Public finance investment bankers play a crucial role in the financial sector, but their work hours can vary significantly. While some may work traditional 9-to-5 schedules, others might find themselves working long hours, especially during deal-making processes or when managing complex projects. Understanding the typical work patterns of these professionals is essential for anyone interested in pursuing a career in this field or for those seeking to collaborate with them. This paragraph aims to shed light on the diverse work schedules of public finance investment bankers, offering insights into their dedication and the potential demands of their profession.

| Characteristics | Values |

|---|---|

| Typical Work Hours | Long hours, often 60-80 hours per week |

| Overtime | Common, especially during busy periods or for critical projects |

| Flexibility | Some firms offer flexible schedules, but the job is generally demanding |

| Weekend Work | Possible, especially for deal-related tasks or client meetings |

| Travel | Frequent, both domestically and internationally |

| Stress Level | High, due to the fast-paced nature of the job and the pressure to deliver results |

| Job Security | Generally good, but can be volatile in the financial industry |

| Education | Typically a bachelor's degree in finance, economics, or a related field; advanced degrees are common |

| Experience | Entry-level positions often require 0-2 years of experience, while senior roles demand 5+ years |

| Salary | Competitive, with base salaries and performance-based bonuses |

What You'll Learn

- Work-Life Balance: Public finance investment bankers often work long hours, but strategies for maintaining a healthy work-life balance are essential

- Compensation and Benefits: The relationship between hours worked and compensation, including bonuses and benefits, is a key consideration for investment bankers

- Career Progression: Understanding the impact of hours on career advancement and the potential for promotion is crucial for public finance investment bankers

- Stress and Wellbeing: High-pressure work environments can lead to stress; promoting employee wellbeing is essential for long-term success

- Regulatory Compliance: Investment bankers must adhere to regulations regarding working hours to ensure fair labor practices and avoid legal issues

Work-Life Balance: Public finance investment bankers often work long hours, but strategies for maintaining a healthy work-life balance are essential

Public finance investment bankers often find themselves immersed in a high-pressure environment, where long work hours are the norm. The nature of their work, which involves complex financial analysis, deal structuring, and client management, can demand significant time and dedication. While the job offers exciting opportunities and competitive salaries, it's crucial for bankers to prioritize their well-being and maintain a healthy work-life balance. Striking this balance is essential for long-term success, productivity, and overall happiness.

One of the primary challenges for public finance investment bankers is managing the demanding workload. The job often requires long hours, especially during deal-making processes, due diligence, and when meeting client deadlines. It is not uncommon for bankers to work late nights and weekends, which can quickly lead to burnout if not managed properly. To combat this, it is advisable to set clear boundaries and establish a structured routine. Creating a schedule that allocates specific time slots for work and personal activities can help ensure that professional commitments do not overshadow personal responsibilities.

Maintaining a healthy work-life balance also involves effective time management and prioritization. Bankers should learn to delegate tasks when possible and focus on high-value activities that directly impact their career growth and client satisfaction. By streamlining processes and optimizing workflows, they can reduce the overall time spent on tasks, thereby creating more room for personal pursuits. Additionally, setting realistic goals and breaking larger projects into manageable tasks can prevent overwhelm and promote a sense of accomplishment.

Self-care is another critical aspect of achieving work-life balance. Public finance investment bankers should make time for physical exercise, healthy meals, and adequate sleep. Engaging in activities that promote relaxation and stress relief, such as meditation, yoga, or hobbies, can significantly improve overall well-being. Taking regular breaks during work hours to stretch, walk, or simply recharge can boost productivity and prevent mental fatigue.

Furthermore, building a strong support network is invaluable. Connecting with colleagues, mentors, or friends who understand the demands of the job can provide emotional support and valuable insights. Sharing experiences and best practices can help individuals navigate the challenges of long work hours and find sustainable solutions. Mentorship programs within the industry can also offer guidance on maintaining a healthy work-life balance while pursuing a successful career in public finance investment banking.

