The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected rate of return for an asset or investment. It determines whether an investment's returns are in balance with its risks. CAPM is widely used by investors to evaluate stocks and other potential investments. The model focuses on systematic risk, which is the general perils of investing, and its formula includes the risk-free rate, investment beta, and the market return. While it is a useful tool, CAPM has some limitations and assumptions that may not hold true in reality.

What You'll Learn

CAPM's formulaic approach

The Capital Asset Pricing Model (CAPM) is a formulaic approach that calculates whether the expected returns of an investment are desirable, given the risks involved in the investment. It is a financial model that establishes a linear relationship between the required return on an investment and risk.

The CAPM formula is:

Expected return = Interest rate on risk-free securities x [investment beta x (market return - interest rate on risk-free securities)]

The formula is represented symbolically as:

Ra = Rrf + [βa x (Rm – Rrf)]

Where:

- Ra = Expected return of investment

- Rf = Risk-free rate

- Beta = The transaction's underlying transaction

- (Rm-Rf) = Current Market Risk Premium

The CAPM formula includes the risk-free rate, investment beta and the market return. The risk-free rate, or Rf, is the interest rate an investor could earn from securities that carry little or no risk. The investment beta, or Beta, is a value that compares the systematic risk of a particular stock to the volatility of the overall market. The market risk premium, or (Rm-Rf), is the expected incremental return of the overall market above the risk-free rate.

The CAPM formula is a useful tool for understanding the relationship between risk and return in the stock market. It is widely used because it is simple and allows for easy comparisons of investment alternatives. However, it has some limitations, such as making unrealistic assumptions and relying on a linear interpretation of risk vs. return.

Understanding Total Cash and ST Investments: A Comprehensive Guide

You may want to see also

The role of beta in CAPM

Beta is a crucial component of the Capital Asset Pricing Model (CAPM). It is used to gauge the volatility or systematic risk of a security or portfolio compared to the overall market. Beta is denoted by the Greek letter 'β' and is calculated by assessing the correlation between the security and the market.

A stock's beta value indicates the extent to which it amplifies the returns of the overall market. Here is a breakdown of what different beta values represent:

- Beta = 1: The stock has the same level of risk as the market. If the market rises or falls by 1%, the stock price will move by 1%.

- Beta > 1: The stock has a higher level of risk and volatility compared to the market. The direction of price change will be the same, but the price movements will be more extreme. For instance, if the beta is 1.2, a 10% increase in the market will result in a 12% rise in stock prices.

- 0 < Beta < 1: The stock prices will move with the market but will be less risky and volatile. For example, if the beta is 0.5, a 1% change in the market will result in a 0.5% change in stock prices.

- Beta < 0: The stock's performance is counter-cyclical, offsetting the overall market experience.

Beta is an essential input in the CAPM formula, which calculates the expected return of an investment:

Expected return of investment = Risk-free rate + Beta of the investment x (Expected return of the market - Risk-free rate)

The CAPM formula uses the expected return on the market and a risk-free asset, along with the asset's beta, to determine the expected return of an investment. Beta reflects the correlation or sensitivity of the asset to the market.

In summary, beta plays a vital role in CAPM by quantifying the systematic risk of an investment and helping investors understand how their portfolio will respond to market movements. It provides insights into the volatility and risk associated with a particular stock or security, guiding investors in their decision-making process.

ETFs: Your Guide to Making a Cool Half Million

You may want to see also

Limitations of CAPM

The Capital Asset Pricing Model (CAPM) is a widely used model in finance that calculates the relationship between expected dividends and the risk of investing in specific equity. While it is a useful tool for investors, it does have some limitations and drawbacks that are important to consider. Here are some of the key limitations of CAPM:

Unrealistic Assumptions

CAPM is based on several assumptions that may not hold true in the real world. For instance, it assumes that investors are rational, risk-averse, and have access to the same information, which is often not the case in practice. It also assumes that investors can borrow and lend at the same risk-free rate as the government, which is unrealistic for individual investors.

Reliance on Historical Data

CAPM relies heavily on historical data to estimate expected returns and risks. However, past performance does not always predict future results accurately. This can lead to inaccurate estimates and affect the reliability of the model.

Ignores Unsystematic Risk

CAPM only accounts for systematic risk, which is inherent to the entire market. It fails to consider unsystematic risk, which is specific to individual companies or industries. This limitation may make CAPM less effective for investors with concentrated or illiquid portfolios.

Difficulty in Determining Beta

Calculating an accurate beta value, which reflects the security being invested in, can be challenging and time-consuming. In most cases, a proxy value for beta is used, which reduces the accuracy of the return calculations.

Volatile Risk-Free Rates

The risk-free rate used in CAPM calculations is typically generated by short-term government securities. However, this rate can fluctuate frequently, creating volatility and affecting the reliability of the model.

Inability to Account for Market Anomalies

CAPM assumes that all assets are priced efficiently and that there are no market anomalies. However, in reality, certain assets may be over or undervalued due to market inefficiencies, which the model fails to capture.

Limited Scope

CAPM only takes into account market risk and assumes that all investors have access to the same information. This limitation means that it may not fully capture other factors that can impact the value of an investment.

Difficulty in Creating a True Market Portfolio

CAPM defines a true market portfolio as including both financial and non-financial assets. However, since many assets are not investable, it is challenging to create a CAPM-defined market portfolio, making it difficult to test the model.

In conclusion, while CAPM is a valuable tool for investors, it is important to be aware of its limitations and potential drawbacks. Investors should use CAPM in conjunction with other tools and analyses to make well-informed investment decisions.

