Investing for retirement can be a daunting task, but it is never too late to start. The first step is to assess your current financial situation and set clear goals for what you want to achieve. It is important to be disciplined and live within your means, saving and investing any extra income.

There are various investment options available, such as 401(k)s, IRAs, and brokerage accounts, each with its own advantages and tax implications. It is recommended to consult with a financial advisor to determine the best strategy for your specific circumstances, but some general advice includes maximising contributions to tax-advantaged retirement accounts, investing in broad-market low-cost index funds, and maintaining a diverse portfolio.

It is also crucial to have an emergency fund in place and to ensure that any investments are actively managed and allocated appropriately. While historical market returns can provide a guide, it is important to be cautious and conservative when planning for the future, as actual returns may differ.

By taking control of your finances, setting clear goals, and seeking professional advice when needed, you can work towards a comfortable retirement.

| Characteristics | Values |

|---|---|

| Age | 19-76 |

| Income | $90k-125k per year |

| Savings | $16k in traditional savings, $15k in a taxable brokerage account |

| Investments | VOO, QQQ, VUG, VB, VXUS |

| Debt | $296k on mortgage, $32k on car |

| Risk tolerance | High |

What You'll Learn

How to save for retirement

Retirement planning can be a daunting task, but it is important to start early and save as much as possible. Here are some tips to help you save for retirement:

Start Early:

The power of compound interest means that the earlier you start saving, the more time your money has to grow. Don't wait until you are older to begin retirement planning. Even if you are young and just starting your career, try to put away a small amount each month into a retirement account. Over time, this will grow and you will be thankful you started early.

Take Advantage of Employer Matching:

If your employer offers a retirement plan such as a 401(k) and provides matching contributions, take full advantage of this. It is essentially free money that you should not pass up. Contribute at least enough to get the full employer match. You may also want to consider contributing more than the minimum required to get the match, as this will help you save even more for retirement.

Maximise Tax-Advantaged Accounts:

Utilise tax-advantaged retirement accounts such as a Roth IRA or 401(k) if you are in the US. These accounts offer tax benefits that can help your savings grow faster. With a Roth IRA, you contribute after-tax dollars, and withdrawals in retirement are tax-free. Traditional IRAs offer tax deductions when you contribute, but you pay taxes on withdrawals in retirement.

Diversify Your Investments:

Don't put all your eggs in one basket. Diversifying your investments across different asset classes and geographic regions can help reduce risk and increase the potential for long-term growth. Consider investing in a mix of stocks, bonds, mutual funds, and exchange-traded funds (ETFs). You can also invest in real estate or other alternative investments, depending on your risk tolerance and financial goals.

Set Clear Goals and Benchmarks:

Figure out how much you want to save for retirement and set clear, achievable goals to help you get there. For example, you could aim to save a certain percentage of your income each year or reach a specific milestone by a certain age. This will help you stay focused and motivated.

Automate Your Savings:

Make saving for retirement easier by automating your contributions. Set up regular transfers from your paycheck or bank account into your retirement accounts. That way, you don't even have to think about it, and your savings will grow effortlessly over time.

Control Spending and Live Within Your Means:

Saving for retirement is not just about how much you save; it's also about how much you spend. Control your spending impulses and live within your means. This may involve creating a budget and sticking to it, cutting back on unnecessary expenses, or finding cheaper alternatives for the things you enjoy.

Consult a Financial Advisor:

Retirement planning can be complex, and it may be helpful to consult a fee-only financial advisor. They can provide personalised advice and help you create a comprehensive retirement plan that takes into account your unique circumstances, risk tolerance, and financial goals.

Remember, saving for retirement is a marathon, not a sprint. It requires discipline, consistency, and a long-term mindset. By starting early, taking advantage of tax benefits, and making saving a habit, you can put yourself on the path to a comfortable retirement.

The Investment Firm Payment Paradox: Navigating the Complex World of Fees and Returns

You may want to see also

How to invest in a 401k

A 401(k) is a workplace retirement plan that allows employees to invest a portion of their paycheck before taxes are taken out. It's a great way to save for retirement and offers several benefits, including tax advantages and employer matching contributions. Here are some steps to guide you through the process of investing in a 401(k):

Step 1: Understand the Basics

Before investing in a 401(k), it's important to understand the basics. A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their salary on a pre-tax or post-tax basis. This means that the money you invest in your 401(k) is either taken from your paycheck before taxes are deducted or after taxes have been paid. It's important to note that you won't pay taxes on the money you invest in your 401(k) until you withdraw it during retirement.

Step 2: Check if Your Employer Offers a 401(k) Plan

Not all employers offer 401(k) plans, so it's essential to check with your company's human resources department or benefits administrator to see if this option is available to you. If your employer does offer a 401(k) plan, they will provide you with the necessary information and enrolment materials.

