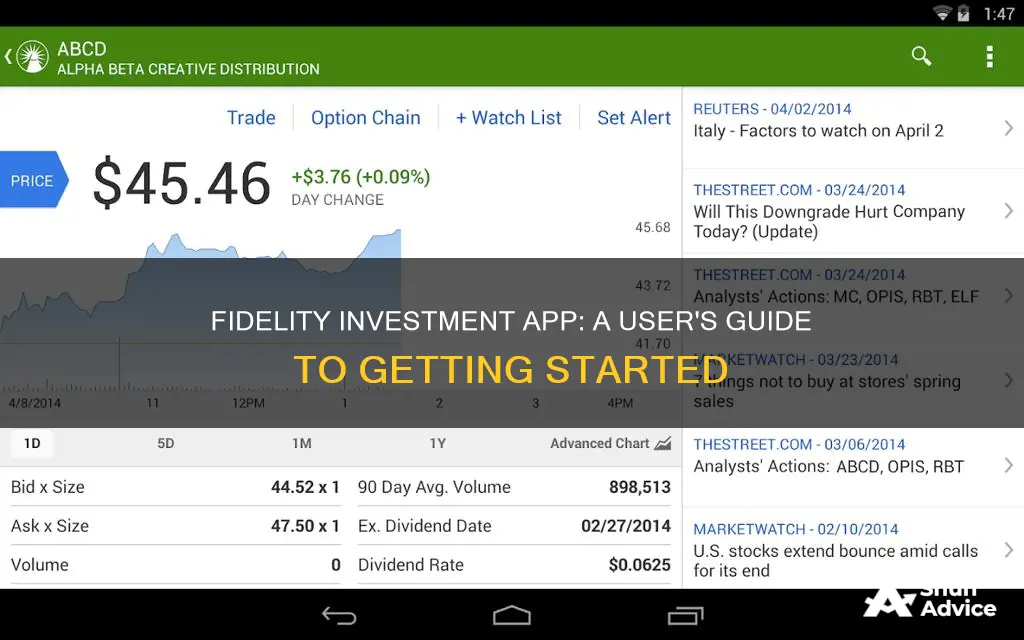

The Fidelity Investments app is an award-winning mobile application that allows users to manage their money, investments, and benefits anywhere and at any time. The app provides access to a wide range of investment options, expert insights, and tools to help users make informed financial decisions. It offers features such as commission-free trading of US stocks, ETFs, and fractional shares, cash management, advanced trading tools, alerts and notifications, and a customizable dashboard. The app is designed with security in mind, employing two-factor authentication, voice biometrics, security text alerts, and money transfer lockdowns to protect user information. Overall, the Fidelity Investments app provides a comprehensive suite of tools and resources to help users effectively manage their finances on the go.

| Characteristics | Values |

|---|---|

| Security | 2-factor authentication, voice biometrics, security text alerts, money transfer lockdowns |

| Account fees | No account fees or minimums for brokerage accounts |

| Trading fees | Commission-free trades for US stocks, ETFs, and fractional shares for as little as $1 |

| Trade tools | Advanced charts, on-the-go technical analysis, real-time quotes |

| Cash management | Schedule transfers and automate investments |

| Financial learning | Podcasts, articles, videos, small classes, coaching sessions, webinars |

| Alerts and notifications | Timely, customizable alerts, price triggers |

| Customer support | 24/7, 2-factor authentication, voice biometrics, virtual assistant |

| Accessibility | Enhanced voiceover, dynamic type |

| Navigation | Standard (one-click access to positions and net worth) and Classic (fast access to market information and Watch Lists) |

| Trading | Single or multi-screen trade experience, recurring investments, enhanced options trading, crypto trading |

| Customization | Show/hide account number, balances, balance chart, markets on Home; single-screen or tabbed layouts for viewing accounts; create and manage multiple Watch Lists |

What You'll Learn

Navigating the app

Navigating the Fidelity app is simple and user-friendly. The app offers a customizable dashboard, allowing you to show or hide features such as your account number, balances, balance chart, and markets on the home screen. You can also choose between standard and classic navigation. Standard navigation offers one-click access to your positions and net worth, while classic navigation provides fast access to market information and your Watch Lists.

