National sovereignty, the principle of a state's authority and independence, has significantly influenced the foreign direct investment (FDI) landscape in the Netherlands. As a highly open economy, the Netherlands has historically embraced foreign investment, but the balance between attracting FDI and maintaining national sovereignty has been a delicate matter. The country's strategic location, robust infrastructure, and highly skilled workforce have made it an attractive destination for international investors. However, the Dutch government has also been cautious about potential negative impacts on its sovereignty, such as the loss of control over critical industries and the erosion of national policies. This introduction explores the intricate relationship between national sovereignty and FDI in the Netherlands, examining how the country has navigated the challenges and opportunities presented by foreign investment while safeguarding its core principles of independence and autonomy.

What You'll Learn

- Historical Context: The Netherlands' Evolution of Sovereignty and FDI

- Political Stability: How Sovereignty Ensures Attractive FDI Environment

- Economic Policies: Sovereignty's Role in FDI Incentives and Regulations

- International Relations: Sovereignty and FDI in Global Context

- Sectoral Impact: Sovereignty's Influence on FDI in Dutch Industries

Historical Context: The Netherlands' Evolution of Sovereignty and FDI

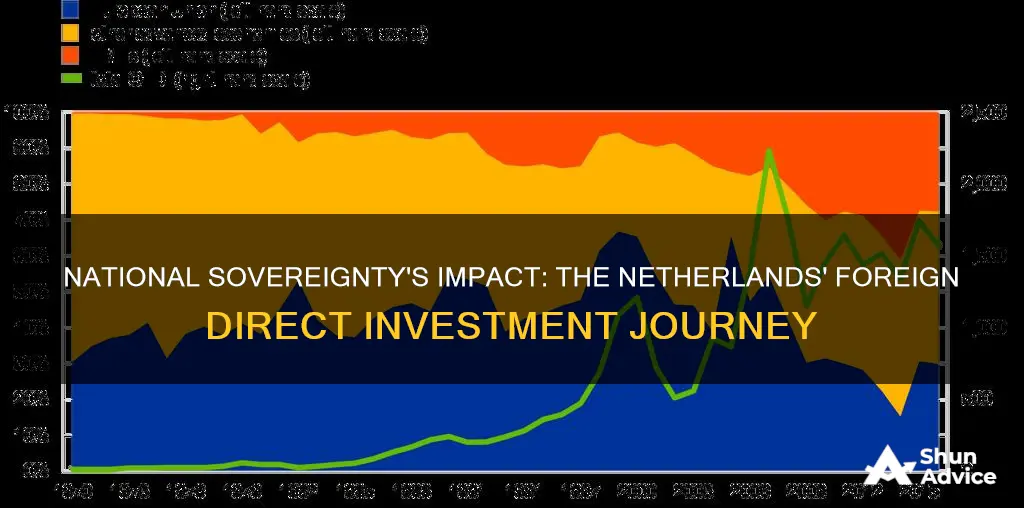

The historical context of the Netherlands' evolution of sovereignty and its impact on foreign direct investment (FDI) is a fascinating journey through time. The country's sovereignty has undergone significant transformations, which have played a pivotal role in shaping its economic landscape, particularly in attracting FDI.

In the early modern period, the Dutch Republic, established in the 16th century, was a powerful maritime state with a strong navy. This era marked a shift from feudalism to early capitalism, and the Dutch Republic became a major trading nation. The country's sovereignty was characterized by a federal system, with a central government and seven provincial states, each with its own autonomy. This structure provided a unique environment for FDI, as it allowed for a degree of local control while also benefiting from international trade networks. The Dutch East India Company, founded in 1602, is a prime example of how sovereignty and FDI intertwined. This company, with a royal charter, became one of the earliest multinational corporations, engaging in extensive trade and investment across Asia, Africa, and the Americas.

The 19th century brought significant changes to the Netherlands' sovereignty. The country became a kingdom with a constitutional monarchy, and the establishment of a centralized government under the Constitution of 1887 further solidified the nation's sovereignty. This period saw the Netherlands adopting a more liberal and open economic policy, which attracted foreign investors. The country's focus on international trade and its strategic location in Europe made it an appealing destination for FDI, particularly in industries like shipping, banking, and agriculture. The Dutch government also played a crucial role in promoting foreign investment through various incentives and policies.

