To figure out the total value of your investments, you need to understand the concept of total return, which gives you a full picture of how well your investments are performing by taking into account gains in price, as well as interest or dividend payments. Total return is generally expressed as a percentage, which helps you compare the performance of different assets. To calculate total return, you need to know the basis or cost basis of your investment, which is the original purchase price. You then need to factor in any income earned by the investment over time, such as dividend payments, interest income, or capital gains. This information can be used to calculate the total return of your investment, which can also be referred to as the total rate of return or return on investment (ROI). ROI is an important measure of an investment's performance and can be used to evaluate the success of different types of investments, including stocks, business ventures, and real estate transactions.

| Characteristics | Values |

|---|---|

| What is ROI used for? | ROI is a straightforward method of calculating the return on an investment. It can be used to measure profit or loss on a current investment or to evaluate the potential profit or loss of an investment that you are considering making. |

| How to calculate ROI | ROI = (Net Return on Investment) / (Cost of Investment) x 100% |

| How to calculate total return | Total return = [(Current Value – Cost Basis + Distributions) / Cost Basis] x 100 |

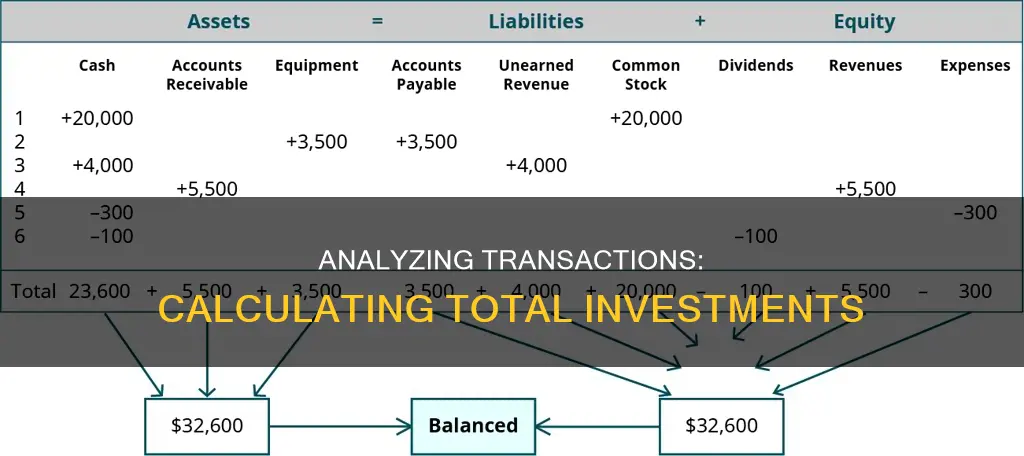

| How to calculate total investment | Total investment = Total contributions + Total interest earned |

| How to calculate rate of return | Rate of return = (Change in value + Income) / Investment amount |

| How to calculate annualized return | Annualized return = [(1 + return)^(1/years)] - 1 |

| How to calculate time-weighted return | TWR = (1 + sub-period return 1) x (1 + sub-period return 2) x ... x (1 + sub-period return n) - 1 |

| How to calculate money-weighted return | MWR = Internal rate of return for the portfolio |

What You'll Learn

Calculating the total return on investment (ROI)

Return on Investment (ROI) is a profitability metric used to evaluate the efficiency or profitability of an investment. ROI is usually presented as a percentage and can be calculated using a specific formula.

ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally, multiplying it by 100.

\[

\begin{aligned}

&\text{ROI} = \frac { \text{Final value of investment} - \text{Initial value of investment} }{ \text{Cost of Investment} } \times 100\% \\

\end{aligned}

\]

Assume an investor bought 1,000 shares of the hypothetical company Worldwide Wickets Co. at $10 per share. One year later, the investor sold the shares for $12.50. The investor earned dividends of $500 over the one-year holding period. The investor spent a total of $125 on trading commissions in order to buy and sell the shares.

The ROI for this investor can be calculated as follows:

\begin{aligned}

\text{ROI} &= \frac { ( \$12.50 - \$10 ) \times 1000 + \$500 - \$125 }{ \$10 \times 1000 } \times 100 \\

&= 28.75%

\end{aligned}

A positive ROI means that net returns are positive because total returns are greater than any associated costs. A negative ROI indicates that the total costs are greater than the returns.

It is important to note that ROI does not account for how long an investment is held, which can be a significant factor when comparing different investment options. To address this limitation, the annualized ROI calculation takes into account the length of time an investment is held.

\[

\begin{aligned}

&\text{Annualized ROI} = \big [ ( 1 + \text{ROI} ) ^ {1/n} - 1 \big ] \times100\% \\

&\textbf{where:}\\

&n = \text{Number of years investment is held}

\end{aligned}

\]

For example, assume an investment generated an ROI of 50% over five years. The simple annual average ROI of 10% is only an approximation because it does not consider the effects of compounding over time. Using the annualized ROI formula, the actual annualized ROI is calculated to be 8.45%.

