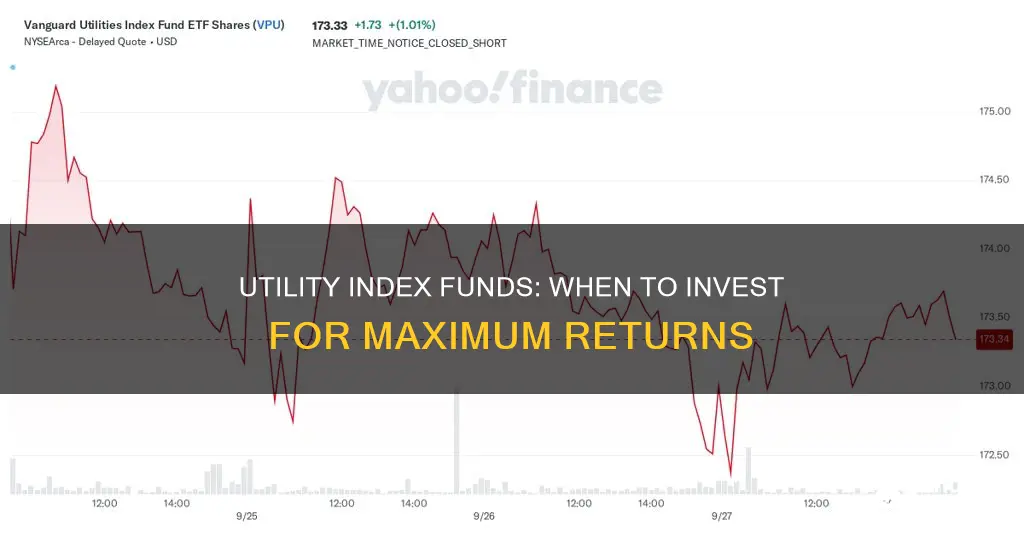

Utility index funds are a type of investment fund that tracks the performance of a specific market index, such as the S&P 500. These funds are designed to provide investors with a diversified portfolio of stocks or bonds that match the composition of the chosen index. When investing in utility index funds, it is important to consider factors such as the fund's historical performance, dividend yield, expense ratio, and the specific companies within the fund's portfolio. One of the key advantages of utility index funds is their low volatility and stable demand, making them an attractive option for investors seeking reliable income and lower risk.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment objective | Long-term growth |

| Risk | Lower than individual stocks |

| Returns | Reliable dividend income |

| Performance | Good relative returns |

| Management | Passively managed |

| Fees | Lower fees than actively managed funds |

| Taxation | Tax advantages |

What You'll Learn

- Utility funds are a safe investment during a recession

- Natural gas utilities have a better growth trajectory than other utilities

- Utility funds are a good option for long-term investors

- Utility funds are a good option for investors seeking lower volatility

- Utility funds are a good option for investors seeking reliable dividend income

Utility funds are a safe investment during a recession

Utility funds are a good defensive strategy against inflation or recession. They offer reliable dividend income, which can beat other defensive options such as CDs or bonds. Utility stocks have historically provided good relative returns, and the sector has demonstrated above-average growth in EPS (earnings per share).

Additionally, utility companies are often natural monopolies, with no direct competitors, so they are largely immune to softening sales, demand issues, price volatility, and competition. Many utility companies also provide stable and expanding dividends, making them an attractive investment option.

When considering utility funds, investors should look at the fund's historical performance, dividend yield, the specific companies within the fund, expense ratios, and how the fund has performed in both bear and bull markets.

Overall, utility funds are a smart choice for investors seeking stable and reliable investments, especially during a recession.

Pension Funds: Exploring Their Diverse Investment Strategies

You may want to see also

Natural gas utilities have a better growth trajectory than other utilities

Utility funds are considered a safe-haven sector as the demand for their services is stable, even during a recession. They are a good investment option as they provide reliable dividend income, act as a defensive guard against inflation or recession, and offer good relative returns.

The following factors contribute to the long-term growth potential of natural gas:

- Growing demand for clean fossil fuels: Natural gas is recognised for its role in backup and resiliency, and there is a push for a transition to net-zero carbon emissions.

- Vast domestic supply: The US has a vast supply of natural gas, with production expected to remain relatively unchanged in the coming months.

- Increase in US exports: US exports of liquefied natural gas (LNG) are expected to rise in 2025, contributing to an overall increase in natural gas prices.

