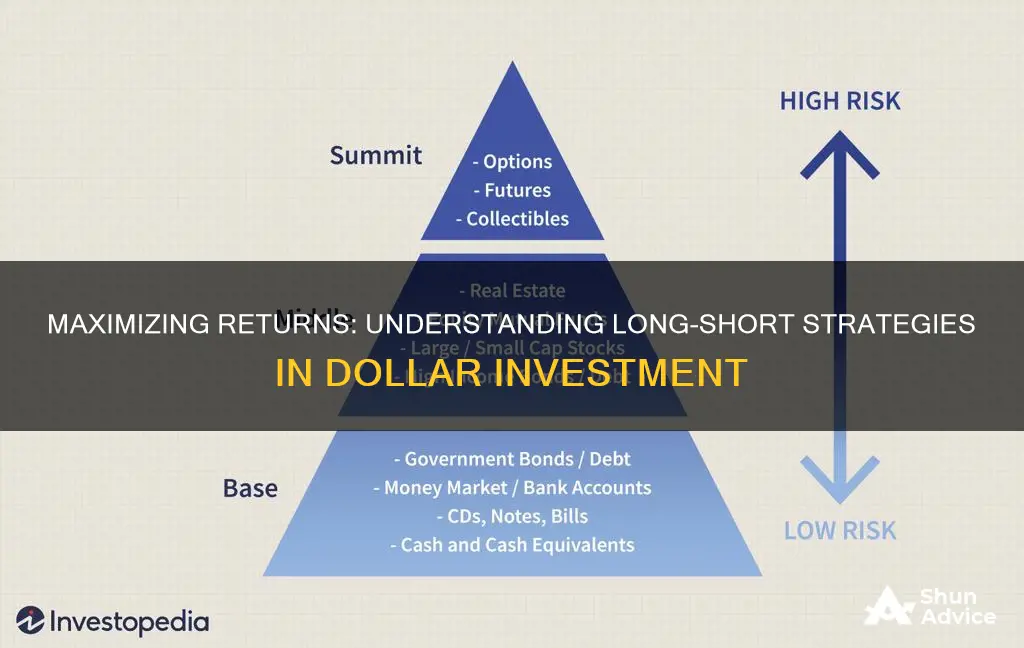

Long-short equity strategies involve simultaneously investing in both long and short positions in the stock market, aiming to capitalize on market inefficiencies and generate returns regardless of market direction. This approach allows investors to profit from both rising and falling markets, as it involves taking long positions in stocks expected to appreciate and short positions in those expected to decline. By carefully selecting securities and managing risk, long-short funds can provide diversification and potentially higher returns compared to traditional long-only strategies, making it an attractive investment option for those seeking to optimize their portfolio performance.

What You'll Learn

- Long Short Strategy: Investors use long-short funds to gain exposure to both rising and falling markets

- Dollar-Weighted Return: This metric measures the actual return on investment after accounting for fees and expenses

- Risk Management: Long-short funds employ hedging techniques to manage risk and protect capital

- Market Neutrality: The goal is to achieve zero beta, reducing market risk

- Performance Metrics: Tracking metrics like Sharpe ratio and Sortino ratio to evaluate fund performance

Long Short Strategy: Investors use long-short funds to gain exposure to both rising and falling markets

The long-short strategy is an investment approach that allows investors to profit from both rising and falling markets, providing a hedge against potential market downturns. This strategy involves taking long positions in securities expected to increase in value and short positions in those anticipated to decrease. By doing so, investors can aim to generate positive returns regardless of the market's direction.

In a long-short fund, investors typically invest in a diversified portfolio of long and short positions. When the market is bullish, the long positions can drive significant gains, while the short positions act as a hedge, protecting the fund from potential losses in case of a market downturn. Conversely, during a market decline, the short positions can provide a source of returns, offsetting any losses from the long positions. This strategy enables investors to potentially benefit from market volatility and gain exposure to both sides of the market.

The key to the long-short strategy's success lies in the careful selection of securities for both long and short positions. Investors must conduct thorough research and analysis to identify undervalued assets that are poised to rise and overvalued securities that may decline. This process requires a deep understanding of market trends, fundamental analysis, and technical indicators. By combining long and short positions, investors can create a balanced portfolio that aims to deliver consistent returns over the long term.

One of the advantages of the long-short strategy is its ability to provide diversification. By holding both long and short positions, investors can reduce the overall risk of their portfolio. This diversification can help smooth out market volatility and provide a more stable investment experience. Additionally, long-short funds often have lower correlation with traditional long-only funds, allowing investors to access a unique segment of the market.

