Navigating the complexities of investing in foreign entities requires a strategic approach to risk management, particularly when it comes to hedging net investments. This paragraph introduces the topic by highlighting the importance of understanding how to effectively protect capital in international markets. It emphasizes the need for investors to explore various hedging techniques, such as currency swaps, options, and futures, to mitigate potential losses and ensure the stability of their foreign investments. By implementing these strategies, investors can safeguard their net investments and make informed decisions in the dynamic global economy.

What You'll Learn

- Currency Risk: Assess foreign exchange fluctuations and their impact on investment value

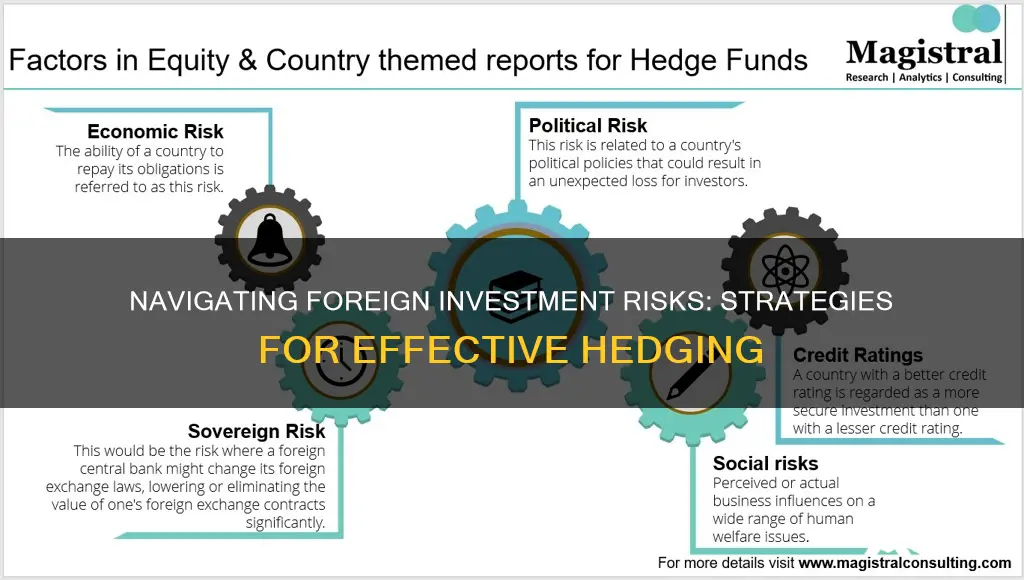

- Political Risk: Evaluate potential political instability and its effects on foreign investments

- Transfer Risk: Understand the challenges of transferring funds across international borders

- Tax Considerations: Navigate tax implications and double taxation agreements for foreign investments

- Legal and Regulatory Compliance: Ensure adherence to local laws and regulations in foreign markets

Currency Risk: Assess foreign exchange fluctuations and their impact on investment value

Currency risk is a critical aspect of investing in foreign entities, as it directly impacts the value of your investments. When you invest in a company or asset located in a different country, the value of that investment is subject to the fluctuations of the foreign exchange market. This risk arises because the value of your investment will change based on the exchange rate between your home currency and the currency of the foreign entity.

To assess currency risk, you need to understand the potential volatility of the foreign currency. Foreign exchange rates are influenced by various factors, including economic policies, political stability, interest rates, and market speculation. For instance, if the country's central bank decides to raise interest rates, it can attract foreign investors, causing the local currency to appreciate against others. Conversely, a decrease in interest rates might lead to a depreciation of the currency. Monitoring these factors and their historical trends can help you anticipate potential currency movements.

The impact of currency fluctuations on your investment can be significant. A strengthening of the foreign currency relative to your home currency will result in a higher value for your investment when converted back to your domestic currency. This means that your investment will be worth more in your local currency, potentially increasing your overall return. However, if the foreign currency weakens, your investment's value will decrease, leading to a lower return or even a loss. For example, if you invest in a foreign company and the local currency depreciates, the value of your investment in your home currency will decline.

To mitigate currency risk, investors can employ various strategies. One common approach is to use currency hedging, which involves entering into a forward or futures contract to lock in an exchange rate for a future transaction. By doing so, investors can protect themselves against adverse currency movements. Another strategy is to invest in currency-hedged funds or exchange-traded funds (ETFs) that are designed to provide exposure to a specific market while minimizing currency risk. These funds typically use financial derivatives to adjust for currency fluctuations, ensuring that the investment's value remains relatively stable in the investor's home currency.

Additionally, diversifying your investments across multiple countries and currencies can help reduce the overall impact of currency risk. By having a portfolio with a mix of domestic and foreign investments, you can balance the potential gains from currency appreciation with the losses that may occur in other investments. Regularly reviewing and rebalancing your portfolio based on currency trends and economic conditions can also help manage currency risk effectively.

