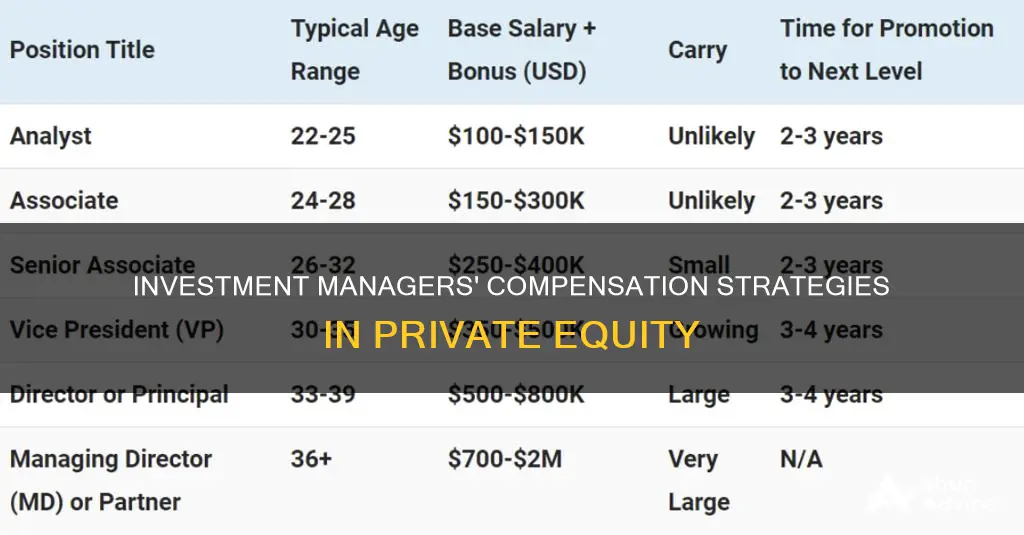

Investment managers in private equity (PE) are compensated in a variety of ways, including salaries, bonuses, and carried interest (also known as carry). The specific structure of their compensation depends on factors such as the size of the fund, the investment strategy, and the individual's role within the firm.

In general, PE firms are structured as Limited Partnerships between one General Partner (GP) and multiple Limited Partners (LPs). The GP is typically the firm itself, while the LPs include institutional investors and high-net-worth individuals. The LPs contribute the majority of the capital and earn the largest share of investment profits. The GP earns a share of the profits in exchange for managing day-to-day operations and assuming more risk than the LPs.

PE firms generate revenue through management fees, deal fees, and investment returns. Management fees, typically around 2% of the fund's assets under management (AUM), are charged annually to cover overhead expenses such as salaries and office rent. Deal fees, sometimes referred to as net monitoring and transaction fees, are charged to portfolio companies and are usually around 20% of the total management fees. Investment returns are profits generated when the fund's investments appreciate in value.

The compensation for investment managers in PE firms consists of base salaries, bonuses, and carried interest. Base salaries are paid monthly, while bonuses are typically paid as a lump sum at the end of the year. These payments are funded by management fees and deal fees. Carried interest is a percentage of the investment profits that fund managers receive as compensation. It is usually distributed according to a European-style or American-style waterfall scenario. In a European-style scenario, carried interest is applied to the entire investment fund, while in an American-style scenario, it is applied on a deal-by-deal basis.

The amount of carried interest an investment manager receives depends on their role within the firm. Associates, Vice Presidents (VPs), Principals, and Managing Directors (MDs) or Partners may all have different percentages and vesting periods for their carried interest. Additionally, co-investment opportunities may be available, allowing investment managers to invest their own money in specific deals.

Overall, the compensation structure for investment managers in private equity is complex and varies across firms and individuals. It is important for those seeking careers in this field to understand the nuances of compensation and how it aligns with their career goals and risk tolerance.

What You'll Learn

- Investment managers' compensation is performance-based and influenced by factors like seniority, fund size and performance

- Management fees are charged to LPs to cover fund operating costs and are typically 2% of total funds raised

- Carried interest is a share of fund returns and accounts for the bulk of private equity managers' compensation

- Hurdle rate is the minimum return LPs must earn before the GP can collect carried interest

- Clawback provision lets LPs recoup carried interest if losses lower fund returns below the hurdle rate

Investment managers' compensation is performance-based and influenced by factors like seniority, fund size and performance

Investment managers' compensation is performance-based and influenced by factors like seniority, fund size, and performance. While the specifics of compensation packages can vary, performance-based pay is a common feature in the industry.

