Worldwide foreign direct investment (FDI) has undergone significant transformations since the 1970s, reflecting the evolving global economy and changing international trade dynamics. The 1970s marked a period of increased FDI, driven by the oil crisis and the need for capital-intensive industries to expand globally. However, the 1980s and 1990s saw a shift towards more liberalized and deregulated investment environments, with a focus on developing markets and the rise of multinational corporations. The 21st century has been characterized by a surge in FDI, particularly in emerging economies, driven by technological advancements, globalization, and the increasing importance of knowledge-based industries. This evolution has reshaped the global investment landscape, impacting industries, economies, and geopolitical dynamics in profound ways.

| Characteristics | Values |

|---|---|

| Total FDI Inflows | $1.8 trillion in 2021, a record high |

| Regional Distribution | Asia-Pacific: 40% of global FDI inflows in 2021; Europe and Central Asia: 25%; Americas: 20% |

| Top Investors | United States, China, Japan, Hong Kong, Singapore |

| Top Recipients | United States, China, India, Singapore, United Arab Emirates |

| FDI Stock | $84.2 trillion in 2020, a significant increase from $15.4 trillion in 1980 |

| FDI as a % of Global GDP | Around 3-4% since the 1990s |

| FDI Flows and Crises | Fluctuations during global financial crises (2008-2009) and the COVID-19 pandemic (2020) |

| Multinational Enterprises | Increased number of multinational corporations, with a higher global presence |

| Policy and Regulatory Environment | Liberalization of FDI regulations, reduced restrictions, and improved business environments |

| Technology and Innovation | FDI has been a driver of technological transfer and innovation, particularly in developing countries |

| Sustainability and ESG | Growing focus on environmental, social, and governance (ESG) factors in FDI decisions |

What You'll Learn

- Investment Patterns: Shifts in FDI destinations and industries over time

- Economic Growth: Impact of FDI on host country economic development

- Policy Influence: Role of government policies in attracting FDI

- Global Trends: Major changes in FDI flows worldwide since 1970

- Regional Disparities: Variations in FDI across regions and their causes

Investment Patterns: Shifts in FDI destinations and industries over time

The global landscape of Foreign Direct Investment (FDI) has undergone significant transformations since 1970, reflecting evolving economic policies, technological advancements, and geopolitical dynamics. Initially, FDI flows were predominantly directed towards developed countries, particularly in North America, Western Europe, and Japan, as these regions offered stable economies, skilled labor, and established infrastructure. Sectors like manufacturing, automotive, and electronics were major recipients of these investments, driving industrialization and economic growth.

However, the late 20th and early 21st centuries witnessed a notable shift in FDI patterns. The rise of emerging markets, such as China, India, and Brazil, presented new opportunities and attracted substantial foreign investments. These countries offered large consumer markets, abundant natural resources, and favorable investment climates, often with government incentives and support. As a result, FDI flows diversified, with a significant portion directed towards these emerging economies, leading to rapid industrialization and the development of local industries.

The service sector has become a major magnet for FDI in recent decades. With the globalization of markets and the growth of the digital economy, industries like telecommunications, finance, and business services have attracted substantial investments. This shift is particularly evident in developed countries, where FDI in services has contributed to the expansion of knowledge-based economies and the creation of high-value jobs. Moreover, the trend of FDI in developing countries has led to the establishment of regional trade hubs, fostering economic integration and cooperation.

Another critical aspect of FDI evolution is the increasing focus on sustainable and green investments. In response to global environmental concerns and the need for economic sustainability, many countries are now directing FDI towards renewable energy, environmental protection, and green technologies. This shift not only addresses environmental challenges but also creates new investment opportunities and promotes long-term economic resilience.

In summary, the patterns of worldwide FDI have evolved significantly since 1970, with a gradual shift from developed to emerging markets and a growing emphasis on the service sector and sustainable investments. These changes reflect the dynamic nature of the global economy and the ongoing pursuit of economic growth, innovation, and environmental sustainability. Understanding these investment patterns is crucial for policymakers, businesses, and investors to navigate the complex global FDI landscape effectively.

