Investing in the long term with Col Financial can be a strategic move for those seeking financial growth. This guide will explore the key steps and considerations for building a robust long-term investment strategy, including understanding your financial goals, assessing risk tolerance, and selecting appropriate investment vehicles. We'll delve into the benefits of long-term investing, such as compound interest and the power of time, and provide practical tips on how to navigate market fluctuations and make informed decisions. Whether you're a seasoned investor or just starting, this comprehensive approach will empower you to make the most of your long-term financial journey with Col Financial.

What You'll Learn

- Research and Analysis: Understand market trends, study financial reports, and assess risk factors

- Diversification Strategies: Spread investments across assets to minimize risk and maximize returns

- Long-Term Investment Vehicles: Explore options like mutual funds, ETFs, and index funds for sustained growth

- Risk Management Techniques: Implement stop-loss orders, use hedging, and regularly review portfolio performance

- Tax Efficiency: Optimize tax strategies to reduce long-term capital gains and maximize after-tax returns

Research and Analysis: Understand market trends, study financial reports, and assess risk factors

To invest long-term in COL Financial, a comprehensive research and analysis process is essential. This involves understanding market trends, studying financial reports, and assessing risk factors to make informed investment decisions. Here's a detailed breakdown of each step:

Understanding Market Trends:

- Stay Informed: Keep yourself updated on economic news, industry trends, and global events that could impact COL Financial's performance. Utilize reputable financial news sources, industry publications, and market research reports.

- Analyze Historical Data: Study COL Financial's historical performance, including stock price trends, revenue growth, and earnings per share. Identify patterns, cycles, and potential catalysts for future growth.

- Identify Key Drivers: Determine the primary factors driving COL Financial's success. This could include market share gains, innovative products, strong management team, or favorable industry conditions.

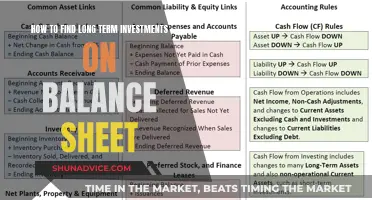

Studying Financial Reports:

- Annual and Quarterly Reports: COL Financial will release annual and quarterly financial statements, providing detailed insights into its financial health. Carefully examine these reports to understand revenue, expenses, profits, assets, liabilities, and cash flow.

- Key Financial Ratios: Calculate and analyze financial ratios such as price-to-earnings (P/E), price-to-book (P/B), return on equity (ROE), and debt-to-equity. These ratios offer valuable insights into COL Financial's valuation, profitability, and financial leverage.

- Management Discussion and Analysis (MD&A): The MD&A section of financial reports provides management's perspective on the company's performance, future prospects, and potential risks. It offers valuable insights into COL Financial's strategic direction and potential challenges.

Assessing Risk Factors:

- Industry Risks: Evaluate the risks associated with COL Financial's industry. This includes competition, regulatory changes, technological disruptions, and economic cycles.

- Company-Specific Risks: Identify potential risks specific to COL Financial, such as management changes, litigation, product recalls, or supply chain disruptions.

- Market Risks: Consider broader market risks, including interest rate fluctuations, inflation, geopolitical tensions, and economic downturns.

- Risk Mitigation Strategies: Develop strategies to mitigate identified risks. This may involve diversification, insurance, or implementing contingency plans.

Remember, investing long-term requires a thorough understanding of the company, the industry, and the market. By conducting thorough research and analysis, you can make informed decisions and build a robust investment strategy for COL Financial.

Prepaid Expenses: Are They a Short-Term Investment?

You may want to see also

Diversification Strategies: Spread investments across assets to minimize risk and maximize returns

When it comes to long-term investing in COL Financial, one of the fundamental principles to follow is diversification. This strategy involves spreading your investments across various assets to minimize risk and potentially maximize returns. Here's a detailed breakdown of how you can approach diversification:

Asset Allocation: Diversification starts with a well-thought-out asset allocation strategy. This means dividing your investment portfolio into different asset classes such as stocks, bonds, real estate, commodities, and cash equivalents. For long-term investors, a common approach is to allocate a portion of your portfolio to each asset class based on your risk tolerance and financial goals. For instance, you might allocate 60% to stocks for potential capital growth, 30% to bonds for stability, and 10% to real estate or commodities for diversification. This allocation ensures that your portfolio is not overly exposed to any single asset class, reducing the impact of market volatility.

Diversifying Within Asset Classes: Within each asset class, you can further diversify your investments. For stocks, consider investing in companies from various sectors and market capitalizations. You could choose between large-cap, mid-cap, and small-cap stocks, and also explore different industries like technology, healthcare, or consumer goods. This way, you're not just betting on one company or sector, but rather on the overall market's performance. Similarly, for bonds, you can invest in government bonds, corporate bonds, or mortgage-backed securities, each offering different levels of risk and return.