Performance-based compensation is driven by monetary incentives and is often used for portfolio managers. In the investment sector, hedge fund managers are known for their performance-based fees. The amount they earn is influenced by the performance of the fund they manage. If the fund performs well, they receive a higher fee, and if it underperforms, their fee may be deducted. This type of compensation encourages investment managers to focus on delivering returns and aligns their interests with those of the investors.

The Investment Company Act of 1940 regulates the mutual fund sector and sets specific rules for portfolio manager compensation. Mutual fund managers typically charge a fee as a portion of the fund's total operating expenses annually, which can range from 0.5% to 2.5%. Active fund managers tend to receive higher compensation. Additionally, they may also receive performance-based fees, which can add 0.20% to the managerial charges if the fund meets or exceeds standards.

Hedge fund managers, on the other hand, often charge a "two and twenty" fee structure, which includes a flat 2% management fee and a 20% performance fee. The management fee is based on the assets under management, while the performance fee is charged when the fund performs beyond expectations or set standards.

Seniority also plays a role in investment manager compensation. More senior professionals tend to have a higher proportion of their compensation in the form of bonuses or performance-based pay. This aligns their interests with the fund's performance and can result in higher earnings when the fund does well.

Fund size is another factor influencing investment manager compensation. Larger funds tend to have higher management fees since they are charged as a percentage of the fund's assets under management (AUM). For example, a 2% management fee on a $1 billion fund generates $20 million per year in fees.

In addition to management fees, some firms also charge "deal fees" or "net monitoring and transaction fees" to portfolio companies, which can add to the revenue stream for investment managers.

Overall, investment manager compensation is performance-based and influenced by various factors, including seniority, fund size, and the performance of the fund they manage. The specific structure of compensation packages can vary, but performance-based pay is a common feature across the industry.

Investing: A Smarter Option Than Saving for Your Future

You may want to see also

Management fees are charged to LPs to cover fund operating costs and are typically 2% of total funds raised

Management fees are a crucial component of private equity (PE) fund managers' compensation. These fees are charged to the limited partners (LPs) of the fund, who are typically institutional investors such as pension funds, funds of funds, and high-net-worth individuals. The management fee is designed to cover the fund's operating costs, including salaries, travel expenses, and office rent.

The standard rate for management fees in the PE industry is 2% of the fund's total assets under management (AUM) per year. This fee is usually agreed upon between the LPs and the general partner (GP) of the fund during the negotiation of the fund's terms. While this rate has remained relatively consistent over the years, it is not uncommon for it to scale down after the "investment period," which is typically the first five years of a 10-year fund's life.

The management fee provides a significant source of revenue for PE firms, as it is charged regardless of the fund's performance. For example, a 2% fee on a $1 billion fund generates $20 million in annual revenue. This revenue helps cover the salaries and bonuses of the fund's employees, with base salaries being paid monthly and bonuses paid as a lump sum at the end of the year.

While management fees are a significant component of PE fund managers' compensation, it is important to note that they also earn carried interest, commonly known as "carry." Carry is a percentage of the fund's investment profits and is usually around 20%. Carry is typically paid once the fund has returned the invested capital and achieved a certain hurdle rate, ensuring that the LPs' interests are aligned with those of the GP.

Understanding Passive Portfolio Investment Vehicles: Strategies and Benefits

You may want to see also

Carried interest is a share of fund returns and accounts for the bulk of private equity managers' compensation

Carried interest, or "carry", is the percentage of a private fund's profits that a fund manager receives as compensation. It is one of the main ways that private equity fund managers are paid. The general partner (GP) of a fund is a legal entity that takes liability for the fund's activities and is directly involved in managing and operating the fund. In return for managing day-to-day operations and taking on more risk than limited partners (LP), GPs typically earn a share of the profits from the pooled investments of LPs.

The GP entity usually earns money by charging two fees: a management fee and carried interest. The management fee is paid by the LPs to the GP annually to cover overhead expenses such as salaries, travel, and office rent. This fee is usually around 2% of the fund's assets under management (AUM) per year.

Carried interest is often the primary source of compensation for the GP, who then passes the gains on to the fund's managers. It is typically around 20% of a fund's returns, though it can range from 15% to 30%. Carried interest is only paid if the fund achieves a minimum return, known as the hurdle rate. This rate represents the minimum profit the fund needs to earn before the GP starts earning carry.

LPs that invest in a fund contractually agree on the percentage of profit that will go toward carry for fund managers. The ability to command a higher or lower carry depends on LP demand for the fund, which is often based on the background of the fund managers and their previous funds' performance. The percentage is also market-driven and can vary according to the performance of the overall financial market during the fundraising period.

