Understanding the intricacies of retirement savings can be complex, especially when it comes to the 6500 IRA investment limit and its impact on rollovers. This paragraph aims to provide a concise overview. The 6500 IRA investment limit is a crucial aspect of retirement planning, allowing individuals to contribute a certain amount to their Individual Retirement Accounts (IRAs) annually. When it comes to rollovers, this limit becomes even more significant. Rollovers involve transferring funds from one retirement account to another, often to maintain tax-advantaged status. The 6500 limit restricts the total amount that can be rolled over in a year, ensuring that individuals don't exceed their contribution capacity. This limit is essential for managing retirement savings effectively, especially for those approaching retirement age, as it helps prevent over-contribution and ensures a balanced approach to retirement planning.

What You'll Learn

- IRA Contribution Limits: Understand the annual contribution limits for IRAs, including the $6500 cap for those under 50

- Rollover Rules: Learn how rollovers from other retirement accounts fit into the $6500 IRA contribution limit

- Catch-Up Contributions: Explore the option for individuals aged 50+ to contribute an additional $1,000 beyond the $6500 limit

- Roth IRA Conversion: Discover how converting a traditional IRA to a Roth IRA impacts the $6500 limit

- Backdoor Roth IRA: Understand the strategy of using a 401(k) loan to bypass the $6500 limit and contribute to a Roth IRA

IRA Contribution Limits: Understand the annual contribution limits for IRAs, including the $6500 cap for those under 50

Understanding the annual contribution limits for Individual Retirement Accounts (IRAs) is crucial for anyone looking to maximize their retirement savings. The IRS sets these limits to ensure that retirement savings are not overburdened and to promote a balanced approach to investing. For individuals under the age of 50, the annual contribution limit for traditional IRAs is $6,500. This limit is a significant benefit for younger individuals who can take advantage of compound interest over a more extended period. It's important to note that this limit applies to both traditional and Roth IRAs, providing flexibility in how individuals choose to save for retirement.

When it comes to rollovers, the $6,500 limit becomes even more relevant. Rollovers allow individuals to transfer funds from one retirement account to another without incurring penalties, which is particularly useful when moving between different types of IRAs or even between an IRA and an employer-sponsored plan like a 401(k). However, the $6,500 cap still applies to the total amount you can contribute in a year, even if you are rolling over funds from multiple sources. For instance, if you have a $4,000 distribution from a previous employer's 401(k) and a $2,500 contribution from your current employer, you can only contribute an additional $0 in the same year to reach the $6,500 limit.

The $6,500 limit is a significant advantage for those who are just starting to build their retirement savings or are looking to boost their existing contributions. It allows individuals to make substantial annual contributions without facing the risk of penalties or exceeding the annual contribution limit. This is especially beneficial for those who have not yet reached the age of 50, as it provides an opportunity to make larger contributions and potentially take advantage of catch-up contributions in the future.

It's essential to plan your contributions carefully, especially if you are close to the $6,500 limit. If you exceed this limit, you may face penalties and taxes, which can negate the benefits of your retirement savings. Additionally, if you are over the age of 50, you can contribute an additional $1,000 as a catch-up contribution, bringing the total limit to $7,500. This catch-up contribution is a valuable option for older individuals who want to maximize their retirement savings.

In summary, the $6,500 IRA contribution limit for individuals under 50 is a significant advantage for building retirement savings. Understanding how this limit works with rollovers is essential to ensure you are maximizing your contributions effectively. By being aware of these limits and planning your contributions accordingly, you can make the most of your retirement savings and secure your financial future.

