Investing a large sum of money can be a daunting task, but if you do it the right way, you can build up your wealth effectively. Before investing, it is important to understand your financial situation, goals, personality, and values to determine your risk tolerance and the returns you require. It is also crucial to become financially literate so that you can make well-informed decisions and avoid common pitfalls. Once you have a solid understanding of your finances and goals, you can explore various investment options such as stocks, bonds, mutual funds, real estate, or starting a business. Consulting a financial advisor can help you navigate the complexities of investing and ensure your decisions align with your short-term and long-term objectives.

| Characteristics | Values |

|---|---|

| Risk tolerance | High-risk investments include stocks, bonds, and high-yield savings accounts. Low-risk investments include certificates of deposit (CDs) and money market funds. |

| Investment goals | Short-term, long-term, retirement, passive income, etc. |

| Financial literacy | Understanding how to invest yourself is important before giving your money to someone else to manage. |

| Financial advisor | A fee-only financial advisor with a Certified Financial Planner (CFP) designation is recommended. |

| Investment options | Stocks, bonds, mutual funds, real estate, business, etc. |

What You'll Learn

Lump-sum investing vs. dollar-cost averaging

Lump-sum investing and dollar-cost averaging are two contrasting strategies for investing a large amount of cash. Both have their pros and cons, and the best approach depends on your financial goals, risk tolerance, and emotional relationship with money.

Lump-Sum Investing

Lump-sum investing involves deploying your capital all at once into a diversified portfolio or strategic asset allocation. This approach often proves advantageous over longer periods. Historical market trends indicate that the returns of stocks and bonds exceed those of cash investments and bonds. Therefore, investing a lump sum immediately can take full advantage of market growth when markets are going up.

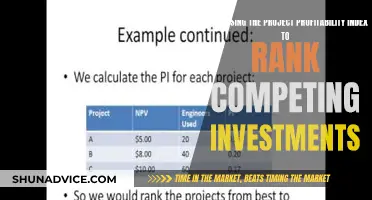

Lump-sum investing may generate slightly higher annualized returns than dollar-cost averaging. For example, in an analysis of over 1,000 historical seven-year periods, Morgan Stanley found that lump-sum investing yielded slightly higher returns in more than 55% of cases.

However, the cons of lump-sum investing are that short-term market movements are unpredictable. If you invest all your money during a volatile market stretch, such as at the start of a correction or a bear market, you could experience significant losses that may take years to recoup.

Dollar-Cost Averaging

Dollar-cost averaging, on the other hand, involves investing your cash in equal installments over a period of time. For example, investing $120,000 in $10,000 monthly installments over 12 months. This approach can ease you into the market, especially if you are cautious about the market outlook. It reduces the sensitivity of your portfolio's return to a single trade date, making it easier to ride out the market's ups and downs.

Dollar-cost averaging may appeal to investors seeking to minimize potential short-term losses and "regret risk". If the market takes a downturn after investing a small portion of your funds, you may feel less regret than investing a lump sum. Additionally, dollar-cost averaging can help you stay committed to your investment strategy, even if initial returns are poor.

However, a con of dollar-cost averaging is that by only investing small amounts at a time, you might miss out on positive returns in a rising market.

Research suggests that lump-sum investing tends to outperform dollar-cost averaging. However, dollar-cost averaging may be preferable for risk-averse investors. Vanguard's research indicates that lump-sum investing outperforms dollar-cost averaging 68% of the time across global markets measured after one year. Nevertheless, dollar-cost averaging still largely beats remaining completely in cash.

In conclusion, both lump-sum investing and dollar-cost averaging have their advantages and disadvantages. Lump-sum investing provides higher returns in most cases but carries the risk of significant losses in volatile markets. Dollar-cost averaging reduces the risk of short-term losses and can provide a more gradual entry into the market, but you may miss out on gains in a rising market. The best strategy depends on your financial goals, risk tolerance, and emotional comfort.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Short-term liquid options

If you have any high-interest consumer debt, such as credit cards, it is advisable to pay that off before investing any money.

Money market funds are a good option for short-term cash needs. They are interest-earning savings vehicles that are liquid, meaning you can generally deposit and withdraw from them at any time without penalty or fees. Vanguard Cash Reserves Federal Money Market Fund (VMMXX) and Fidelity Government Cash Reserves (FDRXX) are good options for larger, well-known financial institutions.

Certificates of deposit (CDs) and high-yield savings accounts are also viable options for those who are risk-averse. CDs are currently paying better interest rates due to inflation, with rates above 4% for short-term CDs.

Creating Cash Flow: Investment Strategies for Success

You may want to see also

Pay off debt or invest

When deciding whether to pay off debt or invest, it is important to consider the interest rate of the debt and the expected return on investments. If the interest rate on the debt is higher than the expected return on investments, it is generally better to pay off the debt first. This is because the effective return on paying off the debt is equal to the interest rate. On the other hand, if the expected return on investments is higher than the interest rate on the debt, investing may be the better option.

