The first cash outlay of an investment, also known as the initial outlay, is the total money available when a project or business is in the planning stages. It includes all the costs associated with starting the project or investment, such as equipment, shipping, installation, startup, and training. This figure is important as it is used to calculate potential returns and determine whether the investment is worthwhile.

The initial outlay is usually a negative figure as it represents the upfront costs involved in starting a new project or purchasing an asset. It is factored into the discounted cash flow analysis, which evaluates the feasibility of a project.

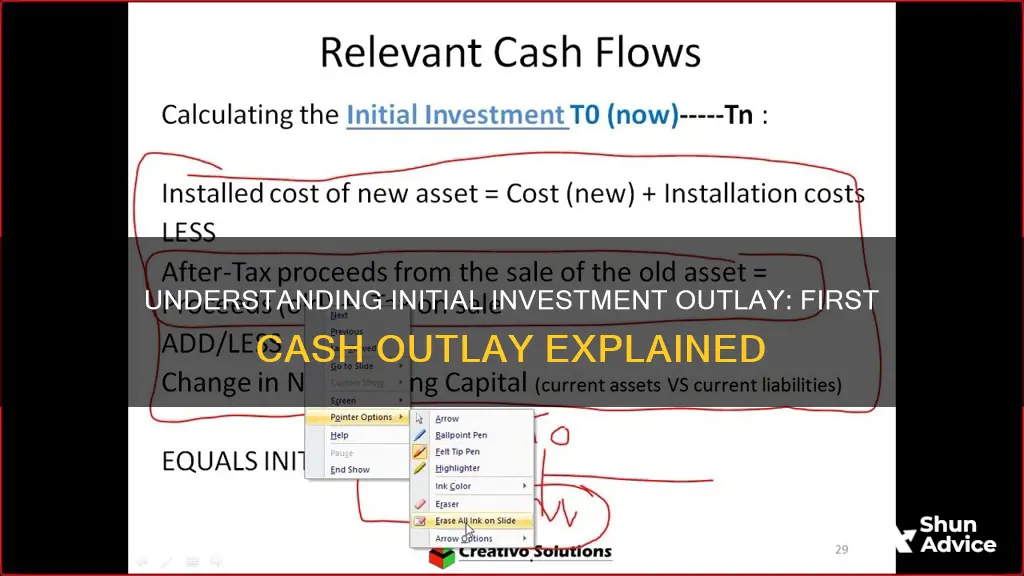

When calculating the initial outlay, it is important to consider the explicit initial outlay or costs, such as the cost of equipment, shipping, taxes, fees, and installation. Additionally, changes in working capital, such as accounts receivable and inventory levels, should be taken into account. If replacing existing equipment, the salvage value should be included, while removal costs should be considered if removing equipment. Tax consequences, such as increased taxes or tax credits, should also be factored in.

| Characteristics | Values |

|---|---|

| Definition | The initial cash outlay is the total money available at the planning stage of a project or business. |

| Purpose | To determine the profitability of an investment. |

| Components | Fixed capital investment, working capital investment, salvage value, book value, tax rate. |

| Calculation | The initial outlay is calculated using a formula that takes into account the above components. |

| Considerations | All costs associated with starting the project, including equipment, shipping, installation, startup, and training costs. |

What You'll Learn

- Initial cash flow: The total money available when a project is in the planning stage

- Fixed capital investment: The investment in new equipment, including installation and shipping costs

- Working capital investment: The investment in initial operating expenses, e.g. raw materials

- Salvage value: The cash from selling old equipment, which may offset the initial outlay

- Tax implications: The effective tax rate in the company's jurisdiction, which impacts the initial outlay

Initial cash flow: The total money available when a project is in the planning stage

Initial cash flow is the total money available when a project is in the planning stage. It is the first cash outlay of an investment and is crucial as it includes all the costs associated with starting the project.

Initial cash flow is the sum of the explicit initial outlay or costs of the project. These are items specifically related to the investment or expansion project. For example, the cost of a new piece of factory equipment would be part of the explicit initial outlay. Shipping costs, taxes, fees, and installation costs are also included in the initial outlay.

