Understanding how to calculate the time it takes for an investment to reach a certain value using compound interest is a valuable skill for anyone interested in personal finance and investments. The compound interest formula is a powerful tool that can help you determine how long it will take for your money to grow, given a specific interest rate and initial investment amount. By learning how to find the time invested, you can make informed decisions about when to start saving or investing to achieve your financial goals. This knowledge is particularly useful for planning long-term financial strategies and understanding the impact of compounding over time.

What You'll Learn

- Understanding Compound Interest: Learn the basics of how interest compounds over time

- Compound Interest Formula: Apply the formula to calculate future value of investments

- Time and Interest Rates: Explore how different rates affect growth over time

- Compounding Periods: Understand the impact of daily, monthly, or yearly compounding

- Real-World Examples: Study case studies to see the power of compound interest

Understanding Compound Interest: Learn the basics of how interest compounds over time

Compound interest is a powerful financial concept that can significantly impact your savings and investments over time. It is the process by which interest is calculated on the initial principal amount, and then that interest is added to the principal, generating further interest. This compounding effect can work both for and against you, depending on whether you're saving or borrowing money. Understanding how it works is essential for making informed financial decisions.

The formula to calculate the future value of an investment with compound interest is: FV = PV (1 + r/n)^(nt). Here, FV represents the future value, PV is the present value (initial investment), 'r' is the annual interest rate (in decimal form), 'n' is the number of times interest is compounded per year, and 't' is the number of years. This formula shows that the more frequently interest is compounded, the faster your money can grow. For example, if you invest $1,000 at 5% interest, compounded annually, it will grow to $2,205.38 after 10 years. However, if compounded monthly, the same investment would grow to $2,207.14, demonstrating the power of compounding.

To understand the impact of compounding, consider the difference between simple and compound interest. Simple interest is calculated only on the initial principal amount, and it does not compound. For instance, if you borrow $1,000 at 5% simple interest for one year, you'll pay $50 in interest, and the total amount due is $1,050. With compound interest, the interest earned each period is added to the principal, and interest is then calculated on the new total. This results in a snowball effect, where the interest earned in the first period becomes part of the principal, leading to higher interest in subsequent periods.

The key to maximizing the benefits of compound interest is time. The longer your money is invested, the more it can grow due to compounding. This is why early investment and long-term financial planning are crucial. For instance, investing in a retirement account at a young age and letting it grow over several decades can result in a substantial nest egg due to the power of compounding.

In summary, compound interest is a fundamental concept in finance, and understanding it can help you make better financial choices. It's a key reason why saving and investing early can pay off significantly over time. By grasping the basics of compounding and using the compound interest formula, you can estimate the growth of your investments and make informed decisions to secure your financial future.

Understanding Interest on Discounted Investments: A Comprehensive Guide

You may want to see also

Compound Interest Formula: Apply the formula to calculate future value of investments

The compound interest formula is a powerful tool for understanding and calculating the growth of investments over time. It is a fundamental concept in finance and can help individuals make informed decisions about their money. This formula allows you to determine the future value of an investment, taking into account the effects of compound interest, which is the interest calculated on the initial principal and the accumulated interest from previous periods.

To apply the compound interest formula, you need to know the initial investment amount, the interest rate, the number of times interest is compounded per year, and the number of years the money is invested for. The formula is structured as:

FV = P(1 + r/n)^(nt)

Where:

- FV = Future Value

- P = Principal amount (initial investment)

- R = Annual interest rate (in decimal form)

- N = Number of times interest is compounded per year

- T = Number of years

Here's a step-by-step guide on how to use this formula:

- Identify the values: Start by gathering the necessary information. You'll need the initial amount you want to invest, the interest rate offered by your bank or investment vehicle, how often the interest is compounded (daily, monthly, annually), and the duration of the investment in years.

- Plug in the numbers: Substitute these values into the formula. For example, if you invest $1000 at an annual interest rate of 5%, compounded monthly, for 3 years, the formula would look like this: FV = 1000(1 + 0.05/12)^(12*3).

- Calculate: Perform the calculation to find the future value. In this example, you would calculate the value inside the parentheses first, then raise it to the power of the total number of compounding periods (12*3), and finally multiply by the principal amount.

- Interpret the result: The calculated FV represents the total amount you will have at the end of the investment period, including the interest earned. This can help you understand the potential growth of your investment and make comparisons between different investment options.

By using the compound interest formula, you can forecast the growth of your investments and make more accurate financial decisions. It is a valuable skill to master, especially when considering long-term financial goals and planning for the future. Remember, the power of compound interest lies in its ability to grow your wealth exponentially over time.

