Calculating investment gains in a portfolio is a crucial skill for investors to understand the performance of their investments and make informed decisions. It involves determining the net gain or loss by comparing the current and initial values of the portfolio while accounting for dividends, interest, and other factors. This process can be complex due to various factors such as cash flows, market volatility, and different types of assets. However, with a basic understanding of portfolio management and the use of financial tools, investors can make more informed decisions about their investment strategies.

| Characteristics | Values |

|---|---|

| Definition of investment gains | A gain is when the market value of an asset exceeds the purchase price of that asset |

| How to calculate gains | Net gain = current value – initial value |

| ROI = net gain / initial value | |

| ROI % = (net gain / initial value) x 100 | |

| How to calculate portfolio gains | Cost basis = share price x number of shares |

| Current stock value = number of shares x current stock price | |

| Gain/loss = current stock value – cost basis | |

| Gain/loss % = (current stock value – cost basis) / cost basis x 100 | |

| Time-weighted returns (TWR) | TWR = (1 + rate of return for each sub-period) – 1 |

| Money-weighted returns (MWR) | MWR = net enrichment, taking cash flows into account |

What You'll Learn

Calculating the percentage gain or loss

To calculate the net gain or loss, subtract the purchase price from the selling price. If you don't have the original purchase price, you can obtain it from your broker, as they provide trade confirmations for every transaction.

Now, take the gain or loss from the investment and divide it by the original cost of the investment or purchase price. Finally, multiply that result by 100 to get the percentage change.

Final Value - Initial Value) / Initial Value) x 100

For example, let's say you bought 100 shares of a company at $30 per share, so your initial investment was $3,000. You then sold those shares for $38 each, so the total sale proceeds were $3,800.

To calculate the percentage gain, you would use the formula:

[<$3,800 (sale proceeds) - $3,000 (original cost)] / $3,000 (original cost)] x 100 = 26.67% gain

It's important to note that this calculation can also be done using the per-share price:

[<$38 (selling price) - $30 (purchase price)] / $30 (purchase price)] x 100 = 26.67% gain

This calculation can be applied to various types of investments, such as stocks, bonds, or other assets in your portfolio.

Additionally, it's worth considering other factors that can impact your investment's performance, such as broker fees, commissions, taxes, and dividend payments. By incorporating these factors, you can obtain a more accurate representation of the percentage gain or loss on your investments.

Diversification: Saving and Investing's Best Friend

You may want to see also

ROI calculations for a single investment

To calculate the return on investment (ROI) for a single investment, you can use the following formula:

> ROI = Net Return on Investment / Cost of Investment x 100%

Alternatively, you can use this formula:

> ROI = (FVI - IVI) / Cost of Investment x 100%

Where:

- FVI = Final value of investment

- IVI = Initial value of investment

Here's an example to illustrate this calculation:

> Assume an investor bought 1,000 shares of Worldwide Wickets Co. at $10 per share. One year later, the investor sold the shares for $12.50. The investor earned dividends of $500 over the one-year holding period and spent $125 on trading commissions.

>

> The ROI for this investor can be calculated as follows: ROI = [($12.50 - $10) x 1,000 + $500 - $125] / ($10 x 1,000) x 100 = 28.75%

It's important to note that ROI calculations can vary depending on the specific cash flows and costs included in the analysis. Additionally, ROI does not take into account the holding period of an investment, which can be a limitation when comparing investment alternatives.

Diversification: Managing Risk in Your Investment Portfolio

You may want to see also

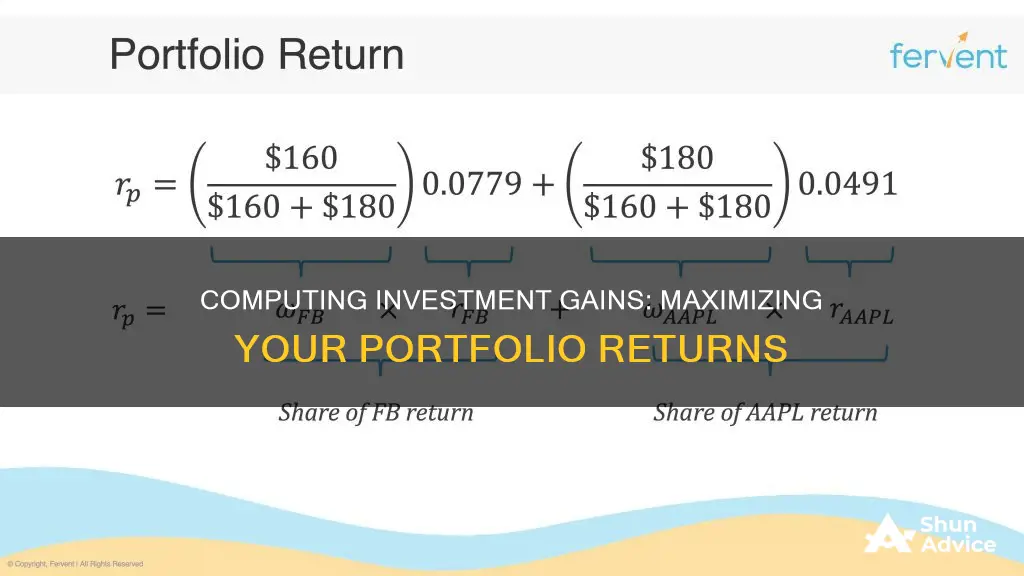

ROI calculations for an entire portfolio

To calculate the ROI for an entire portfolio, you will need to consider the returns and costs of each individual investment within the portfolio. This is because the ROI formula is based on the net return on investment divided by the cost of investment, multiplied by 100.

