Investing in opportunity zones is a way to revitalise distressed communities while saving on taxes. The 2017 Tax Cuts and Jobs Act established a tax rule that allows investors to defer their capital gains taxes by reinvesting their capital gains into qualified opportunity funds (QOFs). QOFs are investment vehicles that aim to drive business and real estate investments towards low-income or economically distressed areas of a country. To become a QOF, an eligible corporation or partnership elects to self-certify by annually filing Form 8996 with its federal income tax return.

To invest in a QOF, you must first identify an existing fund that is raising opportunity zone equity from investors. These funds are typically private placement funds that do not trade publicly on an exchange. As a result, shares or interests in QOFs are not available at a brokerage like traditional stocks or bonds. Instead, they are similar to private equity or private equity real estate funds.

Most QOFs are only open to accredited investors, which means having a net worth of $1 million or an annual income of at least $200,000. These investors are usually required to provide proof of their accredited status to the QOF manager. Once you've found a suitable QOF and met the eligibility criteria, you can then invest your capital gains and take advantage of the tax benefits offered by the fund.

| Characteristics | Values |

|---|---|

| Purpose | To provide tax incentives for investors to invest in economically distressed communities |

| Type of investment | Real estate or startup businesses |

| Tax benefits | Deferral of capital gains tax liability, 100% tax-free gain on investment if held for 10 years |

| Time requirements | 180 days to invest eligible gains, hold investment for at least 5 years for 10% tax basis increase, 7 years for 15% increase, 10 years for tax-free gains |

| Investment options | Single-asset or multi-asset funds, specific sectors or diversified portfolio, single city or region, or national |

| Investor requirements | Accredited investor with annual income of $200,000+ or net worth of $1 million+ |

| Investment minimums | $50,000 to $1 million |

What You'll Learn

Understand the tax benefits of investing in Opportunity Zones

Opportunity Zones are tax incentives designed to encourage investors with capital gains to invest in low-income and undercapitalized communities. The Opportunity Zone program was established by the 2017 Tax Cuts and Jobs Act to spur investment in undercapitalized communities by providing tax benefits.

There are three main tax benefits offered by the Opportunity Zone program:

- Temporary deferral of taxes on capital gains: Investors can defer taxes on capital gains by investing in a Qualified Opportunity Fund (QOF). Taxes on the invested gains can be deferred until December 31, 2026, or until the investment is disposed of, whichever comes first.

- Basis step-up of previously earned capital gains: If investors hold their investment in a QOF for at least 5 years, they receive a 10% step-up in tax basis. If they hold the investment for at least 7 years, they receive an additional 5% step-up, resulting in a total of 15% increase in tax basis.

- Permanent exclusion of taxable income on new gains: If investors hold their investment in a QOF for at least 10 years, they pay no taxes on any capital gains produced through their investment.

It is important to note that these tax benefits are available only when investors retain their investment in a Qualified Opportunity Fund for the specified time frames. Additionally, only capital gains or qualified 1231 gains recognized for federal income tax purposes prior to January 1, 2027, are eligible for these tax benefits.

By investing in Opportunity Zones, investors can benefit from tax deferral and potential tax savings while also contributing to the economic development and job creation in distressed communities.

Best Funds to Invest in Right Now

You may want to see also

Know the eligibility criteria for Opportunity Zone Funds

To be eligible for tax benefits, investors must invest their capital gains directly into a Qualified Opportunity Fund (QOF) instead of an Opportunity Zone. QOFs are investment vehicles structured as REITs or partnerships, with the specific objective of investing in opportunity zone assets.

To be eligible, a QOF must:

- File either a partnership or corporate federal income tax return.

- Be organised for the purpose of investing in Qualified Opportunity Zone property.

- Invest in Qualified Opportunity Zone businesses.

- Hold and invest at least 90% of its assets in Qualified Opportunity Zone properties.

QOFs are only eligible for tax benefits if they invest in Qualified Opportunity Zones (QOZ). These are economically distressed communities where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as QOZs if they have been nominated for that designation by a state, the District of Columbia, or a U.S. territory, and that nomination has been certified by the Secretary of the U.S. Treasury via their delegation of authority to the Internal Revenue Service (IRS).