Unlocking Investment Opportunities: Understanding Principal Payments

You may want to see also

Rollover Rules: Learn how rollovers from other retirement accounts fit into the $6500 IRA contribution limit

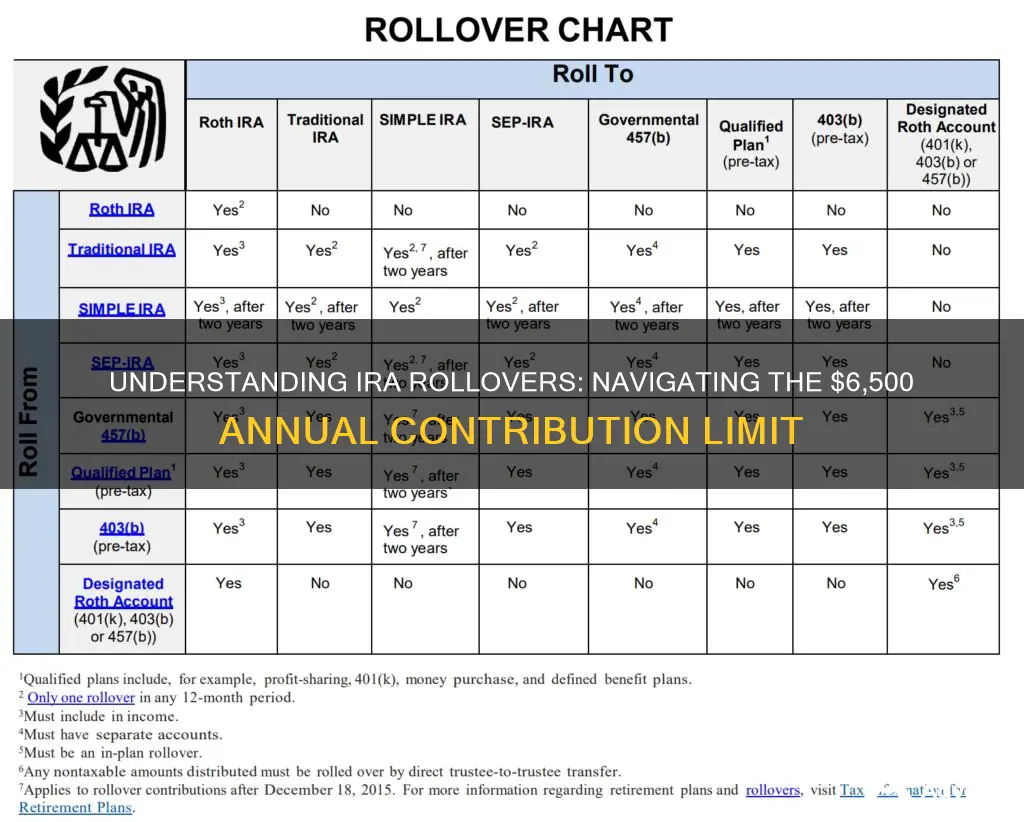

The $6,500 annual Individual Retirement Account (IRA) contribution limit is a crucial aspect of retirement planning, but it can be a bit tricky when it comes to rollovers from other retirement accounts. Understanding how rollovers fit into this limit is essential to ensure you're maximizing your retirement savings effectively. Here's a detailed breakdown of the rollover rules:

When you have a rollover from an existing retirement account, such as a 401(k) or a traditional IRA, it doesn't count towards the $6,500 contribution limit for that year. This means you can contribute the full $6,500 to your new IRA and then roll over funds from another account without exceeding this limit. Rollovers are a way to transfer funds from one retirement account to another, typically without incurring penalties or taxes, as long as certain conditions are met. The key is that the rollover itself does not count as a contribution, allowing you to make additional contributions within the annual limit.

It's important to note that there are specific requirements for rollovers. You must receive written confirmation from the distributing plan administrator that the distribution was a direct rollover and not a partial withdrawal. This confirmation ensures that the funds are treated as a rollover and not as a regular contribution. Additionally, the rollover must be made within 60 days of the distribution to avoid potential tax implications. If you're rolling over funds from a 401(k), you might also need to consider the rules surrounding the distribution of your former employer's plan, especially if it's a large distribution.

Understanding the rollover process is crucial, especially if you're looking to consolidate multiple retirement accounts into one IRA. By strategically planning your rollovers, you can take advantage of the $6,500 limit and potentially grow your retirement savings more efficiently. It's always a good idea to consult with a financial advisor or tax professional to ensure you're following the correct procedures and taking full advantage of the IRA contribution rules.