The 20th century presented both challenges and opportunities for the Netherlands' sovereignty and FDI. The country's neutrality during World War II and its post-war economic recovery were significant factors. The Dutch government implemented policies to encourage foreign investment, especially in industries like manufacturing and technology. The establishment of the Netherlands Foreign Investment Agency in 1954 further facilitated FDI by providing support and information to foreign investors. This period also saw the rise of multinational corporations with Dutch origins, such as Shell and Unilever, which had a substantial impact on the country's economy and global FDI patterns.

In recent decades, the Netherlands has continued to evolve its sovereignty to attract and retain FDI. The country has embraced globalization and international cooperation, becoming a founding member of the European Union in 1993. This move has further enhanced the Netherlands' attractiveness as a destination for foreign investors, offering access to a larger market and a stable political environment. The Dutch government has also focused on developing specific sectors, such as renewable energy, life sciences, and creative industries, to attract targeted FDI. Additionally, the country's strong legal framework and business-friendly environment have contributed to its reputation as a top FDI destination in Europe.

In summary, the historical context of the Netherlands' sovereignty evolution has been instrumental in shaping its FDI landscape. From the early modern period's maritime power to the 21st century's focus on specific sectors, the country's sovereignty has provided a foundation for attracting foreign investment. The Dutch government's policies, combined with the country's strategic location and economic openness, have made the Netherlands a significant player in global FDI, offering valuable insights into the relationship between national sovereignty and foreign investment.

Foreign Investment's Impact on Economic Growth: Unlocking New Possibilities

You may want to see also

Political Stability: How Sovereignty Ensures Attractive FDI Environment

National sovereignty plays a crucial role in shaping the Netherlands' foreign direct investment (FDI) landscape, particularly in terms of political stability and the overall attractiveness of the country as an investment destination. The concept of sovereignty, in this context, refers to the state's ability to maintain control over its internal affairs and policies, which directly influences the business environment and investor confidence.

A politically stable environment is a fundamental requirement for attracting FDI. The Netherlands' sovereignty allows for consistent and predictable governance, which is essential for international investors. When a country has a strong and independent political system, it ensures that policies and regulations remain relatively stable over time. This stability is a key factor in attracting foreign investors who seek a secure and reliable environment for their operations. For instance, the Dutch government's commitment to a transparent and consistent legal framework has been a significant draw for FDI, especially in sectors like technology, agriculture, and renewable energy, where long-term planning and investment are critical.

Sovereignty also enables the Netherlands to implement and enforce policies that support foreign investment. The government can establish incentives, tax benefits, and regulatory frameworks tailored to the needs of international investors. These policies can include streamlined business registration processes, simplified tax procedures, and targeted grants or subsidies for specific industries. By offering such advantages, the country can position itself as an attractive FDI destination, especially for multinational corporations seeking a stable and supportive environment for their European operations.

Moreover, a sovereign nation can negotiate favorable trade agreements and partnerships, which further enhances its appeal to foreign investors. The Netherlands' strategic location in Europe and its membership in the European Union provide a unique advantage. The country can negotiate bilateral and multilateral trade deals, ensuring reduced tariffs and improved market access for foreign investors. These agreements not only facilitate the movement of goods and services but also provide a stable and secure trading environment, which is crucial for long-term FDI.

In summary, national sovereignty is a powerful tool for the Netherlands to foster political stability and create an attractive FDI environment. It enables the country to maintain control over its policies, provide consistent governance, and offer tailored incentives to foreign investors. By leveraging its sovereignty, the Netherlands can continue to attract a diverse range of FDI, contributing to economic growth and development while maintaining its unique cultural and political identity. This approach has likely played a significant role in the country's success in attracting international investors and fostering a thriving business environment.

ETFs: A Passive Investor's Best Friend?

