Understanding how 1201 K's investments work is crucial for anyone looking to optimize their financial portfolio. 1201 K's investment strategy involves a unique approach to asset allocation and risk management, focusing on long-term growth and diversification. This method is designed to balance risk and reward, ensuring that investments are both stable and profitable over time. By carefully selecting assets and employing a disciplined investment approach, 1201 K's strategy aims to provide consistent returns while minimizing potential losses. This paragraph introduces the concept of 1201 K's investments, setting the stage for a detailed exploration of its principles and benefits.

What You'll Learn

- Investment Strategy: 1201 K's approach to allocating funds across various asset classes

- Risk Management: Techniques to mitigate potential losses in the investment portfolio

- Market Analysis: Research methods to identify trends and make informed investment decisions

- Portfolio Diversification: Strategies to spread investments across different sectors and regions

- Performance Tracking: Regular monitoring and evaluation of investment returns and goals

Investment Strategy: 1201 K's approach to allocating funds across various asset classes

The 1201K investment strategy is a structured approach to managing personal finances, focusing on long-term wealth creation and preservation. This strategy involves a careful allocation of funds across different asset classes to optimize returns while managing risk. Here's an overview of how this strategy works and the key principles behind it:

Asset Allocation: At its core, 1201K emphasizes a well-diversified portfolio. This means allocating your investments across various asset classes such as stocks, bonds, real estate, and alternative investments. Diversification is a key risk management tool, as it reduces the impact of any single asset's performance on the overall portfolio. For instance, a typical allocation might include 60% in stocks for long-term growth, 20% in bonds for stability and income, 10% in real estate for tangible asset exposure, and 10% in alternatives like commodities or private equity for added diversification.

Risk Management: Risk is an inherent part of investing, and 1201K investors aim to strike a balance between risk and reward. This strategy involves regular risk assessments and adjustments to the portfolio. For example, during periods of market volatility, the strategy might involve rebalancing the portfolio to maintain the desired asset allocation. This could mean selling assets that have appreciated and buying those that have underperformed, thus keeping the overall risk exposure in line with the investor's goals.

Long-Term Perspective: This investment approach is designed with a long-term horizon in mind. It encourages investors to remain invested through market cycles, focusing on the potential for long-term growth rather than short-term price movements. By holding a well-diversified portfolio over extended periods, investors can benefit from the power of compounding and the historical trend of markets rising over time.

Regular Review and Adaptation: A critical aspect of the 1201K strategy is the commitment to regular portfolio reviews. This involves assessing the performance of each asset class and making adjustments as necessary. Market conditions, economic trends, and individual investor circumstances can change, so periodic reviews ensure the portfolio remains aligned with the investor's goals. For instance, if the stock market has outperformed expectations, the strategy might suggest reallocating some funds to other asset classes to maintain the desired risk profile.

