Understanding where short-term investments are recorded on a company's balance sheet is crucial for investors and financial analysts. Short-term investments, also known as marketable securities, are highly liquid assets that can be quickly converted into cash within a year. These investments typically include stocks, bonds, and other securities that can be sold in the near term without significant loss. They are essential components of a company's financial health, providing a buffer for liquidity and a means to generate returns. This paragraph will explore the various places where short-term investments can be found on a balance sheet, including cash and cash equivalents, marketable equity securities, and marketable debt securities.

What You'll Learn

- Cash and Cash Equivalents: Short-term investments in highly liquid assets like cash, bank deposits, and short-term bonds

- Marketable Securities: Includes short-term investments in stocks, bonds, and other securities that can be easily converted to cash

- Treasury Bills: Short-term government securities with maturities of up to one year, offering low risk and liquidity

- Money Market Instruments: Short-term investments in money market funds, providing access to liquid assets with minimal risk

- Trade Accounts Receivable: Short-term investments in accounts receivable, representing future cash inflows from sales on credit

Cash and Cash Equivalents: Short-term investments in highly liquid assets like cash, bank deposits, and short-term bonds

When examining a company's balance sheet, one of the key areas to focus on for short-term investments is the section dedicated to Cash and Cash Equivalents. This category is crucial as it represents highly liquid assets that can be quickly converted into cash with minimal impact on their market value. Here's a detailed breakdown of what this section entails and how to interpret it:

Understanding Cash and Cash Equivalents:

Cash and Cash Equivalents primarily consist of three components: cash, bank deposits, and short-term investments. Each of these elements plays a vital role in a company's liquidity and financial health. Cash includes physical currency, funds in bank accounts, and any other liquid assets that can be readily used for transactions. Bank deposits refer to the money held in various bank accounts, ensuring easy access to funds. Short-term investments are highly liquid financial instruments that can be quickly sold without significant loss of value. These typically include money market funds, short-term government bonds, and other similar securities.

Interpreting the Balance Sheet:

On the balance sheet, the Cash and Cash Equivalents section provides a snapshot of a company's immediate financial resources. It is essential to analyze this section to understand the company's ability to meet its short-term obligations. Here's how to interpret it:

- Total Cash and Cash Equivalents: This figure represents the sum of cash, bank deposits, and short-term investments. A higher value indicates a more robust liquidity position, suggesting the company can quickly access funds for various purposes.

- Breakdown by Type: Examining the individual components is crucial. For instance, a significant amount of cash in bank deposits might indicate a conservative approach to liquidity management, while short-term investments could provide insights into the company's strategy for short-term capital appreciation.

- Trends Over Time: Comparing the Cash and Cash Equivalents section across different financial periods can reveal valuable insights. A consistent or increasing trend in this area is generally positive, indicating effective management of short-term investments and a healthy cash flow position.

Short-Term Investments within Cash and Cash Equivalents:

The short-term investments portion of this category is particularly interesting for investors and analysts. Here's how to identify and interpret these investments:

- Money Market Funds: These are highly liquid investments that mimic the performance of the money market, offering both safety and liquidity. They are an essential part of a company's short-term investment strategy.

- Short-Term Bonds: These are low-risk, highly liquid securities with maturity dates within one year. They provide a stable return on investment while maintaining liquidity.

- Other Short-Term Investments: This category may include various other highly liquid assets, such as commercial paper or repurchase agreements, which are used to manage short-term cash flow needs.

In summary, the Cash and Cash Equivalents section of a balance sheet provides critical insights into a company's short-term financial health and investment strategies. By analyzing this section, investors and analysts can make informed decisions regarding the company's liquidity, risk management, and overall financial stability. Understanding the composition and trends within this category is essential for a comprehensive evaluation of a company's financial position.

Unraveling Secure Rate Term Investments: A Comprehensive Guide

You may want to see also

Marketable Securities: Includes short-term investments in stocks, bonds, and other securities that can be easily converted to cash

Marketable securities are a crucial component of a company's short-term investments and are an essential item to consider when analyzing a balance sheet. These securities are highly liquid assets that can be quickly converted into cash with minimal impact on their market value. They are an attractive option for businesses seeking to optimize their cash flow and manage their financial resources effectively.

