Lightweight Hybrid Technology (LiHTC) investments are a unique and innovative approach to funding and developing sustainable infrastructure projects. This system allows for the efficient allocation of resources by combining the strengths of both public and private sectors. LiHTC investments typically involve a partnership between governments, private investors, and local communities to create a shared ownership model. This model enables the development of essential infrastructure, such as renewable energy systems, transportation networks, and water management solutions, while also promoting economic growth and environmental sustainability. By leveraging the power of hybrid financing, LiHTC investments can provide a cost-effective and flexible solution for large-scale projects, making it an attractive option for governments and investors seeking to drive positive change in their communities.

What You'll Learn

- Eligibility and Income Limits: Understanding who qualifies for LIHTC and income thresholds

- Tax Credits and Benefits: How developers receive tax credits for affordable housing

- Project Development and Compliance: Steps to ensure projects meet LIHTC regulations

- Funding and Investment Sources: Exploring various funding options for LIHTC projects

- Impact and Community Benefits: The positive effects on communities and residents

Eligibility and Income Limits: Understanding who qualifies for LIHTC and income thresholds

Understanding the eligibility criteria and income limits is crucial when it comes to Low-Income Housing Tax Credit (LIHTC) investments. These programs are designed to provide affordable housing options for low- and moderate-income families, and they offer a unique investment opportunity for those seeking to support this cause while also generating tax benefits.

LIHTC eligibility is primarily based on the income of the intended residents. The program sets income limits to ensure that the housing units are accessible to those who truly need them. These limits are typically based on the area's median income and are adjusted annually to reflect changes in the local economy. For example, in many areas, the income limit for a household of four might be set at 60% of the median income, ensuring that the units are affordable for families with moderate incomes.

To qualify for LIHTC, applicants must meet specific criteria, which may vary slightly depending on the state or local program guidelines. Generally, applicants must be individuals or families who meet the income thresholds set by the program. This includes providing proof of income through tax returns, pay stubs, or other relevant documents. Additionally, applicants may need to demonstrate their need for affordable housing, often through a statement of hardship or similar documentation.

The income limits for LIHTC are designed to be flexible and adaptable. They are typically set at a percentage of the area's median income, which is determined by the U.S. Department of Housing and Urban Development (HUD). For instance, a common threshold is 50% or 60% of the median income, ensuring that the housing units are affordable for low- to moderate-income earners. These limits are regularly updated to keep pace with rising costs of living and to ensure that the program remains effective in providing affordable housing.

It's important to note that LIHTC programs often have specific guidelines for different types of households, such as the elderly, disabled individuals, or families with children. These guidelines may include additional criteria or preferences to ensure that the housing units cater to the unique needs of these populations. Understanding these nuances is essential for investors and applicants alike to fully grasp the eligibility process and maximize their chances of qualifying for this valuable housing initiative.

Investment Advisor: Helping People Navigate Finances

You may want to see also

Tax Credits and Benefits: How developers receive tax credits for affordable housing

The Low-Income Housing Tax Credit (LIHTC) program is a powerful tool for incentivizing the development of affordable housing. This federal program provides tax credits to developers who build or rehabilitate housing units for low-income families. These credits can significantly offset the costs of construction, making it more financially viable for developers to create affordable housing.

