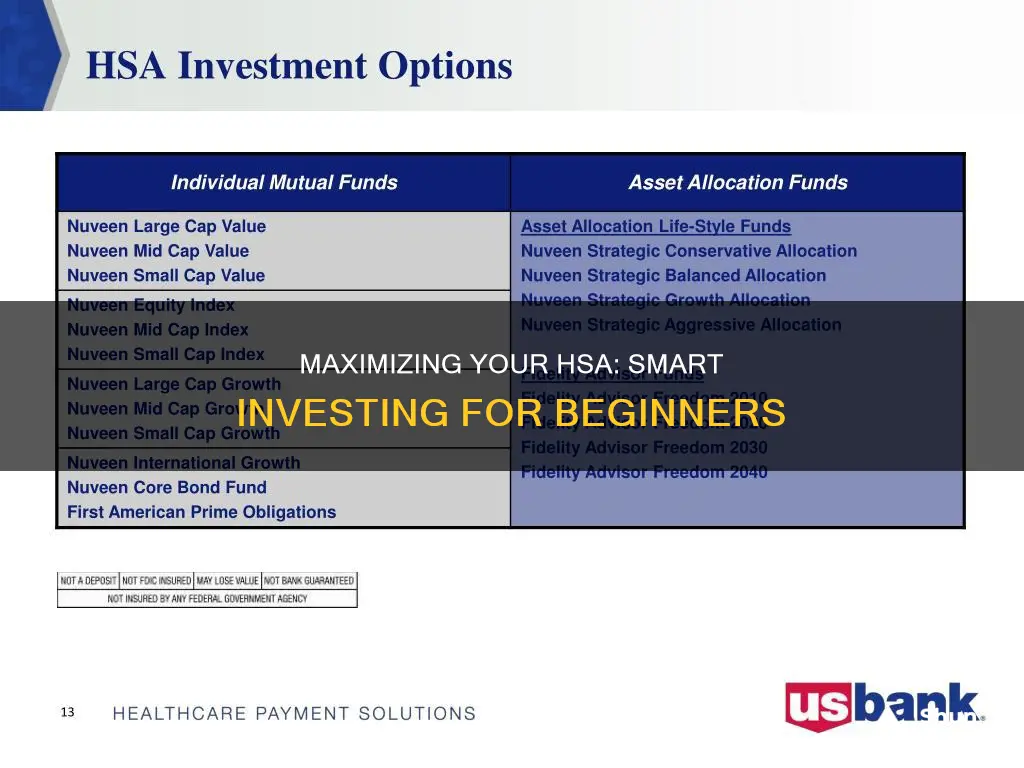

You can invest HSA dollars in the same way you would an individual retirement account (or other investment account). You can choose to invest in stocks, bonds, mutual funds, ETFs, and more. Some providers offer robo-advisors that will manage your investments for you, while others allow you to choose and manage your own.

Investing your HSA dollars can allow your money to grow faster than by saving alone, and the tax-free growth can make a significant difference over time.

| Characteristics | Values |

|---|---|

| Tax advantages | Contributions reduce taxable income, money grows tax-free, and withdrawals for qualified expenses aren't taxed |

| Investment options | Stocks, bonds, mutual funds, ETFs, robo-advisors, dividend funds, individual stocks, short-term bond funds |

| Eligibility | Must have a high-deductible health insurance plan |

| Contribution limits | $4,150 for individuals in 2024, $8,300 for families in 2024, $3,850 for individuals in 2023 |

| Withdrawal rules | Withdrawals for qualified medical expenses are tax-free, non-qualified withdrawals incur a 20% bonus penalty and income taxes (except after age 65) |

| Investment gains | Not taxed if used for qualified medical expenses |

| Minimum balance | No minimum balance required to open an account or start investing |

| Fees | No transaction fees for buying or selling investments, but mutual funds have internal expenses and may have short-term redemption fees |

What You'll Learn

- HSA funds can be used to invest in stocks, bonds, mutual funds and ETFs

- You can invest any amount and there's no minimum required to open an account

- HSA funds can be used to pay for out-of-pocket medical expenses

- HSA funds can be withdrawn tax-free at any time to pay for qualified medical expenses

- HSA funds can be rolled over from year to year

HSA funds can be used to invest in stocks, bonds, mutual funds and ETFs

Health savings accounts (HSAs) are a great way to save for future medical expenses and come with a triple tax benefit. HSAs are also a great way to invest your savings. You can invest your HSA funds in stocks, bonds, mutual funds, and ETFs.