Step 3: Decide How Much to Contribute

Once you have confirmed that your employer offers a 401(k) plan, you need to decide how much of your salary you want to contribute. It's generally recommended to contribute enough to take advantage of any employer matching contributions, as this is essentially free money towards your retirement. For example, if your employer matches your contributions up to 5% of your salary, you should aim to contribute at least 5% to maximize this benefit. Keep in mind that you can usually adjust your contribution amount at any time.

Step 4: Choose Your Investments

When investing in a 401(k), you will have a variety of investment options to choose from, such as mutual funds, target-date funds, and individual stocks or bonds. It's important to carefully consider your investment options and select those that align with your risk tolerance and investment goals. Diversification is also key to managing risk and maximizing returns.

Step 5: Monitor and Adjust Your Investments

Investing in a 401(k) is not a "set it and forget it" proposition. It's important to regularly review your investments to ensure they are performing as expected and still align with your investment strategy. You may also need to adjust your contributions over time as your financial situation changes.

Step 6: Consider the Tax Implications

When investing in a 401(k), it's crucial to understand the tax implications of your contributions and withdrawals. Traditional 401(k) contributions are made with pre-tax dollars, which means you will pay taxes on the money when you withdraw it during retirement. On the other hand, Roth 401(k) contributions are made with after-tax dollars, so you won't owe any taxes when you withdraw the money in retirement.

Step 7: Plan for Withdrawal

Finally, it's important to have a plan for withdrawing your 401(k) funds during retirement. You can typically start withdrawing money from your 401(k) without penalty at age 59½, and you are required to take minimum distributions by age 72. Carefully consider your income needs and budget accordingly to ensure your 401(k) funds last throughout your retirement.

Paycheck Investing: A Guide to Regularly Buying Amazon Stock

You may want to see also

How to choose a financial advisor

A financial advisor can help you manage your money and reach your financial goals. However, with so many options available, it can be challenging to choose the right one for you. Here are six steps to help you select a financial advisor that suits your needs:

Step 1: Identify your financial needs

Before starting your search, reflect on what you want from your relationship with a financial advisor. Do you need help with budgeting, taxes, investments, savings goals, estate planning, or holistic financial management? Knowing your needs will help you find an advisor with the right expertise and services.

Step 2: Understand the types of financial advisors

Financial advisors go by various names, such as investment advisors, brokers, certified financial planners, financial coaches, and portfolio managers. Some titles, including "financial advisor" itself, are not tied to specific credentials. To ensure you're working with a qualified professional, look for advisors with fiduciary duty, such as certified financial planners (CFPs), who are legally required to act in their client's best interest.

Step 3: Review the range of options

Financial advisors are available through different service types, including robo-advisors (digital services offering low-cost investment management), online financial planning services (virtual access to human advisors), and traditional financial advisors (in-person meetings and holistic financial planning). Consider your budget, personal preferences, and the level of service you need when choosing an option.

Step 4: Consider your budget

Financial advisors have different fee structures, so understanding their costs is essential. Robo-advisors often charge a low annual fee, while online financial planning services may charge a flat subscription fee or a percentage of your assets. Traditional financial advisors typically charge a percentage of your assets under management, which can be more expensive. Choose an option that fits your budget and financial guidance needs.

Step 5: Vet the financial advisor's background

It's crucial to verify a financial advisor's credentials and experience. Check their Form ADV, employment record, and disciplinary history using resources like FINRA's BrokerCheck website. Ensure they have the necessary certifications and no significant complaints or disciplinary issues.

Step 6: Hire the financial advisor

Once you've found a suitable financial advisor, the next step is to engage their services. This typically involves an initial consultation, where you discuss your financial situation and goals. The advisor will then provide legal documents outlining their ethical principles, fees, and services. After signing the necessary paperwork, they will start managing your finances.

Self-Employed Investment Strategies

You may want to see also

How to set a retirement budget

Setting a retirement budget is an important step in planning for your financial future. Here are some steps to help you get started:

Track your current spending

Before you can set a retirement budget, it's crucial to understand your current spending habits. Use a spreadsheet, budgeting app, or financial software to track your income and expenses over several months. Categorise your spending, including essentials such as housing, transportation, and groceries, as well as discretionary spending on entertainment, dining out, and hobbies. This will give you a clear picture of where your money is going and help you identify areas where you can cut back if needed.

Determine your retirement income sources and estimate expenses

Calculate your expected income from sources such as Social Security, pensions, investments, and retirement savings. Consider meeting with a financial advisor to get an accurate estimate of your retirement income. Next, create a list of expected expenses during retirement. Include essentials like housing, utilities, food, transportation, and healthcare. Don't forget to factor in discretionary spending on travel, hobbies, and entertainment.