The app provides easy access to powerful trading tools. You can trade stocks, ETFs, mutual funds, and crypto, using advanced charts and real-time quotes. The app also supports single or multi-screen trade experiences and recurring investments. Additionally, you can create and manage multiple Watch Lists to track specific stocks or investments.

To find your net worth, tap on "Planning" in the navigation bar. If you don't see the "Planning" option, ensure you are using Standard navigation. Your net worth will be displayed at the top of the screen.

The app also includes a "Discover" feature, where you can explore and research various investments and stocks. You can access in-depth research on different investment opportunities and make informed decisions.

Fidelity's app also offers a Virtual Assistant, accessible through the profile icon in the upper right corner of the home screen. This feature provides 24/7 customer support and can help you navigate the app and answer any queries.

Understanding Cash Flow: Investing Activities Analysis

You may want to see also

Trading tools

The Fidelity Investment app provides a range of trading tools to help you make smarter and more informed trading decisions. Here are some of the key features:

Active Trader Pro Platforms

This platform offers powerful and intuitive tools for web and desktop, enabling you to find opportunities and trade quickly. It provides real-time, streaming market updates, direct and intelligent order routing, portfolio management tools, customisation options, advanced order types, and trailing stop orders.

Advanced Account Features

The app offers equity, index, and ETF options for all expirations, including weeklies. It also supports streaming pricing, multi-leg strategies, and full Greeks (mathematical calculations used to determine the effect of various factors on options). Additionally, it facilitates spread trading for IRAs and international stock trading with the ability to exchange between 16 currencies.

Margin Trading

Adding margin to your brokerage account increases your buying power by allowing you to buy more shares of a security than you could with a cash-only basis. This feature is accessible through the Active Trader Pro platform and comes with tools to help monitor and manage your margin balances.

Industry-Leading Research and Analysis

Fidelity provides research tools ranked #1 by Investor's Business Daily. These tools enable you to look under the hood of your next opportunity, offering insights and analytics to make informed decisions.

Options Trading

The app provides tools to help identify options opportunities, create and execute strategies, and manage risk. This includes an options profit/loss calculator, options strategy evaluator, options strategy ideas, options probability calculator, and an options summary page.

Trading Dashboard

The Trading Dashboard allows you to tackle all your trading needs in a single screen. You can get real-time market data, research ideas, and execute trades from one convenient place, and it works on any browser.

Investing Activities: Sources of Cash Revealed

You may want to see also

Cash management

The Fidelity Cash Management Account is a brokerage account designed for spending and cash management. It is not a bank account. There are no account fees or minimums to open an account.

The account offers competitive rates as well as spending and money movement features, including a free debit card, check writing, Bill Pay, and more. You can use the Fidelity mobile app to access free mobile check deposit and Bill Pay.

With the Fidelity Cash Management Account, you can choose where you hold your uninvested cash: the Fidelity Government Money Market (SPAXX) or the FDIC-Insured Deposit Sweep Program. The former is a taxable money market mutual fund investing in U.S. Government Agency and Treasury debt, and related repurchase agreements. The latter sweeps your uninvested cash into an FDIC-insured interest-bearing account at one or more program banks, and, under certain circumstances, a money market mutual fund (the "Money Market Overflow").

The Cash Manager is an optional feature that gives you flexibility in managing your finances. You can set a maximum and minimum target balance, a minimum transfer amount, and a hierarchy of funding accounts to supply available cash to your Fidelity Cash Management Account. When your balance hits the maximum target balance, Cash Manager alerts you so you can move the money and, if you choose, invest it. If your balance drops below the minimum target balance, Cash Manager moves available cash automatically from your designated funding accounts in the order you specify.