In summary, rollovers from other retirement accounts do not count towards the $6,500 IRA contribution limit, allowing you to make additional contributions within the annual limit. By understanding the rollover rules and requirements, you can effectively manage your retirement savings and make the most of your IRA contributions. Remember, proper planning and consultation with financial experts can help you navigate these rules successfully.

The Smart Money Move: Pay Off Debt or Invest?

You may want to see also

Catch-Up Contributions: Explore the option for individuals aged 50+ to contribute an additional $1,000 beyond the $6500 limit

For individuals aged 50 and above, the ability to make catch-up contributions to their Individual Retirement Accounts (IRAs) is a valuable feature of retirement savings plans. This option allows seniors to contribute an additional $1,000 beyond the standard $6,500 limit, providing a boost to their retirement funds. Catch-up contributions are particularly beneficial for those who have reached or are approaching retirement age and may have accumulated a substantial amount of savings over their working years.

The concept is straightforward: once an individual turns 50, they can contribute an extra $1,000 to their IRA each year, in addition to the regular contribution limits. This additional contribution can be a strategic move for those who want to maximize their retirement savings, especially if they have a substantial amount of disposable income during their later years. It provides an opportunity to further enhance their financial security in retirement.

To take advantage of catch-up contributions, individuals must ensure they meet the age requirement of being 50 or older. Once they reach this age, they can make the additional contribution to their IRA, which can be a traditional, Roth, or SEP IRA, depending on their preferences and financial goals. It's important to note that this option is exclusive to those aged 50 and above, making it a targeted benefit for seniors.

When making catch-up contributions, it's essential to stay within the IRS-defined contribution limits for that year. The $1,000 catch-up contribution is in addition to the standard limit, but it doesn't increase the overall contribution cap. For example, in 2023, the standard IRA contribution limit is $6,500, and with catch-up, it becomes $7,500. However, this doesn't mean one can contribute $7,500 in total; it's simply an additional amount available for those aged 50 and above.

Understanding and utilizing catch-up contributions can be a strategic move for seniors looking to optimize their retirement savings. It provides a financial boost during the years when individuals often have more disposable income, allowing them to potentially build a more substantial nest egg for their retirement years. This option is a valuable tool for those who want to ensure their retirement savings are well-prepared and adequately funded.

Retirement and Mortgages: Exploring the Similarities

You may want to see also

Roth IRA Conversion: Discover how converting a traditional IRA to a Roth IRA impacts the $6500 limit

The $6,500 annual contribution limit for Individual Retirement Accounts (IRAs) is a crucial aspect of retirement savings, and understanding how it applies to Roth IRA conversions is essential for anyone looking to optimize their retirement strategy. When you convert a traditional IRA to a Roth IRA, the contribution limits come into play, and it's important to know how these limits work to ensure you're making the most of your retirement savings.

During a Roth IRA conversion, you transfer funds from your traditional IRA to a Roth IRA. The key point to note is that the $6,500 limit applies to each individual's total contributions across all IRAs, not just to the Roth IRA itself. This means that if you have both a traditional and a Roth IRA, the $6,500 limit must be considered for the entire IRA portfolio. If you exceed this limit in a single year, you may face penalties and taxes, as excess contributions are not deductible.

The conversion process can be complex, especially when considering the tax implications. When you convert a traditional IRA to a Roth IRA, you pay taxes on the converted amount as if it were a regular income. This is because the traditional IRA's earnings have likely grown tax-deferred, and converting it to a Roth IRA means paying taxes on that growth. The $6,500 limit doesn't directly impact the conversion itself but rather the overall contribution strategy. You can still contribute up to $6,500 to your Roth IRA in the same year as the conversion, but you must be mindful of the total contributions across all IRAs.

It's important to plan your conversions carefully, especially if you have multiple IRAs. If you have a traditional IRA and a Roth IRA, and you decide to convert the entire traditional IRA, you must consider the $6,500 limit for the year. You can then contribute the remaining amount to your Roth IRA, ensuring you stay within the annual limit. This strategy allows you to maximize your retirement savings while adhering to the IRS rules.