Navigating the Low-Interest Rate Landscape: Why People Still Invest in CDs

You may want to see also

Time and Interest Rates: Explore how different rates affect growth over time

Understanding the relationship between time and interest rates is crucial when dealing with compound interest, as it directly impacts the growth of an investment. Compound interest is a powerful tool that can significantly increase the value of your money over time, but it's essential to grasp how different interest rates influence this process. When you invest, the interest earned is added to the principal amount, and subsequently, interest is calculated on the new total, leading to exponential growth. This concept is particularly relevant in various financial scenarios, from personal savings to business investments.

The impact of interest rates on investment growth is profound. Higher interest rates generally result in more substantial growth over time. This is because a larger portion of the principal amount is subject to interest calculation, leading to a snowball effect. For instance, if you invest $1000 at an annual interest rate of 5%, the interest earned in the first year is $50, making the total $1050. In the second year, interest is calculated on this new total, resulting in a higher interest amount. This process continues, and the investment grows exponentially.

Conversely, lower interest rates lead to slower growth. With a reduced interest rate, the amount of interest earned each year is smaller, and the overall growth is more gradual. For example, an investment of $2000 at 2% interest will yield a lower interest amount compared to the same investment at 5%, resulting in a slower increase in value. This illustrates how interest rates play a pivotal role in determining the speed at which your money grows.

The time factor is equally important. The longer your money is invested, the more opportunity it has to grow, regardless of the interest rate. This is because compound interest compounds over time, leading to a cumulative effect. Even with relatively low interest rates, a long investment horizon can result in significant growth. For instance, an investment of $5000 at 3% interest for 20 years will accumulate a substantial amount due to the power of compounding.

In summary, when considering investments, it's essential to evaluate both time and interest rates. Higher interest rates accelerate growth, while lower rates may result in more modest returns. Additionally, the longer the investment period, the more substantial the potential gains, especially with compound interest working in your favor. Understanding these dynamics can help individuals and businesses make informed decisions about their financial strategies, ensuring their money works harder for them over time.

Keynesian Economics: Investment and Interest Rates Explored

You may want to see also

Compounding Periods: Understand the impact of daily, monthly, or yearly compounding

Understanding the concept of compounding periods is crucial when calculating the growth of an investment over time, especially in the context of compound interest. The compounding period refers to the frequency at which interest is applied to the principal amount, and it significantly affects the final value of your investment. This is particularly important when comparing different investment options or assessing the performance of your money over various time frames.

In the world of finance, the compounding period can be daily, monthly, or yearly, each with its own unique implications. Daily compounding means that interest is calculated and added to the principal amount every day. This frequent calculation results in a higher final amount compared to less frequent compounding periods. For instance, if you invest $1,000 at an annual interest rate of 5% compounded daily, the interest is calculated and added daily, leading to a more substantial growth over a year.

Monthly compounding is another common practice, where interest is applied once each month. This method provides a steady growth rate, slightly lower than daily compounding but higher than yearly compounding. For example, with monthly compounding, the same $1,000 investment at 5% interest would grow more than with yearly compounding but less than with daily compounding over the same period.

Yearly compounding is the simplest form, where interest is applied once annually. This method is often used in traditional savings accounts. With yearly compounding, the interest is calculated and added to the principal at the end of each year, resulting in a lower final amount compared to more frequent compounding. For instance, an investment of $1,000 at 5% interest compounded yearly would grow less than the same investment compounded daily or monthly over a year.

The choice of compounding period can significantly impact your investment returns. Investors should consider the frequency of compounding when evaluating investment options, as it directly influences the growth of their money. Understanding these differences allows investors to make informed decisions, especially when comparing investments with different compounding periods, ensuring they choose the one that aligns best with their financial goals and risk tolerance.

Maximize Your Savings: Strategies for Earning Interest on Investments

You may want to see also

Real-World Examples: Study case studies to see the power of compound interest

To truly understand the impact of compound interest, it's invaluable to examine real-world examples and case studies. These provide a tangible context to the concept, allowing you to see how compound interest can work its magic over time.

One classic example is the story of Benjamin Franklin and his famous 13-week experiment. Franklin borrowed $20 from a friend, promising to repay the loan with interest after 13 weeks. He then invested the borrowed amount, earning a modest 4% annual interest. At the end of the 13 weeks, he repaid the original $20 plus interest, but the real surprise came when he calculated the total amount repaid. Due to the power of compounding, he ended up repaying $24.49. This simple experiment demonstrates how even a small amount of interest, compounded over time, can significantly increase the final amount.

Another compelling case study involves the long-term savings of an individual who started investing in a retirement account early in their career. Let's say this person invested $5,000 annually in a tax-advantaged retirement account, earning an average annual return of 7%. Over 30 years, they would have contributed a total of $150,000. However, due to the magic of compounding, their investment would grow to approximately $531,300. This example highlights the immense power of starting early and allowing compound interest to work its wonders over an extended period.

