Short-term investments play a crucial role in financial planning, particularly when it comes to the matching concept. This concept emphasizes the importance of aligning investment strategies with an individual's or organization's financial goals and time horizons. Short-term investments are typically those with a maturity period of less than one year, designed to provide liquidity and meet immediate financial needs. Understanding how short-term investments relate to the matching concept is essential for investors and financial managers, as it helps in optimizing asset allocation, managing risk, and ensuring that investments are strategically aligned with specific objectives.

What You'll Learn

- Time Horizon: Short-term investments align with the matching concept's focus on liquidity and short-term goals

- Risk Management: Short-term investments offer flexibility to manage risks associated with short-term obligations

- Asset Allocation: Matching concept emphasizes asset allocation for short-term needs, ensuring liquidity and accessibility

- Tax Efficiency: Short-term investments can be tax-efficient, aligning with the matching concept's short-term focus

- Liquidity: Short-term investments provide immediate liquidity, crucial for the matching concept's short-term funding needs

Time Horizon: Short-term investments align with the matching concept's focus on liquidity and short-term goals

The concept of time horizon is a critical aspect of understanding how short-term investments relate to the matching principle. This principle, a fundamental concept in finance, emphasizes the need for investments to be aligned with the time frame over which they are intended to be held. When it comes to short-term investments, the focus is on liquidity and the ability to meet short-term financial goals.

In the context of short-term investments, the time horizon is typically measured in months or years, as opposed to long-term investments, which are often held for decades. Short-term investments are designed to provide quick access to capital and are often used to meet immediate financial needs or to take advantage of short-term market opportunities. These investments are characterized by their low-risk nature and the ability to be easily converted into cash without significant loss of value.

The matching concept, on the other hand, is a principle that ensures an organization's assets are matched with its liabilities and expenses over a specific period. This concept is particularly relevant for pension funds, where the goal is to ensure that the assets held can be used to meet the future obligations of the pension plan. Short-term investments play a crucial role in this context by providing a source of liquidity that can be quickly accessed to meet short-term liabilities or to fund short-term projects.

For example, a company might invest in short-term government bonds or money market funds to ensure it has the necessary funds to pay its short-term debts or to take advantage of short-term market opportunities. These investments are aligned with the matching concept as they provide the necessary liquidity to meet short-term financial goals while also maintaining a low level of risk.

In summary, short-term investments are closely aligned with the matching concept due to their focus on liquidity and the ability to meet short-term financial goals. These investments provide a means to quickly access capital, ensuring that an organization can meet its short-term liabilities or take advantage of immediate opportunities without compromising its long-term financial stability. Understanding this relationship is essential for effective financial management and planning.

Securities: Cash Equivalent or Long-Term Investment?

You may want to see also

Risk Management: Short-term investments offer flexibility to manage risks associated with short-term obligations

Short-term investments play a crucial role in risk management, particularly when it comes to addressing short-term obligations and their associated risks. This is where the concept of matching investments with specific needs comes into play. By understanding the relationship between short-term investments and the matching concept, organizations can effectively navigate their financial obligations and mitigate potential risks.

In the context of risk management, short-term investments are those made with a focus on liquidity and the ability to quickly convert assets into cash without significant loss. These investments are typically made to meet short-term financial goals, such as funding operational expenses, paying off short-term debts, or covering unexpected costs. The key advantage here is the flexibility it provides to organizations, allowing them to adapt to changing financial circumstances.

The matching concept is a fundamental principle in financial management, which suggests that investments should be aligned with the time horizon of the financial obligation they are intended to cover. For short-term obligations, this means investing in assets that can be readily converted into cash within a relatively short period. This approach ensures that the organization can meet its short-term financial commitments without incurring excessive risks or penalties. For example, a company might invest in highly liquid assets like treasury bills or short-term bonds to ensure it has the necessary funds to pay suppliers or employees on time.