Investments: Mortgage Payoff or Keep?

You may want to see also

Political Risk: Evaluate potential political instability and its effects on foreign investments

When considering investments in foreign entities, one of the critical aspects to evaluate is political risk, which can significantly impact the success and sustainability of these ventures. Political instability in a host country can lead to various challenges and uncertainties for investors, making it essential to understand and mitigate these risks effectively. Here's a detailed approach to assessing and managing political risk in the context of foreign investments:

Understanding Political Instability: Begin by researching and analyzing the political landscape of the country or region in question. This involves studying the historical and current political climate, including the nature of the government, its stability, and any ongoing or potential political conflicts. Identify key factors such as regime type, political parties, and their ideologies, as well as any recent or impending elections or referendums that could influence the investment environment. For instance, a country with a history of military coups or frequent changes in government might present higher political risk.

Impact on Foreign Investments: Political instability can have far-reaching consequences for foreign investors. It may lead to policy changes, regulatory uncertainties, and even the nationalization or confiscation of assets. Investors should assess the potential impact on their specific industry and business operations. For example, a political shift could result in new trade regulations, tax policies, or labor laws that favor domestic entities over foreign investors. Understanding these risks is crucial for making informed decisions and developing appropriate strategies.

Risk Mitigation Strategies: To hedge against political risk, investors can employ several strategies. One approach is to diversify investments across multiple countries and industries, reducing the concentration of risk. This diversification can help minimize the impact of political events in any single country. Additionally, investors can consider political risk insurance, which provides financial protection against losses caused by political events. This insurance typically covers areas like expropriation, war, and civil unrest. Another effective strategy is to engage in political lobbying and advocacy, where investors can work with local and international organizations to influence policies and regulations that affect their operations.

Regular Monitoring and Adaptation: Political risk is not a static concept; it evolves over time. Therefore, investors should establish a robust monitoring system to track political developments and their potential impact on their investments. This includes staying informed about news, legal changes, and political statements. Regularly reviewing and updating investment strategies based on these insights is essential to ensure that the business remains resilient and adaptable to changing political conditions.

By thoroughly evaluating political risk and implementing appropriate strategies, investors can make more informed decisions, protect their interests, and increase the likelihood of successful and sustainable foreign investments. It is a complex process that requires ongoing research, analysis, and a proactive approach to risk management.

Fidelity Investments and ChexSystems: What You Need to Know

You may want to see also

Transfer Risk: Understand the challenges of transferring funds across international borders

Transferring funds internationally can be a complex process, especially when dealing with net investments in foreign entities. The primary challenge lies in the inherent risks associated with cross-border transactions, which can significantly impact the value of your investment. One of the most significant risks is the fluctuation of exchange rates. When converting one currency to another, the value of the funds can change due to market volatility, which may result in a loss if the investment is not properly hedged. For instance, if a company invests in a foreign subsidiary and the local currency depreciates against the investor's home currency, the value of the investment could diminish.

Another critical aspect is the time it takes for funds to cross international borders. This delay can be a significant concern, especially in volatile markets where the value of an investment can change rapidly. The longer the transfer takes, the more exposed the investment is to potential losses or gains. To mitigate this risk, investors should consider the liquidity of the investment and the speed at which funds can be transferred without incurring substantial costs or losses.

Transferring funds internationally also involves various regulatory and compliance issues. Different countries have different rules and regulations regarding cross-border transactions, and non-compliance can lead to legal and financial repercussions. For instance, some countries may require specific documentation, such as trade agreements or customs declarations, which can add complexity and time to the transfer process. Understanding and adhering to these regulations is essential to avoid delays and potential penalties.

To manage transfer risk effectively, investors should employ various strategies. One common approach is to use financial derivatives, such as forward contracts or currency swaps, to lock in exchange rates and protect against currency fluctuations. These instruments allow investors to fix the exchange rate at the time of the transaction, ensuring that the investment value remains stable despite market changes. Additionally, investors can consider using specialized financial institutions that offer international money transfer services, which often provide competitive rates and efficient processing times.

Lastly, diversifying the investment across multiple currencies and regions can also help mitigate transfer risk. By spreading the investment, investors can reduce the impact of any single currency's volatility. This strategy requires careful planning and research to ensure that the investment aligns with the company's overall financial goals and risk tolerance. In summary, understanding and managing transfer risk is crucial for protecting the value of net investments in foreign entities, and it involves a combination of financial strategies, compliance knowledge, and a well-thought-out investment approach.

Investment Strategies: Navigating Change for Success

You may want to see also

Tax Considerations: Navigate tax implications and double taxation agreements for foreign investments

When investing in a foreign entity, understanding the tax implications is crucial to ensure compliance and optimize your financial strategy. One of the primary concerns is the potential for double taxation, which occurs when the same income is taxed in two or more jurisdictions. This issue can significantly impact the net investment return and must be carefully navigated.

