When it comes to investing, the term long-term can vary significantly depending on the context and the investor's goals. Generally, long-term investments are those held for an extended period, often spanning several years or even decades. This approach is favored by many investors as it allows them to ride out short-term market fluctuations and focus on the potential for long-term growth. The duration of a long-term investment can range from a few years to a retirement horizon, making it a crucial aspect to consider when building a financial strategy. Understanding the length of a long-term investment is essential for investors to make informed decisions and align their portfolios with their financial objectives.

What You'll Learn

- Time Horizon: Longer-term investments typically span years, offering more time for growth

- Risk Tolerance: Investors with a higher risk tolerance may opt for longer-term investments

- Market Volatility: Longer-term investments can smooth out market volatility over time

- Compounding: Compound interest benefits longer-term investments, growing wealth over years

- Diversification: Longer-term investments allow for better diversification across asset classes

Time Horizon: Longer-term investments typically span years, offering more time for growth

When considering investments, the time horizon is a critical factor that determines the investment strategy and its potential outcomes. Longer-term investments are characterized by a time frame that typically spans several years, providing investors with a more extended period to achieve their financial goals. This extended time horizon offers several advantages and considerations that investors should be aware of.

One of the primary benefits of longer-term investments is the potential for greater growth. Over an extended period, markets have historically demonstrated the ability to rise, allowing investors to benefit from compound interest and the accumulation of wealth. For example, investing in stocks or mutual funds for a decade or more can lead to significant appreciation, especially when compared to shorter-term investments. This is because longer-term investments provide a more comprehensive view of market trends and economic cycles, allowing investors to ride out short-term fluctuations and focus on long-term gains.

Additionally, longer-term investments often come with lower risk due to the time value of money. In the long run, markets tend to smooth out volatility, and investors can benefit from the power of diversification. By investing for the long term, individuals can take advantage of the fact that markets tend to reward patient investors. This strategy is particularly effective for retirement planning, where a longer time horizon allows for a more relaxed approach to market fluctuations, ensuring a more stable and secure financial future.

However, longer-term investments also require a certain level of discipline and commitment. Investors must remain invested for the entire period, avoiding the temptation to make frequent changes based on short-term market movements. This approach can be challenging for those seeking quick returns, as it requires a long-term perspective and the ability to withstand market volatility.

In summary, longer-term investments are a strategic approach to building wealth, offering more time for growth and the potential to overcome short-term market challenges. It is a commitment to a financial strategy that can lead to substantial rewards, especially when combined with a well-diversified portfolio. Understanding the time horizon and its implications is essential for investors to make informed decisions and build a secure financial future.

Unlocking Wealth: Discover the Ultimate Long-Term Investment Strategy

You may want to see also

Risk Tolerance: Investors with a higher risk tolerance may opt for longer-term investments

For investors with a higher risk tolerance, longer-term investments can be a strategic choice. This approach involves committing funds to assets with a maturity or expected holding period of several years or more. The primary rationale behind this strategy is to harness the power of compounding and to benefit from the potential for significant growth over an extended period.

Longer-term investments often involve a higher degree of risk, as they are more susceptible to market fluctuations and economic cycles. However, investors with a higher risk tolerance are generally more comfortable with these fluctuations and view them as opportunities for potential gains. This tolerance allows them to make bolder investment decisions, such as investing in volatile assets like growth stocks or emerging market funds, which have the potential for substantial returns over time.

The key advantage of longer-term investments is the ability to weather short-term market volatility. Over an extended period, the market has historically demonstrated a tendency to rise, and investors can benefit from this trend. For instance, investing in index funds or exchange-traded funds (ETFs) that track a broad market index can provide diversification and the potential for long-term capital appreciation.

Additionally, longer-term investments often align with the investment goals of many individuals, particularly those saving for retirement or long-term financial milestones. By investing for the long term, investors can take advantage of tax efficiency, as many retirement accounts offer tax benefits for long-term holdings. This strategy also allows investors to focus on the fundamental analysis of companies and industries, rather than getting caught up in short-term market noise.

In summary, investors with a higher risk tolerance can benefit from longer-term investments by embracing market volatility and the potential for significant growth. This approach requires a long-term perspective and the ability to withstand short-term fluctuations, but it can lead to substantial financial gains over time. It is a strategy that suits those who are comfortable with risk and have a well-defined investment horizon.

Understanding CAPEX: Short-Term Investments and Their Role

You may want to see also

Market Volatility: Longer-term investments can smooth out market volatility over time

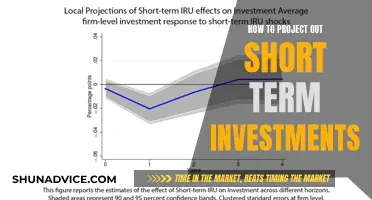

Market volatility is an inherent part of the financial landscape, and it can significantly impact investment strategies. While short-term market fluctuations can be concerning, longer-term investments offer a powerful tool to navigate this volatility and potentially achieve more stable and consistent returns. This approach is particularly relevant in today's dynamic and often unpredictable financial markets.

When investors focus on the long term, they gain a strategic advantage by adopting a more patient and disciplined mindset. Longer-term investments typically span several years, allowing investors to ride out the short-term market swings and focus on the underlying fundamentals of their investments. This perspective enables investors to make more informed decisions, as they consider the broader economic trends and the long-term growth potential of their chosen assets.

The concept of smoothing out market volatility is a key benefit of longer-term investments. By holding investments for an extended period, investors can experience a more stable and less turbulent journey. This strategy is based on the idea that short-term market fluctuations are often temporary and can be mitigated over time. For example, a well-diversified portfolio of long-term investments, such as stocks, bonds, or real estate, can provide a more consistent return stream, even during periods of market downturn.

