Axis Mutual Fund is one of the top 10 asset management companies in India. It is a joint venture between India's third-largest private bank, Axis Bank, and Schroder Singapore Holdings Private Limited. The company boasts a well-rounded portfolio of more than 53 mutual fund schemes across categories like debt, equity, and hybrid. It maintains over 98 lakh investor accounts and offers its services online and through more than 100 branches in India.

Axis Mutual Fund offers a range of investment options, including equity funds, debt funds, and hybrid funds. The company's investment philosophy is based on three principles: long-term wealth creation, outside-in view, and long-term relationships.

Investing in Axis Mutual Fund schemes can be done online or offline. For online investments, individuals can follow these steps:

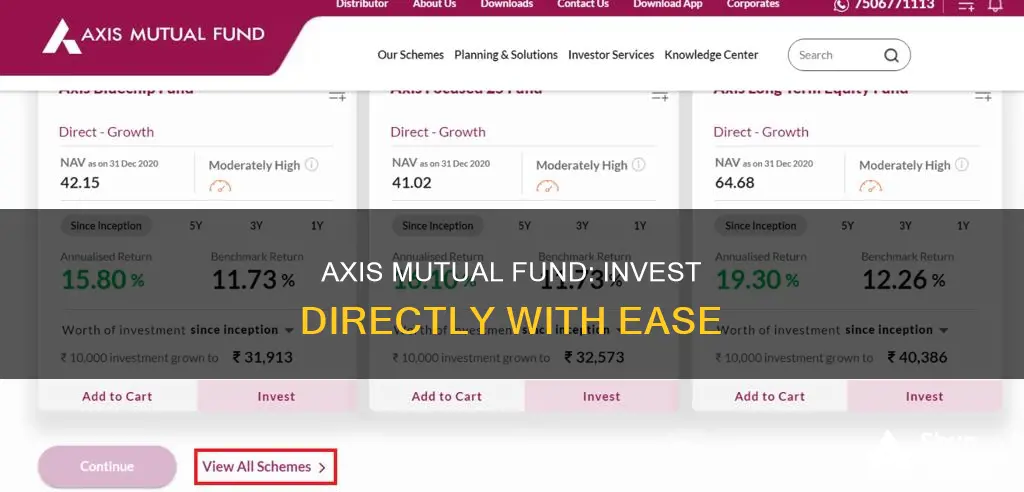

1. Visit the website of a preferred investment platform or the official website of Axis Mutual Fund.

2. Register and create a new account by providing personal and address proof documents, such as a PAN card, Aadhaar card, or passport.

3. Choose the duration of the investment and the preferred risk level (low, mid, or high).

4. Select the desired Axis Bank Mutual Fund scheme.

5. Decide on the investment type: a one-time lump sum investment or a Systematic Investment Plan (SIP).

6. Provide bank account details and complete the investment process.

Offline investments can be made by filling out an investment application form and submitting it to Axis Mutual Fund or an authorised distributor.

It is important to note that investing in mutual funds carries risks, and individuals should carefully evaluate their financial goals, risk tolerance, and investment horizon before making any investment decisions.

| Characteristics | Values |

|---|---|

| Name | Axis Mutual Fund |

| Formal Name | Axis Asset Management Company Ltd. |

| Incorporation Date | 13-01-2009 |

| Sponsors | Axis Bank and Schroder Investment Management (Singapore) Limited (SIMSL) |

| Number of Schemes | 53-66 |

| Types of Schemes | Debt, equity, hybrid, index, gold, international funds |

| Number of Investor Accounts | 98-126 lakh |

| Number of Branches | 100 |

| Average AUM | Rs. 2.74-2,89,307.18 lakh crores |

| Investment Options | Lump sum, Systematic Investment Plan (SIP) |

| Minimum Investment Amount | Rs. 100-5,000 |

What You'll Learn

How to invest in Axis Mutual Fund online

Investing in mutual funds is a great way to diversify your portfolio and reduce risk. Axis Mutual Fund, the investment wing of Axis Bank, is one of the top 10 asset management companies in India. Here is a step-by-step guide on how to invest in Axis Mutual Fund online:

Step 1: Register and create an account

You can invest in Axis Mutual Fund online through their website or platforms like Groww, ET Money, or 5Paisa. Start by registering and creating an account on your chosen platform. Provide your email address and create a password. You may also need to set up two-factor authentication for added security.

