Diversifying your investment portfolio is a way to manage risk by investing in a variety of asset classes and different investments within those classes. The central thesis of diversification is to never put all your eggs in one basket. A diversified portfolio minimises risks while investing for the long term, allowing for a certain amount of high-return investments by offsetting possible risks through more stable alternatives.

A diversified portfolio should have a broad mix of investments. For years, many financial advisors have recommended a 60/40 portfolio, allocating 60% of capital to stocks and 40% to fixed-income investments. However, others have argued for more stock exposure, especially for younger investors.

- Invest in different industries, interest plans, and tenures.

- Divide your money between stocks and bonds to minimise risk exposure.

- Invest in money market securities for cash.

- Consider adding index funds or fixed-income funds to the mix.

- Add real estate to your portfolio.

- Think global with your investments.

What You'll Learn

Diversify your investments across asset classes

Diversifying your investments across asset classes is a crucial step in creating a robust investment portfolio. Here are some detailed tips to help you diversify effectively:

Understand the Basics of Asset Allocation

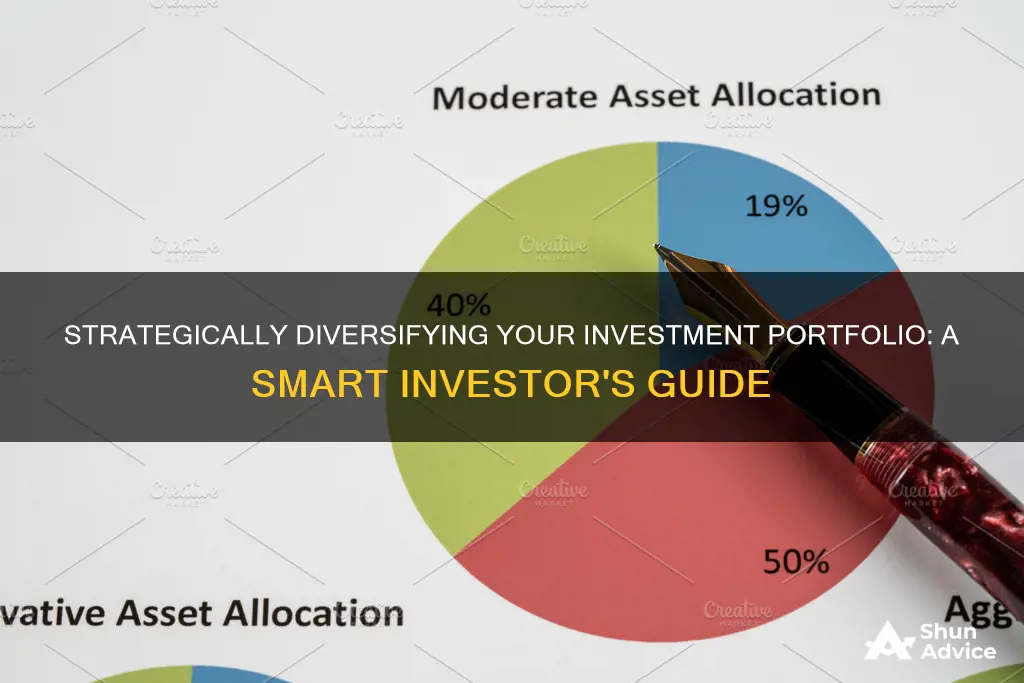

Asset allocation is the process of dividing your investments across different asset classes, such as stocks, bonds, and cash. The right mix of assets depends on your risk tolerance, investment goals, and time horizon. A well-diversified portfolio typically includes a mix of stocks, bonds, and cash, but you can also explore other asset classes like real estate, commodities, and alternative investments.

Diversify Across Multiple Asset Classes

To truly diversify your portfolio, spread your investments across multiple uncorrelated asset classes. This means investing in a variety of stocks, bonds, and other assets that are not closely tied to each other. By doing so, you reduce the impact of market fluctuations and increase the likelihood of achieving your long-term investment goals. Remember, the key is to find assets with low or negative correlations so that when one asset class moves down, the other can counteract it.