Some HSAs offer tools to help you choose your investments and provide automatic rebalancing to maintain your preferred allocation. Other HSAs allow you to select specific investments.

Stocks

Investing in stocks can be a great way to grow your HSA funds, but it's important to remember that stocks are volatile. If you plan to use your HSA for medical expenses in the next year or two, it's a good idea to keep a portion of your account in cash or money market funds to ensure the money is there when you need it.

- Index funds: These funds allow investors to purchase a diversified group of stocks that track indexes like the S&P 500 or Russell 2000. Index funds have low fees, so more of your returns go to you instead of the fund's manager.

- Dividend funds: These funds hold dividend-paying stocks, which are typically from profitable and established companies. You won't be taxed on the dividends, and you can reinvest them or hold them as cash in your account.

- Individual stocks: This is the riskiest approach, as you're investing in a small number of stocks. It's important to understand the business model, competitive position, and valuation of the company you invest in.

Bonds

If you have a lower risk tolerance or expect future medical expenses, short-term bond funds may be a good option. These funds can generate some cash and are relatively stable, so you're less affected by fluctuating interest rates.

Mutual Funds and ETFs

Mutual funds and ETFs (exchange-traded funds) are another way to invest your HSA funds. These funds typically invest in a diversified portfolio of stocks, bonds, or other assets and are managed by a professional.

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX): This fund is heavily diversified, featuring over 3,700 stocks from all 11 market sectors. It has a low expense ratio of 0.04% and a $3,000 minimum investment requirement.

- Vanguard Wellington Fund Investor Shares (VWELX): This mutual fund offers a balanced allocation of two-thirds in stocks and one-third in bonds. It prioritizes high-quality mid- and large-cap companies with above-average dividend yields and low valuation multiples. It has a 0.26% expense ratio and a $3,000 minimum investment.

- Fidelity 500 Index Fund (FXAIX): This fund tracks the S&P 500 index and has a rock-bottom expense ratio of 0.015%. It has no minimum investment requirement or transaction fees.

- Schwab Target 2050 Index Fund (SWYMX): This is a target-date fund, which automatically adjusts its asset allocation over time to become more conservative as the target date approaches. It currently has about 90% in stocks and 10% in bonds. It has a 0.08% expense ratio.

- Schwab Value Advantage Money Fund - Investor Shares (SWVXX): This fund provides liquidity and safety by investing in repurchase agreements, commercial paper, certificates of deposit, and variable-rate demand notes. It has a 5.2% seven-day SEC yield and a 0.34% expense ratio.

- Fidelity Short-Term Bond Fund (FSHBX): This fund invests in high-quality, short-maturity bonds and is slightly riskier than a money market fund but has historically offered better performance. It has a 0.3% expense ratio and no required minimum investment.

Remember, when choosing investments, it's important to consider your unique circumstances, including your risk tolerance and potential future medical needs.

The True Cost of Cashing in Your Investments

You may want to see also

You can invest any amount and there's no minimum required to open an account

With an HSA, you can invest any amount, and there's no minimum required to open an account. This means you can start investing with as little or as much as you want. For example, Fidelity, a popular HSA provider, allows you to start investing with as little as $10.

The ability to invest any amount in an HSA gives you flexibility in how you choose to grow your savings. You can choose to invest a small amount each month or invest a larger sum upfront. This flexibility can be beneficial if you have varying income levels or financial commitments.

Additionally, the lack of a minimum required to open an HSA account makes it accessible to everyone. You can start investing for your future health care expenses or retirement, regardless of your financial situation. This can be especially useful if you're just starting in your career or have limited funds to allocate towards investing.

It's important to note that while there is no minimum required to open an HSA account, some investments within the HSA may have minimum investment requirements. For example, certain mutual funds may have minimum investment thresholds. Therefore, it's essential to review the specific requirements of the investments you're considering within your HSA.

By taking advantage of the ability to invest any amount in your HSA, you can make the most of the tax advantages that HSAs offer. HSAs provide a triple tax benefit, where contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

When deciding how much to invest in your HSA, consider your unique circumstances, including your risk tolerance and potential future medical needs. If you have a high risk tolerance and don't anticipate significant medical expenses in the near future, you may want to invest in stocks or other higher-return, higher-risk options. On the other hand, if you have a lower risk tolerance or expect to need funds for medical expenses soon, you may want to focus on more conservative investments, such as short-term bond funds or money market funds.

