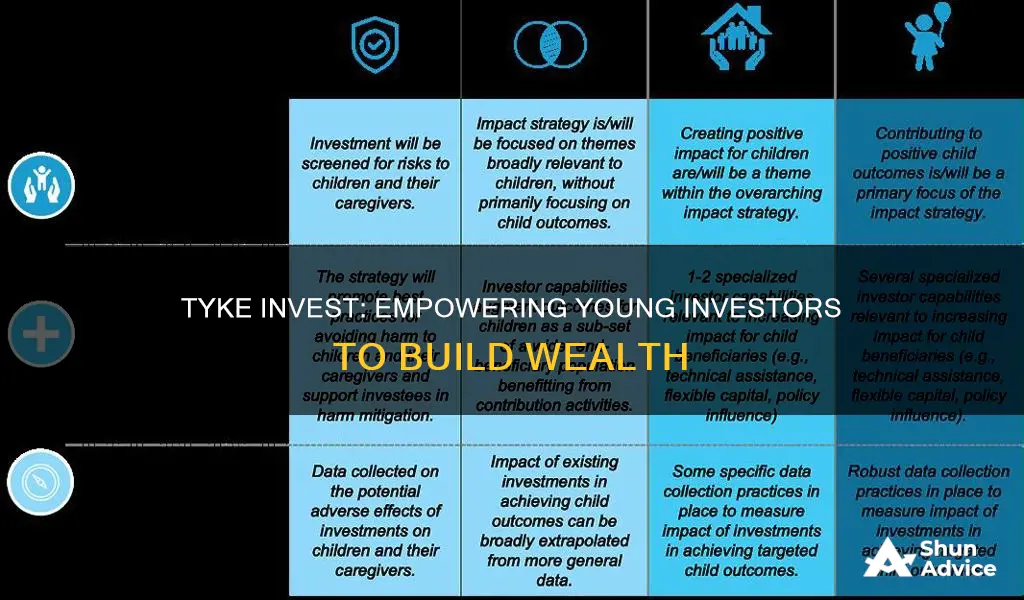

Tyke Invest is a revolutionary platform designed to empower young investors to take control of their financial future. It offers a user-friendly interface and educational resources, making it easy for kids to learn about investing and build their portfolios. With a focus on accessibility and financial literacy, Tyke Invest provides a fun and engaging way for children to explore the world of investing, allowing them to make informed decisions and potentially grow their wealth over time. This platform is an excellent tool for parents and educators to teach financial responsibility and inspire a lifelong journey of financial success.

What You'll Learn

- Understanding the Basics: Learn the fundamentals of investing for kids, including the concept of saving and earning

- Types of Investments: Explore different investment options like stocks, bonds, and mutual funds for young investors

- Risk and Rewards: Explain how risk and potential returns are linked in investing for children

- Long-Term Benefits: Highlight the advantages of starting to invest early and the power of compound interest

- Parental Guidance: Emphasize the importance of parental involvement and education in a child's investment journey

Understanding the Basics: Learn the fundamentals of investing for kids, including the concept of saving and earning

Understanding the Basics: Learn the Fundamentals of Investing for Kids

Investing is a smart way to grow your money over time, and it's a valuable skill to teach kids from an early age. The concept of investing is simple: you put your money into something that has the potential to increase in value, and over time, you can earn more money. This process is similar to saving, but with a focus on growth and long-term financial goals.

For kids, the idea of investing might seem abstract, but it's essential to introduce them to the fundamentals of saving and earning. Start by explaining that saving money is like putting it in a safe place where it can grow. When you save, you're not spending the money on immediate wants or needs; instead, you're setting aside funds for future goals. This could be buying a new toy, saving for a special trip, or even planning for their future education. Encourage kids to set small, achievable savings goals and celebrate their progress.

Earning money is another crucial aspect of investing. Kids can learn that money doesn't just appear out of thin air; it's often the result of hard work and effort. For instance, they might earn money by doing chores for the family, selling handmade crafts, or even through part-time jobs as they get older. Teaching them about earning provides a real-world connection to investing. Explain that when they earn money, they can choose to save it, spend it, or even invest it. Investing, in this context, means using their earnings to buy assets that can grow in value, such as stocks, bonds, or even real estate.

The key to understanding investing is to break it down into simple terms. You can use analogies and relatable examples to make it more accessible. For instance, you could compare investing to planting a seed. When you plant a seed, it takes time and care to grow into a strong tree. Similarly, investing involves putting money into something that has the potential to grow, and over time, it can yield significant returns.

Involve kids in financial discussions and activities to make learning fun. Create a mock investment portfolio where they can pretend to buy and sell different assets, or use online resources designed for kids to learn about investing. By making it interactive and engaging, you're more likely to capture their interest and help them grasp the concepts of saving, earning, and investing.