You may want to see also

Economic Policies: Sovereignty's Role in FDI Incentives and Regulations

National sovereignty plays a crucial role in shaping the economic policies and regulations that attract or deter foreign direct investment (FDI) in a country like the Netherlands. The country's sovereignty allows it to implement various strategies to encourage FDI while also maintaining control over its economic affairs. Here's an overview of how sovereignty influences the Netherlands' approach to FDI:

Incentives and Tax Benefits: The Dutch government has established a range of incentives to attract FDI, particularly in strategic sectors. These incentives often include tax benefits, such as tax credits, reduced corporate taxes, or even tax-free zones for specific industries. By offering these advantages, the Netherlands aims to make the country an attractive destination for foreign investors, especially in sectors like technology, innovation, and sustainable energy, which are key areas of focus for the country's economic development.

Regulatory Framework: Sovereignty enables the Netherlands to design and enforce a comprehensive regulatory framework that ensures a stable and predictable business environment. This includes streamlined business registration processes, transparent legal systems, and efficient dispute resolution mechanisms. A well-structured regulatory environment is essential for FDI as it provides foreign investors with the confidence to establish and operate their businesses in the country. The Dutch government also actively engages in international trade agreements and treaties to further enhance the country's attractiveness for FDI.

Investment Promotion Agencies: To maximize the impact of sovereignty in attracting FDI, the Netherlands has established investment promotion agencies. These agencies act as a single point of contact for foreign investors, providing information, guidance, and support throughout the investment process. They offer tailored solutions, assist with site selection, and help navigate the local regulatory landscape. By providing such dedicated services, the government ensures that foreign investors receive the necessary support to establish and grow their businesses in the Netherlands.

Sector-Specific Policies: National sovereignty allows the Dutch government to implement sector-specific policies to target FDI in areas of strategic importance. For instance, the government may offer additional incentives or grants for investments in renewable energy projects, high-tech industries, or research and development. This targeted approach ensures that FDI contributes to specific economic goals and helps the Netherlands maintain a competitive edge in these sectors.

International Cooperation: While sovereignty provides the framework, international cooperation is also vital. The Netherlands actively engages in bilateral and multilateral agreements to facilitate FDI. These agreements often include provisions for the protection of foreign investments, the resolution of investment disputes, and the promotion of fair competition. By participating in such international partnerships, the country ensures that its economic policies are aligned with global standards, making it an even more attractive destination for foreign investors.

Fidelity Investments: Committed to ESG Principles?

You may want to see also

International Relations: Sovereignty and FDI in Global Context

National sovereignty, the principle of a state's authority and autonomy, has a significant impact on foreign direct investment (FDI) and the global economic landscape. In the context of the Netherlands, understanding the relationship between sovereignty and FDI is crucial to comprehending the country's economic dynamics and its role in international trade.

The Netherlands, known for its open and globalized economy, has historically embraced foreign investment as a key driver of growth. The country's sovereignty, while providing a stable and secure environment, also presents certain challenges and considerations for foreign investors. One of the primary effects of national sovereignty is the establishment of regulatory frameworks and policies that govern foreign investment. The Dutch government, through its Ministry of Foreign Affairs and other relevant departments, sets guidelines and conditions for FDI, ensuring that it aligns with the country's economic and social objectives. These policies may include investment incentives, tax benefits, and specific regulations tailored to attract foreign capital. For instance, the Dutch government has implemented measures to promote sustainable and responsible investment, encouraging FDI in sectors that contribute to environmental and social goals.

Sovereignty also influences the negotiation and protection of rights for foreign investors. The Netherlands has engaged in various international agreements and treaties to safeguard the interests of investors while also maintaining its sovereignty. Bilateral Investment Treaties (BITs) and double taxation agreements are examples of such arrangements. These agreements provide a legal framework for protecting foreign investments, ensuring fair treatment, and facilitating dispute resolution. By doing so, the Dutch government reassures investors that their rights are protected, fostering a conducive environment for FDI.

Moreover, national sovereignty allows the Netherlands to carefully select and manage its FDI portfolio. The country's strategic approach involves assessing the potential economic, social, and environmental impacts of each investment. This includes considering the transfer of technology, job creation, and the overall contribution to the Dutch economy. The Dutch government's ability to exercise sovereignty enables it to strike a balance between attracting FDI and maintaining control over critical sectors, ensuring that investments align with national priorities.