Geographical Diversification: Expanding your investments across different countries and regions is another crucial aspect of diversification. COL Financial likely offers a range of international investment options, allowing you to invest in foreign markets. This strategy reduces the impact of country-specific risks and takes advantage of global economic growth. You can invest in international stocks, bonds, or even exchange-traded funds (ETFs) that track specific regions or markets.

Sector-Specific Investing: Diversification also involves investing in different economic sectors. For example, if you're invested in stocks, consider sectors like energy, financials, healthcare, and consumer staples. Each sector has its own unique characteristics and performance patterns, so by holding a variety of sector-specific investments, you can reduce the risk associated with any single industry.

Regular Review and Rebalancing: Diversification is an ongoing process that requires regular review and adjustment. Market conditions change, and so should your investment strategy. Periodically assess your portfolio's performance and rebalance it to maintain your desired asset allocation. If certain asset classes have outperformed others, consider reallocating some funds to bring the portfolio back to its original target. This practice ensures that your investments remain aligned with your long-term goals and risk tolerance.

By implementing these diversification strategies, you can navigate the complexities of the financial markets with greater confidence. Remember, the goal is to minimize risk while also capturing the potential for long-term growth. COL Financial's platform likely provides the necessary tools and resources to facilitate these diversification techniques, allowing you to build a robust and well-rounded investment portfolio.

Maximize Returns: TurboTax Tips for Long-Term Investment Reporting

You may want to see also

Long-Term Investment Vehicles: Explore options like mutual funds, ETFs, and index funds for sustained growth

When considering long-term investments, it's essential to explore various financial instruments that can help you build wealth over time. One popular approach is to invest in mutual funds, which are a type of investment fund that pools money from many investors to purchase a diversified portfolio of assets. These assets can include stocks, bonds, or other securities, and the fund is managed by a professional money manager. Mutual funds offer a way to invest in a wide range of companies and industries, reducing risk through diversification. They are typically categorized into different types, such as growth funds, income funds, or balanced funds, each with its own investment strategy.

Another option for long-term investors is Exchange-Traded Funds (ETFs). ETFs are similar to mutual funds in that they hold a basket of securities, but they trade on stock exchanges like individual stocks. ETFs often track an index, such as the S&P 500, and provide investors with a simple and cost-effective way to gain exposure to a broad market or a specific sector. They offer flexibility and the ability to buy or sell throughout the trading day, making them attractive for those seeking active management and quick access to their investments.

Index funds are another excellent choice for long-term investors seeking sustained growth. These funds aim to replicate the performance of a specific market index, such as the Dow Jones Industrial Average (DJIA) or the NASDAQ-100. By investing in an index fund, you gain exposure to a diverse range of companies within that index, mirroring the market's overall performance. This strategy is often associated with lower fees and provides a passive investment approach, allowing investors to benefit from the long-term growth potential of the market.

Diversification is a key principle in long-term investing, and these investment vehicles excel in this aspect. By investing in mutual funds, ETFs, or index funds, you spread your capital across various assets, sectors, and industries, reducing the impact of individual stock volatility. This approach helps to smooth out returns over time and provides a more stable investment journey. Additionally, these long-term investment vehicles often offer lower expense ratios compared to actively managed funds, making them an attractive choice for cost-conscious investors.

In summary, when planning for the long term, mutual funds, ETFs, and index funds are powerful tools to consider. They provide access to diverse investment opportunities, offer low-cost options, and can help investors stay on track to achieve their financial goals. By understanding the characteristics of each and choosing the right fit for your investment strategy, you can build a solid foundation for long-term wealth creation. Remember, investing is a marathon, not a sprint, and these vehicles can help you stay the course towards financial success.

Maximizing Your Million: Strategies for Investing in Term Deposits

You may want to see also

Risk Management Techniques: Implement stop-loss orders, use hedging, and regularly review portfolio performance

When it comes to long-term investing in COL Financial, risk management is a critical aspect to ensure the preservation of your capital and the achievement of your financial goals. Here are some effective techniques to consider:

Implement Stop-Loss Orders: One of the most popular risk management tools is the stop-loss order. This strategy involves setting a specific price level at which you want to sell your investment if it drops to that point. For example, if you purchase shares of a particular stock, you might set a stop-loss order at a price slightly below your purchase price. If the stock price falls to that level, the order triggers a sell, limiting potential losses. This technique is particularly useful for long-term investors as it provides a safety net, allowing you to manage risk without actively monitoring the market constantly.

Use Hedging: Hedging is a more advanced risk management strategy that involves taking a position in an asset or security that moves in the opposite direction of your primary investment. For instance, you could buy put options on a stock you own, which would profit if the stock price falls. This approach can reduce the impact of potential losses and provide a form of insurance against market downturns. Hedging can be a powerful tool for long-term investors to protect their portfolios, especially during volatile periods.