In conclusion, while the role of a public finance investment banker may demand long hours, it is essential to adopt strategies that promote a healthy work-life balance. By setting boundaries, managing time effectively, prioritizing self-care, and building a support network, bankers can ensure they lead fulfilling lives both professionally and personally. Achieving this balance will ultimately contribute to increased job satisfaction, improved performance, and a more sustainable career trajectory.

Unlocking EB-5: How EB-5 Investments Work for Immigrants

You may want to see also

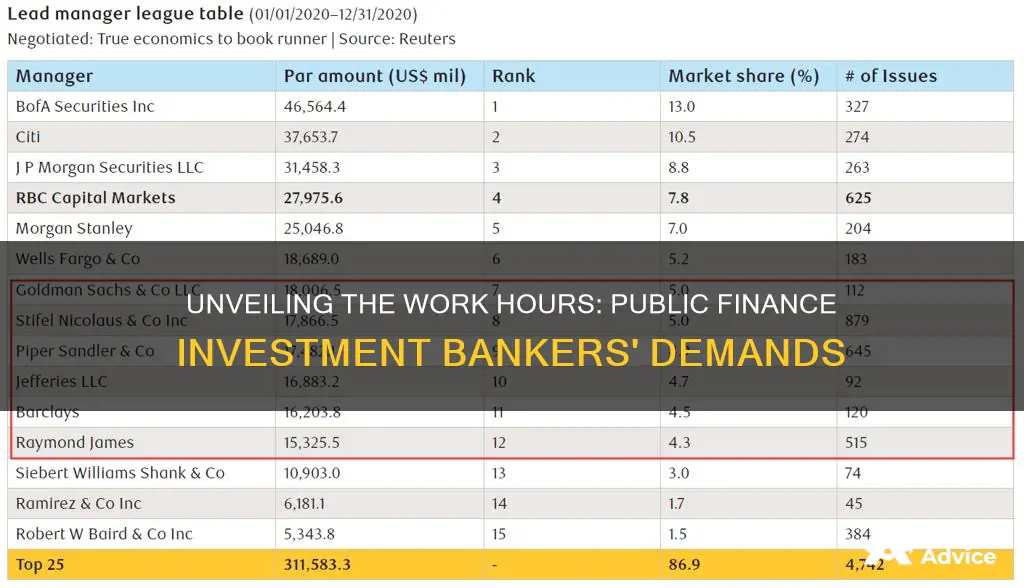

Compensation and Benefits: The relationship between hours worked and compensation, including bonuses and benefits, is a key consideration for investment bankers

The relationship between the number of hours worked and compensation is a critical aspect of the employment experience for public finance investment bankers. This dynamic is particularly relevant in the highly competitive and demanding financial industry, where long hours are often the norm. Investment banking roles, especially those in public finance, are renowned for their intense work culture, with employees frequently working extended hours, including weekends and evenings. This is primarily due to the nature of the job, which involves managing complex financial transactions, dealing with tight deadlines, and providing round-the-clock support to clients.

Compensation structures in investment banking are designed to reflect the value and impact of an individual's contributions, often incorporating a combination of base salary and performance-based bonuses. The hours worked are a significant factor in determining these compensation components. Typically, investment bankers who work longer hours are eligible for higher bonuses, which can be substantial, especially during peak periods or when a significant deal is closed. For instance, a successful public finance deal might result in a bonus that could be several times the annual base salary, rewarding the extended hours and dedication demonstrated by the banker.

However, the long hours culture in investment banking has its drawbacks. The pressure to work extended periods can lead to burnout, affecting the overall health and well-being of employees. As a result, many firms are now implementing policies to promote a healthier work-life balance, such as flexible working hours, remote work options, and enhanced parental leave. These initiatives aim to address the concerns of employees regarding the sustainability of the long hours model and to attract and retain top talent.

Benefits packages in investment banking are also designed to be competitive and comprehensive. These often include health and dental insurance, retirement plans, and other perks such as gym memberships, financial planning services, and access to company events. The value of these benefits should be considered in the context of the demanding work environment, as they contribute to the overall compensation package. For instance, comprehensive health insurance can provide peace of mind, knowing that employees and their families are covered, which is especially important given the high-stress nature of the job.