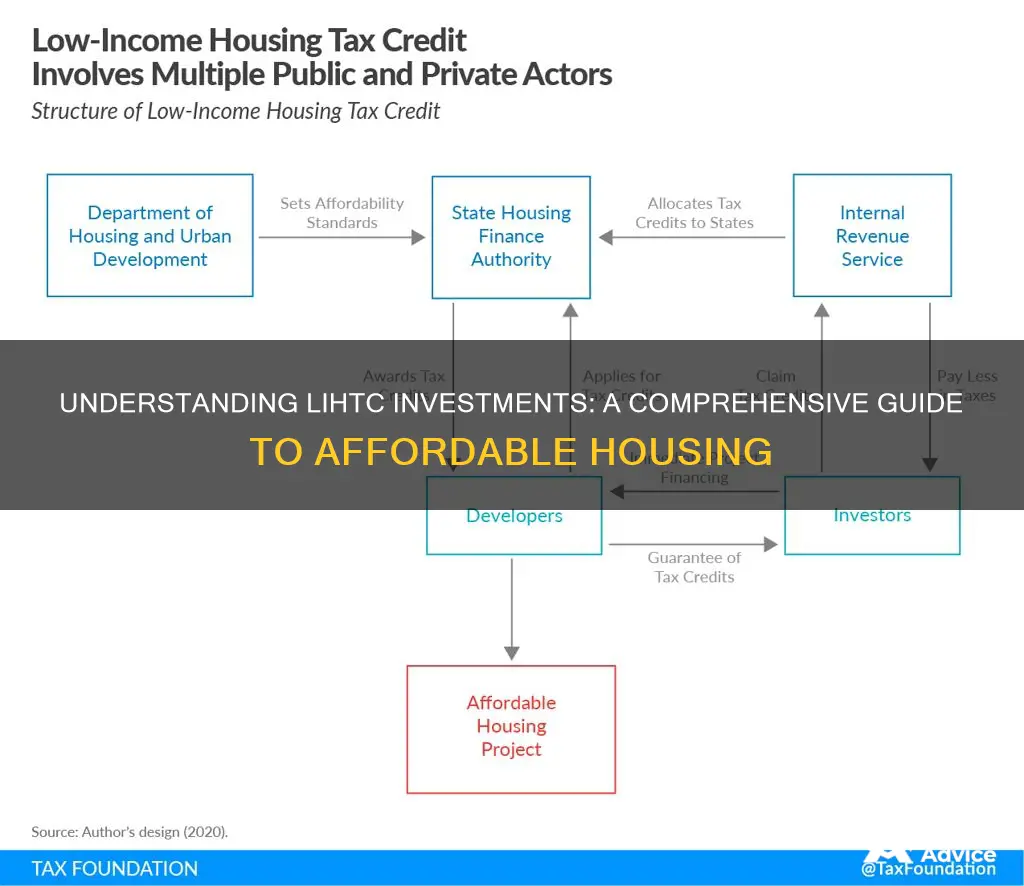

The process begins with state housing agencies, which are responsible for administering the LIHTC program within their respective states. These agencies allocate a portion of the available tax credits to developers who submit qualified affordable housing projects. Developers must meet specific criteria, such as providing a minimum number of units for low-income households and adhering to rent restrictions. Once a project is approved, the developer receives a series of tax credits over a set period, typically 10 years.

These tax credits can be used to reduce the developer's federal and state income taxes. The amount of the credit is based on the project's qualified basis, which includes the number of affordable units, the rent restrictions, and the project's overall cost. For example, if a developer builds a 50-unit apartment complex, with 30 units reserved for households earning below 60% of the area median income, they may qualify for a substantial tax credit. This credit can be applied against the developer's federal and state income taxes, providing a significant financial incentive.

One of the key benefits of LIHTC is its ability to leverage private investment. Developers can partner with private investors who are attracted to the tax credits and the potential for a steady return on their investment. This partnership model allows for a more significant scale of affordable housing development, as private investors provide the capital needed to fund these projects. The tax credits ensure that the financial risk is mitigated, encouraging more developers to participate in the affordable housing market.

Additionally, the LIHTC program has a positive impact on the communities it serves. By providing affordable housing, developers can help reduce homelessness, stabilize neighborhoods, and promote economic growth. Low-income households can access more affordable housing options, improving their quality of life and financial stability. This, in turn, can lead to increased local tax revenue and a more vibrant community.

In summary, the LIHTC program offers a comprehensive solution to the challenge of developing affordable housing. Through tax credits, developers are incentivized to create much-needed housing units for low-income families. This program not only benefits developers financially but also contributes to the social and economic well-being of the communities it serves. Understanding the mechanics of LIHTC investments is essential for anyone interested in promoting affordable housing and making a positive impact on society.

