Cash and short-term investments refer to the highly liquid assets of a company, which can be readily converted into known amounts of cash. This includes cash, cash equivalents, and investments with original maturities of three months or less. The total cash and short-term investments of a company are calculated by taking all these liquid assets and dividing them by the total shares outstanding. This figure is used to assess a company's liquidity or its ability to pay off its short-term obligations.

| Characteristics | Values |

|---|---|

| Definition | TOTAL CASH FROM INVESTING shows a firm's cash inflows and outflows related to the purchase and sale of investments. |

| Calculation | Net investment cash flow equals the total cash inflows less the cash outflows from the section and can be a positive or negative number. |

| Cash | Currency on hand as well as demand deposits with banks or financial institutions. |

| Cash Equivalents | Short-term, highly liquid investments that are both readily convertible to known amounts of cash and so close to their maturity that they present insignificant risk of changes in interest rates. |

| Short-Term Investments | Any investments in debt and equity securities with a maturity of one year or less. |

What You'll Learn

Cash and cash equivalents

Cash equivalents must be able to be liquidated to cash and so need to be highly liquid assets. They should also have a known market price and should not be subject to meaningful price fluctuations. Examples include:

- Certain marketable securities

- Treasury bills

- Other short-term government bonds

- Banker's acceptance

- Commercial paper

- Money market accounts

- Certificates of deposits

Cash App Investing: Legit or Scam?

You may want to see also

Short-term investments

- Certificates of Deposit (CDs): Offered by banks, CDs usually pay a higher interest rate because they lock up cash for a given period, ranging from several months to five years. They are FDIC-insured for up to $250,000.

- Money Market Accounts: These accounts offer higher returns than savings accounts but require a minimum investment. They are FDIC-insured and highly liquid, although there may be restrictions on withdrawals.

- High-Yield Savings Accounts: These accounts offer significantly higher annual percentage yields (APY) than checking accounts, while still providing liquidity and security. They are insured by the FDIC or NCUA for up to $250,000 per depositor.

- Government Bonds: These include Treasury bills, notes, floating-rate notes, and Treasury Inflation-Protected Securities (TIPS). They are considered very safe due to being backed by the full faith and credit of the government.

- Bond Funds: Offered by professional asset managers or investment companies, bond funds can offer better-than-average returns for a shorter time frame. Examples include corporate bonds, municipal bonds, and short-term corporate bond funds.

- Peer-to-peer (P2P) lending: This involves putting excess cash into lending platforms that match borrowers to lenders.

- Roth IRAs: Contributions to Roth IRAs can be withdrawn at any time without penalty or taxes due, offering flexibility and a variety of investment options.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

Cash flow and net investment

Cash flow is the movement of money into or out of a business. Positive cash flow indicates that a company has more money coming in than going out, while negative cash flow means the opposite. A company's cash flow can be improved by increasing income, reducing costs, or a combination of both.

Cash and cash equivalents are highly liquid assets that can be quickly and easily converted into cash. These include physical currency, demand deposits in bank accounts, treasury bills, and other money market instruments. Short-term investments are also included in this category, provided they mature within a year or less.

The cash asset ratio is a financial metric used to determine a company's liquidity, or its ability to meet its short-term obligations. It is calculated by dividing the sum of cash and cash equivalents by current liabilities. A ratio of 1 or above indicates that a company is in good financial health and can meet its short-term obligations, while a ratio below 1 may suggest financial distress.