In summary, the relationship between hours worked and compensation is a delicate balance in public finance investment banking. While longer hours often lead to higher bonuses and an attractive overall compensation package, it is essential to maintain a healthy work environment. Firms are increasingly recognizing the need to support employee well-being, ensuring that the long hours culture does not lead to burnout. This approach not only benefits the employees but also contributes to the long-term success and sustainability of the investment banking industry.

Retirement Savings: Invest or Save?

You may want to see also

Career Progression: Understanding the impact of hours on career advancement and the potential for promotion is crucial for public finance investment bankers

The working hours of public finance investment bankers can significantly influence their career progression and advancement opportunities. While the industry is known for its demanding nature, understanding the impact of hours on career growth is essential for professionals in this field. Here's an exploration of this crucial aspect:

Impact on Career Advancement: Public finance investment banking is a highly competitive and fast-paced sector. The long hours often associated with this profession can have both positive and negative effects on an individual's career trajectory. On the positive side, extensive hours can demonstrate dedication, work ethic, and a strong commitment to the job. This may lead to increased visibility and recognition within the firm, especially if the banker consistently delivers high-quality results. However, it is crucial to maintain a healthy work-life balance to avoid burnout and maintain productivity over the long term.

Promotional Opportunities: Career advancement in public finance investment banking often correlates with increased responsibility and leadership roles. When considering promotions, employers typically look for individuals who can handle additional challenges and responsibilities. Working long hours can signal to employers that a banker is willing to take on more complex tasks and manage a heavier workload. This can be advantageous when applying for promotions, as it showcases a proactive approach and a desire to contribute beyond one's current role. However, it is essential to ensure that these extended hours do not compromise the quality of work, as this could potentially hinder career progression.

Maintaining Productivity and Quality: The pressure to work long hours might lead to increased stress and fatigue, which can negatively impact productivity and the overall quality of work. Investment bankers must strive to maintain a consistent level of performance while managing their time effectively. This includes setting realistic deadlines, prioritizing tasks, and ensuring that extended hours do not result in rushed or subpar work. By demonstrating a commitment to excellence despite the demanding hours, bankers can position themselves as valuable assets to the firm.

Strategic Planning and Time Management: To navigate the challenges of long working hours, investment bankers should focus on strategic planning and time management. This involves setting clear goals, breaking down projects into manageable tasks, and allocating specific time slots for different responsibilities. Effective time management ensures that bankers can deliver high-quality work without compromising their well-being. Additionally, learning to delegate tasks and seek support when needed can help maintain productivity and prevent burnout.

In summary, while the hours in public finance investment banking can impact career progression, a balanced approach is key. Bankers should strive to work efficiently, maintain a healthy lifestyle, and demonstrate their value through consistent performance. By understanding the relationship between hours worked and career advancement, professionals can make informed decisions to enhance their long-term success and job satisfaction.

Is Now the Time to Be All In?

You may want to see also

Stress and Wellbeing: High-pressure work environments can lead to stress; promoting employee wellbeing is essential for long-term success

The demanding nature of public finance investment banking can significantly impact the mental health and overall wellbeing of professionals in this field. Investment bankers often find themselves in high-pressure environments, dealing with tight deadlines, complex projects, and the constant need to deliver results. While the industry offers lucrative career paths and exciting challenges, the long hours and intense work culture can take a toll on employees' physical and mental health.

Stress is a common byproduct of the fast-paced nature of investment banking. The job requires professionals to make quick decisions, manage multiple tasks simultaneously, and often work late into the night. According to a survey conducted among investment bankers, it was revealed that over 70% of respondents worked more than 60 hours per week, with some even exceeding 80 hours. Such long work hours can lead to burnout, fatigue, and increased stress levels, affecting not only the individual's performance but also their overall quality of life.