However, there are other factors to consider as well. For example, if the debt has a relatively high-interest rate, particularly if it is credit card debt, paying it off can provide a better return on investment. Additionally, paying off debt can improve an individual's credit score, which can be beneficial when applying for loans in the future. It is also important to consider an individual's risk tolerance. Investments can be volatile, and some individuals may prefer the certainty of paying off debt rather than taking on the risk of investing.

Another option is to do both—pay off debt and invest. This can be a good approach to balance the benefits of both options. For example, an individual can use some of their money to create an emergency fund, which is typically kept in a low-risk and liquid investment, while using the rest to pay down debts.

It is also worth noting that investing a lump sum of money can be a risky strategy. A dollar-cost averaging strategy, which involves investing smaller increments over time, can help to minimise the downside risk and take advantage of market volatility. However, investing a lump sum can provide faster exposure to the markets and has the potential for higher returns.

In summary, the decision to pay off debt or invest depends on various factors, including interest rates, expected returns, credit scores, risk tolerance, and investment strategies. It is important to carefully consider these factors and seek professional advice when making financial decisions.

Maximizing Cash Value Life Insurance: A Smart Investment Guide

You may want to see also

Investing in a business

There are several advantages to corporate investing. Firstly, it allows your business to diversify into other securities and assets, giving your company multiple revenue streams. Secondly, it can potentially generate more money that can be reinvested into your business, helping it grow and expand. Finally, investing surplus cash gives it a chance to grow rather than leaving it in a savings account with a low-interest rate.

However, there are also disadvantages to consider. All investments carry the risk of losing money, and corporate investing is no exception. Even if you invest cautiously, you could still lose money if the investment market crashes or fails to achieve the expected returns. Additionally, corporate investing may not be suitable if you need instant access to your cash or plan to make significant investments in your business soon.

When considering corporate investing, it is essential to seek professional advice to ensure you make tax-efficient decisions and fully understand the risks involved. An independent financial advisor can help you gauge your risk tolerance and provide guidance on investment options.

There are several investment vehicles to consider for corporate investing, including funds, trusts, pensions, individual stocks, bonds, and commodities. Each option has its own advantages and considerations, so it is important to carefully evaluate them before making any decisions.

In conclusion, investing in a business can be a smart way to utilize your large amount of cash, but it requires careful planning, professional advice, and a clear understanding of your financial goals and risk tolerance.

Smart Ways to Invest a Windfall of $300K

You may want to see also

Investing in real estate

There are many ways to invest in real estate, from owning physical property to online crowdfunding platforms. Here are some options to consider:

Traditional Real Estate Investing

This involves purchasing and renting out properties or flipping properties for a profit. The location of the property is one of the most important factors in determining its value. It is also important to consider the condition of the market before investing. Real estate purchases require a significant amount of capital, so investors should consider their return on investment, the property's profitability, and the associated costs.

Real Estate Investment Trusts (REITs)

REITs are a great option if you want to invest in real estate without the complexities of directly purchasing property. REITs are securities that you can purchase through a brokerage account, similar to investing in stocks. They tend to pay high dividends, making them a common retirement investment. REITs typically include properties that generate income, such as retail spaces, medical facilities, residential properties, and commercial properties.

Online Real Estate Investing Platforms

These platforms connect investors to real estate projects. Investors provide funding for projects through debt or equity and receive distributions in return. However, these investments tend to be speculative and illiquid, and some platforms are only open to accredited investors.

Rental Properties

Investing in rental properties can provide a steady stream of income while also benefiting from price appreciation. This option may require more time and involvement, as you will need to manage the property or hire a property manager.

Flipping Properties

This strategy involves investing in an underpriced home, renovating it, and then reselling it for a profit. However, house flipping can be risky and may require significant capital to cover the cost of renovations and holding the property until it is sold.

Remember, when investing a large sum of money, it is important to consider your financial goals, risk tolerance, and seek advice from a financial professional.

Free Cash Flow: Investment Costs and Their Inclusion

You may want to see also

Frequently asked questions

It is important to first understand your financial situation, goals and risk tolerance. You should also consider seeking advice from a financial advisor.

Some options include investing in a business, real estate, or the stock market. You can also invest in high-yielding certificates of deposit (CDs) or a high-interest savings account if you are risk-averse.

Investing a large sum of money all at once, also known as "lump-sum investing", allows your investments to be exposed to the markets sooner. On the other hand, investing smaller amounts over time, known as "dollar-cost averaging", may help to minimise the downside risk of a large investment and take advantage of market volatility.

You should avoid handing your money over to someone else to manage without first understanding how to invest yourself. Additionally, do not rely on others to make financial decisions for you if they do not know about your finances and goals.