Protecting Your Investments: The Power of Stop Losses

You may want to see also

Economic Growth: Impact of FDI on host country economic development

Foreign Direct Investment (FDI) has played a pivotal role in shaping the global economy since 1970, and its impact on host countries' economic development has been a subject of extensive research and analysis. The trend of FDI has evolved significantly over the decades, with a notable shift from a focus on industrial sectors to a more diverse range of industries, including services, technology, and infrastructure. This evolution has had profound implications for the economic growth and development of host nations.

One of the most significant effects of FDI on economic growth is its contribution to capital formation. FDI brings in much-needed capital, which is essential for the development of infrastructure, the expansion of industries, and the creation of new jobs. In many developing countries, FDI has been a critical source of funding for large-scale projects, such as building roads, bridges, and power plants, which are fundamental for economic diversification and industrialization. For instance, in the 1980s, many African countries attracted substantial FDI in the form of oil and mining projects, which not only boosted their GDP but also provided employment opportunities and improved the standard of living for local communities.

The impact of FDI on economic growth is also evident in the transfer of technology and knowledge. Multinational corporations (MNCs) investing in host countries often bring with them advanced technologies, management practices, and expertise. This transfer of knowledge can lead to increased productivity, improved product quality, and the development of new industries. For example, the arrival of Japanese car manufacturers in the United States in the 1980s not only created jobs but also led to the transfer of automotive engineering and manufacturing techniques, which helped the US auto industry modernize and compete globally.

Furthermore, FDI can stimulate economic growth by fostering competition and innovation. When MNCs enter a new market, they often bring with them a competitive edge, which can drive local businesses to improve their efficiency and product offerings. This competitive environment can lead to technological advancements, increased productivity, and the development of more efficient business practices. In the technology sector, for instance, the entry of foreign IT companies has encouraged local startups and established firms to invest in research and development, resulting in a more dynamic and innovative business environment.

However, the relationship between FDI and economic growth is not without challenges. Critics argue that FDI can sometimes lead to a 'resource curse' where host countries become overly dependent on a single industry or sector, making them vulnerable to market fluctuations. Additionally, the benefits of FDI may not always be evenly distributed, and local communities might face social and environmental issues due to rapid industrialization. To maximize the positive impact of FDI, host countries need to implement sound economic policies, ensure transparency, and promote sustainable development practices.

In conclusion, worldwide FDI has undergone significant changes since 1970, and its role in economic growth and development has been transformative. FDI has the potential to bring capital, technology, and competition, all of which are essential for economic diversification and industrialization. However, to ensure that the benefits are long-lasting and inclusive, host countries must carefully manage the process, addressing potential challenges and implementing policies that promote sustainable and equitable economic growth.

The Value Line Investment Survey: A Guide to Profitable Stock Picks

You may want to see also

Policy Influence: Role of government policies in attracting FDI

The evolution of worldwide foreign direct investment (FDI) since 1970 has been significantly shaped by the actions and policies of governments around the globe. This period has witnessed a dramatic shift from a highly regulated and state-controlled environment to a more liberal and market-oriented approach, with governments playing a pivotal role in attracting FDI.

One of the most notable changes is the transition from the traditional view of FDI as a tool for economic development, often controlled by state-owned enterprises, to a more modern perspective where FDI is seen as a catalyst for economic growth and a means to foster competition and innovation. This shift has been driven by the realization that FDI can bring not only capital but also advanced technology, management practices, and access to international markets.

Government policies have been instrumental in this transformation. Many countries have adopted liberalization measures, such as reducing barriers to entry, simplifying regulatory processes, and offering incentives like tax breaks and subsidies to foreign investors. These policies have aimed to create a more conducive environment for FDI, encouraging multinational corporations to invest in local markets and contributing to the overall economic development of the host country. For instance, countries in Eastern Europe and the former Soviet Union have implemented significant economic reforms, including privatization and market liberalization, which have attracted substantial FDI, particularly in the 1990s.

The role of governments has also been crucial in addressing specific challenges and risks associated with FDI. To mitigate potential negative impacts, such as environmental degradation or social conflicts, governments have introduced environmental regulations and social impact assessments. Additionally, policies promoting local content and technology transfer have been implemented to ensure that FDI contributes to the long-term development of the host country. These measures have helped to create a more sustainable and mutually beneficial relationship between foreign investors and the local economy.