While ROI is a useful metric, it has some drawbacks. It does not take into account the holding period, which can be important when comparing investments. Additionally, ROI does not adjust for risk, and it may not capture all relevant costs, especially in more complex investments.

Despite these limitations, ROI is widely used due to its simplicity and versatility. It is a quick and intuitive way to evaluate the potential returns on different investments.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Evaluating performance

Evaluating the performance of your investments is a critical part of managing and monitoring your assets over time. Here are some key considerations for evaluating your investment performance:

- Frequency of evaluation: Striking a balance between "set it and forget it" and constant monitoring is essential. A yearly evaluation of your investments, preferably at the same time each year, is generally sufficient. This allows you to stay engaged with your holdings while tracking the progress of your investment goals.

- Consolidated statements: If you have accounts with multiple financial services firms or a mix of tax-deferred and taxable accounts, you may need to review statements from different sources to get a comprehensive view of your portfolio's performance.

- Current value of investments: You can usually find the current value of each investment online or through regular account statements provided by your brokerage or financial services firm. Even if some individual investments have lost value, overall progress is indicated by a steadily increasing portfolio value.

- Performance measures: Here are some common ways to assess performance:

- Yield: Yield is typically expressed as a percentage and measures the income generated by an investment over a specific period (usually a year) relative to its price. For bonds, the yield is the interest rate or coupon rate. For stocks, yield is calculated by dividing the annual dividend by the market price (if there is no dividend, there is no yield). For conventional CDs, your financial institution will provide the interest rate and annual percentage yield (APY).

- Rate of Return: This measures the total money earned or lost on an investment. To find the total return, add any income earned from the investment (interest or dividends) to the change in value since purchasing the investment. To calculate the percent return, use the following formula:

> (Change in value + Income) / Investment amount = Percent return

For example, if you invested $2,000 in 100 shares of stock at $20 per share, and over three years, the price increased to $25 per share, and you received $120 in dividends, your total return would be $500 + $120 = $620, and your percent return would be 31%.

Annualized Percent Return: To accurately compare the performance of investments held for different periods, calculate the annualized percent return using this formula:

> AR = (1 + return)¹/years - 1

Using the previous example, the annualized return would be 9.42%.

- Transaction fees: Ensure that you include transaction fees in your calculations to achieve accurate results. When calculating returns after selling an investment, subtract any fees incurred during the buying and selling process.

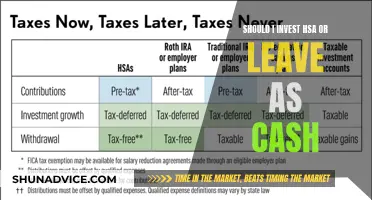

- Taxes: Consult a tax professional to help you calculate after-tax returns, taking into account capital gains and losses.

- Inflation: For long-term investments, inflation can significantly impact your returns. Use calculators to assess how inflation affects your savings and investments over time.

- Longitudinal comparison: Compare returns over several years to identify patterns and understand how your investments perform in different market environments.

- Rebalancing: Be prepared to adjust your portfolio as needed. This process is known as rebalancing in investment parlance.

In addition to the above considerations, there are several portfolio performance measures that incorporate both returns and risk to provide a more comprehensive evaluation:

Treynor Measure: This is defined as:

> Treynor Measure = (Portfolio Return - Risk-Free Rate) / Beta

The Treynor Measure assesses the portfolio's return per unit of risk, taking into account both the return and the volatility of the portfolio relative to the overall market (represented by beta).

Sharpe Ratio: The Sharpe Ratio is similar to the Treynor Measure but uses standard deviation as the risk measure instead of beta:

> Sharpe Ratio = (Portfolio Return - Risk-Free Rate) / Standard Deviation

The Sharpe Ratio evaluates the portfolio manager based on both the rate of return and diversification.

Jensen Ratio: The Jensen Ratio, also known as alpha, calculates the excess return generated by a portfolio over its expected return:

> Jensen Ratio = Portfolio Return - (Risk-Free Rate + Beta x (Market Return - Risk-Free Rate))

The Jensen Ratio measures the portfolio manager's ability to deliver above-average returns, adjusted for market risk.

By utilizing these evaluation techniques and performance measures, you can effectively assess the performance of your investments and make more informed decisions regarding your investment portfolio.

Smart Ways to Invest a Windfall of $150K Cash

You may want to see also

Annualized returns

The calculation of annualized returns is based on the following formula:

> Annualized Return = ((Ending value of investment / Beginning value of investment) ^ (1 / Number of years held)) - 1

For example, if an investment is worth $2,000 at the beginning of the year and $5,000 at the end of the year, the annualized return would be:

> Annualized Return = ((5000 / 2000) ^ (1 / 1)) - 1 = 0.28 or 28%

This calculation can also be adjusted to account for periods of less than a year by converting the holding period to a fraction of a year. For example, if an investment has a cumulative return of 23.74% over 575 days, the annualized rate of return would be:

> Annualized Return = (1 + 0.2374) ^ (365 / 575) - 1 = 0.145 or 14.5%

It is important to note that annualized returns do not account for potential price fluctuations, negative changes, or volatility of an investment. Therefore, it is often used in conjunction with other performance measures such as risk and return, yield, and rate of return to get a complete picture of an investment's performance.