Carried interest is considered a return on investment for federal tax purposes and is taxed as capital gains, which have a lower rate than ordinary income. This preferential treatment is known as the carried interest "loophole" and has been criticised as allowing high-income investment managers to pay lower taxes than other employees.

Monitoring Your Investment Portfolio: A Comprehensive Guide

You may want to see also

Hurdle rate is the minimum return LPs must earn before the GP can collect carried interest

Investment managers are often compensated based on performance. In the private equity (PE) industry, fund managers are compensated through a management fee and carried interest or "carry". The management fee is paid by the limited partners (LPs) to the general partner (GP) on an annual basis to cover overhead expenses such as salaries, travel, and office rent. The carried interest is the percentage of the fund's profits that the GP receives as compensation.

Before the GP can collect the carried interest, the fund must meet a preferred return, also known as the hurdle rate. The hurdle rate is the minimum rate of return that the fund must achieve for the LPs before the GP can share in the profits. This serves as a performance benchmark that ensures the GP has a strong incentive to generate significant returns. The hurdle rate is typically stipulated in the Limited Partnership Agreement and can range from 6% to 10%.

If the fund's performance does not exceed the hurdle rate, the GP may only collect the management fees, which are generally much lower than the carried interest. A high hurdle rate may discourage the GP from taking on riskier investments, while a low hurdle rate may make it too easy for the GP to earn carried interest. Thus, the hurdle rate plays a crucial role in balancing the interests of the LPs and the GP.

In most private equity funds, the GP is incentivized to achieve strong results by participating in the return as part of their fee. The hurdle rate ensures that investors receive a minimum specified return before the GP can share in the profits. The GP must exceed the hurdle rate to be eligible for a portion of the profits, often around 20% of the fund's returns above the hurdle rate. This arrangement aligns the interests of the fund managers with those of the investors, providing an incentive for the GP to strive for returns above the hurdle rate.

Transferring Funds: Ally Invest to Ally Savings

You may want to see also

Clawback provision lets LPs recoup carried interest if losses lower fund returns below the hurdle rate

Clawback provisions are an essential component of carried interest agreements. They ensure fairness in the distribution of profits and protect investors in the event of underperformance. While they may be seen as a disadvantage by the private equity firm, they are key to maintaining balanced relationships between the parties involved.

Clawback provisions allow limited partners (LPs) to recoup carried interest from general partners (GPs) if losses lower fund returns below the hurdle rate. The hurdle rate is the minimum profit a fund needs to earn before the GP starts earning carry. LPs must earn back their initial investment, plus a preferred return, before the GPs can take a share of the profits.

If a fund underperforms and fails to meet certain performance criteria, the GP may be required to return previously distributed profits to the LPs. This is known as a clawback. A clawback is triggered when the fund's overall performance does not meet expectations, and it ensures that the GP does not profit disproportionately from early successes.

Clawback provisions are designed to protect the interests of LPs by ensuring that fund managers are held accountable and that they receive compensation proportional to the fund's actual performance. This helps to maintain fairness and transparency in the fund's compensation structure and promotes long-term thinking.

In summary, clawback provisions are a crucial mechanism in carried interest agreements that align the interests of GPs and LPs. They allow LPs to recoup carried interest if losses lower fund returns below the hurdle rate, ensuring fairness and protecting investors from excessive compensation payouts.

Gross Saving and Investment: Understanding the Basics

You may want to see also

Frequently asked questions

Private equity funds are typically structured as Limited Partnerships between one General Partner (GP)—the firm itself—and many Limited Partners (LPs), including institutional investors and high-net-worth individuals. The LPs contribute most of the capital and thus earn the majority of investment profits. The GP earns management fees, typically 2% of fund assets, and a share of fund profits called carried interest, often 20%.

Fund performance has a significant impact on compensation, particularly for mid- and senior-level employees. The better the fund performs, the higher the potential profits and compensation. Additionally, carried interest, a major component of private equity compensation, is dependent on the fund's performance, as it is calculated as a share of fund profits above a preset hurdle rate or preferred return.

Private equity compensation typically consists of a base salary, bonus, and carried interest. The base salary is paid out regularly, while the bonus is usually paid out annually and may be discretionary based on performance. Carried interest is the most complex component, involving a share of fund profits above a certain hurdle rate, and it is typically reserved for more senior employees.

Fund size significantly influences compensation, as larger funds can generate larger profits. Larger funds can buy larger companies, leading to potentially larger profits. As a result, compensation in larger funds tends to be higher, and there is greater competition for roles in mega funds and upper middle-market funds.