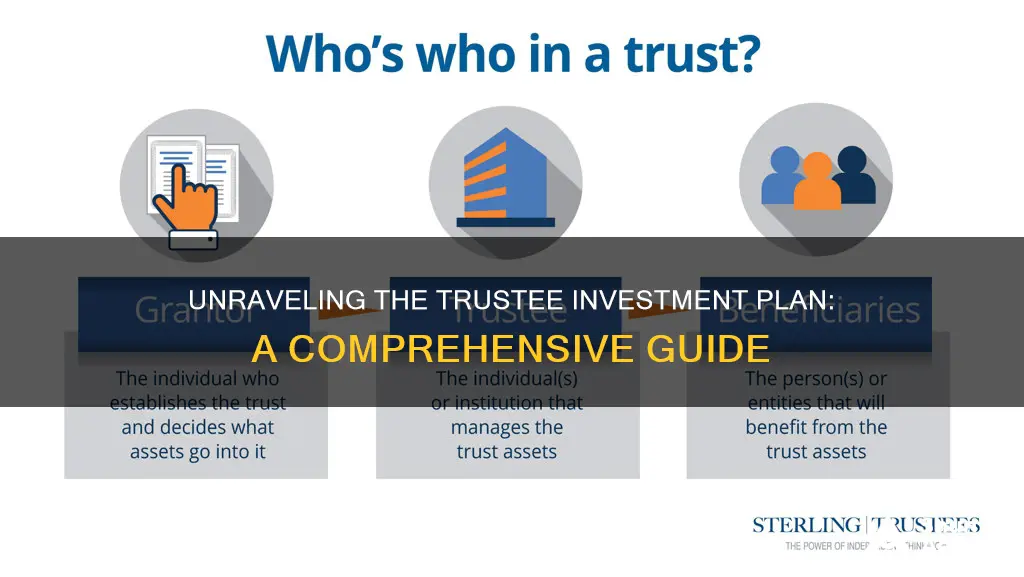

A trustee investment plan is a structured approach to managing and investing assets on behalf of beneficiaries, often used in retirement plans and trust funds. This plan involves a trustee, typically a financial institution or an individual, who is responsible for making investment decisions and managing the assets according to a predetermined strategy. The trustee's role is to ensure the investments are aligned with the beneficiaries' financial goals and risk tolerance, providing a steady stream of income or capital growth over time. This type of plan offers a disciplined and professional approach to wealth management, allowing individuals to build and grow their assets with the guidance of a trusted third party.

What You'll Learn

- Trustee Selection: Trustees manage investments on behalf of beneficiaries

- Investment Strategy: Plans outline investment goals and asset allocation

- Risk Management: Trustees must mitigate risks to protect beneficiaries' interests

- Performance Monitoring: Regular reviews ensure investments meet plan objectives

- Beneficiary Communication: Trustees keep beneficiaries informed about plan status

Trustee Selection: Trustees manage investments on behalf of beneficiaries

Trustees play a crucial role in the management of investment plans, acting as fiduciaries who are responsible for the prudent management of beneficiaries' assets. When it comes to trustee selection, it is essential to choose individuals or entities that possess the necessary expertise, skills, and ethical standards to handle the complex task of managing investments. The primary objective is to ensure the best interests of the beneficiaries are served while adhering to legal and regulatory requirements.

The selection process often involves a thorough evaluation of potential trustees, considering their financial acumen, investment knowledge, and ability to make sound decisions. Trustees should have a deep understanding of investment strategies, market trends, and risk management techniques. They must also demonstrate a strong commitment to ethical practices and a track record of making informed choices that align with the plan's objectives. A diverse range of investment expertise is often sought to ensure a well-rounded approach to portfolio management.

One key aspect of trustee selection is the evaluation of their risk tolerance and investment philosophy. Trustees should be aligned with the plan's risk profile and investment goals. For instance, a conservative plan might require trustees who prioritize capital preservation and steady growth, while a more aggressive plan may seek out trustees with a proven track record of taking calculated risks to achieve higher returns. The ability to adapt investment strategies based on market conditions is also a valuable trait for trustees to possess.

Additionally, the transparency and accountability of potential trustees are vital considerations. Trustees should provide regular reports on investment performance, fees incurred, and any potential conflicts of interest. They must also be willing to engage in open communication with beneficiaries and their representatives, ensuring that everyone is well-informed about the plan's progress. This level of transparency fosters trust and allows beneficiaries to make informed decisions regarding their investments.

In summary, the selection of trustees is a critical process in establishing a trustee investment plan. It requires a careful assessment of their financial expertise, risk management skills, and ethical standards. By choosing the right trustees, beneficiaries can have confidence in the management of their assets, knowing that their investments are in capable and trustworthy hands. This process ensures that the plan operates efficiently and effectively, ultimately benefiting the beneficiaries in the long term.

The Great Debate: Upgrading Your Home vs. Investing – Which is the Smarter Financial Move?

