Understanding how to identify long-term investments on a company's balance sheet is crucial for investors and analysts alike. Long-term investments are a significant component of a company's financial health, representing assets that are expected to provide returns over an extended period. These investments can include various financial instruments such as stocks, bonds, and other securities. By carefully examining the balance sheet, investors can gain insights into a company's strategic financial decisions, risk exposure, and potential growth prospects. This guide will explore the key indicators and methods to help you navigate the balance sheet and uncover valuable long-term investments.

What You'll Learn

- Analyze Financial Ratios: Examine key ratios like return on assets and equity to gauge investment quality

- Study Debt-to-Equity Ratio: A high ratio may indicate financial risk and potential instability

- Evaluate Cash Flow: Assess the company's ability to generate cash, a vital sign of long-term viability

- Review Asset Turnover: Low turnover may suggest underutilized assets or poor management

- Scrutinize Intangible Assets: These can include patents, trademarks, and goodwill, impacting long-term value

Analyze Financial Ratios: Examine key ratios like return on assets and equity to gauge investment quality

When assessing the long-term investment potential of a company, financial ratios are invaluable tools that provide insights into its financial health and performance. One of the most important aspects to consider is the analysis of key financial ratios, particularly those related to return on assets and equity. These ratios offer a comprehensive view of a company's ability to generate returns and manage its assets effectively over time.

Return on Assets (ROA) is a critical ratio that measures a company's efficiency in utilizing its assets to generate profits. It is calculated by dividing net income by total assets. A higher ROA indicates that the company is proficient at converting its assets into profits, which is a positive sign for long-term investors. Investors should compare the ROA of different companies within the same industry to identify the most efficient performers. For instance, a technology company with a high ROA suggests that it effectively utilizes its assets, such as intellectual property and equipment, to generate revenue.

Equally important is the analysis of Return on Equity (ROE), which assesses a company's profitability in relation to shareholders' equity. ROE is calculated by dividing net income by shareholders' equity. This ratio is particularly useful for understanding how well a company utilizes the capital provided by shareholders. A consistently high ROE over several years indicates that the company is effectively reinvesting its profits and managing its equity, which is a strong indicator of long-term sustainability. Investors can use ROE to compare companies and identify those that consistently generate substantial returns on the capital they have raised.

In addition to ROA and ROE, other financial ratios like the Debt-to-Equity Ratio and the Current Ratio can provide further context. The Debt-to-Equity Ratio helps assess a company's financial leverage, indicating the proportion of debt to equity financing. A low debt-to-equity ratio suggests a more financially stable company, especially during economic downturns. Meanwhile, the Current Ratio, which is the ratio of current assets to current liabilities, provides insight into a company's liquidity and ability to meet short-term obligations.

By carefully examining these financial ratios, investors can make informed decisions about long-term investments. It allows them to identify companies with strong asset utilization, efficient equity management, and a healthy financial structure. These insights are crucial for building a robust investment portfolio and ensuring that the investments made today will contribute to the company's success in the future.

Unlock Short-Term Gains: A Beginner's Guide to Treasury Bills

You may want to see also

Study Debt-to-Equity Ratio: A high ratio may indicate financial risk and potential instability

The debt-to-equity ratio is a crucial financial metric that provides insight into a company's financial health and stability. This ratio compares a company's total debt to its shareholders' equity, offering a clear picture of the company's financial leverage. A high debt-to-equity ratio can be a red flag, indicating that a company may be taking on excessive financial risk.

When analyzing this ratio, investors and analysts look for a balance between debt and equity. A company with a high debt-to-equity ratio might be heavily reliant on borrowing to finance its operations, which can lead to several potential issues. Firstly, it may suggest that the company is not generating sufficient profits to cover its debt obligations, making it more vulnerable to economic downturns or market fluctuations. This could result in a higher risk of default on loans or bond payments. Secondly, a high ratio might indicate that the company is using debt to finance growth, which, if not managed properly, can lead to a situation where the company becomes overly leveraged and struggles to meet its financial commitments.