Regularly Review Portfolio Performance: Active monitoring and regular reviews of your investment portfolio are essential for effective risk management. It allows you to identify potential issues and make necessary adjustments. Review your portfolio's performance at regular intervals, such as monthly or quarterly. Analyze the performance of individual securities, sectors, and the overall market. This process helps you stay informed about market trends, economic changes, and any unexpected events that might impact your investments. By regularly reviewing your portfolio, you can make timely decisions to rebalance your holdings and ensure they align with your long-term investment strategy.

Additionally, consider diversifying your investments across different asset classes, sectors, and regions to spread risk. Stay informed about the financial products and services offered by COL Financial, as they may provide additional risk management tools and resources to assist in your long-term investment journey. Remember, successful long-term investing requires a disciplined approach to risk management, and these techniques can help protect your capital and contribute to your financial success.

Unlocking Long-Term Wealth: Strategies for Profitable Investment Growth

You may want to see also

Tax Efficiency: Optimize tax strategies to reduce long-term capital gains and maximize after-tax returns

When investing in COL Financial, tax efficiency is a crucial aspect to consider for long-term success. Here are some strategies to optimize your tax position and maximize your after-tax returns:

Understand Tax Implications: Familiarize yourself with the tax laws and regulations related to long-term capital gains in your jurisdiction. In many countries, long-term capital gains are taxed at a lower rate than ordinary income. Research the specific rates and thresholds to understand how your investments will be taxed over time. For instance, in some markets, long-term capital gains may be exempt or taxed at a reduced rate if held for a certain period, typically more than one year.

Utilize Tax-Advantaged Accounts: Consider investing in tax-efficient accounts, such as retirement accounts or tax-free savings accounts, if they are available in your region. These accounts often provide tax benefits, allowing your investments to grow faster. For example, in certain countries, individual retirement accounts (IRAs) offer tax deductions for contributions, and the earnings can grow tax-deferred until withdrawal. Similarly, tax-free savings accounts may exempt qualified investments from taxation, providing a significant advantage for long-term wealth accumulation.

Long-Term Holding Strategy: Adopting a long-term investment approach can be advantageous from a tax perspective. Holding investments for an extended period allows you to take advantage of lower long-term capital gains tax rates. By minimizing short-term trading and focusing on long-term holdings, you can reduce the frequency of taxable events. This strategy also helps to avoid the potential negative impact of short-term market fluctuations on your tax liability.

Tax-Loss Harvesting: This strategy involves selling investments that have decreased in value to offset capital gains and use those losses to reduce taxable income. By strategically realizing losses, you can lower your tax bill and potentially free up capital for reinvestment. Tax-loss harvesting is particularly useful when you have a diverse investment portfolio, allowing you to balance gains and losses across different holdings.

Donation of Appreciated Assets: If you have investments that have appreciated significantly, consider donating them to charitable organizations. This strategy provides a tax benefit by allowing you to claim a deduction for the fair market value of the donated assets, which can be a substantial amount. Additionally, you avoid paying taxes on the capital gains, effectively maximizing your after-tax return.

By implementing these tax-efficient strategies, you can optimize your long-term investment approach in COL Financial, potentially reducing your tax liability and increasing your overall financial gains. It is essential to consult with a tax professional or financial advisor to ensure compliance with local regulations and to tailor these strategies to your specific investment goals and circumstances.

Understanding the Essentials of Long-Term Investment Strategies

You may want to see also

Frequently asked questions

A great starting point is to define your investment goals and risk tolerance. COL Financial offers a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider consulting a financial advisor to create a personalized plan. They can help you navigate the platform and choose assets aligned with your objectives.

Diversification is key to long-term success. You can achieve this by investing in various asset classes and sectors. COL Financial provides a platform to research and select individual stocks, bonds, and funds. Aim for a mix of growth and value stocks, consider sector-specific ETFs, and explore international markets to diversify your portfolio. Regularly review and rebalance your holdings to maintain your desired asset allocation.

Long-term investors often employ strategies like dollar-cost averaging and buy-and-hold. Dollar-cost averaging involves investing a fixed amount regularly, regardless of the asset price, which smooths out market volatility. The buy-and-hold strategy focuses on holding investments for extended periods, allowing compound interest to work in your favor. COL Financial's platform may offer tools to facilitate these strategies.

Tax considerations are essential for long-term investors. COL Financial may provide tax-efficient investment options, such as tax-advantaged retirement accounts or specific investment vehicles designed to minimize tax liabilities. It's advisable to consult a tax professional to understand the tax treatment of your investments and explore strategies to optimize your after-tax returns.

COL Financial likely offers a user-friendly interface and tools to track your investments' performance. You can log in to your account and access real-time data, charts, and performance metrics for your holdings. Regularly reviewing your portfolio's performance and staying informed about market trends will help you make informed decisions and adjust your strategy as needed.