Promoting employee wellbeing is crucial for the long-term success and sustainability of the industry. Investment banks should prioritize creating a supportive and healthy work environment. Here are some strategies to consider:

- Flexible Work Arrangements: Offering flexible working hours or remote work options can help employees manage their time more effectively and reduce the stress associated with long commutes or rigid schedules. This flexibility can improve work-life balance and allow individuals to better handle personal responsibilities and potential health concerns.

- Wellness Programs: Implementing comprehensive wellness initiatives can significantly contribute to employee wellbeing. These programs can include access to counseling services, stress management workshops, fitness programs, and financial planning resources. By providing tools and support to manage stress and improve overall health, banks can foster a more resilient and productive workforce.

- Regular Performance Reviews: Conducting regular performance evaluations can help identify individuals who may be struggling with workload management or stress-related issues. Through open communication, employers can offer support, adjust workloads, or provide resources to help employees thrive in their roles without compromising their wellbeing.

- Encourage Work-Life Balance: Banks should actively promote a culture that values productivity over long hours. Encouraging employees to take breaks, utilize their vacation days, and maintain a healthy work-life balance can prevent burnout and promote a more positive and sustainable work environment.

By implementing these strategies, public finance investment banks can create a healthier and more supportive workplace, ultimately benefiting both the employees and the organization's long-term success. It is essential to recognize that a happy and healthy workforce is more productive, engaged, and capable of handling the challenges of the dynamic investment banking industry.

Smart Investment Strategies: Unlocking the Power of a $50K Investment

You may want to see also

Regulatory Compliance: Investment bankers must adhere to regulations regarding working hours to ensure fair labor practices and avoid legal issues

The working hours of investment bankers, particularly those in the public finance sector, are subject to specific regulations to ensure fair labor practices and prevent potential legal complications. These regulations are designed to protect employees from excessive work hours and promote a healthy work-life balance. Public finance investment banking often involves long and demanding workweeks, but it is crucial to operate within legal boundaries.

In many jurisdictions, there are labor laws and industry standards that dictate maximum working hours for employees. For investment bankers, these regulations typically set a limit on the number of hours worked per week, often around 40 hours, similar to other professional roles. However, the nature of investment banking can sometimes lead to longer hours due to project deadlines, market volatility, and the need for rapid decision-making.

To comply with these regulations, investment banking firms must implement policies that monitor and manage working hours. This includes tracking the hours worked by each employee and ensuring that no individual consistently exceeds the legal limit. Regular reviews of work schedules and providing adequate breaks throughout the day are essential practices to maintain compliance.

Additionally, investment bankers should be aware of their rights and responsibilities regarding working hours. This includes the right to refuse overtime work if it exceeds reasonable limits and the right to report any violations or concerns to relevant authorities. By understanding and adhering to these regulations, investment bankers can ensure that their work environment remains fair and compliant.

Maintaining regulatory compliance in working hours is not just about avoiding legal consequences but also about fostering a sustainable and healthy work culture. It encourages a balanced approach to work, allowing investment bankers to manage their time effectively and prevent burnout. Firms that prioritize compliance are more likely to create a positive and productive work environment, ultimately benefiting both the employees and the organization's long-term success.

Tips: Invest or Avoid?

You may want to see also

Frequently asked questions

Public finance investment bankers often have demanding schedules and may work long hours, especially during busy periods or when dealing with high-profile deals. On average, they can work anywhere from 50 to 60 hours per week. However, this can vary depending on the specific role, the firm's culture, and individual responsibilities. Some may have more flexible schedules, while others might require extended hours to meet deadlines or client demands.

Unlike some other financial sectors, public finance investment banking doesn't typically follow a traditional 9-to-5 schedule. The work often requires flexibility and can be project-based, with varying start and end times. Investment bankers might work early mornings, late evenings, or even weekends to accommodate global markets and client needs. They may also have to travel frequently, which can disrupt their regular working hours.

Vacation policies can vary widely among financial institutions and even within different teams. Some firms offer a set number of vacation days annually, while others provide a flexible vacation policy, allowing bankers to take time off based on their needs and the firm's requirements. Additionally, public holidays and personal days off are usually part of the package, ensuring a balanced work-life integration.