Step 2: Complete your profile

After registering, you will need to complete your profile by providing personal information, such as your full name, date of birth, address, and contact details. You will also need to upload proof of identity and address, such as a government-issued ID, passport, driver's license, or utility bills. This process is known as Know Your Customer (KYC) verification.

Step 3: Choose your investment options

Once your account is set up, you can browse the different Axis Mutual Fund schemes available. Axis offers a wide range of mutual fund options, including equity, debt, hybrid, index, gold, and international funds. Select the fund that aligns with your investment goals, risk tolerance, and investment horizon.

Step 4: Decide on the investment type and amount

Axis Mutual Fund offers both lump-sum and Systematic Investment Plan (SIP) options. Lump-sum investments typically refer to amounts above a certain threshold (e.g., INR 5,000), while SIP allows you to invest smaller amounts (e.g., INR 500) at regular intervals. Choose the investment type and amount that suits your financial goals and capacity.

Step 5: Make your investment

After selecting the fund and deciding on the investment type and amount, proceed to make your investment. Carefully review the investment details, including the fund name, amount, and frequency. Enter your payment details and complete the transaction.

Step 6: Track your investment

After investing, you can track the performance of your mutual fund holdings through the platform you used to invest. You should be able to view the current value of your investments, returns generated, and other relevant information. Some platforms may also provide updates and notifications about your investments.

Remember that investing in mutual funds carries risks, and past performance does not guarantee future results. It is essential to do your research, understand the fees and charges associated with the fund, and consider your financial goals and risk tolerance before investing.

Mutual Fund Investment: Best Day to Invest and Grow Wealth

You may want to see also

How to invest in Axis Mutual Fund offline

Investing in mutual funds is a great way to diversify your portfolio and mitigate potential losses while offering the opportunity for returns. Axis Mutual Fund, the mutual fund investment wing of Axis Bank, offers a range of investment options that can be accessed both online and offline. Here's a step-by-step guide on how to invest in Axis Mutual Fund offline:

Step 1: Understand the Basics of Mutual Funds

Before investing in any mutual fund, it's important to understand what mutual funds are and how they work. Mutual funds are investment schemes that pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other securities. By investing in mutual funds, you can spread your investments across different assets, reducing the risk of putting all your money in one place.

Step 2: Know Your Investment Goals and Risk Tolerance

Different types of mutual funds cater to various investment goals and risk tolerances. Axis Mutual Fund offers a wide range of schemes, including equity funds, debt funds, and hybrid funds. Identify your short-term and long-term financial goals, and assess your risk tolerance. Are you comfortable with higher-risk investments for potentially higher returns, or do you prefer more stable, lower-risk options? This will help you choose the right type of mutual fund.

Step 3: Complete the Know Your Customer (KYC) Process

To invest in Axis Mutual Fund offline, you will need to complete the Know Your Customer (KYC) process. This is a one-time process and can be done by submitting the necessary documents to a KRA-registered intermediary, such as a Mutual Fund distributor or a bank branch. The documents typically required include identity proof (such as a PAN card, Aadhaar card, or passport) and address proof.

Step 4: Fill Out the Investment Application Form

Once you have completed the KYC process, you can invest in Axis Mutual Fund offline by filling out an investment application form. This form can be obtained from an Axis Bank branch or an authorised Mutual Fund distributor. Provide all the necessary details, including your personal information, investment amount, and choice of scheme.

Step 5: Submit the Application Form and Make the Investment

Submit the completed application form to the bank branch or Mutual Fund distributor, along with a cheque or demand draft for the investment amount. They will guide you through the process and provide you with the necessary support. Make sure to review the scheme's details, such as the fund's investment objective, performance, and associated risks, before finalising your investment.