First, calculate the net return for each investment in your portfolio. To do this, subtract the initial value of the investment from its final value, and then add any dividends or other payouts received.

Next, divide this figure by the total cost of the investment, including any fees and commissions.

Finally, multiply this number by 100 to get the ROI as a percentage.

Repeat this process for each investment in your portfolio, and then sum all the ROIs to get the total portfolio return. This will give you a clear picture of how your portfolio is performing.

It is worth noting that this method does not take into account the time frame of the investment, which may be an important consideration when evaluating the success of your portfolio. In this case, you may want to calculate the annualized ROI, which takes into account the length of time the investment is held.

Invest Wisely to Secure Your Dream Home

You may want to see also

Time-weighted returns

TWR is calculated by breaking the overall time interval into smaller sub-periods or chapters at each point where there is an external flow of cash, securities, or other financial instruments into or out of the portfolio. These sub-periods are generally of unequal lengths. The rate of return for each sub-period is calculated by finding the difference between the ending balance and the beginning balance of that period and dividing it by the beginning balance. To get the TWR for the entire period, add 1 to each sub-period return, multiply them together, and then subtract 1 from the final result.

TWR is especially useful for comparing the performance of different portfolios or fund managers because it eliminates the distorting effects of external cash flows. It provides a more accurate representation of the effectiveness of investment strategies by isolating the returns generated by the investments themselves.

It is important to note that TWR calculations assume that all cash distributions, such as dividends, are reinvested in the portfolio. Additionally, daily portfolio valuations are necessary whenever there is an external cash flow, as this denotes the start of a new sub-period.

Suppose an investor has a mutual fund with an initial investment of $1,000 on January 1. By June 30 (the middle of the year), the investment has grown to $1,200, and the investor decides to deposit an additional $500, bringing the total to $1,700. However, by the end of the year, the portfolio value has decreased to $1,600.

To calculate the TWR for the entire year, we first find the rate of return for each sub-period:

For the first half of the year:

Rate of return = ($1,200 - $1,000) / $1,000 = 0.20 or 20%

For the second half of the year:

Starting point = $1,700 (ending balance of the first half + additional deposit)

Ending point = $1,600

Rate of return = ($1,600 - $1,700) / $1,700 = -0.059 or -5.9%

Next, we add 1 to each sub-period return:

1 + 0.20 = 1.20 for the first half

1 + (-0.059) = 0.94 for the second half

Then, we multiply these values together:

20 x 0.94 = 1.13

Finally, we subtract 1 from the result to get the TWR:

13 - 1 = 0.13 or approximately 13%

So, the time-weighted return for the entire year is approximately 13%.

Who Runs Berkshire's Investment Portfolio?

You may want to see also

Money-weighted returns

MWR is calculated by finding the rate of return that sets the present values of all cash flows equal to the value of the initial investment. In other words, it determines the rate of return needed to start with the initial investment amount, factoring in all changes to cash flows during the investment period, including the sale proceeds. The formula for MWR is complex and typically requires the use of a spreadsheet or calculator to estimate returns.

The main advantage of MWR is that it offers a personalised perspective on investment performance. It captures the financial journey of the investor, taking into account their decisions about when and how much to contribute or withdraw from a portfolio. This approach allows for a more nuanced understanding of real returns, especially when multiple contributions or withdrawals have been made.

However, MWR has some limitations. It is not well-suited for comparing the performance of different fund managers or investment strategies because it doesn't isolate the returns on investments from investor decisions about timing and amount. Additionally, the calculation can become complicated when multiple irregular cash flows are involved, and the method is highly sensitive to the timing of these cash flows.

MWR is particularly relevant for individual investors who want to understand the return on their investments based on their specific deposit and withdrawal timings. It provides a measure of portfolio returns that accounts for the size and timing of cash flows, giving a clear picture of how the portfolio is performing from the investor's perspective.

Savings and Investment Spending: Friends or Foes?

You may want to see also

Frequently asked questions

The formula for calculating the percentage gain or loss on an investment is:

Percentage Gain/Loss = ((Current Value – Original Value) / Original Value) x 100

To calculate the total gain/loss in your portfolio, you need to first calculate the cost basis (share price x number of shares) for each stock in your portfolio. Then, subtract the cost basis from the current stock value (number of shares x current stock price) to get your gains or losses.

TWR focuses on the portfolio's investment performance by removing the impact of external cash flows, providing a more accurate measure of the effectiveness of your investment strategy. MWR, on the other hand, accounts for the timing and size of an investor's contributions and withdrawals, reflecting their personal return.

To calculate the ROI for a single investment, subtract the initial cost of the investment from its current value, including any dividends or interest earned. Then, divide the net gain by the initial cost. To get the percentage, multiply by 100.

Yes, there are online investment calculators that can help you determine the return rate, accumulation schedule, and other parameters of your investment plan. These calculators use a fixed rate of return and allow you to input additional contributions to personalise the results.