Understanding Owner Cash Investments: Reporting and Strategies

You may want to see also

Holding period return

The holding period is the amount of time an investment is held by an investor, or the period between the purchase and sale of a security. The holding period determines tax implications. For example, in the US, if an investor sells a stock within a year of its acquisition, they would realise a short-term capital gain or capital loss. If they sell after a year, it would be a long-term capital gain or loss.

The HPR is calculated by dividing the total return by the initial value of the investment. The total return is the sum of the income and the change in value of the investment. The formula for calculating the HPR is:

> Holding Period Return (HPR) = [(Ending Value – Beginning Value) + Income] ÷ Beginning Value

The HPR can also be calculated using the following formula if the investment consists of stocks:

> Holding Period Return (HPR) = Capital Gains Yield (CGY) + Dividend Yield (DY)

The HPR can be annualised to determine the rate of return per year. The formula for calculating the annualised HPR is:

> Annualised HPR = (1 + Holding Period Return) ^ (1 ÷ t) – 1

Where t is the number of years of the holding period.

For example, suppose you purchased one share in a public company for $50 and held onto the investment for two years. During the two-year holding period, the share price rose to $60, reflecting a capital appreciation of $10 (a 20% increase). You also received $2 in total dividend income since the date of purchase. The HPR for this investment would be:

> Holding Period Return (HPR) = $12 / $50 = 24%

The annualised HPR would be:

> Annualised HPR = (1 + 24%) ^ (1 ÷ 2) – 1 = 11.4%

The HPR is an important metric in investment management as it provides a comprehensive view of the financial performance of an asset or investment. It can be used to compare the performance of different investments or assets and to identify the appropriate tax rate.

Warren Buffett's Cash Investment Strategies Revealed

You may want to see also

Adjusting for cash flows

When figuring out total investments, it is important to understand the concept of cash flow analysis. This analysis is an important aspect of a company's financial management because it reveals the cash it has available to pay bills and invest in its business. It is also important to note that there are two methods of calculating cash flow: the direct method and the indirect method.

The direct method involves listing all cash receipts and payments during the reporting period. This method is simpler and more straightforward but is rarely used as it does not provide as much detail.

The indirect method is more commonly used and starts with net income, making adjustments for changes in non-cash transactions. This method provides a more comprehensive view of the company's cash flow by taking into account factors such as depreciation, amortization, and changes in working capital.

Now, let's discuss the three main sections of a cash flow statement and how they relate to adjusting for cash flows:

Operating Cash Flow:

This section reports the cash flow generated from a company's core business operations, including sales, purchases, and other expenses. It includes accounts receivable, accounts payable, and income taxes payable. Changes in current assets or current liabilities are also recorded as cash flow from operations.

Investing Cash Flow:

This section focuses on the cash flow related to the purchase and sale of long-term assets, such as property, plant, and equipment. It includes cash inflows from the sale of assets and cash outflows from acquisitions or investments in securities.

Financing Cash Flow:

This section reflects the cash flow from debt and equity transactions, including the issuance or repayment of loans, dividends, and the repurchase or sale of stocks and bonds. It is important for investors, especially those who prefer dividend-paying companies, as it shows cash dividends paid.

By analyzing these three sections of the cash flow statement, investors can gain insights into the company's financial health and stability. It is important to note that cash flow analysis should be done regularly, such as annually, to track the progress of investment goals and make necessary adjustments. Additionally, factors such as transaction fees, taxes, and inflation should be considered when evaluating investment performance.

In summary, adjusting for cash flows involves analyzing the three main sections of a cash flow statement: operating, investing, and financing activities. This analysis provides a clear picture of a company's financial health and stability, helping investors make informed decisions. Regular evaluation of cash flow statements is essential for effective financial management and investment planning.

CAPM: Should You Invest?

You may want to see also

Frequently asked questions

You can calculate the total return on your investments by using the following formula: Total return = [(Current Value – Cost Basis + Distributions) / Cost Basis] x 100. The cost basis is the original purchase price of an investment.

ROI, or return on investment, is a ratio that measures the profitability of an investment by comparing the gain or loss to its cost. You can calculate it by using the following formula: ROI = (Net Return on Investment / Cost of Investment) x 100%.

To calculate the total return on your portfolio, you need to list each type of asset in a spreadsheet along with its calculated ROI, dividends, cash flows, management fees, and any other figures relevant to the cost or returns of those assets. Then, multiply the ROI of each asset by its portfolio weight and sum these together to get the total portfolio return.