Albert Auto Investment is a revolutionary financial tool designed to simplify the process of investing for individuals. It offers an automated approach to investing, allowing users to build and manage their investment portfolios with minimal effort. The platform utilizes advanced algorithms to analyze market trends, select assets, and execute trades on behalf of the user, making it an attractive option for those seeking a hands-off investment strategy. With its user-friendly interface and automated features, Albert Auto Investment aims to democratize access to the financial markets, empowering individuals to take control of their financial future.

What You'll Learn

- Investment Strategy: Albert's AI-driven approach to investing, utilizing machine learning and data analysis

- Portfolio Management: Automated rebalancing and diversification to optimize investment returns and risk

- Risk Assessment: Advanced algorithms assess and manage risk exposure for personalized investment plans

- Market Insights: Real-time market data and insights inform investment decisions and strategy adjustments

- User Experience: Intuitive interface and personalized recommendations enhance user engagement and satisfaction

Investment Strategy: Albert's AI-driven approach to investing, utilizing machine learning and data analysis

Albert Auto Investment is an innovative investment strategy that leverages the power of artificial intelligence (AI) and machine learning to revolutionize the way individuals approach their financial portfolios. This approach is designed to automate the investment process, making it more efficient, data-driven, and potentially lucrative for investors. Here's an overview of how Albert Auto Investment works and its key components:

Data-Driven Decision Making: At the heart of Albert Auto Investment is a vast amount of financial data. The system collects and analyzes market trends, historical performance, economic indicators, and news data from various sources. By utilizing machine learning algorithms, it identifies patterns, correlations, and insights that might not be apparent to human investors. This data-driven approach allows Albert to make informed investment decisions, adapting to market dynamics in real-time.

Automated Portfolio Management: The platform automates the entire investment process, from account setup to trade execution. Investors can define their risk tolerance, investment goals, and time horizons. Albert's AI then constructs a customized portfolio tailored to the individual's preferences. It regularly rebalances the portfolio, ensuring it stays aligned with the investor's strategy. This automation reduces the emotional aspect of investing, often a significant factor in human decision-making biases.

Risk Assessment and Management: Risk assessment is a critical aspect of investing, and Albert excels in this area. It employs sophisticated risk models and scenario analysis to identify potential pitfalls and opportunities. By continuously monitoring market conditions and individual holdings, Albert can adjust the portfolio's risk exposure dynamically. This ensures that investors' capital is protected while also pursuing growth opportunities.

Machine Learning for Optimization: Machine learning algorithms are at the core of Albert's investment strategy. These algorithms learn from historical data and market behavior to optimize investment choices. They can identify undervalued assets, predict market shifts, and suggest optimal entry and exit points. Over time, the system refines its strategies, improving performance and adapting to changing market conditions.

Personalized Investment Insights: Albert provides investors with personalized insights and recommendations. It generates detailed reports and visualizations, offering a clear understanding of the portfolio's performance and the underlying factors driving it. This transparency empowers investors to make informed decisions and take control of their financial future. Additionally, Albert can provide tailored advice on tax-efficient strategies and wealth management.

Albert Auto Investment's AI-driven approach offers a unique and modern way to navigate the complex world of investing. By combining data analysis, automation, and machine learning, it aims to deliver competitive returns while minimizing risks. This strategy is particularly appealing to those seeking a more systematic and disciplined investment process, free from the emotional biases that often impact traditional investing.

Caribbean Citizenship: Investing in a Tropical Paradise

You may want to see also

Portfolio Management: Automated rebalancing and diversification to optimize investment returns and risk

Albert Auto Investment is an innovative approach to portfolio management that utilizes automated rebalancing and diversification strategies to optimize investment returns and manage risk effectively. This method is designed to help investors achieve their financial goals by providing a dynamic and adaptive investment strategy. Here's how it works:

Automated Rebalancing: At the core of Albert Auto Investment is the concept of automated rebalancing. This process involves regularly adjusting the allocation of assets within a portfolio to maintain the desired risk and return profile. Investors often face the challenge of staying invested while managing risk, especially during market fluctuations. Automated rebalancing addresses this by automatically buying or selling assets to ensure the portfolio remains aligned with the investor's risk tolerance and objectives. For example, if the stock market experiences a significant surge, the algorithm might sell a portion of the stock holdings to rebalance the portfolio, thus reducing overall risk. This automated process eliminates the need for manual intervention, allowing investors to benefit from a consistent and disciplined approach.