Broaden Your Horizons: Diversifying Retirement Investments Across Nine Key Areas

You may want to see also

Types of Investments: Explore different investment options like stocks, bonds, and mutual funds for young investors

When it comes to investing for young individuals, it's important to understand the various options available to build a solid financial future. Here's an overview of some common investment types that can be suitable for young investors:

Stocks: Investing in stocks means purchasing shares of a company, which represents ownership in that business. Young investors can buy stocks of established companies or even consider investing in startups or growth-oriented businesses. Stocks offer the potential for significant returns over time, as the value of the stock can increase if the company performs well. However, it's a risky venture, and stock prices can fluctuate, so diversification is key. Young investors might consider starting with a small allocation to stocks and gradually increasing it as they gain experience and knowledge.

Bonds: Bonds are essentially loans made to governments or corporations. When you buy a bond, you're lending money to the issuer, who promises to pay you back with interest over a specified period. Bonds are generally considered less risky than stocks, making them an attractive option for risk-averse young investors. Government bonds, issued by the national government, are often seen as a safe haven. Corporate bonds, on the other hand, may offer higher returns but come with more risk. Young investors can explore various bond types to find the right balance between risk and reward.

Mutual Funds: Mutual funds are a basket of securities, such as stocks or bonds, managed by a professional fund manager. Investors buy shares in the mutual fund, and the fund's assets are invested in a diversified portfolio. This approach allows young investors to gain exposure to a wide range of securities without having to pick individual stocks or bonds. Mutual funds can be categorized into different types, such as equity funds (focused on stocks), bond funds, or a mix of both. This investment option provides instant diversification and professional management, making it an excellent choice for beginners.

For young investors, it's crucial to start early and take advantage of compound interest, which can significantly grow their wealth over time. Diversification is key to managing risk, and a well-rounded investment strategy might include a combination of stocks, bonds, and mutual funds. It's always advisable to consult a financial advisor to tailor an investment plan according to individual goals, risk tolerance, and time horizon.

Retirement Planning: Your Future, Your Wealth

You may want to see also

Risk and Rewards: Explain how risk and potential returns are linked in investing for children

When it comes to investing for children, understanding the relationship between risk and potential returns is crucial. This concept is fundamental to the world of finance and plays a significant role in shaping a child's financial future. Here's a breakdown of how these two elements are interconnected:

Risk and Investment Options: Investing for a minor involves a careful consideration of risk, as the child's financial journey is likely to be a long-term one. Risk refers to the possibility of losing some or all of the invested amount. In the context of children's investing, this could mean the difference between a conservative, low-risk approach and a more aggressive, high-risk strategy. For instance, a young investor might choose to invest in a savings account, which offers minimal risk but also lower potential returns. Alternatively, they could opt for stocks or mutual funds, which carry higher risks but also the potential for greater rewards over time. The key is to strike a balance, ensuring that the chosen investment aligns with the child's financial goals and risk tolerance.

Long-Term Perspective: One of the unique aspects of investing for children is the long-term nature of their financial journey. When investing for a child, it's essential to remember that the primary goal is often to build a substantial nest egg for their future. This long-term perspective allows for a more flexible approach to risk. Over time, the power of compounding returns can significantly boost the investment, even if it starts with a relatively small amount. For example, investing in a diversified portfolio of stocks and bonds for a child's college fund might involve a higher risk tolerance, as the money has decades to grow and recover from any potential downturns.

Diversification and Risk Management: To navigate the risk-return relationship effectively, diversification is a powerful tool. This strategy involves spreading investments across various asset classes, sectors, and geographic regions. By diversifying, investors can reduce the impact of any single investment's performance on the overall portfolio. For children's investments, this could mean allocating funds to a mix of stocks, bonds, real estate investment trusts (REITs), and even alternative investments like commodities or private equity. Diversification helps manage risk by ensuring that the child's investment is not overly exposed to any one market or asset class, thus providing a more stable and consistent return over time.

Educating on Risk Awareness: As children grow and become more financially savvy, it's essential to educate them about risk and its implications. Teaching them to understand and assess risk will empower them to make informed investment decisions in the future. This education should include discussions about market volatility, the impact of economic cycles, and how different investment choices carry varying levels of risk. By fostering an early understanding of these concepts, you can help the child develop a healthy relationship with risk and make more confident investment choices as they mature.

In summary, investing for children involves a thoughtful approach to risk and returns. It requires a long-term vision, a well-diversified portfolio, and an education on the risks and rewards associated with different investment options. By understanding and managing risk effectively, parents and guardians can set their children on a path toward financial success and security.