To study this ratio effectively, one should compare it over time to identify any trends or significant changes. A consistent increase in the debt-to-equity ratio could be a cause for concern, suggesting that the company's financial position is deteriorating. It is also essential to consider the industry norms and compare the company's ratio with its competitors to gauge its relative financial health. For instance, a high ratio in an industry known for its high-risk, capital-intensive nature might be more acceptable than in a sector with lower operational costs.

Investors and analysts often use this ratio as a tool to assess a company's ability to manage its finances and its long-term sustainability. A low debt-to-equity ratio is generally preferred, as it indicates a more financially stable company with a stronger foundation to weather economic challenges. However, it's important to remember that this ratio should be interpreted in the context of the company's overall financial health, industry position, and growth strategies.

In summary, the debt-to-equity ratio is a critical indicator of a company's financial risk and stability. A high ratio may signal potential financial distress, and investors should carefully analyze this metric along with other financial ratios and industry benchmarks to make informed investment decisions. Understanding this ratio can help in identifying companies that are well-managed and have a lower risk profile, which is essential for long-term investment success.

Understanding the Difference: Current vs. Short-Term Investments

You may want to see also

Evaluate Cash Flow: Assess the company's ability to generate cash, a vital sign of long-term viability

When evaluating a company's long-term viability, assessing its cash flow is crucial. Cash flow is the lifeblood of any business, ensuring it can meet its short-term obligations and fund its operations and growth. Here's a detailed guide on how to evaluate cash flow and understand a company's financial health:

Understand Cash Flow Statements:

Start by examining the company's cash flow statements, which are typically divided into three main sections: operating activities, investing activities, and financing activities. Each section provides insights into different aspects of the company's cash movements.

- Operating Activities: This section reveals the cash generated or used in the company's core business operations. Positive cash flow from operations indicates the company's ability to generate revenue and manage expenses effectively. Look for consistency and trends over multiple periods to identify any potential issues.

- Investing Activities: Here, you'll find information about cash flows related to the purchase and sale of long-term assets, investments, and other non-current assets. Significant outflows or inflows in this section could indicate major investments or divestitures. Analyze these movements to understand the company's strategic decisions and their impact on long-term investments.

- Financing Activities: This part of the statement reflects cash flows from borrowing, repaying debt, issuing stock, and other financing activities. It provides insights into the company's capital structure and access to capital markets. Consistent borrowing or large dividend payments might suggest a need for external funding, which could impact long-term financial stability.

Calculate Key Cash Flow Ratios:

Financial ratios provide a standardized way to compare a company's cash flow performance over time and across industries. Here are some essential ratios to calculate:

- Cash Flow from Operations to Total Debt: Divide the cash flow from operations by the total debt to assess the company's ability to service its debt. A ratio greater than 1 indicates that the company's cash flow covers its debt obligations.

- Free Cash Flow: This measures the cash flow available after accounting for capital expenditures and debt payments. It represents the cash the company can use for investments, dividends, or strategic initiatives. A positive and increasing free cash flow is a strong indicator of long-term viability.

- Operating Cash Flow Margin: Calculate this by dividing cash flow from operations by revenue. It shows the percentage of revenue that translates into cash. A higher margin suggests efficient revenue generation and better cash flow management.

Analyze Trends and Variability:

- Consistency: Look for consistent cash flow patterns over multiple years. Fluctuations in cash flow might indicate seasonal business cycles or one-time events, but sustained positive trends are more reassuring.

- Variability: Assess how much cash flow varies from period to period. High volatility could signal risks, such as reliance on specific customers or markets, or it might be a result of effective management strategies.

- Comparative Analysis: Compare the company's cash flow performance with industry peers and historical data. This helps identify potential issues or advantages unique to the company.

Consider Qualitative Factors:

While financial ratios are essential, don't overlook qualitative aspects:

- Management's Perspective: Understand the company's strategic goals and how they align with its cash flow. Does the company have a clear plan for utilizing its cash flow?

- Industry Dynamics: Research industry trends and competitors' strategies. A company's ability to adapt and generate cash in a changing market is vital for long-term success.

- Risk Assessment: Evaluate the company's exposure to various risks, such as market risk, financial risk, and operational risk. These factors can significantly impact cash flow and long-term investments.