The initial outlay also takes into account any changes in working capital that may result from the project. This could include increases or decreases in accounts receivable, inventory levels, and the amount of cash on hand.

If the project involves replacing existing equipment, the salvage value of the old equipment may be included in the initial outlay if it can be sold. Conversely, if the project involves removing equipment, the costs associated with its removal will be factored in.

Finally, any tax consequences resulting from the project will be considered. This could include increased taxes due to higher revenue or tax credits received for undertaking the project.

The initial cash flow is usually a negative figure as launching a business or project requires a capital investment, with the expectation of generating future income. It is important to accurately calculate the initial cash flow as it is used to evaluate the feasibility of a project and determine whether it is worth pursuing.

Cashing Out Putnam Investments: A Step-by-Step Guide

You may want to see also

Fixed capital investment: The investment in new equipment, including installation and shipping costs

Fixed capital investment refers to the long-term investment in new equipment required for a project. This includes the cost of purchasing the equipment as well as installation and shipping costs. It is an essential component of the initial outlay for any project, as it ensures that the necessary tools and resources are in place for the project to be successful.

Fixed capital investment is particularly relevant when a company is pursuing projects that require significant capital expenditures, such as the construction of a new plant or expansion into a new market. For example, if a company is building a new factory, it will need to invest in new machinery and equipment to support the increased production capacity. This fixed capital investment is crucial for the long-term success of the project, as it lays the foundation for efficient and effective operations.

The fixed capital investment is often a substantial expense, encompassing various costs beyond the equipment itself. Installation costs, for instance, can be significant, especially if specialised labour or customisation is required. Shipping costs can also add up, particularly for large or heavy equipment that needs to be transported over long distances. In some cases, additional infrastructure or ancillary buildings may be needed to house and support the new equipment, further increasing the fixed capital investment.

When planning for a fixed capital investment, it is essential to consider not only the upfront costs but also the long-term maintenance and operating expenses associated with the new equipment. This includes the cost of raw materials, utilities, labour, repairs, and maintenance. By carefully evaluating these ongoing expenses, companies can make more informed decisions about their fixed capital investments and ensure they have the necessary resources to support their projects in the long term.

In conclusion, fixed capital investment, including the cost of new equipment, installation, and shipping, is a critical component of any project that requires new equipment. By understanding and effectively managing these costs, companies can ensure they have the tools and resources needed to achieve their project goals and maintain efficient operations over the long term.

Settled Cash for Investment: What's Available and How?

You may want to see also

Working capital investment: The investment in initial operating expenses, e.g. raw materials

Working capital investment is a crucial aspect of a company's financial strategy, representing the initial investments made to cover the operating expenses of a project. This includes the cost of raw materials, inventory, and other short-term investments required to get the project off the ground.

Working capital investment is often considered a short-term investment strategy, aimed at ensuring the company has sufficient resources to finance its operational activities. It is calculated by assessing the difference between cyclical operating needs and cyclical operating resources. Cyclical operating needs refer to the funds required for the company's operational activities, including advances to suppliers, receivables from state and other public entities, and other current assets. On the other hand, cyclical operating resources reflect the operating funds that the company already holds, including advances from customers, payables to state and other public entities, and other accounts payable.

A positive working capital investment indicates that the company's operational liabilities are insufficient to meet its cash needs, while a negative working capital investment suggests that the company has enough resources to finance its operations. For example, a company with a positive working capital investment may need to turn to short-term funding or permanent financing to bridge the gap between its liabilities and cash requirements.

The calculation of working capital investment is distinct from net working capital, as it focuses solely on the capital required for operations and excludes any unnecessary treasury held by the company. Net working capital, on the other hand, represents the difference between a company's current assets and current liabilities, providing insight into its short-term liquidity and financial health.

By effectively managing their working capital investment, companies can ensure they have adequate cash flow to meet short-term operating costs and debt obligations. This involves monitoring and optimising the use of current assets and liabilities, such as accounts receivable, accounts payable, inventory, and cash.

Overall, working capital investment plays a critical role in ensuring a company has the necessary resources to initiate and sustain its operations, making it an essential consideration in financial planning and decision-making.