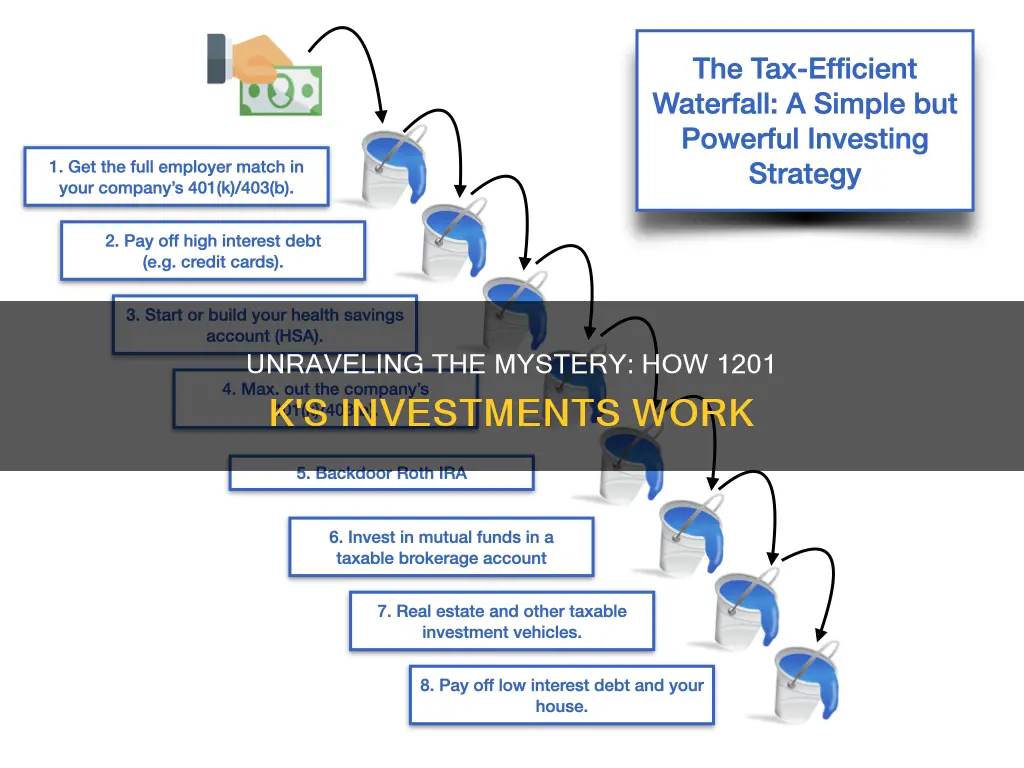

Tax Efficiency: Another important consideration in the 1201K strategy is tax efficiency. This involves making investment choices that minimize tax implications. For example, investing in tax-efficient vehicles like index funds or exchange-traded funds (ETFs) can help reduce taxable events. Additionally, understanding the tax treatment of different asset classes can guide investment decisions, ensuring that the strategy remains tax-effective over time.

By following this structured approach, investors can navigate the complexities of the financial markets, manage risk effectively, and work towards their long-term financial goals. The 1201K strategy provides a framework that allows for flexibility and adaptability, ensuring that investments remain aligned with the investor's needs and market conditions.

Retirement Investment Strategies: Navigating Your Golden Years

You may want to see also

Risk Management: Techniques to mitigate potential losses in the investment portfolio

Effective risk management is a critical component of any investment strategy, especially when navigating the complexities of a portfolio like 1201 K's. It involves a comprehensive approach to identifying, assessing, and mitigating potential risks to ensure the preservation of capital and the achievement of investment goals. Here are some key techniques to consider:

Diversification: One of the fundamental principles of risk management is diversification. This strategy involves spreading investments across various asset classes, sectors, and geographic regions. By diversifying, investors can reduce the impact of any single investment's performance on the overall portfolio. For instance, if a particular stock underperforms, a well-diversified portfolio can be supported by the positive performance of other assets, thus minimizing potential losses. Consider allocating assets to stocks, bonds, real estate, commodities, and alternative investments to create a balanced and resilient portfolio.

Risk Assessment and Analysis: Conducting thorough risk assessments is essential to understanding the potential pitfalls of your investments. This process involves identifying different types of risks, such as market risk, credit risk, liquidity risk, and operational risk. For market risk, analyze historical data and market trends to predict potential volatility. Credit risk analysis evaluates the financial health and creditworthiness of borrowers or counterparties. Liquidity risk assessment ensures that assets can be easily converted into cash without significant loss. Regularly reviewing and updating these assessments will help investors make informed decisions and adjust their strategies accordingly.

Risk Mitigation Strategies: Implementing various risk mitigation techniques can help minimize potential losses. One approach is to use hedging, which involves taking offsetting positions to reduce the impact of adverse price movements. For example, buying put options can protect against potential stock price declines. Another strategy is to employ risk-reducing financial instruments like derivatives, futures, and swaps, which can be used to manage exposure to specific risks. Additionally, regular portfolio rebalancing ensures that asset allocations remain aligned with the investor's risk tolerance and goals.

Regular Monitoring and Review: Risk management is an ongoing process that requires constant vigilance. Investors should regularly monitor their portfolios to identify any emerging risks or changes in market conditions. This includes staying updated on economic indicators, industry trends, and company-specific news. By conducting periodic reviews, investors can make timely adjustments to their investment strategies, rebalancing the portfolio to maintain the desired risk exposure.