The rebalancing strategy is typically based on predefined rules or thresholds. Investors can set parameters such as target asset allocations, risk tolerance levels, and rebalancing frequency. When the portfolio deviates from these targets, the system triggers adjustments to restore balance. This ensures that the portfolio remains diversified and aligned with the investor's strategy, even in the face of market volatility.

Diversification: Diversification is a key principle in investment management, and Albert Auto Investment excels in this aspect. By automatically diversifying across various asset classes, sectors, and geographic regions, the system aims to minimize risk and maximize potential returns. Diversification involves spreading investments across different types of assets to reduce the impact of any single investment's performance on the overall portfolio. For instance, it might allocate a portion of the portfolio to stocks, bonds, real estate, and commodities, ensuring that the investor is not overly exposed to any one market or asset class.

The algorithm continuously monitors market conditions and adjusts the portfolio's asset allocation accordingly. This dynamic approach allows investors to benefit from the potential upside of different asset classes while managing risk through diversification. As market trends change, the system adapts, ensuring that the portfolio remains well-diversified and optimized for the investor's goals.

Risk Optimization: Albert Auto Investment's primary objective is to optimize investment returns while effectively managing risk. The automated rebalancing and diversification strategies work together to achieve this. By regularly rebalancing the portfolio, investors can avoid the pitfalls of market timing and emotional decision-making. The system's ability to adapt to market changes helps in capturing potential gains while minimizing losses during downturns.

Additionally, the diversification aspect reduces the overall risk of the portfolio. By holding a wide range of assets, the impact of any single investment's poor performance is mitigated, thus preserving capital and ensuring a more stable investment journey. This risk-focused approach is particularly beneficial for long-term investors seeking consistent growth and stability.

In summary, Albert Auto Investment offers a sophisticated and automated solution for portfolio management. Through automated rebalancing and diversification, it aims to optimize investment outcomes, providing investors with a disciplined and adaptive strategy. This approach empowers investors to make informed decisions, manage risk effectively, and work towards their financial objectives with confidence.

Franklin Templeton-Putnam Deal: A Merger of Investment Giants

You may want to see also

Risk Assessment: Advanced algorithms assess and manage risk exposure for personalized investment plans

Albert Auto Investment is a sophisticated automated investment platform that utilizes advanced algorithms to create personalized investment plans for its users. The core of its functionality lies in its risk assessment and management capabilities, which are designed to optimize investment strategies while minimizing potential risks. Here's an overview of how these algorithms work to ensure a tailored and secure investment experience:

Risk Profiling and Assessment: The first step in the process involves a comprehensive risk assessment of the user. This assessment is based on various factors, including the user's financial goals, risk tolerance, investment horizon, and current financial situation. By gathering this information, the platform's algorithms can categorize investors into different risk profiles, such as conservative, moderate, or aggressive. This classification is crucial as it forms the foundation for all subsequent investment decisions.

Advanced Algorithmic Analysis: At the heart of Albert Auto Investment's success are its proprietary algorithms. These algorithms employ machine learning techniques to analyze vast amounts of financial data, market trends, and historical performance. They consider numerous variables, such as asset correlations, volatility, and market dynamics, to identify patterns and make informed predictions. The algorithms then use this analysis to assess the potential risk associated with different investment options. For instance, they can determine the likelihood of an asset's price movement and the potential impact on the overall portfolio.

Dynamic Risk Management: One of the key advantages of Albert Auto Investment's approach is its ability to dynamically manage risk. The algorithms continuously monitor the investment portfolio and adjust the asset allocation accordingly. If market conditions change or a specific investment becomes too risky, the algorithms can rebalance the portfolio to maintain the desired risk level. This real-time risk management ensures that the investment strategy remains aligned with the user's risk tolerance and goals. For example, if a stock's volatility increases, the algorithm might suggest diversifying by investing in less volatile assets to reduce overall portfolio risk.

