Investing $2,000 a month can be a powerful way to build wealth over time. Whether you're a seasoned investor or just starting, understanding the various investment options and strategies is crucial. This guide will explore different approaches, from traditional stocks and bonds to alternative investments like real estate and cryptocurrencies, offering insights into how to make the most of your monthly investment budget. We'll also discuss the importance of diversification, risk management, and long-term financial planning to help you achieve your financial goals.

What You'll Learn

- Budgeting: Create a monthly budget to allocate funds for investments

- Diversification: Spread investments across stocks, bonds, and real estate

- Research: Study market trends and choose suitable investment vehicles

- Risk Management: Understand risk tolerance and set stop-loss orders

- Long-Term Strategy: Focus on long-term goals and avoid short-term market volatility

Budgeting: Create a monthly budget to allocate funds for investments

Creating a monthly budget is a crucial step towards investing $2000 consistently. Here's a detailed guide on how to approach this:

- Track Your Income and Expenses: Begin by understanding your financial situation. Calculate your total monthly income, including your salary, any side hustles, or investments. Then, meticulously track all your expenses for a month. Categorize them into essentials (rent, utilities, groceries, transportation), discretionary spending (entertainment, dining out, hobbies), and savings/investments. This awareness is key to budgeting.

- Calculate Your Disposable Income: After identifying your income and expenses, subtract your essential costs from your total income. The remaining amount is your disposable income, which you'll allocate towards investments.

- Prioritize Your Investments: Decide on your investment goals. Are you saving for retirement, a house down payment, or a specific financial objective? Prioritize these goals and allocate your disposable income accordingly. For instance, if your retirement goal is most important, allocate a larger portion of your budget to retirement savings or investments.

- Create a Realistic Budget: Based on your priorities, allocate a specific amount for investments each month. Let's say you decide to invest $2000. Break this down into smaller, manageable chunks if needed. For example, you could allocate $500 for stocks, $700 for a high-yield savings account, and $800 for a real estate investment trust (REIT). Ensure your budget is realistic and aligns with your financial capabilities.

- Automate Your Investments: To make investing effortless, consider setting up automatic transfers from your checking account to your investment accounts. This way, you invest consistently without constant reminders. You can start with a smaller amount and gradually increase it as your budget allows.

- Review and Adjust: Regularly review your budget and investment performance. Track your progress towards your financial goals. If certain investments are underperforming, consider reallocating funds or adjusting your strategy. Stay informed about market trends and economic factors that might impact your investments.

Remember, budgeting is a dynamic process. It requires discipline and adaptability. By creating a structured budget and allocating funds for investments, you're taking control of your financial future. This approach ensures that your $2000 monthly investment becomes a consistent and powerful tool for achieving your financial aspirations.

Investments Impact: Daytona Beach's Future on the Line

You may want to see also

Diversification: Spread investments across stocks, bonds, and real estate

When you're investing $2000 a month, diversification is key to managing risk and maximizing returns. Here's how to spread your investments across stocks, bonds, and real estate:

Stocks:

- Index Funds or ETFs: A great way to diversify into stocks is through index funds or Exchange-Traded Funds (ETFs). These funds track a specific market index, like the S&P 500. They offer instant diversification across a broad range of companies, reducing the risk associated with individual stock selection.

- Sector-Specific ETFs: If you want to focus on a particular industry or sector (e.g., technology, healthcare, energy), consider sector-specific ETFs. This allows you to benefit from the growth of a specific area while still maintaining a diversified portfolio.

- Individual Stocks: While less common with a monthly investment, you can also allocate a portion of your $2000 to individual stocks. Research and choose companies with strong fundamentals, competitive advantages, and growth potential. However, be mindful that individual stocks carry higher risk.

Bonds:

- Government Bonds: These are generally considered low-risk investments. You can invest in US Treasury bonds or similar government securities from other countries. Bonds provide a steady income stream through interest payments and are a crucial component of a balanced portfolio.

- Corporate Bonds: These are issued by companies and offer higher yields than government bonds. They carry more risk but can provide diversification within the bond market.

Real Estate:

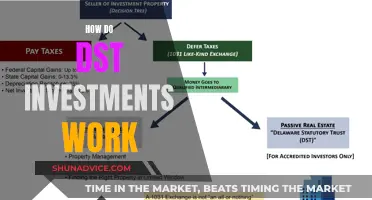

- Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate without directly buying property. They are traded on stock exchanges and offer exposure to income-generating real estate assets. REITs can provide diversification across various property types and geographic locations.

- Crowdfunding Platforms: Platforms like Fundrise and RealtyMogul allow you to invest in real estate projects with smaller amounts of money. This is a relatively new and accessible way to get into real estate diversification.