Set your retirement budget and make adjustments

Once you have an idea of your income and expenses, create a retirement budget that aligns with your income. If there's a gap between your income and expenses, look for areas where you can cut back or consider ways to increase your income, such as working longer or investing wisely. Be sure to review and adjust your budget periodically to account for inflation and unexpected expenses.

Test drive your retirement budget

If possible, try living on your retirement budget for a few months before you actually retire. This will help you identify any areas where you may have underestimated expenses or cut back too aggressively. It also gives you a chance to adjust your spending habits and ensure your budget is realistic and comfortable.

Seek professional advice

Retirement planning can be complex, and it's important to make sure you're making the right decisions for your financial future. Consider meeting with a financial advisor or planner who can provide personalised advice based on your unique circumstances. They can help you optimise your retirement income, minimise taxes, and ensure your budget is realistic and sustainable.

Pension Investment: Choosing Wisely

You may want to see also

How to invest in stocks

Investing in stocks is a great way to grow your wealth over time and build a solid retirement fund. Here are some instructive guidelines on how to get started and make informed decisions:

Understand the Basics

Start by educating yourself about the stock market and investing fundamentals. Familiarize yourself with basic concepts, such as buying and selling stocks, market trends, and the different types of stocks available for investment. You can find a wealth of information on reputable websites, such as Investopedia, or consider reading books like "The Intelligent Investor" by Benjamin Graham or "One Up on Wall Street" by Peter Lynch.

Open a Brokerage Account

To begin investing, you'll need to open an account with a brokerage firm. Compare different brokers and choose one that suits your needs, considering factors such as fees, research tools, and customer support. Some popular options include Vanguard, Fidelity, and Charles Schwab.

Start with a Small Investment

When you're just starting, it's advisable to invest a small amount, such as $100 or $500, to get a feel for the market and minimize risks. You can gradually increase your investments as you gain more knowledge and confidence.

Focus on Long-Term Growth

Investing in stocks should generally be viewed as a long-term strategy. Avoid the temptation of trying to time the market or making quick gains. Instead, focus on buying stocks that you believe will grow over time, ignoring short-term fluctuations.

Diversify Your Portfolio

Diversification is a key aspect of successful investing. Spread your investments across different sectors and industries to reduce risk. Consider investing in exchange-traded funds (ETFs) or mutual funds, which offer instant diversification by pooling your money with other investors to purchase a basket of stocks.

Research and Analyze

Before investing in a particular stock, conduct thorough research. Examine the company's financial health by reviewing financial statements, analyzing revenue growth, and assessing the competitive landscape. Understand the risks and potential rewards associated with the investment.

Practice Discipline and Patience

Successful investing requires discipline and a long-term perspective. Avoid making impulsive decisions based on short-term market movements. Stay invested during downturns and focus on your long-term goals.

Consider Using Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money in the stock market at regular intervals, regardless of the share price. This approach helps mitigate the risk of investing a large sum at an inopportune time and can lead to better returns over time.

Stay Informed and Seek Guidance

Stay up-to-date with market news and trends. Follow reputable financial news sources and consider seeking guidance from financial advisors or mentors who can provide personalized advice based on your goals and risk tolerance.

Manage Risk and Emotions

Investing in stocks involves risk, and it's essential to understand your risk tolerance. Avoid investing money you can't afford to lose. Additionally, emotions can play a significant role in investing decisions. Stay objective and don't let fear or greed drive your choices.

Remember, investing in stocks is a journey, and it's crucial to approach it with a long-term perspective. Start with small investments, educate yourself continuously, and make informed decisions based on research and analysis.

Fundrise: Your Guide to Smart Investing

You may want to see also

Frequently asked questions

It is important to start investing for retirement as early as possible. You should aim to put more money into your 401K than just what your employer matches. You should also consider opening a Roth IRA. It is recommended to put any extra money into an emergency fund and then into your 401K. You should also ensure that your 401K is invested in the stock market.

A Roth IRA is a tax-advantaged retirement account where you make after-tax contributions and can withdraw those contributions tax-free and penalty-free at any time and for any reason. You can open a Roth IRA with providers such as Vanguard, Fidelity, or Schwab.

It is recommended to contribute about 12% of your income as a permanent investment. You should also try to maximize your contributions to tax-advantaged retirement accounts for a few years.

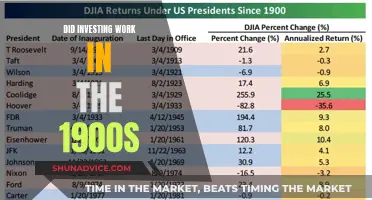

You should be conservative and account for 5-7% annual returns. You should also be aware that the average long-term real return of the S&P500 is around 7%.