Whole Life: Smart Investment?

You may want to see also

Project Development and Compliance: Steps to ensure projects meet LIHTC regulations

Understanding the Low-Income Housing Tax Credit (LIHTC) program is crucial for any project aiming to provide affordable housing. LIHTCs are a powerful tool for developers and investors, offering a federal tax credit to encourage the development and rehabilitation of affordable rental housing for low-income families. Here's a breakdown of the key steps to ensure your project complies with LIHTC regulations:

Project Eligibility:

- Target Income: Define the target income range for your project. LIHTC regulations specify income limits based on the area's median income. You must demonstrate that the majority of your units will be occupied by households earning below these limits.

- Affordability: Ensure your rental prices are affordable for the target income group. The rent should not exceed a predetermined percentage of the area's median gross income.

- Location: LIHTCs are typically allocated to specific geographic areas. Verify that your project is located within a designated LIHTC allocation area.

Application and Certification:

- Application: Complete a detailed application package provided by the relevant state or local housing agency. This includes financial projections, construction plans, and a comprehensive description of the project's affordability features.

- Certification: The state or local agency will review your application and, if approved, issue a certification letter. This letter confirms your project's eligibility for LIHTCs and outlines the specific terms and conditions.

Construction and Compliance:

- Construction Standards: Adhere to the construction standards set by the LIHTC program. This includes building codes, energy efficiency requirements, and accessibility standards.

- Affordability Maintenance: Implement mechanisms to ensure the affordability of the units over the long term. This may involve setting aside a portion of the tax credits for future affordability adjustments or establishing a reserve fund.

- Tenant Selection: Implement fair and equitable tenant selection processes that prioritize low-income households.

Ongoing Compliance:

- Annual Reporting: File annual reports with the state or local housing agency to demonstrate ongoing compliance with LIHTC regulations. This includes financial updates, tenant income verification, and maintenance of affordability standards.

- Monitoring and Audits: Be prepared for periodic audits and monitoring to ensure your project remains in compliance.

Long-Term Management:

- Sustainability: Develop a long-term plan to ensure the project's sustainability and continued affordability. This may involve exploring partnerships with non-profit organizations or government agencies.

- Community Engagement: Foster community engagement and involvement to strengthen the project's social impact.

Remember, LIHTC regulations are designed to promote affordable housing development and require careful planning and adherence to specific guidelines. Working closely with experienced professionals, such as housing consultants and tax credit advisors, can help ensure a successful and compliant project.

Unleash Your Potential: A Guide to Investing in Small Businesses

You may want to see also

Funding and Investment Sources: Exploring various funding options for LIHTC projects

Funding and Investment Sources for LIHTC Projects

Low-Income Housing Tax Credit (LIHTC) projects are a crucial component of affordable housing development, offering a powerful tool to address housing needs for low-income families. These projects rely on a variety of funding sources to finance construction, rehabilitation, and acquisition. Understanding these funding options is essential for developers, investors, and policymakers alike.

One primary funding source for LIHTC projects is the federal government. The Low-Income Housing Tax Credit Program, administered by the Department of Housing and Urban Development (HUD), provides tax credits to investors who contribute to affordable housing developments. These tax credits are allocated to states based on a formula, and states then distribute them to qualified projects. The program encourages private investment in affordable housing by offering a credit against federal income taxes, typically worth 9% of the investment amount.

In addition to federal funding, state and local governments play a significant role in supporting LIHTC projects. Many states have their own housing credit programs that complement the federal program. These state programs often provide additional tax credits or grants to further incentivize investment in affordable housing. Local governments may also offer subsidies, low-interest loans, or tax breaks to developers and investors. For instance, a city might provide a property tax abatement for a period, reducing the financial burden on the project.

Non-profit organizations and community development financial institutions (CDFIs) are another vital source of funding for LIHTC projects. These entities often have a mission to support affordable housing development and may provide grants, loans, or equity investments. CDFIs, in particular, specialize in serving underserved communities and can offer tailored financial products to meet the unique needs of LIHTC projects. They may provide gap financing to bridge the gap between construction costs and other funding sources.