Important Considerations:

- Risk Tolerance: Determine your risk tolerance. Are you comfortable with potential short-term fluctuations in value for potentially higher long-term gains?

- Time Horizon: Consider your investment timeframe. Diversification is most effective over the long term.

- Fees: Be mindful of fees associated with different investment vehicles. ETFs and index funds often have lower expense ratios than actively managed funds.

Remember, diversification doesn't guarantee profit or protect against losses in a declining market. However, it can help smooth out the ride and potentially lead to better long-term results.

Maximizing Your Fortune: Strategies for Investing $500 Million

You may want to see also

Research: Study market trends and choose suitable investment vehicles

When investing $2000 a month, thorough research is key to making informed decisions and maximizing your potential returns. Here's a breakdown of how to approach studying market trends and selecting appropriate investment vehicles:

Define Your Investment Goals and Risk Tolerance:

- Short-Term vs. Long-Term: Are you investing for retirement, a house down payment, or something else? Different investment horizons require different strategies. Short-term goals might lean towards more volatile but potentially higher-yielding options, while long-term goals could benefit from a more balanced approach.

- Risk Tolerance: How comfortable are you with potential losses? Are you a conservative investor who prefers stable, low-risk investments, or are you willing to take on more risk for potentially higher returns? Understanding your risk tolerance will guide your asset allocation.

Study Market Trends:

- Economic Indicators: Keep a close eye on economic data like GDP growth, inflation rates, interest rates, and employment reports. These indicators provide insights into the overall health of the economy and can influence market performance.

- Industry Analysis: Identify sectors or industries that are expected to grow. Technological advancements, emerging markets, and sustainable energy are often areas of interest.

- Market Research: Utilize financial websites, news outlets, and research reports to gather information on market trends, company performance, and industry news.

Choose Suitable Investment Vehicles:

- Stocks: Investing in individual stocks offers ownership in companies and potential for high returns. Research companies based on their financial health, growth prospects, and industry position. Diversify your stock portfolio across different sectors and market capitalizations.

- Bonds: Bonds are generally considered less risky than stocks but offer lower potential returns. They provide a steady income stream through interest payments. Government bonds are often seen as a safe haven, while corporate bonds can offer higher yields but with increased risk.

- Mutual Funds and ETFs: These are baskets of securities that offer instant diversification. Mutual funds are managed by professionals, while ETFs track specific indexes or sectors. They provide an easy way to gain exposure to a broad market or niche.

- Real Estate: Consider investing in real estate through REITs (Real Estate Investment Trusts) or crowdfunding platforms. This allows you to invest in property without directly owning a physical asset.

- Alternative Investments: Explore other options like commodities, futures, options, and cryptocurrencies. These can be more complex and carry higher risks, but they can also offer diversification and potential for significant gains.

Diversification is Crucial:

Don't put all your eggs in one basket. Diversifying your investments across different asset classes, sectors, and geographic regions is essential to managing risk. A well-diversified portfolio can help smooth out market volatility and protect your capital over the long term.

Stay Informed and Adapt:

The investment landscape is constantly evolving. Stay updated on market news, economic trends, and regulatory changes. Regularly review your portfolio and make adjustments as needed to align with your goals and risk tolerance.

Generous Investment Opportunities: Exploring the Power of 30,000

You may want to see also

Risk Management: Understand risk tolerance and set stop-loss orders

Understanding your risk tolerance is a crucial step in managing your investments, especially when you're investing a substantial amount like $2,000 per month. Risk tolerance refers to your ability and willingness to withstand price fluctuations in your investments. It's important to recognize that investing always carries some level of risk, and being aware of your own comfort level with volatility is essential for making informed decisions.

To determine your risk tolerance, consider your financial goals, time horizon, and emotional capacity. Are you investing for the long term, such as for retirement, or do you need more immediate access to funds? If you have a longer investment period, you might be more comfortable with higher-risk strategies. Conversely, if you require more liquidity or are investing for a shorter term, you may prefer less volatile investments. Additionally, think about your emotional response to market changes. Can you handle significant short-term losses without panicking, or do you need a more conservative approach?

Once you've assessed your risk tolerance, you can start implementing risk management strategies. One effective method is setting stop-loss orders. A stop-loss order is an instruction to sell an asset when it reaches a certain price, which helps limit potential losses. For example, if you've invested $2,000 in a stock and set a stop-loss order at $50 per share, the order will trigger a sell if the stock price falls to $50, thus preventing further losses. This strategy is particularly useful for long-term investors who want to protect their capital from sudden market downturns.