You can also use Cash Manager's self-funded overdraft protection, which moves available cash from your designated funding accounts (up to $99,999.99 per day per funding account) to prevent a negative account balance.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Financial learning

The Fidelity app provides a range of financial learning opportunities to help you make smart decisions with your money. The app includes podcasts, articles, videos, webinars, classes, and coaching sessions to build your confidence in investing. Here's a more detailed breakdown:

Podcasts, Articles, and Videos

The app offers a variety of engaging content to enhance your financial knowledge. You can access informative podcasts, insightful articles, and educational videos covering various investing topics. This diverse range of media allows you to learn about investing in a format that suits your preferences and learning style.

Webinars

For a more interactive learning experience, Fidelity provides webinars that cater to different needs. Whether you prefer small classes or large multi-session webinars, they have options to help you elevate your investing knowledge. These webinars are a great opportunity to learn from experts and ask questions in a structured setting.

Coaching Sessions

Fidelity also offers coaching sessions as part of their financial learning offerings. These sessions provide personalized guidance and support to help you take your investing knowledge to the next level. With the app's coaching feature, you can receive tailored advice and gain a deeper understanding of investing strategies.

Alerts and Notifications

The app includes timely and customizable alerts to help you stay on top of your investments. You can set price triggers to ensure you never miss an important moment for entering or exiting the market. These alerts empower you to make informed decisions and respond promptly to market changes.

24/7 Customer Support

Fidelity provides around-the-clock customer support through their state-of-the-art security features, such as 2-factor authentication and voice biometrics. You can also access their Virtual Assistant at any time to get answers to your queries. This feature ensures that you have constant support and peace of mind as you navigate your financial journey.

Understanding Cash Flows: What's Not an Investment?

You may want to see also

Alerts and notifications

Price Alerts:

Price alerts allow you to monitor price-related market movements and can be set for stocks, ETFs, options, and mutual funds. You can choose to be notified when a security falls below or rises above a target price, when it increases or decreases by a certain percentage, or when it reaches its 52-week high or low. These alerts can be customized and sent to your phone or email as push notifications, text messages, or emails.

Account Alerts:

Account alerts notify you when important account activity occurs, such as money movement, posted transactions, payments due, or changes to your profile and password. You can customize these alerts and choose your preferred method of notification, such as email or text message.

Security Alerts:

Security alerts are designed to provide an additional layer of security for your account. You will receive notifications via text or email when changes are made to your personal information, account details, or login credentials. For example, if someone requests login assistance or changes your ID or password, you will be notified. Additionally, you will be alerted when new cards are activated.

Fraud Alerts:

Fidelity offers fraud alerts to help protect your account from suspicious activity. You can enable two-way text message alerts to receive notifications and communicate directly with fraud experts if any issues arise. These alerts can help identify potential fraud and allow you to take immediate action, such as blocking your card from further use until the issue is resolved.

Education Alerts:

Education alerts provide you with informative content designed for active traders. These alerts will be sent automatically and can be accessed through the Education tab in the Message Center. They include Active Trader Training opportunities, Product Information, Directed Trade information, and other alerts to enhance your trading knowledge.

By utilizing these alert and notification features on the Fidelity Investment App, you can stay informed about market movements, account activity, and potential security risks, enabling you to make timely decisions and ensure the security of your investments.

Net Invested Cash: Understanding the Basics of Finance

You may want to see also

Frequently asked questions

To get started with the Fidelity app, you need to create an account, add funds, and make your first investment.

Fidelity is committed to your security with 2-factor authentication, voice biometrics, security text alerts, and money transfer lockdowns.

The Fidelity app gives you mobile access to a broad range of investments, expert insights, and tools to help you make smart investing, saving, and financial planning decisions. You can trade US stocks, ETFs, and mutual funds; deposit checks, pay bills, and transfer money; create savings goals and track your spending; and more.

From the Home screen, tap on the three dots in the upper right corner to access the menu. From there, you can customize your features by showing or hiding your account number, balances, balance chart, and markets. You can also customize your account view by selecting either a single-screen or tabbed layout.