In summary, when converting a traditional IRA to a Roth IRA, the $6,500 limit is a critical factor to consider. It ensures that your retirement savings strategy remains compliant with IRS regulations. Understanding how this limit applies to conversions and overall contributions will help you make informed decisions to optimize your retirement savings plan.

Traditional Investment Strategies: Past, Present, and Future

You may want to see also

Backdoor Roth IRA: Understand the strategy of using a 401(k) loan to bypass the $6500 limit and contribute to a Roth IRA

The Backdoor Roth IRA strategy is a clever way to potentially increase your retirement savings, especially if you're looking to bypass the annual contribution limits set by the IRS. This method involves using a 401(k) loan to make a contribution that exceeds the standard $6,500 limit for individual retirement accounts (IRAs). Here's how it works:

First, you need to understand the basic concept of a Roth IRA. A Roth IRA is a tax-advantaged retirement account where you contribute after-tax dollars, and the earnings grow tax-free. However, there are income-based contribution limits, and once you reach a certain income threshold, you can no longer contribute directly to a traditional Roth IRA. This is where the Backdoor Roth strategy comes into play.

The strategy involves taking out a loan from your 401(k) plan, which typically has no contribution limits. You can then use this loan to make a contribution to a Roth IRA, effectively bypassing the $6,500 limit. Here's the step-by-step process:

- Borrow from Your 401(k): You can borrow a portion of your 401(k) balance, usually with favorable tax treatment. This loan is typically interest-free and can be repaid over time.

- Make the Contribution: With the loan in hand, you can now contribute this amount to a Roth IRA. Since the loan is considered a distribution from your 401(k), it doesn't count against the $6,500 limit. This allows you to potentially contribute more than the standard limit in a single year.

- Repay the Loan: After making the contribution, you'll need to repay the loan to your 401(k) plan. The repayment process may vary, but it often involves making additional contributions or taking advantage of the plan's loan repayment options.

It's important to note that this strategy requires careful planning and consideration of the rules and regulations surrounding 401(k) loans and Roth IRAs. There are specific requirements and restrictions, such as the need to repay the loan within a certain timeframe and the potential impact on your 401(k) balance. Additionally, this approach is not suitable for everyone, and it's essential to consult with a financial advisor to ensure it aligns with your financial goals and circumstances.

By utilizing the Backdoor Roth IRA strategy, you can potentially maximize your retirement savings, especially if you have a high income and are close to the contribution limit. However, it's a complex process, and understanding the rules and potential risks is crucial before proceeding.

Elon Musk's Current Investment Focus

You may want to see also

Frequently asked questions

The 6500 IRA investment limit refers to the annual contribution cap for Traditional and Roth IRAs. For the 2023 tax year, the limit is $6,500, which can be increased to $7,500 for those aged 50 or older. This limit applies to both direct contributions and rollovers. When you roll over funds from an existing retirement account, the amount rolled over counts towards the annual contribution limit. For example, if you roll over $5,000 from a previous employer's 401(k) to your IRA, you can then contribute the remaining $1,500 for the year, provided you meet the other eligibility criteria.

Yes, you can rollover funds from multiple sources, such as a former employer's 401(k) or a 403(b) plan, to your IRA. However, the total amount rolled over must be considered when calculating your annual contribution. For instance, if you rollover $3,000 from a 401(k) and $2,000 from a 403(b), you can contribute up to $1,500 in additional funds to your IRA for the year, as long as you don't exceed the $6,500 limit. It's important to keep records of all rollovers to ensure compliance with IRS regulations.

Yes, there are a few exceptions and special cases to consider. Firstly, if you have a direct rollover from a Roth 401(k) to a Roth IRA, the amount rolled over is not included in your annual contribution limit. Secondly, if you are a beneficiary of an inherited IRA, the annual contribution limit does not apply to you. However, you must follow specific rules and deadlines for making contributions. Additionally, if you have a SEP IRA or a SIMPLE IRA, there are different contribution limits and rules that may apply, which could impact your rollover strategy.