Over time, the power of compounding becomes a significant factor. Longer-term investments allow for the continuous reinvestment of dividends and capital gains, leading to exponential growth. This compounding effect can turn modest initial investments into substantial sums over the years, providing a safety net against market volatility. Additionally, longer investment horizons often align with the natural growth cycles of various asset classes, making it easier to weather short-term storms.

In summary, longer-term investments are a strategic approach to managing market volatility. By adopting a long-term perspective, investors can make more rational decisions, benefit from compounding, and smooth out the impact of short-term market fluctuations. This strategy is particularly valuable for those seeking to build wealth over an extended period, as it encourages a disciplined and patient investment approach, ultimately leading to more stable and potentially higher returns.

Unlocking Investment Strategies: A Guide to Understanding Investment Terms

You may want to see also

Compounding: Compound interest benefits longer-term investments, growing wealth over years

Compounding is a powerful financial concept that can significantly impact the growth of your investments over time. It refers to the process where the interest earned on an investment is added to the principal amount, and subsequent interest is calculated on the new total. This mechanism allows your money to grow exponentially, making longer-term investments even more advantageous.

When you invest for the long term, you're essentially giving your money time to work for you. The longer the investment period, the more opportunities your capital has to benefit from compounding. For instance, consider an investment of $10,000 at an annual interest rate of 5%. If you leave this amount invested for 10 years, the power of compounding will come into play. At the end of the first year, you'll earn interest on the initial $10,000 and an additional 5% on the newly accumulated $10,500. This process repeats annually, and the interest earned each year is added to the principal, leading to a substantial increase in the final amount.

The beauty of compounding lies in its ability to accelerate wealth creation. As time progresses, the interest earned compounds on itself, resulting in a snowball effect. This means that the longer your investment stays in the market, the more substantial the growth. For example, a $10,000 investment at 5% interest, compounded annually for 20 years, would grow to approximately $26,530. The difference in final value compared to a shorter-term investment is substantial, demonstrating the long-term benefits of compounding.

It's important to note that the power of compounding is not limited to high-interest rates alone. Even with relatively modest interest rates, long-term investments can yield impressive results. The key is to start early and let time be your ally. Young investors, in particular, can take advantage of this phenomenon by investing in retirement accounts or other long-term vehicles, allowing their money to grow and compound over several decades.

In summary, longer-term investments are an excellent strategy to harness the power of compounding. By understanding and utilizing this financial concept, you can watch your wealth grow and achieve financial goals that may have seemed distant initially. Compounding is a valuable tool for anyone looking to build a secure financial future, emphasizing the importance of long-term investment horizons.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Diversification: Longer-term investments allow for better diversification across asset classes

Longer-term investments are a strategic approach to building a robust and well-diversified investment portfolio. When you invest for the long term, you gain the flexibility to explore a wide range of asset classes, which is a key principle of diversification. Diversification is a risk management strategy that aims to spread your investments across various assets to reduce the impact of any single asset's performance on your overall portfolio. By holding investments for an extended period, you can take advantage of the natural smoothing effect that market volatility has over time.

In the short term, individual asset prices can fluctuate dramatically, often driven by news, market sentiment, or even random events. However, over the long term, these short-term price movements tend to even out. For example, a stock's price might drop significantly in a single day due to negative news, but over the course of several years, it will likely recover and continue to grow. This long-term perspective allows investors to focus on the underlying value of the asset rather than short-term market noise.

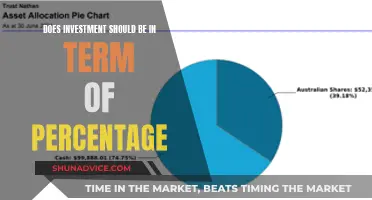

By investing for the long term, you can allocate a portion of your portfolio to different asset classes such as stocks, bonds, real estate, commodities, and even alternative investments like private equity or hedge funds. Each asset class has its own unique characteristics, risk profiles, and potential returns. For instance, stocks generally offer higher long-term returns but come with higher risk, while bonds provide a more stable but lower return. Diversifying across these asset classes ensures that your portfolio is not overly exposed to any one type of risk and can provide a more consistent performance over time.

Additionally, longer-term investments enable you to take advantage of compounding returns. When you reinvest the dividends or interest earned from your investments, you can grow your wealth exponentially. This effect is particularly powerful when combined with the power of diversification, as it allows your portfolio to grow in a more consistent and sustainable manner. Over time, this can lead to significant wealth accumulation, even in the face of market downturns.

In summary, longer-term investments provide the opportunity to diversify your portfolio across a wide range of asset classes, reducing risk and increasing the potential for consistent returns. This approach allows investors to weather market volatility and focus on the long-term growth potential of their investments, ultimately leading to a more secure and prosperous financial future. It is a fundamental strategy for anyone looking to build a robust and resilient investment portfolio.

Long-Term Investments: Navigating the Misconception of Current Liabilities

You may want to see also

Frequently asked questions

Longer-term investments typically refer to assets or funds that are intended to be held for an extended period, often spanning several years or even decades. This can include stocks, bonds, real estate, or other assets that are not meant for frequent trading.

Longer-term investments often involve a buy-and-hold strategy, where investors focus on the long-term growth potential of an asset rather than short-term market fluctuations. This approach allows for a more relaxed attitude towards market volatility, as short-term losses are seen as temporary.

Yes, longer-term investments can provide several advantages. Firstly, they often offer higher returns over time due to the power of compounding. Secondly, they allow investors to ride out market downturns, as short-term losses are less significant in the grand scheme of a longer investment period. This strategy can result in more substantial wealth accumulation over the years.