Implementing a long-short strategy requires a disciplined approach and a well-defined investment process. Investors should set clear criteria for selecting securities, regularly review and rebalance their positions, and monitor market trends to make informed decisions. It is crucial to maintain a balanced portfolio and adapt to changing market conditions. While this strategy can be complex, it offers investors the opportunity to navigate market cycles and potentially generate positive returns in various market environments.

Sativa Investments: A Step-by-Step Guide to Buying Shares

You may want to see also

Dollar-Weighted Return: This metric measures the actual return on investment after accounting for fees and expenses

Dollar-Weighted Return (DWR) is a crucial metric for investors as it provides a more accurate representation of the true performance of an investment strategy. It is a measure that takes into account the impact of fees, expenses, and cash flows associated with an investment, offering a clearer picture of the actual return generated. This metric is particularly important when evaluating the performance of investment funds, portfolios, or any strategy that involves recurring costs.

The calculation of DWR involves a simple yet powerful concept. It is derived by comparing the total return of an investment to the total amount of capital invested, including any outflows and inflows of cash. In simpler terms, it measures the return on investment after considering the effects of fees and expenses, ensuring that the performance is assessed in a way that reflects the actual economic benefit to the investor.

To understand its significance, consider a scenario where an investor allocates $10,000 to a mutual fund with an annual management fee of 2%. Over a year, the fund generates a total return of 15%. However, the DWR calculation would account for the fee, reducing the net return to the investor. This example highlights how DWR provides a more realistic assessment, especially when comparing investment options with different fee structures.

The beauty of DWR lies in its ability to provide an apples-to-apples comparison. When evaluating multiple investment strategies, DWR ensures that the performance is measured on a consistent basis. It allows investors to make informed decisions by understanding the true impact of fees and expenses on their returns. This is particularly valuable for long-short equity strategies, where the DWR can reveal the strategy's true potential and risk-adjusted performance.

In summary, Dollar-Weighted Return is an essential tool for investors to gauge the effectiveness of their investment strategies. By accounting for fees and expenses, it delivers a more accurate representation of the actual return on investment. This metric empowers investors to make better-informed choices, especially when navigating complex investment landscapes with varying fee structures. Understanding DWR is key to unlocking the true performance of investment portfolios and strategies.

ESG Retirement Investing: Building a Sustainable Future

You may want to see also

Risk Management: Long-short funds employ hedging techniques to manage risk and protect capital

Long-short funds are a type of investment strategy that aims to generate returns by taking both long and short positions in various financial instruments, such as stocks, bonds, and derivatives. This approach allows investors to profit from both rising and falling markets, providing a hedge against potential losses. One of the key aspects of long-short funds is their focus on risk management, which is crucial for protecting the capital of investors.

To manage risk effectively, long-short funds employ a range of hedging techniques. These techniques are designed to reduce the potential negative impact of market movements on the fund's performance. One common hedging strategy is the use of derivatives, such as options and futures contracts. By entering into these derivative contracts, the fund can lock in prices for specific securities, thus protecting itself against adverse price movements. For example, if a fund manager believes that a particular stock is overvalued, they can sell a call option on that stock, which gives the fund the right to sell the stock at a predetermined price. This strategy limits the potential upside risk while allowing the fund to benefit from any potential upside in other investments.

Another hedging technique used by long-short funds is the utilization of short selling. Short selling involves borrowing a security and selling it, with the expectation that the price will decline, allowing the investor to buy the security back at a lower price and return it to the lender, thus making a profit from the price decline. By taking short positions, the fund can offset potential losses in other long positions, providing a form of risk mitigation. This strategy is particularly useful when the fund manager anticipates a market downturn or when specific securities are expected to underperform.

Additionally, long-short funds often employ a diversified investment approach, spreading their capital across multiple sectors, industries, and asset classes. This diversification helps to reduce the overall risk of the portfolio by not concentrating investments in a single area. By diversifying, the fund can benefit from various market segments while minimizing the impact of any single investment's poor performance.

The use of hedging techniques and a diversified strategy allows long-short funds to navigate market volatility and protect the capital of investors. These funds are particularly attractive to risk-averse investors who seek to generate returns while minimizing potential losses. By carefully managing risk through hedging, long-short funds can provide a more stable investment experience, even in turbulent market conditions. This risk management approach is a key differentiator for long-short funds, making them a popular choice for investors seeking a balanced and strategic investment vehicle.

SoFi's Investment Fees: Unveiling the Truth

You may want to see also

Market Neutrality: The goal is to achieve zero beta, reducing market risk

Market neutrality is a strategy employed by investors to minimize market risk and achieve a more stable investment performance. The core concept behind market neutrality is to create a portfolio that is not influenced by overall market movements, aiming for a beta of zero. Beta, in financial terms, measures the volatility of a security or portfolio in relation to the overall market. A beta of zero indicates that the investment's performance is not correlated with the market, meaning it neither rises nor falls with the market's trends.