Public-private partnerships are also gaining traction as a funding strategy for LIHTC projects. These partnerships involve collaboration between government agencies, non-profit organizations, and private developers or investors. By combining resources and expertise, these partnerships can leverage the strengths of each partner to create sustainable and impactful affordable housing solutions. For example, a partnership might involve a private developer contributing land and construction expertise while a non-profit organization provides community engagement and resident services.

Exploring various funding options is crucial for the successful implementation of LIHTC projects. Developers and investors should carefully consider the advantages and limitations of each funding source to ensure a robust and sustainable project. A comprehensive understanding of these funding mechanisms will enable stakeholders to navigate the complexities of affordable housing development and create lasting solutions for low-income families.

Brexit's Legacy: Navigating the Post-EU Investment Landscape

You may want to see also

Impact and Community Benefits: The positive effects on communities and residents

The Low-Income Housing Tax Credit (LIHTC) program is a powerful tool for driving positive change in communities and significantly impacting the lives of residents. This federal program, administered by state agencies, plays a crucial role in addressing the housing needs of low-income families and individuals. By providing tax credits to developers and investors, LIHTCs incentivize the creation and preservation of affordable rental housing.

One of the most significant impacts of LIHTC investments is the creation of affordable housing units. These investments enable the development or rehabilitation of multi-family housing projects, ensuring that a portion of the units are rented at below-market rates to eligible low-income households. This results in increased housing options for those who need it most, reducing the burden of high rent or mortgage payments and allowing residents to allocate more of their income towards other essential needs.

The benefits extend beyond just providing housing. LIHTC investments often lead to the revitalization of neighborhoods. Well-maintained and managed affordable housing developments can attract positive attention, encouraging further investment in the area. This can lead to improved infrastructure, better-maintained public spaces, and a sense of community pride. As a result, residents may experience enhanced safety, increased social cohesion, and improved overall quality of life.

Moreover, LIHTC projects often have a ripple effect on the local economy. Construction and maintenance activities create job opportunities for local workers, stimulating economic growth. Additionally, the presence of affordable housing can attract and retain a diverse workforce, benefiting local businesses and the community as a whole. This can lead to increased tax revenue for the community and a more sustainable and prosperous local economy.

In summary, LIHTC investments have a profound and positive impact on communities and residents. They address the critical need for affordable housing, improve neighborhood conditions, and contribute to local economic development. By providing tax incentives, this program encourages private investment in housing, ultimately benefiting those who need it most and fostering stronger, more resilient communities. Understanding and supporting initiatives like LIHTCs are essential steps towards creating a more equitable and thriving society.

Understanding Your Retirement Investment Profile: A Guide to Navigating Your Golden Years

You may want to see also

Frequently asked questions

LIHTCs are a federal program designed to increase affordable housing opportunities for low-income families. It provides tax credits to investors who provide equity financing for affordable housing projects. These credits are allocated by state housing agencies and can be claimed over a period of 10 years. The program encourages private investment in affordable housing by offering a tax benefit to investors, ensuring the long-term affordability of the properties.

Investing in LIHTC projects typically involves working with a qualified developer or housing organization that has experience in securing these credits. Investors can provide equity financing to the developer, who then uses the funds to acquire, develop, or rehabilitate affordable housing properties. Investors receive tax credits based on their investment, which can be used to offset their federal income tax liability. This investment strategy allows individuals to contribute to affordable housing while also receiving a financial return.

While LIHTC investments offer an attractive tax benefit, there are certain considerations. The program has specific guidelines and allocation processes, and investors must adhere to the terms set by the state housing agency. Returns on LIHTC investments are generally lower compared to other investment opportunities, and the credit allocation process can be competitive. Additionally, investors should be aware of the potential risks associated with affordable housing projects, such as market fluctuations, tenant turnover, and maintenance costs. Due diligence and a thorough understanding of the program's rules are essential before investing.