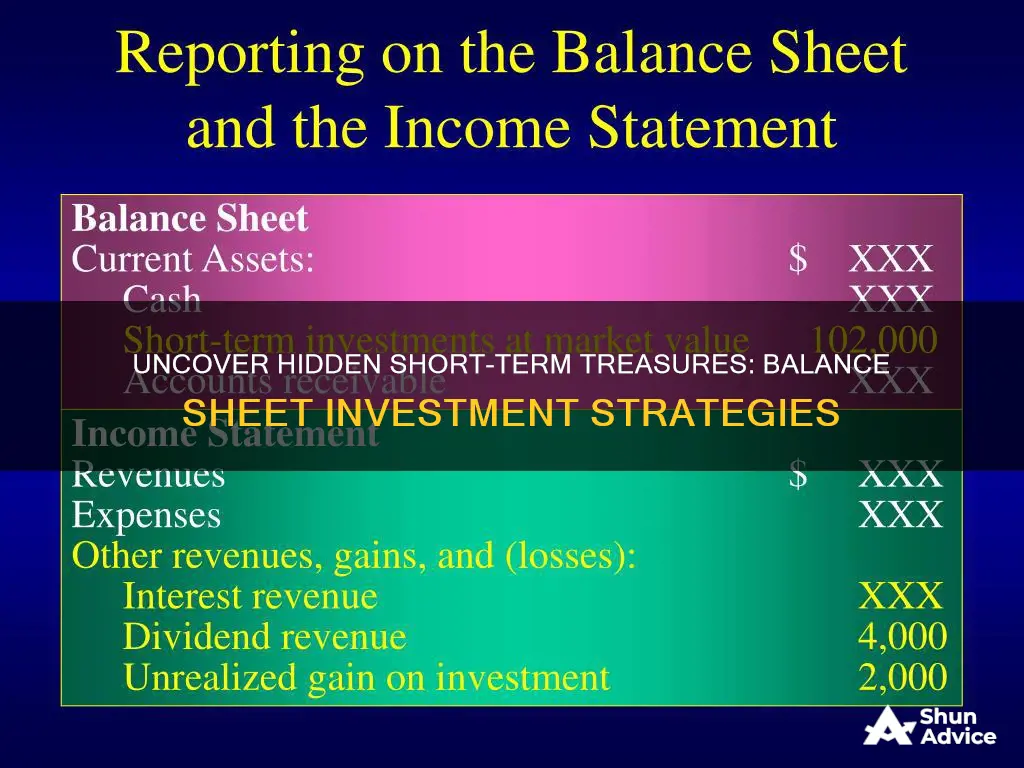

On a balance sheet, marketable securities are typically classified as current assets, which means they are expected to be converted into cash or used up within one year or the operating cycle of the business, whichever is longer. This classification is essential for investors and analysts as it provides insight into a company's liquidity and its ability to meet short-term financial obligations.

These investments can take various forms, including stocks, bonds, and other financial instruments. Stocks, for instance, represent ownership in a company and can be easily bought or sold on the stock market. Bonds, on the other hand, are debt instruments issued by governments or corporations, offering a fixed return to investors over a specified period. These securities are considered low-risk investments, making them a popular choice for companies looking to diversify their short-term portfolio.

The value of marketable securities is determined by their market price, which fluctuates based on supply and demand, interest rates, and overall market conditions. Companies often purchase these securities with the intention of selling them at a higher price in the near future, generating a profit. This strategy allows businesses to take advantage of market opportunities and manage their cash reserves effectively.

In summary, marketable securities are an integral part of a company's short-term investment strategy, providing liquidity and potential returns. They are easily accessible assets that can be quickly converted into cash, making them a valuable tool for businesses to manage their financial position and meet their short-term goals. Understanding the composition of marketable securities on a balance sheet is essential for investors and analysts to assess a company's financial health and investment potential.

Understanding Short-Term Investments: A Comprehensive Guide for Economists

You may want to see also

Treasury Bills: Short-term government securities with maturities of up to one year, offering low risk and liquidity

Treasury bills are a type of short-term investment vehicle that plays a crucial role in the financial markets. These bills are issued by governments, specifically the treasury departments, and are considered one of the safest and most liquid short-term investment options available. The primary characteristic that sets Treasury bills apart is their maturity period, which is typically up to one year, making them an ideal choice for investors seeking both safety and liquidity.

In the context of a balance sheet, Treasury bills are an essential component of a well-diversified investment portfolio. They are classified as highly liquid assets, meaning they can be easily converted into cash without significant loss of value. This liquidity is particularly attractive to investors who may need quick access to their funds while still maintaining a degree of safety. Treasury bills are backed by the full faith and credit of the government, ensuring that investors receive their principal amount upon maturity.

The low-risk nature of Treasury bills is a significant advantage. Since they are government-issued securities, they are considered low-risk investments, especially when compared to other short-term options. This low-risk profile makes Treasury bills a preferred choice for risk-averse investors who want to minimize potential losses while still earning a reasonable return. Additionally, the short maturity period of these bills provides investors with the flexibility to adjust their investment strategies as needed.

When considering short-term investments, Treasury bills offer a competitive interest rate, which can vary depending on market conditions and the specific maturity of the bill. Investors can purchase these bills at a discount to their face value, and as they mature, they are redeemed at par value, providing a fixed return. This makes Treasury bills an attractive option for those seeking a stable and predictable income stream from their short-term investments.

In summary, Treasury bills are a valuable addition to any investor's balance sheet, offering a unique combination of safety, liquidity, and competitive returns. Their short-term nature and government backing make them an accessible and reliable investment choice for individuals and institutions alike, providing a solid foundation for short-term financial goals and risk management strategies.