Investment Activities: Understanding the Cash Flows Involved

You may want to see also

Salvage value: The cash from selling old equipment, which may offset the initial outlay

When launching a new project or business, there is usually an initial cash outlay, which is the total money available at the planning stage. This includes any investments or loans made for the project and is often a negative figure, as capital investment is required to generate future income.

The initial cash outlay is crucial in investment valuation as it includes all the costs associated with starting a project, such as equipment, shipping, installation, start-up costs, and training. This initial investment is then used to calculate potential returns and determine if the investment is worthwhile.

One way to offset this initial outlay is through the salvage value, which refers to the cash proceeds collected from selling old equipment or assets. This only applies when a company decides to sell off older assets, usually in connection with the beginning of a new project. For example, if a company is overhauling a production facility, it may sell old equipment. However, if the project involves expanding into a new facility, there may not be any old equipment to sell. The salvage value is typically close to the prevailing market value of the asset.

The salvage value is calculated as the difference between the sale price and the book value of the asset, multiplied by the tax rate. The book value is the net value of the asset on the company's accounting records, reflecting depreciation. If the sale price exceeds the book value, the company will realise a capital gain and be taxed on this amount. Conversely, if the asset is sold for less than its book value, the company will experience a loss but benefit from a tax reduction.

The salvage value is important because it influences the total depreciable amount used in a company's depreciation schedule. It is based on the expected proceeds from selling the asset at the end of its useful life or its value as parts. Companies may fully depreciate assets to $0 if the salvage value is minimal.

In summary, the salvage value of old equipment can help offset the initial cash outlay of a project by providing additional funds from the sale of old assets. This value is an important consideration in financial planning and can impact the feasibility of a new project.

Unlocking Cash Flow Secrets for Smart Investments

You may want to see also

Tax implications: The effective tax rate in the company's jurisdiction, which impacts the initial outlay

The effective tax rate in a company's jurisdiction is a crucial consideration when determining the initial cash outlay for an investment. This rate directly impacts the upfront costs and initial cash flow, which is typically a negative figure due to the high costs of starting a new project or purchasing an asset.

The effective tax rate influences the calculation of the initial outlay, which includes fixed capital investments, working capital investments, and potential salvage value. The tax rate is applied to any gains or losses realised on the sale of equipment, affecting the overall initial outlay.

For example, if a company sells an old piece of machinery for more than its book value, they will be taxed on the capital gain. On the other hand, if the machinery is sold for less than its book value, the company will incur a loss but benefit from a lower tax liability.

Additionally, the effective tax rate can impact the timing of equipment sales. In some cases, companies may choose to delay the sale of old equipment to take advantage of a more favourable tax environment or to structure the transaction in a way that minimises taxes.

Furthermore, the effective tax rate can influence the decision to invest in certain jurisdictions. Companies may opt for locations with more favourable tax rates or take advantage of tax incentives and exemptions offered by specific regions.

When planning for an investment, companies should carefully consider the effective tax rate in their jurisdiction and how it will impact their initial cash outlay. This includes understanding the tax implications of fixed capital investments, working capital requirements, and potential gains or losses on asset disposals.

Where Should Your Cash Go: Mortgage or Investment?

You may want to see also

Frequently asked questions

The first cash outlay of an investment, also known as the initial outlay, initial cash flow, or initial investment outlay, refers to the total money available at the beginning of a project or business venture. It includes all the costs associated with getting the project up and running, such as equipment, shipping, installation, startup, and training costs.

The initial cash outlay includes both explicit and implicit costs. Explicit costs are those directly related to the investment, such as the cost of new equipment, shipping, taxes, fees, and installation. Implicit costs refer to changes in working capital, such as accounts receivable, inventory levels, and cash on hand.

The initial cash outlay can be calculated using the following formula:

Initial Outlay = Fixed Capital Investment + Working Capital Investment + (Salvage Value - Book Value) x Tax Rate

Where:

- Fixed Capital Investment refers to the cost of purchasing new equipment, including installation and shipping.

- Working Capital Investment refers to the initial operating expenses, such as raw material inventory.

- Salvage Value is the cash obtained from selling old equipment or assets.

- Book Value is the net value of the old assets on the company's accounting records.