When setting stop-loss orders, it's important to consider your investment strategy and the specific characteristics of the asset you're investing in. For instance, in volatile markets, a tight stop-loss might be necessary to limit potential losses, while in more stable markets, a wider stop-loss could be appropriate. It's also crucial to monitor your stop-loss orders regularly, especially in volatile markets, to ensure they remain effective.

In summary, managing risk is an essential aspect of investing $2,000 per month. By understanding your risk tolerance and implementing strategies like setting stop-loss orders, you can make informed decisions that align with your financial goals and comfort level with market volatility. This approach will help you navigate the investment journey with a more confident and disciplined mindset.

The Homeowner's Dilemma: Buy and Hold or Sell?

You may want to see also

Long-Term Strategy: Focus on long-term goals and avoid short-term market volatility

When investing $2000 a month, a long-term strategy is crucial to building wealth and achieving financial goals. This approach involves a disciplined and patient mindset, focusing on the bigger picture rather than short-term market fluctuations. Here's how you can implement this strategy effectively:

- Define Your Long-Term Goals: Start by identifying your long-term financial objectives. Are you saving for retirement, a house down payment, or a child's education? Setting clear goals will help you stay motivated and make investment decisions aligned with your future needs. For example, if you're aiming for retirement, consider the age you plan to retire and the lifestyle you want during that phase. This will determine the type of investments and the time horizon you should consider.

- Diversify Your Portfolio: Diversification is a key principle in long-term investing. Spread your investments across different asset classes such as stocks, bonds, real estate, and commodities. Diversification helps reduce risk by not putting all your money in one basket. You can invest in a mix of stocks and bonds, with a higher allocation to stocks for long-term growth potential. Consider using index funds or exchange-traded funds (ETFs) that track a specific market index, offering instant diversification.

- Ignore Short-Term Market Volatility: The stock market can be unpredictable in the short term, with prices fluctuating daily. However, historical data shows that over the long haul, markets tend to go up. By investing regularly and consistently, you buy more shares when prices are low and fewer when prices are high, averaging out the cost. This strategy, known as dollar-cost averaging, is particularly effective in long-term investing.

- Consider Tax-Advantaged Accounts: Take advantage of tax-efficient investment accounts to maximize your returns. Traditional 401(k) or 403(b) plans and IRAs allow your investments to grow tax-deferred, and in some cases, tax-free. This can significantly boost your long-term returns. Additionally, consider investing in a Health Savings Account (HSA) if you have a high-deductible health plan, as it offers tax advantages and can be a valuable long-term investment tool.

- Stay Informed and Review Regularly: While long-term investing requires patience, staying informed is essential. Keep up with economic news, market trends, and the performance of your investments. Regularly review your portfolio to ensure it remains aligned with your goals. Adjust your asset allocations as necessary, but avoid making frequent changes based on short-term market noise.

By adopting a long-term strategy, you can weather the short-term market storms and benefit from the power of compounding returns. This approach allows you to build a substantial nest egg over time, providing financial security and achieving your long-term aspirations. Remember, successful long-term investing is a marathon, not a sprint, and staying committed to your plan will yield significant results.

Master Cash Flows: Unlocking Secrets of Investing Activities

You may want to see also

Frequently asked questions

A popular strategy is to utilize a dollar-cost averaging approach. This involves investing a fixed amount regularly, regardless of the market conditions. By investing $2000 monthly, you can buy more shares when prices are low and fewer when prices are high, potentially averaging out the market's volatility over time.

Starting with a limited budget is manageable. You can consider investing in index funds or exchange-traded funds (ETFs) that track a specific market index. These funds offer diversification and are typically more affordable for individual investors. Additionally, some online investment platforms offer fractional shares, allowing you to invest in companies with a small amount of money.

Investing a substantial amount monthly can lead to a higher risk profile. The market's volatility can cause short-term fluctuations in the value of your investments. It's essential to have a long-term investment horizon and a well-diversified portfolio to mitigate these risks. Consider consulting a financial advisor to create a strategy that aligns with your risk tolerance.

Unfortunately, there are no guaranteed returns in investing. The market is inherently unpredictable, and even the most successful investors cannot guarantee profits. However, you can aim to maximize your chances of success by diversifying your investments, conducting thorough research, and seeking professional advice.

Creating a financial plan is crucial for managing your monthly investment budget. Start by assessing your financial goals, risk tolerance, and time horizon. Then, allocate a portion of your $2000 budget to different investment vehicles, such as stocks, bonds, or real estate. Regularly review and rebalance your portfolio to ensure it aligns with your objectives and market conditions.