Unraveling the Global Reach: How International Investment Groups Operate

You may want to see also

Long-Term Benefits: Highlight the advantages of starting to invest early and the power of compound interest

Investing early in life can have significant long-term advantages, primarily due to the power of compound interest. Compound interest is the process where the interest earned on an investment is added to the principal amount, and then interest is earned on the new total. This creates a snowball effect, allowing your money to grow exponentially over time. The earlier you start investing, the more time your money has to grow, and the greater the potential for wealth accumulation.

One of the key benefits of early investing is the ability to take advantage of the 'time value of money'. This concept refers to the idea that money in the future is worth less than money today due to its potential earning capacity. By investing early, you can harness this principle, allowing your investments to grow and accumulate wealth over a more extended period. This is especially powerful when considering the long-term goals of retirement or financial independence.

For instance, let's consider a simple scenario: Imagine you start investing $100 per month at the age of 25. Over 40 years, you would have invested a total of $48,000. With a modest annual return of 7%, your investment would grow to approximately $160,000. However, if you had started this investment at the age of 35, the total amount would be significantly lower, around $96,000, due to the reduced time for compound interest to work its magic.

The power of compound interest becomes even more apparent when considering the potential for long-term wealth creation. As your investments grow, you can use the returns to reinvest and further accelerate your wealth accumulation. This strategy, known as 'reinvestment', allows your money to work harder for you, generating more returns over time. The earlier you start, the more opportunities you have to benefit from this compounding effect.

In summary, starting to invest early is a crucial step towards building long-term wealth. The power of compound interest ensures that your money grows exponentially, and the time value of money means that your investments can accumulate significantly over the years. By embracing early investing and understanding the long-term benefits, you can set yourself on a path towards financial security and success.

Immaterial Labor: Why Invest?

You may want to see also

Parental Guidance: Emphasize the importance of parental involvement and education in a child's investment journey

Parental involvement is crucial when it comes to a child's financial journey, as it sets the foundation for their understanding of money management and long-term financial goals. It is never too early to start educating your child about the value of money and the importance of investing. By providing parental guidance, you can ensure that your child develops healthy financial habits and a positive relationship with money.

One of the key aspects of parental involvement is teaching your child about the power of compounding and the long-term benefits of investing. Introduce the concept of investing as a tool to grow their money over time. Explain how, with consistent contributions and the power of compounding interest, their investments can accumulate and potentially provide a secure financial future. This education will empower them to make informed decisions when they are older.

Start by simplifying complex financial concepts into age-appropriate lessons. For younger children, this could involve using visual aids, such as a piggy bank, to demonstrate how saving and investing work. As your child grows, introduce more sophisticated ideas, such as the difference between saving and investing, and the potential risks and rewards of various investment options. Encourage open discussions about money and finances, creating a safe space for your child to ask questions and express their thoughts.

Involve your child in age-appropriate financial decisions within your family. For instance, you could create a family budget together, teaching them about income, expenses, and the importance of saving. As they get older, you might involve them in investment decisions, allowing them to choose specific funds or assets based on their risk tolerance and goals. This hands-on experience will not only educate them but also foster a sense of responsibility and ownership over their financial future.

Additionally, consider using interactive tools and resources available online or through financial institutions. Many platforms offer educational resources and interactive games designed to teach children about money management and investing. These tools can make learning fun and engaging, ensuring that your child stays motivated and interested in the process. By combining parental guidance with interactive learning, you can effectively prepare your child for a lifetime of financial success.

Remember, parental involvement is a powerful catalyst for a child's financial success. By providing education, guidance, and practical experience, you can instill a strong financial foundation. This early start will enable them to make informed choices, understand the value of money, and develop a positive mindset towards investing, setting them on a path toward financial security and independence.

Why Private Equity is Worth the Risk

You may want to see also

Frequently asked questions

Tyke Invest is a digital investment platform designed to help young individuals, often referred to as 'tykes', start their journey into the world of investing. It offers a user-friendly interface and educational resources to make investing accessible and fun for kids and teenagers.

Tyke Invest allows users to create a virtual investment portfolio with a simulated amount of money. This virtual currency can be used to buy and sell various assets like stocks, bonds, and even cryptocurrencies. The platform provides real-time market data and educational tools to help young investors learn about the financial markets. Users can track their portfolio's performance, receive personalized recommendations, and even compete with friends to see who can make the best investment decisions.

Absolutely! Tyke Invest is specifically tailored for beginners, especially those who are new to investing. It provides a safe and risk-free environment to learn and practice investment strategies without any financial risk. The platform's educational resources, including tutorials, articles, and interactive games, make it an excellent tool for teaching financial literacy to young people.