Step 6: Monitor Your Investment

After investing in Axis Mutual Fund, it's important to regularly monitor your investment's performance. You can do this by checking the Net Asset Value (NAV) of the fund, comparing its returns with benchmarks and peer funds, and reviewing its historical performance. Staying informed about your investment helps you make timely decisions and ensure it aligns with your financial goals.

Vanguard Index Funds: Smart, Secure, Long-Term Investment Options

You may want to see also

How to choose the best Axis Mutual Fund for you

Axis Mutual Fund, or Axis Asset Management Company Ltd, is the investment wing of Axis Bank, one of India's largest private banks. The company offers a wide range of mutual fund schemes, including equity, debt, and hybrid funds, with a focus on long-term wealth creation and relationship-building. Here are some key considerations to help you choose the best Axis Mutual Fund for your investment goals:

- Investment Goals: Define your short-term and long-term financial goals. This will help you select funds with investment tenures that align with your timelines. For instance, if you are planning for retirement or saving for a second home, consider a pure equity fund. For shorter-term goals, such as a foreign trip in a couple of years, a hybrid or debt fund may be more suitable.

- Risk Tolerance: Assess your risk appetite and choose funds that match your comfort level. If you have a low to moderate risk tolerance, debt funds or schemes with low-risk profiles may be preferable to minimise potential losses.

- Performance: Evaluate the performance of the fund house and specific schemes. Analyse how the funds have performed over different time periods, especially over the long term. Compare the consistency of annual returns and consider factors like expense ratios and exit load fees.

- Investment Strategy: Understand your investment strategy and choose funds that align with it. For example, if you want to invest in a specific sector or theme, consider sectoral/thematic funds. If you want to track a particular market index, consider index funds.

- Diversification: Diversifying your portfolio across different asset classes and investment types can help manage risk. Axis Mutual Fund offers a range of schemes, including equity, debt, hybrid, index, gold, and international funds, allowing you to spread your investments.

- Expertise: Research the fund managers and their expertise. Axis Mutual Fund has several experienced fund managers with strong track records in their respective fields. Their specialisations can help you choose funds that align with your goals.

- Minimum Investment and Duration: Different Axis Mutual Fund schemes have varying minimum investment amounts and durations. Consider your financial situation and goals when making your choice. For example, if you are a young investor, starting with a lower monthly investment and increasing it over time may be a suitable strategy.

By carefully considering these factors, you can choose the best Axis Mutual Fund scheme that aligns with your financial goals, risk tolerance, and investment strategy. Remember to review your investments periodically and seek expert advice if needed to make informed decisions.

Uncover Mutual Fund Investments: PAN Power

You may want to see also

How to redeem your Axis Mutual Fund units

Redeeming your Axis Mutual Fund units is a straightforward process, and you have the option of doing it online or offline. Here's a step-by-step guide on how to redeem your Axis Mutual Fund units:

Online Redemption:

- Log into your mutual fund account on the respective platform, such as the Axis Mobile app or Axis Internet Banking.

- Select the Axis Mutual Fund you wish to redeem.

- Choose the redemption option.

- Enter the number of units or the specific amount you want to redeem. You can choose between a unit-based or amount-based redemption, depending on your preference.

- Verify the details to ensure accuracy.

- Confirm the transaction to complete the redemption process.

- The redeemed amount will be credited to your linked bank account. Make sure your bank branch is enabled for RTGS/NEFT to receive the funds.

Offline Redemption:

- Visit the Axis Bank branch office.

- Fill out a transaction slip, which you can download from the Axis Mutual Fund website or find at the bottom of your account statement.

- Submit the transaction slip to the branch.

- If you invested through an online portal, you can also redeem your mutual fund units from the same platform.

Redemption through Asset Management Company (AMC) or Distributors:

- Contact the Asset Management Company (AMC) or an authorised distributor.

- Provide your folio number and the amount or number of units you wish to redeem.

- Submit your redemption request.

- Within a few business days, the redeemed funds will be credited to your registered bank account.

Redemption through Registrar and Transfer Agencies:

- Registrar and transfer agencies like CAMS and KFinTech also facilitate Axis Mutual Fund redemptions.