In recent years, the trend of FDI has continued to evolve, with a growing emphasis on sustainable and responsible investment. Governments are increasingly focusing on attracting FDI that aligns with national development goals, such as green energy, digital infrastructure, and social entrepreneurship. This shift reflects a more strategic approach to FDI, where governments aim to maximize the benefits while minimizing potential drawbacks. As a result, the policy environment for FDI has become more nuanced, with a greater emphasis on long-term partnerships and value-added contributions from foreign investors.

Renting: Is Cash Payment an Investment Strategy?

You may want to see also

Global Trends: Major changes in FDI flows worldwide since 1970

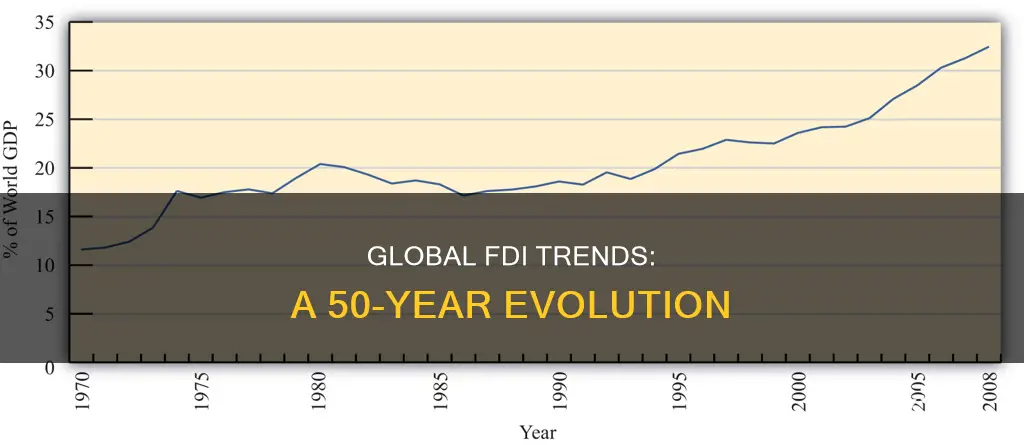

The global landscape of Foreign Direct Investment (FDI) has undergone significant transformations since 1970, reflecting the evolving dynamics of the international economy and the changing nature of business. One of the most notable trends is the substantial increase in FDI flows, which have grown exponentially over the decades. In the early 1970s, FDI was relatively modest, primarily driven by government initiatives and strategic investments. However, the late 1970s and 1980s witnessed a surge in FDI, fueled by the liberalization of trade policies and the emergence of multinational corporations (MNCs). This period marked the beginning of a global shift towards more open and interconnected markets.

The 1990s brought a new era of globalization, characterized by the rapid expansion of FDI. The reduction of trade barriers, the growth of the internet, and the rise of emerging economies created a favorable environment for international investment. FDI flows diversified, with a growing number of countries attracting investments in various sectors, including manufacturing, services, and technology. This period also saw the emergence of new investment patterns, such as cross-border mergers and acquisitions, which allowed companies to expand their global footprint more efficiently.

A significant turning point in FDI trends came with the 2008 global financial crisis. The crisis had a profound impact on FDI, causing a temporary decline in investment flows. However, the post-crisis period brought a renewed focus on sustainable and responsible investment practices. Governments and international organizations emphasized the importance of FDI in promoting economic growth, job creation, and technological advancement. This led to the development of new policies and initiatives aimed at attracting FDI while ensuring environmental and social sustainability.

In recent years, FDI has continued to evolve, driven by technological advancements and changing consumer preferences. The rise of digital technologies and the growth of the gig economy have created new investment opportunities, particularly in the service sector. Additionally, there has been a growing emphasis on green and sustainable FDI, with investors increasingly considering environmental, social, and governance (ESG) factors in their decision-making processes. This shift towards sustainable investment aligns with global efforts to address climate change and promote a more inclusive and resilient economy.

In summary, the global FDI landscape has witnessed a remarkable journey since 1970, marked by liberalization, globalization, and the pursuit of sustainable development. The evolution of FDI flows reflects the changing nature of international trade and investment, with a growing emphasis on openness, diversity, and responsible practices. As the world continues to navigate economic challenges and opportunities, FDI remains a critical driver of global growth, innovation, and international cooperation.