Personalized Investment Strategies: Based on the risk assessment and ongoing market analysis, the platform generates personalized investment plans. These plans are tailored to each user's risk profile and financial objectives. For instance, a conservative investor might be recommended a portfolio with a higher allocation of bonds and stable stocks, while a more aggressive investor could be suggested a mix of growth stocks and alternative investments. The algorithms also provide regular updates and recommendations to adapt to changing market conditions, ensuring that the investment strategy remains optimized.

Risk Mitigation and Protection: To further enhance risk management, Albert Auto Investment employs various risk mitigation techniques. These include setting stop-loss orders to limit potential losses, implementing diversification strategies across different asset classes, and utilizing options and derivatives to hedge against market downturns. The algorithms also provide users with transparent reports and insights, allowing them to understand the risks associated with their investments and make informed decisions. This level of transparency and control empowers users to take an active role in managing their investment portfolios.

Invest or Repay Student Loans: Navigating the Financial Crossroads

You may want to see also

Market Insights: Real-time market data and insights inform investment decisions and strategy adjustments

In the world of investing, staying ahead of the curve is crucial, and this is where real-time market insights play a pivotal role. Market insights provide investors with a dynamic understanding of the financial landscape, enabling them to make informed decisions and adapt their strategies accordingly. This is particularly important in the context of automated investment platforms like Albert Auto Investment, which leverage technology to execute trades and manage portfolios.

Real-time market data offers a comprehensive view of various financial instruments, including stocks, bonds, commodities, and currencies. Investors can access up-to-the-second information on prices, trading volumes, and market trends. For instance, a real-time stock market data feed can display the current share price of a company, its historical performance, and relevant news updates. This immediate access to data allows investors to react swiftly to market changes, ensuring their investment strategies remain relevant and effective.

Market insights also encompass a wide range of analytical tools and indicators. These tools can include technical analysis, which involves studying historical price and volume data to identify patterns and trends, and fundamental analysis, which evaluates a company's financial health and prospects. By utilizing these insights, investors can make more accurate predictions about asset prices and potential investment opportunities. For example, a moving average crossover signal in technical analysis can prompt an investor to buy or sell a stock, indicating a potential price reversal or continuation.

Moreover, real-time market insights enable investors to identify and respond to market anomalies and news-driven events. Unexpected economic data releases, geopolitical events, or company-specific announcements can significantly impact asset prices. Investors with access to real-time data can quickly assess the implications of such events and adjust their portfolios accordingly. This agility is essential in a rapidly changing market environment, where short-term price movements can be influenced by various factors.

In the context of Albert Auto Investment, real-time market insights are instrumental in optimizing the platform's investment algorithms. The platform's algorithms can be designed to analyze market data and make trading decisions based on predefined rules and strategies. For instance, an algorithm might be programmed to buy a particular stock when its price falls below a certain threshold, or to sell when a specific technical indicator is met. By incorporating real-time market insights, Albert Auto Investment can enhance its decision-making process, potentially leading to more profitable and well-timed trades.

Young People: Invest Now, Gain Later

You may want to see also

User Experience: Intuitive interface and personalized recommendations enhance user engagement and satisfaction

The user experience of Albert Auto Investment is designed to be intuitive and user-friendly, ensuring that investors can easily navigate the platform and make informed decisions. Upon signing up, users are greeted with a clean and organized dashboard, providing a comprehensive overview of their investment portfolio. The interface is thoughtfully designed to minimize complexity, allowing users to quickly access essential information. Key features are prominently displayed, such as recent transactions, portfolio performance, and market trends, ensuring that investors can stay updated without feeling overwhelmed.

Personalization plays a crucial role in enhancing user engagement. Albert's algorithm learns from user interactions and preferences, offering tailored investment recommendations. For instance, if a user has a history of investing in tech stocks, the platform will suggest similar opportunities or provide insights on emerging tech trends. This level of customization not only saves users time but also increases their confidence in the platform's suggestions, leading to higher satisfaction. The system continuously adapts to individual needs, ensuring that investors receive relevant and valuable information.

The intuitive nature of the interface is further emphasized through its interactive elements. Users can easily filter and sort data, allowing them to focus on specific investment areas or compare different assets. Interactive charts and graphs provide visual representations of performance, making it easier to identify patterns and trends. Additionally, the platform offers educational resources and tutorials to guide users through various investment strategies, ensuring that they feel empowered to make choices aligned with their financial goals.