By employing short-term investments, organizations can effectively manage the risks associated with short-term obligations. This involves strategically allocating resources to ensure that the investment portfolio is well-suited to meet immediate financial needs. Short-term investments offer a safety net, providing the necessary liquidity to fulfill short-term commitments without exposing the organization to long-term financial risks. This is especially important for businesses with fluctuating cash flows or those facing unexpected financial challenges.

In summary, short-term investments are a powerful tool for risk management, enabling organizations to match their financial resources with short-term obligations. This approach ensures that the company can maintain its financial stability and meet its immediate commitments while also having the flexibility to adapt to changing market conditions. Understanding the relationship between short-term investments and the matching concept is essential for effective financial management and risk mitigation.

Maximize Your Short-Term Cash: Top Investment Strategies

You may want to see also

Asset Allocation: Matching concept emphasizes asset allocation for short-term needs, ensuring liquidity and accessibility

The matching concept is a fundamental principle in asset allocation, particularly for short-term investments, and it revolves around aligning financial resources with specific, time-bound objectives. This approach ensures that an individual's or entity's investments are strategically distributed to meet short-term financial needs, such as upcoming expenses, emergency funds, or near-term goals. By emphasizing asset allocation for these short-term requirements, investors can maintain liquidity and accessibility, which are crucial aspects of effective financial management.

In the context of short-term investments, the matching concept involves categorizing assets based on their liquidity and the time horizon associated with the intended use of the funds. For instance, a person might allocate a portion of their portfolio to highly liquid assets, such as cash or short-term bonds, which can be readily converted into cash without significant loss of value. These assets are essential for covering short-term expenses or unexpected costs, ensuring that the individual has immediate access to funds when needed.

The key idea behind this concept is to create a balanced portfolio that caters to both short-term and long-term financial objectives. Short-term investments should be easily convertible into cash, providing a safety net for unforeseen circumstances or immediate financial obligations. For example, a person might invest in money market funds, certificates of deposit (CDs), or short-term government bonds, which offer higher liquidity compared to longer-term investments.

Asset allocation according to the matching concept also involves considering the time sensitivity of various financial commitments. For instance, funds designated for upcoming vacations, major purchases, or emergency savings should be readily accessible and not tied up in illiquid investments. By allocating assets accordingly, investors can ensure that their financial resources are well-organized and ready to meet short-term obligations without compromising long-term investment goals.

In summary, the matching concept in asset allocation is a strategic approach to managing short-term investments, focusing on liquidity and accessibility. It involves categorizing assets based on their liquidity and aligning them with specific financial needs, ensuring that investors can meet their short-term goals while also maintaining a well-rounded investment strategy. This concept is particularly valuable for individuals seeking to balance their immediate financial requirements with long-term wealth accumulation.

Long-Term Investments: Navigating the Balance Between Growth and Liability

You may want to see also

Tax Efficiency: Short-term investments can be tax-efficient, aligning with the matching concept's short-term focus

Understanding the relationship between short-term investments and the matching concept is crucial for optimizing tax efficiency. The matching concept, a fundamental principle in accounting, emphasizes the timing of expense recognition, ensuring that expenses are matched with the revenues they help generate in the same accounting period. This approach provides a more accurate financial picture by aligning costs with the period in which they are incurred.

In the context of short-term investments, this concept can be particularly beneficial. Short-term investments are typically held for a year or less, and their primary purpose is often to generate a return within a short timeframe. When considering these investments, the matching principle can be applied to optimize tax efficiency. By recognizing the gains or losses from these short-term investments in the same period as the associated expenses, investors can better manage their taxable income.

For instance, if an investor sells a short-term security for a profit, the gain can be matched with the expenses incurred during the holding period. This matching can result in a lower taxable income in the current year, potentially reducing the investor's overall tax liability. Similarly, if the investment results in a loss, it can be used to offset other income, further enhancing tax efficiency.