- You can fill out and submit the redemption form online or visit a branch in person to initiate the redemption process.

- Provide your folio number and specific details of the redemption.

- The agency will process your redemption request.

Systematic Withdrawal Plan (SWP):

If you want to set up a periodic withdrawal plan, you can opt for a Systematic Withdrawal Plan (SWP). This allows you to receive a fixed amount regularly from your Axis Mutual Fund investment. It is beneficial if you need a steady income stream.

Important Considerations:

- Redemption proceeds for liquid or debt-oriented units are typically paid within 1-2 working days, while equity mutual funds may take 4-5 working days.

- Most equity-oriented schemes have an exit load of 1% if redeemed before one year from the purchase date.

- When calculating the approximate value of your investments, multiply the number of units you hold by the Net Asset Value (NAV) of that particular scheme on that day.

- The redemption amount depends on the NAV and the number of units you are redeeming.

Pension Funds' Investment Choices: What, Why, and How?

You may want to see also

How to increase your SIP amount in an Axis Mutual Fund

Investing in mutual funds is a great way to save and grow your money. Axis Mutual Fund is the mutual fund investment wing of Axis Bank, one of India's largest private banks. If you are already investing in an Axis Mutual Fund through a Systematic Investment Plan (SIP), you may want to consider increasing your SIP amount over time. Here are some reasons and ways to do that:

Reasons to Increase Your SIP Amount

- Counter Inflation: Inflation erodes the purchasing power of your money over time. Increasing your SIP amount helps you counter inflation and maintain the value of your investments.

- Build a Bigger Corpus: By investing a higher amount, you can take advantage of compound interest, which leads to higher returns and helps you build a larger corpus over time.

Ways to Increase Your SIP Amount

- Step-up or Top-up: You can increase your SIP amount annually by a fixed rupee amount or a fixed percentage. For example, if your monthly SIP is Rs. 10,000, you can increase it by Rs. 1,000 or 10% every year.

- Review and Rebalance: Even if you opt for a step-up SIP, regularly review your portfolio and rebalance it if needed. Consult your financial advisor to discuss the asset allocation that suits your requirements.

- Increase with Income: When you receive a salary increase, consider adjusting your SIP amount accordingly. This way, you save and invest a portion of your additional income.

Practical Steps to Increase Your SIP Amount in Axis Mutual Fund

- If you are investing in Axis Mutual Fund through the Axis Mobile app or Axis Internet Banking, log in to your account.

- Locate the SIP settings for your chosen mutual fund scheme.

- Follow the instructions to increase your SIP amount. You may need to provide a manual request or mandate to increase the amount.

- Alternatively, you can contact Axis Bank customer support or visit a branch to increase your SIP amount.

Remember, increasing your SIP amount in an Axis Mutual Fund is a strategic decision that should consider your financial goals, risk tolerance, and market conditions. Consult a financial advisor to ensure your investment decisions align with your overall financial plan.

Key Factors for Choosing the Right Mutual Fund Investments

You may want to see also

Frequently asked questions

You can invest in Axis Mutual Fund's schemes in three ways: 1) Through the Axis MF's website, 2) Through a distributor, or 3) Through the ET Money platform.

You must create an account on the website if you are a new customer. If you are an existing customer, you can simply log into your account with your user ID and password.

Sign up using email and OTP, select the fund, enter the investment amount, choose the investment type, enter PAN, full name, and verify the mobile number, enter bank account details and select the payment mode, and follow the KYC process.

The documents for KYC (Know Your Client) include proof of address and proof of identity. Here is a list of officially valid documents (OVD) admissible: PAN Card (Mandatory), any other valid identity card issued by Central or State Government, bank account statement or bank passbook, and utility bills like electricity or gas bills.

It takes about 3-5 working days to get your KYC verified as the verification is done by government-certified agencies.

Axis Mutual Fund offers schemes across categories like debt, equity, hybrid, index, gold, and international funds. Some of its top schemes are Axis Small Cap Fund, Axis Mid Cap Fund, Axis Dynamic Bond Fund, Axis Gold Fund, Axis Flexi Cap Fund, and Axis Equity Hybrid Fund.