In the global context, the Netherlands' approach to sovereignty and FDI has implications for international relations. The country's openness to foreign investment contributes to its reputation as a reliable and attractive investment destination. This, in turn, can influence the behavior of other nations, encouraging them to adopt similar policies or engage in diplomatic efforts to secure favorable investment conditions. The delicate balance between sovereignty and FDI is a critical aspect of international relations, as it shapes the dynamics between host countries and foreign investors, impacting global economic cooperation and competition.

Moomoo Investment's Apex Clearinghouse: What You Need to Know

You may want to see also

Sectoral Impact: Sovereignty's Influence on FDI in Dutch Industries

National sovereignty, the inherent power of a state to govern itself and make decisions without external interference, has a significant impact on foreign direct investment (FDI) in the Netherlands, a country renowned for its open and globalized economy. The Dutch government's approach to sovereignty and its policies have shaped the country's attractiveness to international investors, particularly in various key sectors.

In the manufacturing sector, the Netherlands has a strong reputation for its high-quality and innovative products. The country's sovereignty allows it to maintain a competitive edge by implementing policies that support and protect domestic industries. For instance, the Dutch government has focused on developing and promoting sustainable and green technologies, which has attracted FDI in renewable energy, automotive, and chemical industries. These sectors benefit from the government's ability to set standards and regulations, ensuring a level playing field for domestic and foreign investors, thus fostering a competitive environment that encourages FDI.

The financial services industry in the Netherlands is another area where sovereignty plays a crucial role. The country is home to a significant number of global financial institutions and has a well-established regulatory framework. The Dutch government's commitment to financial stability and its ability to adapt to international regulations have made the Netherlands an attractive hub for FDI in banking, insurance, and asset management. Foreign investors are drawn to the country's robust legal system and the government's support for the development of a competitive and well-regulated financial market.

In the agricultural sector, the Netherlands is a global leader, known for its advanced greenhouse horticulture and dairy farming. National sovereignty enables the country to maintain its position by implementing policies that support sustainable agriculture and food security. The Dutch government's investment in research and development, coupled with its focus on environmental sustainability, has attracted FDI in agricultural technology, seed production, and food processing. This sector benefits from the government's ability to set standards and ensure the quality and safety of agricultural products, which is essential for maintaining the country's reputation in the global market.

Furthermore, the Dutch government's approach to attracting FDI in the technology and innovation sectors is notable. By fostering a business-friendly environment, the government encourages foreign investors to contribute to the country's knowledge-based economy. This includes providing incentives for research and development, offering tax benefits, and establishing special economic zones. As a result, the Netherlands has become a hub for tech startups and innovative companies, attracting FDI in software development, life sciences, and digital media. The government's sovereignty allows it to shape the business environment, making the country an attractive destination for investors seeking a dynamic and supportive market.

Smart Reasons to Choose CDs Over Investing

You may want to see also

Frequently asked questions

The Netherlands, a country with a strong tradition of international openness and cooperation, has historically embraced a balanced approach to FDI. National sovereignty allows the government to carefully screen and regulate foreign investments, ensuring they align with the country's economic, social, and environmental goals. This includes assessing the potential impact on the Dutch economy, labor market, and environmental sustainability before approving or rejecting FDI projects.

Sovereignty enables the Dutch government to protect and promote national interests. By having control over FDI, the country can attract investments that contribute to its long-term economic development, innovation, and job creation. The Netherlands can also ensure that foreign investments respect labor rights, environmental standards, and cultural heritage, fostering a sustainable and inclusive economy.

The Dutch government's sovereignty allows for strategic sectoral policies. For instance, in sectors like agriculture, technology, and renewable energy, the government may encourage FDI to strengthen these industries. In other cases, certain sectors might be restricted or require specific licenses, especially in sensitive areas like defense or critical infrastructure. This approach ensures that FDI complements and enhances the Netherlands' existing economic strengths while mitigating potential risks.