Financial Statements: A Guide to Smart Investing

You may want to see also

Regional Disparities: Variations in FDI across regions and their causes

The global landscape of Foreign Direct Investment (FDI) has undergone significant transformations since 1970, reflecting the evolving dynamics of the international economy and the changing priorities of investors. One of the most notable trends is the shift from traditional manufacturing hubs to emerging markets, particularly in Asia and Africa. This shift is driven by the pursuit of lower production costs, access to new markets, and the availability of skilled labor. For instance, countries like China, India, and Vietnam have become major recipients of FDI, attracting investors with their large consumer bases, favorable tax policies, and robust infrastructure.

Regional disparities in FDI are evident when examining the distribution of investments across continents. North America and Europe have historically been the largest recipients of FDI, benefiting from their well-established economic systems, political stability, and advanced infrastructure. However, the trend has been shifting towards Asia, with countries like China, India, and South Korea becoming increasingly attractive destinations. This shift is further accelerated by the rise of regional economic blocs, such as the Association of Southeast Asian Nations (ASEAN) and the African Continental Free Trade Area (AfCFTA), which aim to enhance intra-regional trade and investment.

The causes of these regional variations are multifaceted. Firstly, economic policies play a crucial role. Countries with favorable investment climates, including stable political environments, transparent regulatory frameworks, and incentives such as tax breaks and subsidies, tend to attract more FDI. For example, Singapore's strategic location, coupled with its business-friendly policies, has made it a regional hub for FDI in Southeast Asia. Secondly, the availability of natural resources and the level of industrialization also influence investment patterns. Resource-rich countries often attract FDI in the mining and energy sectors, while industrialized nations may receive investments in technology and manufacturing.

Another significant factor is the global economic cycle and the impact of international trade agreements. During periods of economic growth, FDI tends to increase as investors seek expansion opportunities. Conversely, during economic downturns, FDI may decline as investors become more cautious. International trade agreements, such as those facilitated by the World Trade Organization (WTO) and regional trade blocs, also play a pivotal role in shaping FDI flows by reducing barriers to trade and investment.

Addressing regional disparities in FDI requires a comprehensive approach. Governments and international organizations should focus on creating an enabling environment for investment, including improving business regulations, enhancing infrastructure, and promoting economic diversification. Encouraging foreign investors to engage with local businesses and fostering technology transfer can help bridge the gap between regions. Additionally, regional cooperation and integration initiatives can facilitate the movement of goods, services, and capital, thereby attracting more FDI to less developed regions.

ThinkorSwim: A Guide to Getting Started with Investing

You may want to see also

Frequently asked questions

Since 1970, global FDI has experienced significant growth and fluctuations. The initial years saw a steady increase, with a notable surge in the 1980s, primarily driven by the liberalization of investment policies in many countries. However, the trend reversed in the early 1990s due to the global financial crisis and economic downturns. The late 1990s and early 2000s witnessed a recovery, with FDI reaching new heights, especially in developing nations. Despite the 2008 financial crisis, FDI flows have been on an upward trajectory, with a slight dip during the COVID-19 pandemic.

The pattern of FDI has shifted dramatically over the years. In the 1970s and 1980s, most FDI flowed from developed countries to other developed nations, often within the same region. However, from the 1990s onwards, there has been a rapid expansion of FDI into developing economies, particularly in Asia and Africa. This shift has been facilitated by the increasing globalization, improved market access, and the desire for cost-efficient production bases. In recent times, there is a growing trend of intra-regional FDI, with companies investing in neighboring countries to establish supply chains and diversify their operations.

Several factors have influenced the dynamics of FDI. Economic policies and regulations play a crucial role, with many countries implementing reforms to attract foreign investors. Political stability, governance, and the rule of law are essential for fostering a favorable investment climate. Technological advancements have also impacted FDI, as companies seek to leverage new technologies for expansion. Additionally, global economic trends, such as the rise of emerging markets and the integration of regional blocs, have significantly influenced FDI patterns. Environmental, social, and governance (ESG) factors are now also gaining prominence, with investors increasingly considering sustainable practices and ethical standards in their investment decisions.