By thoroughly evaluating cash flow and considering these factors, investors and analysts can gain valuable insights into a company's financial health and its ability to sustain long-term investments. This process empowers decision-makers to make informed choices regarding investments, partnerships, or other financial strategies.

Unlocking Long-Term Wealth: Strategies for Smart Investment Choices

You may want to see also

Review Asset Turnover: Low turnover may suggest underutilized assets or poor management

Asset turnover is a crucial financial metric that provides insights into a company's efficiency in utilizing its assets to generate revenue. It is calculated by dividing total sales or revenue by the average total assets. A low asset turnover ratio can be an indicator of potential issues within a company's operations and financial health. When reviewing a company's balance sheet, a low asset turnover may suggest that the company is not making the most of its assets, which could have several implications.

One possible explanation for low asset turnover is underutilized assets. This could mean that the company has a large number of assets on its books but is not effectively deploying them to generate sales or revenue. For example, a manufacturing company with a low asset turnover might have excess inventory, outdated machinery, or underutilized production facilities. These underutilized assets could result in higher holding costs, reduced efficiency, and potentially missed opportunities to increase productivity and output.

Another interpretation of low asset turnover is poor management. Inefficient management practices can lead to suboptimal use of assets, resulting in lower sales or revenue relative to the assets available. This could include issues such as outdated inventory management systems, inefficient production processes, or a lack of strategic planning. Poor management might also indicate a failure to adapt to market changes, leading to a decline in sales and, consequently, a low asset turnover ratio.

To further investigate the reasons behind low asset turnover, it is essential to analyze the company's industry and market position. Some industries naturally have lower asset turnover due to their nature, such as utilities or real estate. However, if a company's asset turnover is significantly lower than its industry peers, it may suggest that the company is not operating efficiently or is facing unique challenges.

In summary, when reviewing a company's balance sheet, a low asset turnover ratio should be carefully examined. It could indicate underutilized assets, suggesting the need for a strategic review and potential investment in new assets or processes. Alternatively, it may point to poor management practices that need to be addressed to improve the company's overall performance and financial health. Understanding the underlying causes of low asset turnover is crucial for making informed investment decisions and ensuring the efficient utilization of resources.

Unveiling the Potential: Is Short-Term Investment an Asset?

You may want to see also

Scrutinize Intangible Assets: These can include patents, trademarks, and goodwill, impacting long-term value

When examining a company's balance sheet, scrutinizing intangible assets is a crucial step to uncover potential long-term value. Intangible assets are non-physical assets that hold significant worth for a business, often representing a substantial portion of its overall value. These assets can include patents, trademarks, and goodwill, each contributing uniquely to the company's success and market position.

Patents, for instance, are legal protections granted to inventors, allowing them to exclude others from making, using, or selling their inventions for a limited period. These patents provide a competitive edge, especially in industries where innovation is key. For investors, assessing the number and strength of a company's patents can indicate its ability to innovate and maintain a unique selling point in the market. A robust patent portfolio can deter competitors, ensuring a steady stream of revenue and long-term profitability.

Trademarks, on the other hand, are legal safeguards for brand names, logos, and other distinctive signs that identify a company's products or services. A strong trademark portfolio can significantly enhance a company's brand value and customer loyalty. Investors should look for companies with well-established trademarks that have been consistently used and protected. These trademarks can become powerful assets, increasing the company's market share and customer recognition over time.

Goodwill, an intangible asset representing the premium paid for a business acquisition, is a measure of the company's reputation and customer relationships. It reflects the value of the business beyond its tangible assets and can be a strong indicator of future earnings potential. Investors should analyze the factors contributing to goodwill, such as brand reputation, customer loyalty, and market position. A well-established goodwill can provide a buffer during economic downturns and contribute to the company's resilience and long-term sustainability.

To effectively scrutinize these intangible assets, investors should consider the following:

- Age and Strength of Patents: Assess the age and validity of patents. Older patents might be less valuable, while newer, more recent ones could indicate ongoing innovation.

- Trademark Usage and Protection: Examine the company's trademark usage and the measures taken to protect them. Consistent use and legal safeguards ensure the trademarks' longevity and value.