You may want to see also

Investment Strategy: Plans outline investment goals and asset allocation

A trustee investment plan is a structured approach to managing investments on behalf of beneficiaries, often in retirement or pension plans. This strategy is designed to provide a clear and consistent investment process, ensuring that the assets are allocated according to the plan's objectives. The plan's primary goal is to optimize returns while managing risk, and this is achieved through a well-defined investment strategy.

The investment strategy within a trustee plan typically involves outlining specific investment goals and a detailed asset allocation plan. This allocation determines the proportion of the portfolio invested in various asset classes such as stocks, bonds, real estate, and alternative investments. For instance, a plan might aim for a balanced approach, with a certain percentage allocated to each asset class, ensuring diversification and risk mitigation. The asset allocation strategy is a critical component as it directly impacts the plan's performance and risk profile.

When outlining investment goals, the plan's trustee or investment manager must consider the time horizon and the risk tolerance of the beneficiaries. For long-term goals, such as retirement, a more aggressive strategy with a higher allocation to stocks might be appropriate. In contrast, short-term goals or those with a closer maturity date may require a more conservative approach, favoring bonds and fixed-income securities. The investment goals should be specific and measurable, providing a clear direction for the asset allocation.

The asset allocation decision involves a careful selection of investment vehicles and a strategic distribution of funds. This includes choosing between different types of stocks, bonds, and other assets, as well as considering factors like market conditions, economic forecasts, and historical performance. For instance, a plan might allocate a larger portion of its portfolio to large-cap stocks for stability and a smaller percentage to emerging market investments for potential higher returns. This allocation should be regularly reviewed and adjusted to reflect changing market dynamics and the plan's performance.

In summary, a trustee investment plan's success relies heavily on a well-structured investment strategy. This strategy involves setting clear investment goals and implementing a thoughtful asset allocation plan. By doing so, the plan can effectively manage risk, optimize returns, and provide a secure financial future for the beneficiaries. It is a comprehensive process that requires regular monitoring and adjustments to ensure the plan's objectives are met.

Maximizing Voya Retirement Investments: A Comprehensive Guide

You may want to see also

Risk Management: Trustees must mitigate risks to protect beneficiaries' interests

Trustees play a crucial role in managing and mitigating risks within a trustee investment plan, ensuring the protection of beneficiaries' interests. Effective risk management is essential to safeguard the assets and, ultimately, the well-being of those who rely on the trust. Here's an overview of the key considerations:

Risk Identification: The first step in risk management is to identify potential risks associated with the investment plan. Trustees should conduct a comprehensive analysis to understand the various types of risks involved. These risks can include market risks, such as fluctuations in asset prices, credit risks related to investments in bonds or securities, liquidity risks, and operational risks arising from the trust's day-to-day operations. By identifying these risks, trustees can develop strategies to address them proactively.

Risk Assessment and Analysis: Once risks are identified, trustees must assess their potential impact and likelihood. This involves evaluating the severity of each risk and determining the appropriate level of risk tolerance for the trust. A thorough analysis should consider historical data, market trends, and expert opinions to make informed decisions. For instance, assessing the impact of market volatility on the trust's portfolio can help in deciding whether to diversify investments or implement hedging strategies.

Risk Mitigation Strategies: To protect beneficiaries, trustees should employ various risk mitigation techniques. Diversification is a fundamental strategy, where investments are spread across different asset classes, sectors, and geographic regions to reduce the impact of any single risk. Regular portfolio reviews and rebalancing can ensure that the investment strategy remains aligned with the trust's objectives and risk tolerance. Additionally, implementing robust internal controls, such as independent audits and fraud detection systems, can minimize operational risks.

Regular Monitoring and Review: Effective risk management requires ongoing monitoring and periodic reviews. Trustees should establish a system to track and analyze the trust's performance against its risk management objectives. This includes regular risk assessments, performance reporting, and compliance checks. By staying vigilant, trustees can quickly identify emerging risks and take corrective actions. For example, if a particular investment becomes overly risky, trustees can consider selling it and reinvesting in a more suitable alternative.

Documentation and Communication: Proper documentation is essential to demonstrate the trustee's diligence in risk management. Trustees should maintain detailed records of their risk assessment processes, decisions, and actions taken. Clear communication with beneficiaries and stakeholders is also vital. Trustees should provide regular updates on the trust's performance, including any identified risks and the measures taken to address them. Transparency ensures that beneficiaries are well-informed and can make confident decisions regarding their trust investments.

Tesla: Electric Dream or Money-Sucking Machine?

You may want to see also

Performance Monitoring: Regular reviews ensure investments meet plan objectives

Performance monitoring is a critical aspect of trustee investment plans, as it ensures that the investments are aligned with the plan's objectives and goals. Regular reviews play a vital role in this process, providing an opportunity to assess the performance of the investments and make necessary adjustments. Here's how it works:

Trustees, who are responsible for the overall management and administration of the plan, should establish a comprehensive performance monitoring process. This process typically involves setting key performance indicators (KPIs) and metrics that are relevant to the plan's objectives. For example, if the plan's goal is to provide retirement benefits, KPIs might include investment returns, risk exposure, and the plan's ability to meet projected benefit payments. By defining these metrics, trustees can objectively evaluate the performance of the investment strategy.