Consider Your Risk Tolerance

Your risk tolerance plays a significant role in determining your asset allocation. If you are a conservative investor who prioritizes capital preservation, you may allocate a larger portion of your portfolio to fixed-income investments and cash. On the other hand, if you are comfortable with higher risk and are seeking long-term growth, you may allocate more to stocks and other growth-oriented assets.

Adjust Your Asset Allocation Over Time

Your asset allocation should not remain static. As you age or your financial situation changes, adjust your allocation accordingly. A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio to allocate to stocks, with the remainder in bonds. For example, a 30-year-old may allocate 70% to stocks and 30% to bonds. However, you may also want to factor in your family finances and expenses when making these adjustments.

Diversify Within Asset Classes

Diversification doesn't stop at the asset class level. Within each asset class, aim for a diverse mix of investments. For example, when investing in stocks, consider companies of different sizes, from different industries, and across different geographies. This helps protect your portfolio from being overly exposed to risks specific to a particular sector or region.

By following these tips, you can effectively diversify your investments across asset classes, reducing risk, and improving the long-term performance of your investment portfolio.

Savings Investment: Choosing Wisely for Your Future

You may want to see also

Consider your age and risk appetite

When considering how to split your investment portfolio, your age and risk appetite are key factors. Your age will dictate how much risk you are willing to take on in your investments. Generally, the younger you are, the more risk you can tolerate, and the older you get, the less risk you can take on. This is because younger investors have more time to recover from losses, whereas older investors may have more money to invest but less time to recover from losses.

Your risk appetite is inversely proportional to your age. As you get older, your capacity to take risks decreases. This is because, at a young age, your earning capacity is higher, and you may have more opportunities to increase your income. However, when you are older, your savings may be your only source of income, and you may not be able to take on as much risk.

One common rule of thumb for determining your asset allocation is the "100 minus your age" rule. According to this rule, you should hold a percentage of stocks equal to 100 minus your age. For example, if you are 40 years old, you should hold 60% of your portfolio in stocks. However, with people living longer, some experts suggest changing this rule to 110 or 120 minus your age.

Another factor to consider is your innate risk tolerance. Your risk tolerance refers to how comfortable you are with market fluctuations and the possibility of losing money. Even if you are young, if the idea of market corrections strikes fear into your heart, you may want to aim for a more conservative allocation, such as a 50/50 split between stocks and bonds. This may not achieve the highest possible returns, but it will provide more stability.

Your financial goals and time horizon are also important considerations when determining your asset allocation. If you have short-term financial goals, such as buying a house in the next year, you may want to choose a more conservative allocation with less volatile investments, such as bonds and cash. On the other hand, if you have long-term financial goals, such as retirement, you can afford to be more aggressive with your asset allocation and invest more in riskier assets like stocks.

Tracking Savings and Investments: Quicken's Smart Money Management

You may want to see also

Understand the benefits of index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

Broad Diversification

Index funds provide broad diversification across various sectors and asset classes. They hold a diversified selection of securities in one easy, low-cost investment. Some index funds provide exposure to thousands of securities in a single fund, which helps lower your overall risk through broad diversification.

Low Fees

Index funds have much lower management fees than other funds because they are passively managed. Instead of having a manager actively trading, the index fund's portfolio just duplicates that of its designated index. They also have lower transaction costs as they hold investments until the index itself changes (which doesn't happen very often).

Tax Advantages

Index funds generate less taxable income than other funds. By trading in and out of securities less frequently, they generate less taxable income that must be passed along to their shareholders. They also have another tax advantage due to having hundreds or thousands of lots to choose from when selling a particular security, allowing them to sell the lots with the lowest capital gains and, therefore, the lowest tax bite.