Risk Tolerance and Goal Setting: Understanding your risk tolerance is crucial for effective risk management. It involves assessing your financial goals, time horizon, and personal comfort with volatility. Investors should set clear, achievable goals and design their portfolios accordingly. For instance, a more aggressive approach might be suitable for long-term investors seeking high returns, while a conservative strategy could be preferred for those closer to retirement. Regularly reviewing and adjusting these goals will help investors stay on track and make necessary modifications to their investment plans.

Securities Spending: Investment or Consumption?

You may want to see also

Market Analysis: Research methods to identify trends and make informed investment decisions

Market analysis is a critical component of investment strategies, especially when it comes to understanding the complex world of financial markets. For investors, particularly those with a keen interest in the strategies employed by 1201 K's Investments, conducting thorough market research is essential to making informed decisions. This process involves a systematic examination of various factors that influence market trends and can significantly impact investment outcomes.

One of the primary research methods in market analysis is quantitative analysis, which involves the use of historical data and statistical models to identify patterns and trends. Investors can study past market performance, economic indicators, and financial statements to make predictions about future behavior. For instance, analyzing stock prices over a decade might reveal seasonal fluctuations or long-term growth trends, providing valuable insights for investors. This method is particularly useful for identifying correlations between different market segments and making data-driven investment choices.

Qualitative analysis, on the other hand, focuses on understanding the qualitative aspects of the market, including industry trends, consumer behavior, and regulatory changes. Investors can gain deep insights by studying market research reports, industry publications, and news articles. For example, understanding the impact of a new government policy on a specific sector can help investors anticipate potential market shifts. This approach is crucial for assessing risks and opportunities that quantitative data might overlook.

Technical analysis is another powerful tool in a market analyst's toolkit. It involves studying historical price and volume data to identify patterns and predict future price movements. Technical analysts use various indicators and charts to visualize market trends, such as moving averages, relative strength index (RSI), and candlestick patterns. By recognizing these patterns, investors can make timely buy or sell decisions, especially in highly volatile markets. This method is particularly popular among short-term traders and can be a valuable addition to a comprehensive investment strategy.

Additionally, fundamental analysis is a key research technique that evaluates the intrinsic value of an investment by examining its financial health and performance. Investors analyze financial statements, assess the company's management, and study industry-specific factors to make informed decisions. This method is often used in conjunction with technical analysis to provide a more comprehensive understanding of the market. By combining these research methods, investors can make well-informed choices, especially when considering the investment strategies of 1201 K's, which likely involve a meticulous and multi-faceted approach.

Understanding the Difference: Investment vs National Savings

You may want to see also

Portfolio Diversification: Strategies to spread investments across different sectors and regions

When it comes to investing, the concept of portfolio diversification is a powerful strategy to manage risk and optimize returns. This approach involves spreading your investments across various sectors, industries, and geographic regions to ensure a balanced and well-rounded investment portfolio. By diversifying, investors aim to reduce the impact of any single investment's performance on the overall portfolio, thus minimizing risk.

One of the primary benefits of portfolio diversification is risk mitigation. By investing in a wide range of assets, investors can reduce the volatility of their portfolio. For instance, if an investor holds stocks from multiple sectors, a downturn in one sector might be offset by the strong performance of others. This strategy is particularly crucial during economic downturns or market corrections, as it can help protect the value of the portfolio.

To achieve effective diversification, investors should consider the following strategies:

- Asset Allocation: This involves dividing your portfolio into different asset classes such as stocks, bonds, real estate, and commodities. Each asset class has its own risk and return characteristics, and allocating them appropriately can provide a solid foundation for diversification. For example, stocks are generally more volatile but offer higher potential returns, while bonds are considered safer but with lower returns.

- Sector Allocation: Diversifying across sectors is essential to manage industry-specific risks. Different sectors, such as technology, healthcare, energy, and consumer goods, perform differently based on market conditions and economic cycles. By investing in multiple sectors, investors can reduce the impact of sector-specific downturns. For instance, if the tech sector experiences a decline, investments in healthcare or consumer staples might perform well, thus balancing the portfolio.