In summary, the flexibility to invest any amount in your HSA, combined with the lack of a minimum required to open an account, makes HSAs an attractive option for those looking to save for future health care expenses or boost their retirement savings. By investing in your HSA, you can take advantage of the tax benefits and potentially grow your savings over time.

Smart Ways to Invest Large Sums of Money

You may want to see also

HSA funds can be used to pay for out-of-pocket medical expenses

A Health Savings Account (HSA) is a tax-exempt trust or custodial account that allows you to set aside money on a pre-tax basis to pay for qualified medical expenses. HSA funds can be used to pay for out-of-pocket medical expenses, such as deductibles, copayments, and coinsurance. HSA funds generally may not be used to pay premiums.

The money in your HSA can be used to pay for qualified medical expenses at any time. HSA funds can also be used to pay for qualified medical expenses for your spouse and any dependents you claim on your tax return. In addition, HSA funds can be used to pay for qualified medical expenses for any person you could have claimed as a dependent on your tax return, except in certain situations, such as if they filed a joint return or had gross income above a certain threshold.

It is important to note that if you use HSA funds to pay for non-qualified expenses, you may be subject to a penalty and additional taxes. However, once you reach the age of 65, you can use HSA funds for any purpose without penalty, although you will still need to pay ordinary income tax on withdrawals for non-qualified expenses.

By using HSA funds to pay for out-of-pocket medical expenses, you can lower your overall healthcare costs. HSAs offer a triple tax benefit, allowing you to reduce your taxable income, grow your savings tax-free, and make tax-free withdrawals for qualified medical expenses. This makes HSAs an attractive option for saving for future medical expenses and even boosting your retirement funds.

Investing a Large Cash Gift: Strategies for Long-Term Growth

You may want to see also

HSA funds can be withdrawn tax-free at any time to pay for qualified medical expenses

One of the benefits of an HSA is that HSA funds can be withdrawn tax-free at any time to pay for qualified medical expenses. This means that you can use the funds in your HSA to pay for qualified medical expenses without having to pay any taxes on the withdrawal.

Qualified medical expenses include things like coinsurance, copayments, and deductibles, as well as certain dental, drug, and vision expenses. It's important to note that HSA funds generally cannot be used to pay premiums. Additionally, if you use your HSA funds for non-qualified expenses, you may be charged a penalty in addition to income taxes on the withdrawal.

Another advantage of HSAs is that they offer a triple tax benefit. Contributions to HSAs may be tax-deductible, the money in the HSA grows tax-free, and withdrawals for qualified medical expenses are not taxed. This makes HSAs a tax-efficient way to save for future medical expenses.

Furthermore, HSA funds can be carried over from year to year, so you don't have to worry about spending the money within a certain time frame. This allows you to accumulate tax-free savings over time, which can be especially beneficial if you are saving for future medical costs or using your HSA as a retirement account.

Overall, HSAs offer flexibility and tax advantages that can help individuals save for and pay for medical expenses in a tax-efficient manner.

Quick Ratio: Short-Term Investments for Short-Term Gains?

You may want to see also

HSA funds can be rolled over from year to year

One of the benefits of an HSA is that the money in the account rolls over from year to year. This means that HSA funds can be carried over and are not "use-them or lose-them" funds. This is in contrast to flexible spending accounts (FSAs), where you must spend the money within a specific time frame or otherwise forfeit it.

With an HSA, you can let your savings grow over time, and there is no pressure to withdraw the funds immediately. This feature makes HSAs an attractive option for long-term savings and investment. The rollover feature also provides flexibility if you change jobs or want to switch to a different HSA provider. You can choose to leave your HSA funds with your current employer, roll them over to an HSA with your new employer, or roll them into an HSA with a provider of your choice.

It's important to note that while HSA funds can be rolled over from year to year, this is different from an HSA rollover. A rollover refers to the process of moving your HSA funds to a new account, which can be done through a trustee-to-trustee transfer or an HSA rollover. A trustee-to-trustee transfer involves your trustee directly moving your HSA funds to a different HSA provider upon your request. On the other hand, an HSA rollover involves receiving a check from your current HSA provider and depositing it into a new HSA within 60 days. You can only do one HSA rollover every 12 months, and there are penalties for non-compliant rollovers.

By taking advantage of the rollover feature, you can consolidate your HSA funds and simplify your financial life. Additionally, you may be able to access better investment options, lower fees, and improved customer service by switching to a different HSA provider. However, it's essential to carefully consider the potential disadvantages of an HSA rollover, such as the time and effort involved in closing one account and opening another.

OPay Cash Investment: Legit or Scam?

You may want to see also