To be eligible for tax benefits, investors must invest their capital gains into a QOF within 180 days of the gain being recognised. Only capital gains or qualified 1231 gains (gains on certain types of business properties) recognised for federal income tax purposes before January 1, 2027, will count. These gains cannot be generated from transactions with a related person.

Depending on the QOF, investors may need to be accredited. This means having earned income of at least $200,000 in each of the past two years ($300,000 with a spouse) and a net worth, alone or with a spouse, of at least $1 million in investable assets.

To become a QOF, an eligible corporation or partnership must elect to self-certify by annually filing Form 8996 with its federal income tax return.

A Beginner's Guide to Mutual Fund Investing in India

You may want to see also

Find out where Opportunity Zones are located

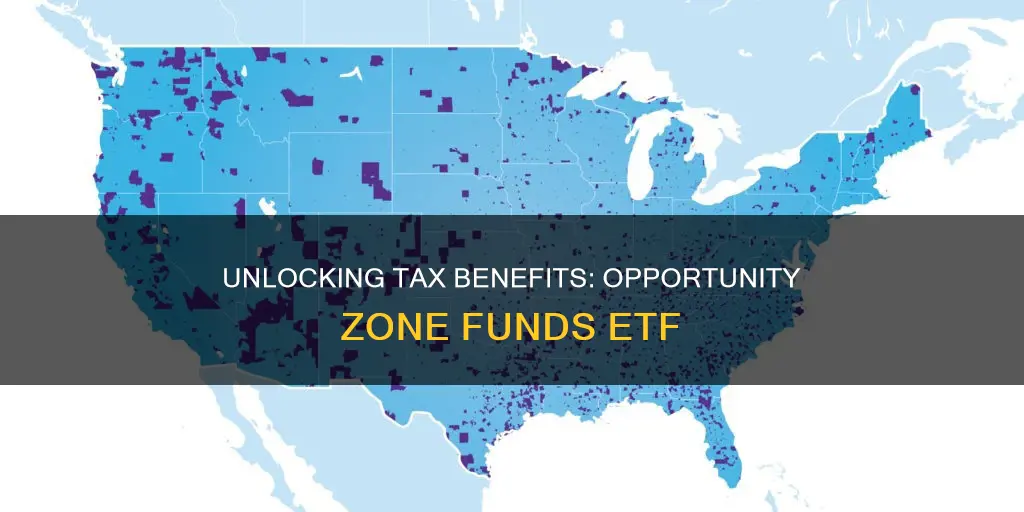

To find out where Opportunity Zones are located, you can refer to the official list provided by the U.S. Department of Housing and Urban Development (HUD). This list includes all the designated Opportunity Zones across the United States and its territories. Additionally, you can utilise interactive maps available online, such as the one provided by OpportunityZones.com, which allows you to search for Opportunity Zones by address or city.

There are currently 8,764 Opportunity Zones in the United States, including the District of Columbia and U.S. territories. States with the highest number of Opportunity Zones include California, Texas, New York, Florida, and Illinois, accounting for nearly one-third of the total. Puerto Rico is a notable outlier, with 863 Opportunity Zones, second only to California, due to its special status following extensive hurricane damage in 2017.

When identifying Opportunity Zones, it is important to understand the criteria for their designation. Opportunity Zones are located in low-income communities or certain neighbouring areas, as defined by population census tracts. States nominate these communities, and the U.S. Department of the Treasury certifies these nominations. The number of Opportunity Zones in each state is correlated with the total population of the state.

Crowdfunding Real Estate: Getting Investors for Your Property Empire

You may want to see also

Learn how to create your own Opportunity Fund

To create your own Opportunity Fund, you must first identify a qualified opportunity zone (QOZ) to invest in. These zones are designated by each state and certified by the U.S. Treasury Department. They are economically distressed areas that are in need of stimulus and can be found in all 50 states, Washington, D.C., and U.S. territories.

Once you have identified a QOZ, you can establish a qualified opportunity fund (QOF) by filing Form 8996 with your federal income tax return. This form certifies individuals, partnerships, or corporations as organizations for investing in QOZs. A QOF must be structured as a REIT or partnership and must hold and invest at least 90% of its assets in QOZ properties and businesses.