Personalized recommendations extend beyond investment suggestions. Albert can provide tailored financial advice based on an individual's risk tolerance and investment horizon. For example, it might recommend a mix of conservative and aggressive investments to balance risk and potential returns. This level of personalization ensures that users receive a unique experience, catering to their specific needs and preferences. By offering customized guidance, Albert Auto Investment aims to build trust and foster long-term user relationships.

In summary, the user experience of Albert Auto Investment is centered around creating an intuitive and personalized environment. Through an easy-to-navigate interface and tailored recommendations, the platform ensures that investors can efficiently manage their portfolios and make informed decisions. This approach not only enhances user engagement but also contributes to overall satisfaction, making Albert a trusted companion for investors seeking automated investment solutions.

The Magic of Compounding: Unlocking the Secret to Wealth

You may want to see also

Frequently asked questions

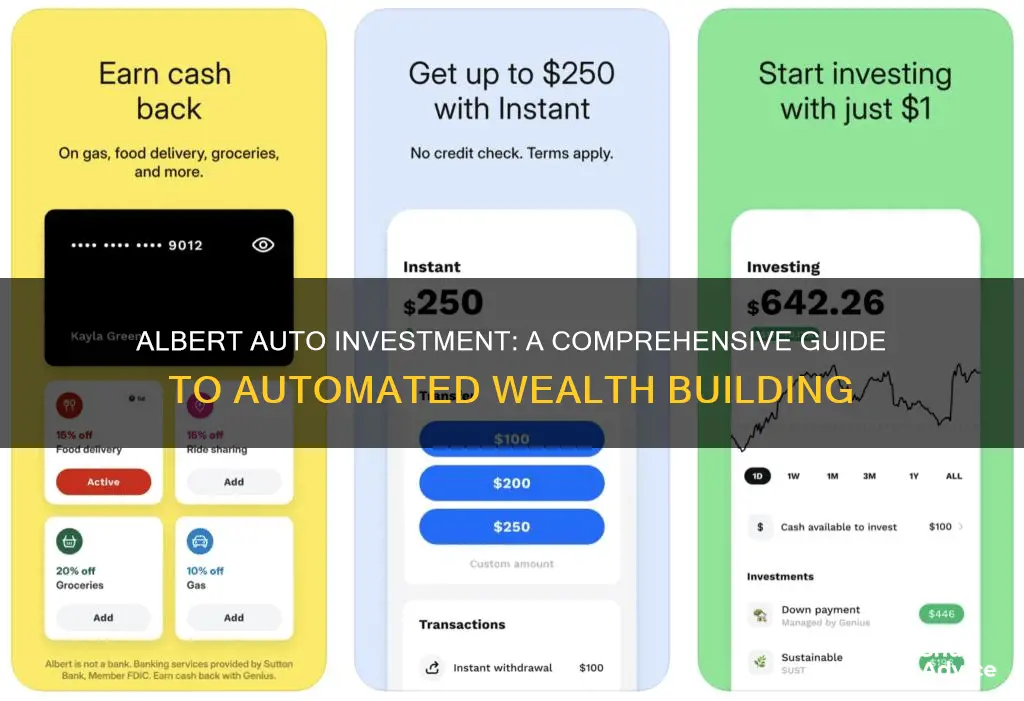

Albert Auto Investment is a feature offered by the Albert savings and investment app, which allows users to automate their savings and investments. It's a tool designed to help individuals reach their financial goals by making saving and investing effortless and consistent.

Albert Auto Investment works by setting up automatic transfers from your linked bank account to your investment account. You can choose a specific amount to invest regularly, such as weekly, bi-weekly, or monthly. The app then invests this amount in a diversified portfolio of stocks, bonds, and other assets based on your risk tolerance and financial goals.

Yes, Albert provides various customization options. You can select your preferred investment strategy, such as growth, income, or a mix of both. The app also allows you to adjust the investment frequency and the amount you want to invest each time. Additionally, you can review and modify your strategy at any time to align with your changing financial needs and goals.

Albert Auto Investment is designed to be fee-friendly. The app offers a low-cost investment approach with no account fees or management fees. However, it's important to note that there may be transaction fees associated with certain market activities, and the app's terms and conditions should be reviewed for the most up-to-date information regarding fees.