The key advantage of this approach is that it allows investors to manage their tax obligations more effectively, especially in years where other sources of income or expenses may vary. By aligning short-term investment gains or losses with the matching concept, investors can strategically plan their tax strategy, potentially saving on taxes and improving overall financial performance.

In summary, short-term investments, when managed with the matching concept in mind, can offer significant tax advantages. This strategy enables investors to optimize their financial outcomes, ensuring that their short-term focus aligns with efficient tax management. It is a valuable approach for those seeking to maximize the benefits of short-term investments while minimizing tax-related drawbacks.

Dividends: A Long-Term Investment Strategy?

You may want to see also

Liquidity: Short-term investments provide immediate liquidity, crucial for the matching concept's short-term funding needs

Short-term investments play a vital role in ensuring liquidity, which is essential for the matching concept's short-term funding requirements. The matching concept, a fundamental principle in accounting, emphasizes the need to pair economic events with their corresponding revenue and expense recognition. This concept requires organizations to match revenues with the expenses incurred to generate those revenues within the same accounting period. To achieve this, short-term investments become a critical tool.

Liquidity refers to the ease and speed with which an asset can be converted into cash without significant loss of value. Short-term investments, such as treasury bills, certificates of deposit, and money market funds, offer immediate liquidity, providing organizations with the flexibility to meet their short-term financial obligations. These investments are highly liquid assets that can be quickly converted into cash with minimal impact on their market value.

In the context of the matching concept, short-term investments are particularly valuable. They enable organizations to have a readily available source of funds that can be readily accessed when needed. For instance, if a company expects a significant increase in short-term expenses, such as payroll or inventory purchases, it can rely on its short-term investments to quickly provide the necessary liquidity. This ensures that the organization can promptly address these financial needs without disrupting its operations or incurring long-term debt.

Moreover, short-term investments offer a safe and low-risk option for organizations. These investments are typically made in highly liquid markets, reducing the risk of significant losses. By utilizing short-term investments, companies can maintain a healthy cash flow position while still benefiting from potential capital appreciation or interest income. This balance between liquidity and potential returns is crucial for the matching concept, as it allows organizations to manage their short-term financial obligations effectively.

In summary, short-term investments are instrumental in providing liquidity, which is essential for the matching concept's short-term funding needs. These investments offer immediate access to cash, enabling organizations to promptly address financial obligations and maintain a healthy cash flow position. By strategically utilizing short-term investments, companies can effectively manage their short-term financial requirements while also benefiting from potential capital appreciation or interest income.

Maturity Risks: Short-Term Investments vs. Long-Term Strategies

You may want to see also

Frequently asked questions

The matching concept is a fundamental principle in accounting that emphasizes the need to match expenses with the revenues they help to generate in the same accounting period. This concept ensures that financial statements provide a true and fair view of a company's financial performance by aligning costs with the revenue they support.

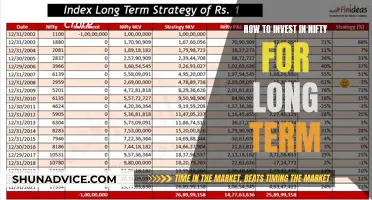

Short-term investments are financial assets that are expected to be converted into cash or sold within one year. These investments are crucial in the matching concept as they provide a means to generate short-term returns that can be matched against related expenses. For example, a company might invest in short-term securities to earn interest income, which can then be matched against the costs associated with generating that revenue.

Imagine a company that invests $10,000 in a 90-day certificate of deposit (CD) with an interest rate of 5%. At maturity, the company will receive $10,500. This short-term investment provides a temporary source of funds, and the interest earned can be matched against the costs of producing the revenue that generated the need for this investment.

The matching concept is essential for financial reporting as it ensures that expenses are recognized in the same period as the revenues they help to generate. This principle provides a more accurate representation of a company's financial performance and helps stakeholders make informed decisions. By matching short-term investments and their returns with related expenses, companies can present a more comprehensive and transparent financial picture.