To address this, many countries have established double taxation agreements or treaties. These agreements aim to prevent double taxation and provide a framework for tax allocation between the countries involved. When investing abroad, it is essential to research and identify the double taxation agreement (DTA) between your home country and the country where the foreign entity is located. DTAs often outline specific rules and rates for taxing various types of income, such as dividends, interest, and royalties. By understanding these agreements, investors can ensure that their tax obligations are clearly defined and potentially reduce their tax liability.

The process of hedging net investments in a foreign entity involves several tax considerations. Firstly, it is important to recognize that different types of investments may be taxed differently. For example, equity investments might be subject to corporate income tax, while debt instruments could attract interest or dividend taxes. Identifying the appropriate tax treatment for each investment type is essential for accurate tax planning. Additionally, investors should be aware of the tax consequences of selling or disposing of their foreign investments. Capital gains taxes may apply, and the timing and method of sale can impact the tax liability.

Furthermore, investors should consider the potential for tax credits or deductions associated with their foreign investments. Some countries offer tax incentives to encourage foreign direct investment, such as tax credits for certain expenses or deductions for losses incurred on foreign investments. Understanding these incentives can help investors optimize their tax position and potentially reduce their overall tax burden.

In summary, navigating tax implications and double taxation agreements is a critical aspect of hedging net investments in a foreign entity. By researching and understanding the relevant double taxation agreements, investors can ensure compliance, optimize their tax strategy, and potentially benefit from tax incentives offered by different jurisdictions. Proper tax planning will contribute to a more efficient and successful foreign investment portfolio.

Fidelity Branches: Can You Deposit Cash?

You may want to see also

Legal and Regulatory Compliance: Ensure adherence to local laws and regulations in foreign markets

When investing in a foreign entity, legal and regulatory compliance is a critical aspect that cannot be overlooked. Each country has its own set of laws and regulations that govern foreign investments, and failing to adhere to these can result in severe consequences. Here are some key considerations to ensure you navigate this complex landscape effectively:

Understand Local Laws and Regulations: Begin by thoroughly researching and understanding the legal framework of the country in which you are investing. This includes studying investment laws, tax regulations, labor laws, and any specific industry-related legislation. For instance, some countries may require foreign investors to obtain special licenses or permits, while others might have restrictions on the types of investments allowed. Being well-informed about these rules is essential to avoid any legal pitfalls.

Local Counsel and Expertise: Engaging local legal counsel who specializes in international investments is highly recommended. These professionals can provide invaluable guidance on how to structure your investments to comply with local laws. They can also assist with drafting and reviewing contracts, ensuring that all agreements are legally sound and compliant. Local expertise is crucial in navigating any cultural or linguistic barriers that might exist in the foreign market.

Tax Considerations: Tax laws can vary significantly across borders, and non-compliance can lead to significant financial penalties. Understand the tax implications of your investment, including withholding taxes, transfer taxes, and any applicable double taxation agreements. Consider consulting a tax advisor who specializes in international investments to ensure you are taking advantage of any available tax benefits and adhering to the local tax code.

Employment and Labor Laws: If your investment involves hiring local employees or contractors, it is imperative to comply with employment regulations. This includes understanding the rights of employees, working hours, minimum wage laws, and any specific industry standards. Failure to comply with labor laws can result in legal action and reputational damage. It is advisable to seek legal advice to ensure fair and lawful employment practices.

Regular Monitoring and Updates: International investment regulations are often dynamic and subject to change. Stay updated on any legislative amendments or policy shifts that might impact your investment. Regularly review and assess your compliance measures to ensure they remain effective. This proactive approach will help you identify and address any potential legal issues before they become significant problems.

Understanding E-Trade Cash Availability for Investment

You may want to see also

Frequently asked questions

Hedging is a risk management strategy used to protect the value of an investment by offsetting potential losses. In the context of foreign investments, it helps mitigate the impact of currency fluctuations, political risks, and other external factors that could negatively affect the net investment.

There are several methods to hedge, including forward contracts, options, swaps, and currency hedging. Forward contracts allow you to lock in an exchange rate for a future transaction, providing protection against currency depreciation. Options give you the right to buy or sell a specific currency at a predetermined rate, offering flexibility. Currency swaps can be used to exchange one currency for another, managing exchange rate risks.

Yes, emerging markets present unique challenges. Volatile exchange rates and political uncertainty are common risks. It is crucial to conduct thorough research and due diligence on the market and the specific entity you are investing in. Consider using a combination of hedging techniques tailored to the market's characteristics and your investment strategy.

While hedging can provide stability, it may also limit the potential upside of an investment. Additionally, hedging strategies can be complex and may incur costs, including transaction fees and potential losses if the hedging strategy is not well-executed. It requires careful planning and expertise to ensure the hedging strategy aligns with the overall investment goals.