The power of compound interest is also evident in the success of mutual funds and index funds. These investment vehicles allow individuals to pool their money with others, enabling them to invest in a diversified portfolio of stocks, bonds, or other securities. Over time, as these investments appreciate in value, the compounded returns can lead to substantial wealth accumulation. For instance, a study on the S&P 500 index fund over a 20-year period revealed that an initial investment of $10,000 grew to over $30,000, showcasing the potential for significant growth through compounding.

In the realm of personal finance, compound interest can be a powerful tool for debt repayment. Consider a credit card balance of $1,000 with an annual interest rate of 18%. If left unpaid, the interest would compound monthly, leading to a much higher final amount. However, if the same balance is paid off within a year, the interest accrued would be significantly lower, demonstrating how responsible financial management can mitigate the negative effects of compounding.

These real-world examples underscore the importance of understanding and harnessing the power of compound interest. By studying these cases, individuals can make informed financial decisions, whether it's starting early for long-term investments, managing debt effectively, or exploring investment opportunities that leverage the compounding effect.

Maximizing Returns: Unlocking the Power of Compound Interest

You may want to see also

Frequently asked questions

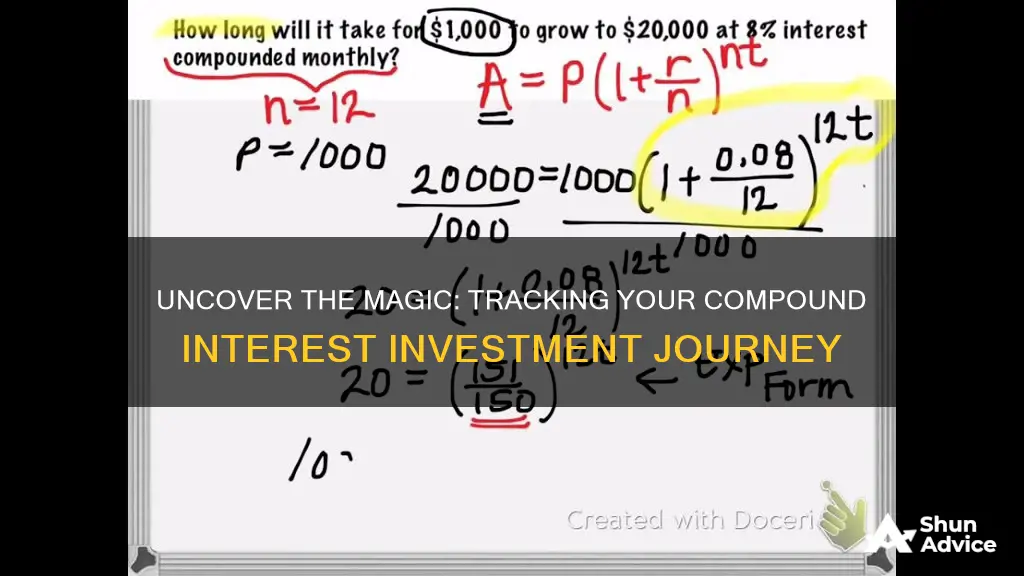

The compound interest formula is a mathematical equation used to calculate the amount of money accumulated after a certain period, considering the initial principal amount, the interest rate, and the number of compounding periods. To find the time invested, you can rearrange the formula to solve for the number of periods (n). The formula is: A = P(1 + r/n)^(nt), where A is the amount after time t, P is the principal amount, r is the annual interest rate, and n is the number of times interest is compounded per year. By rearranging and solving for t, you can determine the time required to reach a specific amount.

If you have the final amount (A) and the interest rate (r), and you want to find the time (t), you can rearrange the formula to solve for t. The formula becomes: t = (ln(A/P)) / (n * ln(1 + r/n)). Here, you need to know the number of compounding periods (n), which can be found by dividing the total number of periods by the number of times interest is compounded annually. This formula will give you the time in years required to reach the specified amount.

Yes, absolutely! If you have the interest rate (r), compounding frequency (n), and final amount (A), you can use the formula: t = (1/n) * (ln(A/P) / (r - d)), where 'd' is the discount rate (if applicable). This formula is particularly useful when you want to find the time to reach a certain amount with regular contributions or withdrawals. It takes into account the compounding frequency and can provide an estimate of the time required.

For irregular contributions, the calculation becomes more complex. You would need to use financial calculators or software that can handle irregular cash flows. The formula for the future value of an irregular annuity is more advanced and involves summing the present values of each contribution period. This approach considers the varying contribution amounts and interest rates over time. It's best to use specialized tools or consult financial advisors for precise calculations in such cases.