Historical Performance

Over the long term, index funds have generally outperformed other types of mutual funds and actively managed funds, especially after accounting for fees and expenses.

Simplicity

Index funds are simple, no-fuss investments that allow you to gain exposure to a broad, diversified portfolio at a low cost. They are also straightforward to invest in, with many index funds having no minimum required to start investing.

Savings-Investment Spending Identity: Lessons for the Economy

You may want to see also

Allocate a portion of your portfolio to real estate

Allocating a portion of your portfolio to real estate is a great way to diversify your investments and protect yourself from adverse stock market conditions.

Real estate offers a hedge against inflation, recurring income in the form of rent, and tax benefits. It is also a tangible asset, which means it has practical value even if its financial value drops.

When deciding how much of your portfolio to allocate to real estate, it's important to consider your risk tolerance, time horizon, and investment goals. There is no one-size-fits-all answer, but some experts recommend allocating 5% to 10% of your portfolio to real estate, while others suggest putting up to 26% or more into this asset class.

If you're just starting out, consider investing in a real estate investment trust (REIT), which is one of the easiest and cheapest ways to get exposure to the real estate market. REITs allow you to invest in multiple properties, providing diversification and reducing risk.

As your portfolio grows and you become more comfortable with real estate investing, you may want to consider investing in single-family homes or commercial properties directly. This approach requires more capital and management, but it also gives you more control over your investments.

Remember that investing in real estate should be part of a well-diversified portfolio that includes stocks, bonds, and other alternative investments.

Betterment: Savings or Investment?

You may want to see also

Don't forget about cash

When considering how to split your investment portfolio, it's important not to overlook the role of cash. While it may not be the most exciting type of investment, cash is a smart position in your portfolio for several reasons.

Firstly, cash can help you minimise risk, especially as you get older. The older you are, the harder it is to recover from a stock market crash. Therefore, many experts advise increasing your cash holdings as you approach retirement to reduce your risk. For example, if you have most or all of your portfolio in stocks and the market crashes, you could lose everything. But if you hold some cash, you'll still have some assets even if the market takes a turn for the worse.

Secondly, cash can provide liquidity and allow you to take advantage of opportunities. If you have cash on hand, you can react quickly and buy stocks that you see as undervalued during market corrections. For instance, imagine being able to buy Amazon stock at a discounted price during a market downturn. That opportunity could result in strong returns over the next market cycle.

Thirdly, cash can help control volatility in your portfolio. While bonds may also balance risk, cash may be a better hedge in a rising interest rate environment. In this scenario, cash values remain stable while bonds are more likely to decline in value. This stability may give investors confidence during market upheaval and prevent them from selling assets at the wrong time.

Finally, cash can be helpful from a logistics perspective. For example, if you sell one asset to buy another but the gain from the sale is less than the cost of the new purchase, cash can make up the difference.

When deciding how much cash to include in your portfolio, consider factors such as your emergency savings buffer, your age, and where we are in the market cycle. Most investors allocate at least some of their portfolio to cash, with recommendations ranging from as little as 2% to more than 20%.

Understanding the Domestic Saving-Investment Imbalance

You may want to see also

Frequently asked questions

A good rule of thumb is to subtract your age from 100 and put the resulting percentage in stocks. For example, if you're 30, you should keep 70% in stocks and 30% in bonds.

A well-diversified portfolio invests in many different asset classes and has a relatively low allocation to any single security. If one security significantly underperforms, it won't have a meaningful impact on the overall return.

Here are some tips to help you diversify your portfolio:

- Think beyond stocks vs. bonds and consider other asset classes such as commodities, real estate, and cash.

- Use index funds to boost diversification at a low cost.

- Don't forget about cash, which can provide protection in the event of a market selloff.

- Consider target-date funds, which shift the portfolio's allocation toward safer assets as you get closer to your goal.

- Periodically rebalance your portfolio to maintain the appropriate weight for each investment.

- Think globally and consider funds focused on emerging markets or other regions.