- Stability during volatile markets: Natural gas is seen as a stable investment option, even during volatile market conditions.

The Hennessy Gas Utility Fund is a leading natural gas mutual fund that offers potential for growth, a focus on distribution, and historically steady dividend payouts.

Index Funds: Understanding Their Typical Investment Strategies

You may want to see also

Utility funds are a good option for long-term investors

Utility funds also offer good relative returns. During the first quarter of 2020, utility stocks fell less than the overall market and outperformed the S&P 500. They have also demonstrated above-average growth in earnings per share (EPS) since 2015.

Additionally, utility funds provide long-term earnings visibility, making it easier for investors and fund managers to analyze companies and the sector as a whole. The companies in this sector can also give EPS and capital expenditure targets for up to five years.

When investing in utility funds, it is important to consider your investment objectives. If you are a long-term investor, you may prefer utility funds and exchange-traded funds (ETFs) that focus on paying dividend income. These funds can provide a steady income stream over time, making them a good option for those seeking consistent returns with lower risk.

Overall, utility funds offer a combination of reliability, stability, and potential for solid returns, making them a suitable choice for long-term investors.

Closed-End Funds: When to Invest for Maximum Returns

You may want to see also

Utility funds are a good option for investors seeking lower volatility

Utility funds offer a diversified portfolio of stocks, bonds, or other securities in the utilities sector, which includes companies providing essential services such as electricity, gas, and telephone services to homes and businesses. By investing in utility funds, individuals can mitigate the risk associated with picking individual stocks and benefit from a professionally managed portfolio.

The COVID-19 pandemic is a testament to the resilience of the utilities sector. While many industries experienced volatility, the utilities sector remained relatively unaffected, and its long-term outlook remains positive. This stability makes utility funds an attractive option for investors seeking lower volatility in their portfolios.

Additionally, utility companies can maintain their profit margins during inflationary periods by passing on higher fuel costs to end-users. This ability to adjust pricing ensures that utility funds can provide stable returns even in challenging economic conditions.

When considering utility funds, investors should evaluate factors such as historical performance, dividend yield, the companies within the fund, expense ratios, and the fund's performance in both bull and bear markets. By including utility funds in their portfolios, investors can benefit from lower volatility and reliable income, making it a strategic choice for those seeking stable and less risky investment options.

Vanguard Mutual Funds: Are They Worth the Investment?

You may want to see also

Utility funds are a good option for investors seeking reliable dividend income

One of the key advantages of investing in utility funds is the reliable dividend income they offer. These funds typically provide dividend yields of 1-3%, which may be higher than other defensive investment options such as CDs or bonds. Additionally, utility companies are able to maintain their profit margins even during periods of inflation or recession by passing on higher fuel costs to their customers. This makes utility funds a defensive investment strategy that can provide a hedge against economic downturns.

Another benefit of utility funds is their long-term earnings visibility. Utilities are able to provide earnings and capital expenditure targets for 3-5 years, making it easier for investors and fund managers to analyze and predict the performance of the sector. This stability and predictability make utility funds an attractive option for investors seeking reliable dividend income.

When considering utility funds, it is important to keep in mind that they may have lower returns compared to other sectors during bull markets. However, their defensive nature and stable dividend income make them a strong choice for investors seeking consistent returns with relatively lower volatility.

Overall, utility funds offer a compelling opportunity for investors seeking reliable dividend income. With their stable demand, ability to maintain profit margins, and long-term earnings visibility, utility funds can provide a steady source of income for investors, especially during challenging economic conditions.

Protect Your 401k: Invest in Mutual Funds for a Secure Future

You may want to see also

Frequently asked questions

Utility funds consist of a portfolio of stocks, bonds, or other securities in the utilities sector. They provide investors with reliable income and stock price appreciation potential with relatively lower volatility.

The utilities sector is considered a "safe-haven sector" as the demand for these services remains stable even during a recession. Utility funds offer reliable dividend income, act as a defensive guard against inflation or recession, and provide good relative returns.

Investors should first be clear about their investment objectives. Consider factors such as the fund's historical performance, dividend yield, the companies within the fund's portfolio, expense ratio, and the fund's performance in both bear and bull markets.

While utility funds are considered less risky than other investments, they are still subject to market volatility and broader economic conditions. Additionally, the passive nature of index funds means they may not be able to pivot away when the market shifts.