What Cash Flows Justify an Investment?

You may want to see also

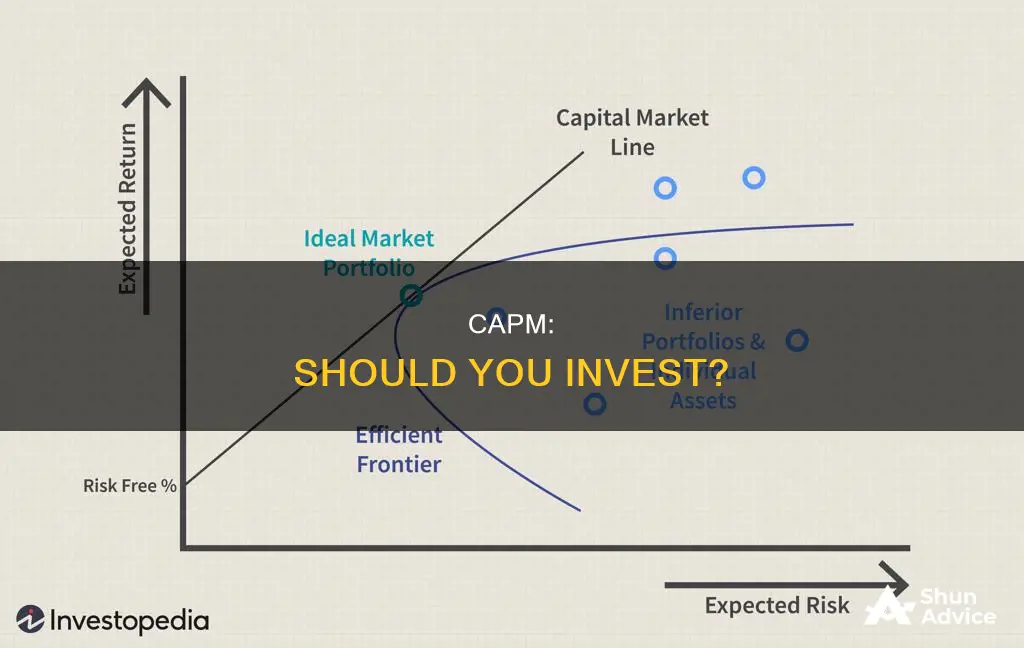

CAPM and modern portfolio theory

Modern portfolio theory (MPT) is attributed to Harry Markowitz, who postulated that a rational investor should evaluate potential portfolio allocations based on the means and variances of the expected return distributions. MPT assumes that capital markets are perfect, that returns from portfolios are normally distributed, and that investors are looking to maximise their returns.

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected rate of return for an asset or investment. It is used to determine a security's expected return considering its associated risk. CAPM is based on the relationship between an asset's beta, the risk-free rate, and the equity risk premium.

The formula for CAPM is:

> ERi = Rf + βi ( ERm – Rf)

Where:

- ERi = Expected return of investment

- Rf = Risk-free rate

- Βi = Beta of the investment

- (ERm – Rf) = Market risk premium

CAPM is often used in conjunction with MPT to understand portfolio risk and expected return. The efficient frontier, a concept developed by Markowitz as part of MPT, can be used to determine if a security is undervalued or overvalued in relation to the market.

While CAPM has its limitations and assumptions, it is still a widely used model that provides investors with a quantitative way to measure the expected return and risk of a given asset.

Emergency Cash: Best Places to Invest for Quick Access

You may want to see also

CAPM's assumptions

The Capital Asset Pricing Model (CAPM) is a financial model used to determine a security's expected return, considering its associated risk. Here are the key assumptions of the CAPM:

- Diversified portfolios: Investors are assumed to hold diversified portfolios, meaning they only require a return for the systematic risk of their portfolios. Unsystematic risk is diversified and can be ignored. This assumption reflects the reality that most investors have diversified portfolios, eliminating unsystematic risk.

- Single-period transaction horizon: CAPM assumes a standardised holding period to make returns on different securities comparable. A one-year holding period is typically used.

- Risk-free borrowing and lending: Investors can borrow and lend at the risk-free rate of return, which is often represented by the return on Treasury securities. This assumption provides a minimum level of return required by investors.

- Perfect capital market: This assumption suggests that all securities are correctly valued and their returns will plot onto the Security Market Line (SML). It implies that there are no taxes or transaction costs, perfect information is freely available to all investors, and all investors are risk-averse, rational, and aim to maximise their utility.

- Efficient markets: CAPM assumes efficient markets, where prices accurately reflect all available information. This leads to all investors having access to the same information and operating on a level playing field.

- Risk-averse investors: All investors are assumed to be risk-averse by nature and will make decisions to maximise their returns while minimising risk.

- No transaction costs: CAPM assumes no transaction costs, taxes, or inflationary pressures.

- Infinite divisibility of assets: Assets can be divided into unlimited pieces and sizes, allowing for easy buying and selling.

- Perfect competition: The model assumes perfect competition, where an individual investor cannot influence the price of an asset by their buying or selling decisions.

- Marketability of all assets: All assets, including human capital, are assumed to be marketable and can be traded freely.

- Standardised information: All investors have the same time period to evaluate information and make decisions.

- Linear relationship between risk and return: CAPM assumes a direct linear relationship between risk and return, which has been challenged as unrealistic.

While these assumptions allow CAPM to focus on the relationship between return and systematic risk, it is important to recognise that they may not accurately reflect the complexities of the real world.

EAS Investment Services: Are They Worth Your Money?

You may want to see also