- Geographic Diversification: Expanding your investments across different countries and regions is another crucial aspect. International markets can offer unique opportunities and help reduce reliance on the performance of domestic markets. This strategy is especially important for long-term investors, as global economic trends and market cycles can vary significantly. For example, a portfolio with a global reach can benefit from the growth of emerging markets while also providing a hedge against domestic economic fluctuations.

- Regular Review and Rebalancing: Portfolio diversification is an ongoing process that requires regular monitoring and adjustment. Market conditions change, and individual investments may outperform or underperform over time. Therefore, investors should periodically review their portfolios and rebalance them to maintain the desired asset allocation and sector distribution. This ensures that the portfolio remains aligned with the investor's risk tolerance and financial goals.

By implementing these diversification strategies, investors can create a robust and resilient portfolio. It's important to remember that diversification does not guarantee profit or protect against losses in a declining market, but it can significantly reduce the impact of adverse events and provide a more stable investment journey. Effective portfolio management and diversification are key components of a successful long-term investment strategy.

Hydrogen's Future: Invest Now

You may want to see also

Performance Tracking: Regular monitoring and evaluation of investment returns and goals

Performance tracking is a critical component of effective investment management, especially for those with defined contribution plans like a 1201 K's investment strategy. It involves a systematic approach to regularly monitoring and evaluating investment returns and goals to ensure that the plan is on track to meet its objectives. This process is essential for several reasons. Firstly, it provides investors with a clear understanding of how their investments are performing over time. By regularly reviewing investment returns, individuals can assess whether their portfolio is generating the expected growth or if adjustments are needed. This proactive approach allows for timely decision-making, enabling investors to make informed choices to optimize their investment outcomes.

Secondly, performance tracking helps identify areas for improvement. Through consistent evaluation, investors can pinpoint underperforming assets or strategies and take corrective actions. This might involve rebalancing the portfolio to align with the investor's risk tolerance and goals or making strategic changes to the investment mix. For instance, if a particular asset class is underperforming compared to its peers, investors can consider diversifying or adjusting their allocation to potentially outperform the market.

Regular monitoring also facilitates the identification of market trends and economic shifts that may impact investment performance. Investors can stay informed about changing market conditions, such as interest rate fluctuations, economic recessions, or industry-specific trends, and adjust their investment strategies accordingly. This proactive approach ensures that the investment portfolio remains aligned with the investor's long-term goals and risk profile.

In the context of a 1201 K's investment strategy, performance tracking becomes even more crucial. This type of investment plan often involves a defined contribution approach, where the employer contributes a fixed amount or a percentage of the employee's salary to the investment fund. Regular performance tracking ensures that both the employer's and the employee's contributions are utilized effectively to achieve retirement savings goals. It also allows for a transparent understanding of how the investment strategy is evolving and whether it is meeting the intended retirement income objectives.

To implement effective performance tracking, investors should establish a structured process. This includes setting clear investment goals, defining performance metrics, and utilizing appropriate investment analysis tools. Regular reviews, such as quarterly or semi-annual assessments, can provide a comprehensive overview of investment performance. Additionally, investors should maintain detailed records of all investment transactions, holdings, and associated fees to facilitate accurate performance measurement and analysis.

MLP Investments: Navigating the Buying Process

You may want to see also

Frequently asked questions

1201 K's Investments is a fictional investment strategy or a placeholder name for a financial service. It is designed to illustrate how a particular investment approach might work, with the number "1201" likely representing a specific amount or a unique identifier. This could be a way to explain a method of investing, such as a tax-efficient strategy, where the focus is on long-term capital gains or a specific investment vehicle like a real estate fund.

The strategy employs a diversified approach, allocating capital across various asset classes like stocks, bonds, and alternative investments. It aims to balance risk and reward by utilizing a combination of fundamental and technical analysis. The "1201" figure could represent a specific allocation percentage or a target return, with the strategy's success measured by achieving or exceeding this financial goal.

Yes, 1201 K's Investments might offer tax benefits, particularly for long-term investors. This could include tax-efficient capital gains treatment, where the strategy aims to minimize short-term trading and maximize long-term holdings. The "1201" could be a reference to a specific tax code or regulation, allowing investors to defer taxes on gains or providing tax credits for certain investment activities.