To achieve market neutrality, investors employ a long-short strategy, which involves taking both long and short positions in securities. This approach is particularly useful when the market is expected to be volatile or when an investor wants to hedge against potential market downturns. By taking long positions in securities that are expected to perform well and short positions in those that are anticipated to underperform, investors can create a balanced portfolio. The long positions aim to capitalize on market upswings, while the short positions are designed to profit from market declines, thus canceling out the overall market risk.

The process of implementing a long-short strategy requires careful selection of securities. Investors must identify stocks or assets that are likely to have opposite movements in the market. For instance, if a particular stock is expected to rise, its counterpart in the same industry or sector might be predicted to fall. By holding these two securities, investors can create a neutral portfolio, as the potential gains from one will offset the losses from the other. This approach ensures that the overall performance of the portfolio is not significantly impacted by market fluctuations.

Calculating the impact of market neutrality on dollars invested is crucial for investors. It involves assessing the performance of the long and short positions separately and then combining them to determine the overall portfolio return. This calculation helps investors understand how their strategy is performing in relation to their initial investment. By regularly monitoring and adjusting the portfolio, investors can ensure that market neutrality is maintained, especially during periods of market volatility.

In summary, market neutrality is a powerful strategy for investors seeking to reduce market risk. By employing a long-short approach and carefully selecting securities, investors can create a portfolio that is not influenced by market trends. Achieving zero beta through market neutrality allows investors to potentially generate stable returns, even during turbulent market conditions, thus providing a more consistent investment experience. This strategy is particularly valuable for risk-averse investors or those seeking to diversify their portfolios.

Unveiling the Power of Collective Investing: A Beginner's Guide

You may want to see also

Performance Metrics: Tracking metrics like Sharpe ratio and Sortino ratio to evaluate fund performance

When assessing the performance of a long-short equity fund, investors often turn to specific metrics that provide valuable insights into the fund's efficiency and risk-adjusted returns. Two commonly used metrics in this context are the Sharpe Ratio and the Sortino Ratio. These tools are essential for evaluating how well a fund manages risk relative to its potential rewards.

The Sharpe Ratio is a widely recognized measure that quantifies the excess return per unit of volatility or risk. It is calculated by subtracting the risk-free rate from the fund's average return and then dividing this difference by the standard deviation of the fund's returns. A higher Sharpe Ratio indicates that the fund has generated better risk-adjusted returns compared to the market or a relevant benchmark. For instance, if a long-short fund has a Sharpe Ratio of 1.5, it means that for every one-unit increase in volatility, the fund returns 1.5 units more than the risk-free rate. This metric is particularly useful for investors who want to understand the fund's ability to generate excess returns while managing risk effectively.

On the other hand, the Sortino Ratio focuses on the relationship between the fund's returns and its downside risk. It is calculated by dividing the fund's excess return by the downside deviation, which measures the volatility of returns when they are below a certain threshold, often the risk-free rate. The Sortino Ratio penalizes only the returns that fall below the risk-free rate, providing a more nuanced view of risk-adjusted performance. A higher Sortino Ratio suggests that the fund has achieved positive returns while minimizing losses during adverse market conditions. This metric is especially valuable for risk-averse investors who prioritize capital preservation and consistent performance over time.

Both ratios offer unique perspectives on fund performance. The Sharpe Ratio provides a comprehensive view of risk-adjusted returns, while the Sortino Ratio highlights the fund's ability to navigate market downturns. Investors can use these metrics in conjunction with other evaluation methods to make informed decisions about fund allocation and strategy. By tracking these performance metrics, investors can identify funds that consistently deliver competitive returns while effectively managing risk, ultimately contributing to the overall success of their investment portfolios.

The Inflation Conundrum: Navigating the Investment Landscape

You may want to see also

Frequently asked questions

Long Short is an investment strategy that involves taking both long and short positions in securities, typically aiming to profit from both rising and falling markets. It is a form of active management where investors try to outperform the market by making strategic bets on individual stocks or assets.

The Long Short strategy generates returns by combining long and short positions. Investors identify stocks or assets that they believe will rise in value (long position) and simultaneously take a short position in a related security or asset that they expect to decline. This allows them to profit from the upside while hedging against potential losses. The strategy often involves a high level of research and analysis to identify undervalued stocks or assets that have the potential to appreciate.

Benefits: This strategy can provide diversification by allowing investors to participate in both bull and bear markets. It can offer the potential for higher returns compared to traditional long-only strategies, especially during volatile market conditions. Long Short funds can also provide liquidity, as they often trade actively.

Risks: However, it also carries risks. The strategy requires active management and a deep understanding of the markets, which may not be suitable for all investors. The potential for significant losses exists if the short positions do not perform as expected, especially in highly correlated markets. Additionally, transaction costs and potential tax implications should be considered.