Understanding Investment: A Key Economic Driver

You may want to see also

Money Market Instruments: Short-term investments in money market funds, providing access to liquid assets with minimal risk

Money market instruments are a crucial component of short-term investments, offering investors a safe and liquid way to grow their capital over the short term. These instruments are highly sought after by those seeking a balance between safety and accessibility, especially in the current economic climate where long-term investments carry higher risks.

Money market funds are a type of mutual fund that primarily invests in high-quality, short-term debt securities. These securities are typically issued by governments, corporations, or other entities with strong credit ratings. The primary goal of these funds is to provide investors with a stable and secure investment option, ensuring that their capital is protected while still offering some growth potential.

One of the key advantages of money market funds is their liquidity. Investors can typically access their funds within a short period, often within a day or two, without incurring significant penalties. This makes them an ideal choice for those who need quick access to their money, such as for emergency funds or short-term financial goals. The funds are designed to maintain a stable net asset value (NAV) per share, usually at $1.00, which further emphasizes their liquidity and safety.

These funds offer a diversified portfolio of short-term securities, which helps to minimize risk. The fund manager carefully selects a range of investments, ensuring that the overall risk is kept at a minimum. This approach provides investors with a sense of security, knowing that their capital is spread across various low-risk assets. As a result, money market funds are often considered a safe haven for investors who want to preserve their capital while still earning a modest return.

In addition to their safety and liquidity, money market funds are also known for their low cost. With relatively low management fees, these funds provide an affordable way to invest in a diversified portfolio of short-term securities. This makes them accessible to a wide range of investors, from individuals looking to grow their savings to institutional investors seeking a stable and secure investment option.

In summary, money market instruments, particularly money market funds, offer a unique and attractive investment opportunity. They provide investors with a safe, liquid, and cost-effective way to access short-term investments, ensuring that their capital is protected while still offering some growth potential. This makes them an essential consideration for anyone looking to find short-term investments on their balance sheet.

Maximizing Returns: The Power of Long-Term Investment Strategies

You may want to see also

Trade Accounts Receivable: Short-term investments in accounts receivable, representing future cash inflows from sales on credit

Trade Accounts Receivable is a crucial component of a company's balance sheet, offering a window into its short-term financial health and liquidity. This section of the balance sheet represents the company's future cash inflows from sales made on credit to customers. It is a dynamic asset, constantly changing as sales are made and payments are received.

In simple terms, Trade Accounts Receivable is the money owed to a company by its customers. When a company sells goods or services on credit, it extends credit to its customers, allowing them to pay at a later date. This credit period is typically short-term, ranging from a few days to a few months. The amount recorded in Trade Accounts Receivable represents the total sales made on credit during a specific period.

This short-term investment is significant because it provides a clear picture of the company's ability to generate cash in the near future. It is a highly liquid asset, meaning it can be quickly converted into cash without significant loss of value. This liquidity is essential for maintaining a healthy cash flow and ensuring the company can meet its short-term financial obligations.

The balance sheet provides a snapshot of a company's financial position at a specific point in time. It includes various assets, liabilities, and shareholders' equity. Trade Accounts Receivable is listed as an asset because it represents a future economic benefit that the company expects to receive. It is considered a short-term investment due to its relatively short maturity, typically less than one year.

By analyzing Trade Accounts Receivable, investors and creditors can gain valuable insights. A healthy and well-managed Trade Accounts Receivable indicates efficient credit sales and a robust customer base. It also suggests that the company has a positive cash flow outlook, enabling it to invest in growth opportunities or manage short-term debts effectively. Understanding this section of the balance sheet is essential for assessing a company's financial stability and its ability to manage its short-term financial resources.

Commission Fees: The Long-Term Investment Conundrum

You may want to see also

Frequently asked questions

Short-term investments are assets that are highly liquid and can be quickly converted into cash within a year or less. These investments are typically used to meet short-term financial goals and provide a safe and accessible way to grow money in the near term. Examples include money market funds, certificates of deposit (CDs), and treasury bills.

On a company's balance sheet, short-term investments are usually classified as 'Current Assets'. This category includes assets that are expected to be converted into cash or used up within one year. Short-term investments are often listed separately from other current assets like cash, accounts receivable, and inventory to provide a clear picture of the company's liquid resources.

Short-term investments are crucial for businesses as they provide a source of quick liquidity and help manage cash flow. Companies often use these investments to take advantage of short-term market opportunities, smooth out cash flow fluctuations, and maintain a healthy cash reserve. These investments also offer a relatively low-risk way to generate returns compared to long-term investments.

Let's say a company, Alpha Corp., has invested $500,000 in a 90-day money market fund. This investment is considered short-term because it can be easily liquidated within the specified timeframe. On Alpha Corp.'s balance sheet, this investment would be recorded as a current asset, with a value of $500,000, and would be noted as a short-term investment or a money market fund investment.