When creating your own QOF, it is important to consider the structure of the fund. It can be set up as an LLC, a C-Corp, or an S-Corp, each with its own pros and cons. You should also be aware of the compliance issues and regulations that come with forming a QOF, such as the substantial improvement test, the 90% asset test, and the gross income test.

Additionally, it is important to note that only capital gains can be invested in QOFs. These gains can come from the sale of stocks, real estate, businesses, cryptocurrency, art, or other investments. Ordinary income, such as wages, interests, and dividends, cannot be invested in a QOF.

By creating your own Opportunity Fund and investing in QOZs, you can take advantage of the tax benefits offered by the Tax Cuts and Jobs Act of 2017. These benefits include the deferral of capital gains taxes until December 31, 2026 (possibly extended to 2028), and the possibility of 100% tax-free gains on investments held for 10 years or more.

Mutual Funds 101: Best Places to Invest for Beginners

You may want to see also

Compare investing in Opportunity Zones with 1031 Exchanges

Investing in Opportunity Zones vs. 1031 Exchanges

Both Opportunity Zones and 1031 Exchanges are tax-saving mechanisms for investors. However, they differ in several ways. Here is a comparison of the two:

Time Sensitivity

Opportunity Zones are time-sensitive, whereas 1031 Exchanges are not. The Opportunity Zones program, established in 2017, allows investors to defer capital gains taxes until 2026 or 2027. To take advantage of the full tax benefits, investments need to be made by specific deadlines. In contrast, 1031 Exchanges have been around since 1921 and do not have similar time constraints.

Investment Types

Opportunity Funds can invest in both businesses and properties, while 1031 Exchanges are limited to real estate, specifically "real property" excluding residential homes. This means that 1031 Exchanges are typically used for commercial real estate. Opportunity Funds, on the other hand, must invest in properties or businesses located within designated Opportunity Zones, which are low-income or economically distressed communities.

Tax Benefits

Both Opportunity Zones and 1031 Exchanges offer tax deferral benefits. However, Opportunity Zones can provide more significant tax savings over time. With Opportunity Zones, investors can reduce their tax liability by 10% if they invest for more than five years, and by 15% if they invest for around seven years. Additionally, if investors hold their investment for at least ten years, they can completely eliminate capital gains taxes. With 1031 Exchanges, investors can defer capital gains taxes by exchanging one investment property for another, but they will eventually need to pay the full capital gains tax when they sell the new property.

Investment Control

With 1031 Exchanges, investors have more control over their investments as they can select the next investment property and are not limited geographically. In contrast, with Opportunity Zones, investors have less control as their money is invested in a fund that makes decisions on where to invest within the designated zones.

Investor Requirements

1031 Exchanges do not have specific investor requirements. However, Opportunity Zone Funds may require investors to be accredited, meaning they have a certain level of income or net worth. Additionally, Opportunity Zone investments are typically long-term, so investors need to be prepared to keep their capital invested for up to ten years to maximize tax benefits.

In summary, Opportunity Zones offer the potential for greater tax savings over time, particularly if investors are willing to commit to a long-term investment in designated low-income communities. On the other hand, 1031 Exchanges provide more flexibility in terms of investment type and timing but may not offer the same level of tax savings. The best option depends on the investor's goals, risk appetite, and investment strategy.

Best Vanguard Index Funds to Invest $1000 Minimum

You may want to see also

Frequently asked questions

A Qualified Opportunity Fund (QOF) is an investment vehicle that files either a partnership or corporate federal income tax return and is organised for the purpose of investing in Qualified Opportunity Zone Property.

The benefits of investing in a Qualified Opportunity Fund include tax deferral and tax-free investing. Capital gains taxes are deferred until December 31, 2026, and if the investment is held for at least 10 years, there is no tax on appreciation.

To invest in a Qualified Opportunity Fund, you must first identify an existing fund that is raising Opportunity Zone equity from investors. Most Qualified Opportunity Funds are private placement funds that do not trade publicly on an exchange. Therefore, shares or interests in these funds are not available at a brokerage and must be purchased directly from the fund manager.