Regular reviews, often conducted on a quarterly or semi-annual basis, are essential to track the progress of the investments. During these reviews, trustees should analyze the performance data, comparing it against the established KPIs and plan objectives. This analysis enables them to identify any deviations from the expected performance and take appropriate actions. For instance, if the investments are underperforming, trustees might consider rebalancing the portfolio or adjusting the investment strategy to improve returns.

The frequency of these reviews is crucial to ensure that the plan remains on track. More frequent reviews allow for quicker identification of potential issues and provide an opportunity to make timely decisions. However, it's important to strike a balance, as excessive reviews might lead to unnecessary costs and potential distractions from the plan's long-term goals. A well-structured performance monitoring process should be designed to provide regular insights without being overly burdensome.

Additionally, performance monitoring should also involve risk assessment and management. Trustees need to regularly review and evaluate the risks associated with the investments, such as market risk, credit risk, and liquidity risk. By staying vigilant and proactive in managing these risks, trustees can ensure that the plan's objectives are not compromised. This includes implementing risk mitigation strategies and regularly updating the plan's risk management policies.

In summary, performance monitoring through regular reviews is essential for trustee investment plans to meet their objectives. It enables trustees to make informed decisions, adjust strategies, and manage risks effectively. By staying committed to this process, trustees can ensure the long-term success and sustainability of the plan, ultimately benefiting the participants and beneficiaries.

Switzerland: A Haven for Investors

You may want to see also

Beneficiary Communication: Trustees keep beneficiaries informed about plan status

Trustees play a crucial role in ensuring effective communication with beneficiaries regarding the status of their investment plans. When it comes to trustee investment plans, beneficiaries often have questions and concerns about their participation, contributions, and the overall performance of the plan. It is the trustee's responsibility to provide clear and transparent information to address these inquiries and maintain a positive relationship with the beneficiaries.

One essential aspect of beneficiary communication is establishing a regular update process. Trustees should set a consistent schedule for providing information to the beneficiaries. This could be in the form of periodic statements, newsletters, or online updates. By maintaining a regular communication channel, beneficiaries will receive timely information about their investment plan's performance, contributions, and any relevant changes. For example, monthly statements can detail the investments made, the current value of the plan, and any recent market fluctuations, ensuring beneficiaries stay informed about their financial interests.

Additionally, trustees should provide comprehensive documentation and resources to beneficiaries. This includes offering easy-to-understand explanations of the investment plan's features, benefits, and potential risks. Educational materials, such as brochures, FAQs, or online tutorials, can empower beneficiaries to make informed decisions and understand their rights and responsibilities. For instance, a simple guide explaining the different investment options available and how they align with the plan's goals can help beneficiaries choose the most suitable investment strategy.

Another critical aspect is making sure that beneficiaries have multiple channels to reach out for inquiries. This could include providing contact information for the trustee's customer service team, an email address, or an online portal where beneficiaries can access their account information and ask questions. By offering various communication methods, trustees ensure that beneficiaries can easily get the information they need and feel supported in their investment journey.

Furthermore, trustees should be proactive in addressing any concerns or complaints raised by beneficiaries. Promptly responding to inquiries and providing accurate, relevant information demonstrates a commitment to transparency and beneficiary satisfaction. If there are any issues with the plan or its performance, the trustee should communicate these matters openly and offer solutions or alternative options to mitigate any potential negative impacts on the beneficiaries' investments.

In summary, effective beneficiary communication is vital for trustee investment plans. By providing regular updates, comprehensive documentation, multiple communication channels, and prompt responses to inquiries, trustees can ensure that beneficiaries are well-informed and confident in their participation. This approach fosters trust and a positive relationship between the trustee and the beneficiaries, ultimately contributing to the success and smooth operation of the investment plan.

Mortgage or Investment: Where Should Your Money Go?

You may want to see also

Frequently asked questions

A trustee investment plan, often referred to as a 'trustee-managed investment plan', is a type of retirement savings plan where an independent trustee, typically a financial institution or a professional trustee, manages the investments on behalf of the plan participants. This plan is designed to provide a structured and professional approach to investing retirement savings.

In a self-managed plan, the participant or their designated representative makes investment decisions. With a trustee investment plan, the trustee takes on the responsibility of selecting and managing investments, ensuring diversification and adhering to the plan's investment strategy. This can offer a more hands-off approach for investors.

Trustee investment plans are often offered as part of employer-sponsored retirement programs, such as 401(k) or pension plans. Employees can contribute a portion of their salary to the plan, and the trustee manages the investments of these contributions. The plan's rules and eligibility criteria may vary depending on the employer and the trustee's policies.

One of the key advantages is the professional management of investments, which can lead to better diversification and potentially higher returns over the long term. Trustees often have access to a wide range of investment options and can provide regular reviews and adjustments to the portfolio. This plan also removes the burden of investment decision-making from the participant, allowing them to focus on other financial goals.

The trustee, in consultation with the plan administrator, distributes the investment returns to participants according to the plan's terms. This may involve regular contributions to the participant's retirement account or providing them with a lump sum at specific intervals. The distribution process ensures that participants benefit from the growth of their investments over time.