- Goodwill Analysis: Study the factors that contribute to goodwill, including brand reputation, customer satisfaction, and market trends. A comprehensive understanding of these elements can provide insights into the company's long-term viability.

- Market Impact: Evaluate how these intangible assets impact the company's market performance. Do they provide a competitive advantage, attract customers, and contribute to overall growth?

By carefully analyzing these intangible assets, investors can make informed decisions about a company's long-term investments and its potential for sustained success. This scrutiny allows for a more comprehensive understanding of the business's value and its ability to create long-lasting value for shareholders.

Understanding Long-Term Investments: A Deep Dive into Balance Sheet Strategies

You may want to see also

Frequently asked questions

A balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It is a crucial tool for investors and analysts to assess a company's long-term investments. By listing a company's assets, liabilities, and equity, the balance sheet offers transparency into the company's financial health and its ability to generate long-term value.

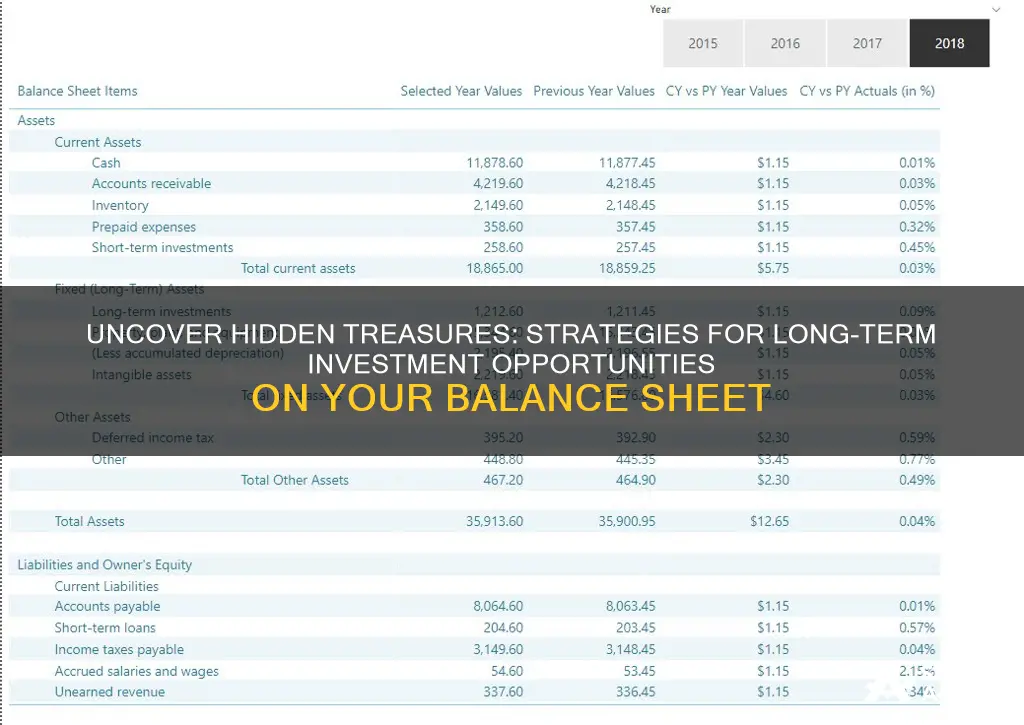

Long-term investments are typically categorized as 'Investments' or 'Long-Term Investments' on a company's balance sheet. These investments can include various financial instruments such as stocks, bonds, and other marketable securities. They are usually reported at fair value, with any changes in value recognized in the income statement. Look for these sections under the 'Assets' side of the balance sheet.

Yes, several key indicators can help identify potential long-term investment opportunities. These include the company's investment portfolio, the cost basis of investments, and any unrealized gains or losses. Additionally, analyzing the company's investment strategy, such as its focus on specific industries or market segments, can provide insights into its long-term investment approach.

The 'Investments' section of the balance sheet provides a detailed breakdown of a company's long-term investments. It includes the cost, fair value, and any changes in value during the reporting period. If a company has significant investments, it may also disclose the nature of these investments, such as the industries or companies they are invested in. This section is essential for understanding the company's financial commitments and potential risks associated with its long-term investments.