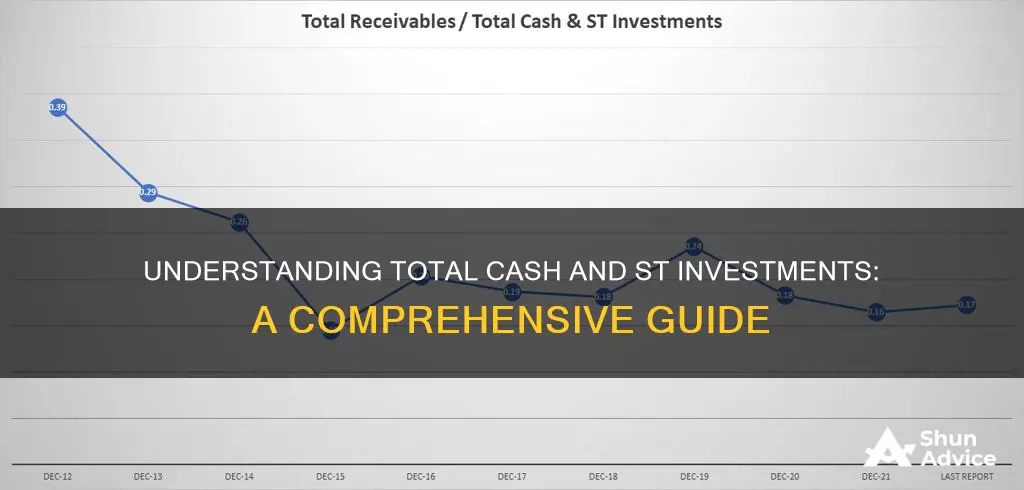

The cash-to-assets ratio, on the other hand, measures the proportion of a company's assets that are in cash and short-term investments. It is calculated by dividing the cash balance by the total assets. This ratio is particularly relevant for analysing investment trusts and funds. If a fund has a high proportion of its assets in cash, it may indicate that the fund manager is not investing all available funds, which could potentially impact returns.

Equity Investment's Impact on Cash Flow Statements

You may want to see also

Cash to assets ratio

The cash asset ratio, also known as the cash ratio, is a financial ratio that assesses a company's liquidity. It measures the proportion of a company's assets that are made up of cash and short-term investments. The formula for calculating the cash ratio is:

Cash Asset Ratio = (Cash + Cash Equivalents) / Current Liabilities

Here, cash includes legal tender (coins and currency) and demand deposits (checks, checking accounts, bank drafts, etc.). Cash equivalents are assets that can be quickly converted into cash, such as treasury bills, bank certificates of deposit, commercial paper, savings accounts, and money market instruments. These cash equivalents are highly liquid and have minimal risk.

Current liabilities refer to obligations due within one year, including short-term debt, accounts payable, accrued liabilities, dividends payable, notes payable, and current maturities of long-term debt.

The cash ratio is a stricter and more conservative measure compared to other liquidity ratios like the current ratio and quick ratio. It provides insight into a company's ability to pay off its short-term debt obligations using only its most liquid assets. A ratio of 1 and above indicates a company is in good financial standing and can meet its short-term obligations. A ratio below 1 may suggest financial distress, but it is not a definitive indicator as companies typically invest excess cash or funnel it back into the business.

While there is no one-size-fits-all ideal ratio, a value of at least 0.5 to 1 is generally preferred. Analysts and investors use the cash asset ratio to assess a company's liquidity and determine if it can cover its short-term obligations.

Smart Ways to Invest Your Cash Wisely

You may want to see also

Cash asset ratio

The cash asset ratio, also known as the cash ratio, is a financial ratio that assesses a company's liquidity by calculating its ability to pay off its short-term obligations with cash and cash equivalents. It is calculated by dividing the sum of cash and cash equivalents by current liabilities.

The formula for the cash asset ratio is:

Cash equivalents include all assets that can be quickly turned into cash, such as treasury bills, bank certificates of deposit, commercial paper, and other money market instruments. Current liabilities include accounts payable, short-term debt, dividends payable, notes payable, and current maturities of long-term debt.

The cash asset ratio is a conservative calculation as it only includes cash and cash equivalents, and no other assets, to determine a company's liquidity. A ratio of 1 and above indicates that a company is in good financial standing and is able to pay off its short-term obligations with its most liquid assets. A ratio below 1 may indicate financial distress, but this is not always the case, as some companies may choose to invest their cash in other ways or funnel it back into the business.

The cash asset ratio is similar to the current ratio, which includes all current assets in addition to cash and marketable securities. The cash asset ratio is, therefore, a stricter measure of liquidity and is often preferred by creditors as it provides a more conservative insight into a company's ability to pay off its debts.

While there is no ideal figure, a ratio of at least 0.5 to 1 is generally considered favourable. It is important to note that the cash asset ratio should not be the sole indicator of a company's financial health, as it is not always realistic for companies to hold large amounts of cash.

Cash Frenzy: Investing's Wild Ride Explained

You may want to see also

Frequently asked questions

Total cash and short-term (ST) investment refer to a company's cash and short-term investments, which are highly liquid and readily convertible to cash.

Total cash and ST investment is calculated by taking all the cash and short-term investments of the company and dividing that number by the total shares outstanding.

Short-term investments include items such as short-term loans, certificates of deposits, short-term paper, financial derivatives, and trading account securities.

Cash includes currency on hand and demand deposits with banks or financial institutions. Cash equivalents are highly liquid investments that are readily convertible to known amounts of cash and have a minimal risk of changes in value due to interest rate fluctuations.

A high proportion of assets in cash and ST investments may indicate that a company's manager is not investing all available funds, potentially impacting returns. However, it could also reflect the manager's opinion on the direction of the financial markets.