Index funds are a popular investment choice for Americans. In 2024, 62% of US adults invested in the stock market, and most Americans hold stocks indirectly through mutual funds, index funds, or retirement accounts. Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a passive investment strategy, meaning they aim to replicate the performance of an underlying index without active management. This makes them a low-cost, diversified, and relatively safe investment option.

| Characteristics | Values |

|---|---|

| Percentage of Americans investing in the stock market | 62% |

| Percentage of Americans investing in the stock market pre-Great Recession | 65% |

| Percentage of Americans who own stocks | 62% |

| Percentage of American families that hold stock | 58% |

| Percentage of American families that directly hold stock | 21% |

What You'll Learn

Index funds are a low-cost, easy way to build wealth

Index funds are a great investment for building wealth over the long term. They are a low-cost, easy way to build wealth and are therefore popular with retirement investors.

Index funds are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500. An index fund will be made up of the same investments that make up the index it tracks. This means the performance of the index fund usually closely mirrors that of the index, without the need for hands-on management.

Index funds are passively managed, meaning they don't need to actively decide which investments to buy or sell. They are often used to balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared to individual stocks.

Index funds are also a great option for beginners. They are a simple, cost-effective way to hold a broad range of stocks or bonds that mimic a specific benchmark index, meaning they are diversified. They also have lower expense ratios than most actively managed funds and often outperform them.

- Have a goal: Know what you want your money to do for you. If you're looking for a short-term option, you may be more interested in certificates of deposit, savings accounts, or money market funds. If you're looking to let your money grow slowly over time, index funds may be a great investment for your portfolio.

- Research index funds: Consider the company size and capitalization, geography, business sector or industry, asset type, and market opportunities.

- Pick your index funds: Oftentimes, this comes down to cost. While index funds are low-cost, don't assume that all index mutual funds are cheap. They still carry administrative costs, which are subtracted from each fund shareholder's returns as a percentage of their overall investment.

- Decide where to buy your index funds: You can purchase an index fund directly from a mutual fund company or a brokerage.

- Keep an eye on your index funds: While index funds are easy to use and their diversity is a benefit, passive management doesn't mean you should completely ignore your index fund. Check that the fund is doing its job by mirroring the performance of the underlying index.

Mutual Fund Investments: Where to Show Them in Your ITR

You may want to see also

Index funds are less risky than individual stocks

Around 62% of U.S. adults, or about 162 million Americans, own stocks. Index funds are a popular investment vehicle for Americans, offering a low-cost, diversified, and relatively safe way to build wealth over time.

Index funds are considered less risky than individual stocks due to several key factors:

Diversification

Index funds provide instant diversification by allowing investors to own a basket of stocks across different companies, sectors, and industries. By investing in an index fund, an investor's portfolio is not dependent on the performance of a single stock or a small group of stocks. This diversification reduces the risk of significant losses that could occur from investing in individual stocks.

Lower Volatility

Because index funds track a broad market index, they tend to exhibit lower volatility compared to individual stocks. The performance of an index fund is an average of the returns of all the stocks in the index. While individual stocks can be more volatile and subject to wider price swings, index funds benefit from the stabilizing effect of diversification, resulting in less volatile returns.

Passive Management

Index funds employ a passive management strategy, meaning they aim to replicate the performance of a specific market index rather than trying to beat the market. This passive approach eliminates the need for active fund management, reducing costs and minimizing the impact of human emotions and biases on investment decisions.

Lower Fees

Index funds have lower expense ratios compared to actively managed funds. The fees for index funds are typically lower because they require less active management and administrative costs. Lower fees mean that a larger portion of the returns stays with the investor, enhancing overall investment performance.

Long-Term Performance

Historically, broad market indexes, such as the S&P 500, have delivered solid long-term returns. The S&P 500, for example, has averaged annual returns of about 10% over the long term. While past performance does not guarantee future results, index funds that track these well-diversified indexes tend to provide more consistent returns over time.

Reduced Risk of Total Loss

The possibility of losing your entire investment in an index fund is extremely low. For an index fund to lose all its value, every stock in the index would have to go to zero, which is highly improbable. The diversification inherent in index funds significantly reduces the risk of a total loss.

Vanguard Target Retirement Funds: Choosing Your Investment Strategy

You may want to see also

Index funds are popular with retirement investors

Index funds are a popular investment choice for retirement investors due to their low costs, diversification benefits, and long-term performance. Here are 4-6 paragraphs explaining why index funds are popular with retirement investors:

Index funds have gained widespread popularity among investors, including those saving for retirement. One of the primary reasons for their appeal is their low cost. Index funds are passively managed, meaning they aim to replicate the performance of a specific market index without actively picking stocks or timing the market. This passive approach results in lower fees and expenses compared to actively managed funds. Index funds typically have lower expense ratios, which are the annual management fees charged by the fund. Additionally, index funds have lower transaction costs since they trade less frequently. As a result, investors in index funds benefit from reduced costs, which can lead to higher returns over time.

Another reason for the popularity of index funds among retirement investors is diversification. Index funds provide exposure to a broad range of stocks or bonds by tracking a market index such as the S&P 500 or the Nasdaq Composite Index. This diversification helps reduce risk and increase the expected returns of the portfolio. By investing in an index fund, retirement investors can gain access to a diversified portfolio of hundreds of financial securities across various sectors and asset classes. This diversification benefit is especially valuable for those saving for retirement, as it provides a more stable and less risky investment option.

Index funds are also favored by retirement investors due to their long-term performance. Historically, index funds have often outperformed actively managed funds, especially after accounting for fees and expenses. The S&P 500, for example, has delivered positive returns over long periods, with an average annual return of about 10%. This consistent performance makes index funds attractive for retirement investors who are seeking steady, long-term growth for their savings.

Additionally, index funds offer simplicity and ease of use. They are straightforward investment options, making them accessible to both new and experienced investors. Retirement investors often appreciate the simplicity of index funds, which require less time and effort to manage compared to actively picking stocks or hiring a portfolio manager. Index funds are also widely available through online brokerages or investment platforms, making them convenient to purchase and monitor.

Furthermore, index funds provide retirement investors with a hands-off approach to investing. Once an investor selects an index fund that aligns with their goals and risk tolerance, there is little need for active management. Index funds are designed to mirror the performance of their underlying index, and they require minimal adjustments. This passive nature suits retirement investors who may not have the time or expertise to actively manage their investments.

Overall, index funds are popular with retirement investors because they offer a low-cost, diversified, and passive investment option with strong long-term performance. Their simplicity, broad market exposure, and reduced risk make them an attractive choice for those saving for retirement. However, it is important to remember that index funds are subject to market swings and may lack the flexibility of active management. Therefore, retirement investors should carefully consider their investment objectives and risk tolerance before choosing an index fund.

Retirement Funds: Investing in India's Future

You may want to see also

Index funds are good for beginners

Index funds are a great investment for beginners as they are a low-cost, easy way to build wealth over time. They are also a good option for beginners as they are passively managed, meaning they don't require active management or a deep understanding of financial markets.

Index funds are a type of investment fund, either a mutual fund or an exchange-traded fund (ETF), that is based on a preset basket of stocks or an index. The fund managers aim to replicate the performance of the index without active management. This passive management strategy means that index funds don't need to actively decide which investments to buy or sell, reducing costs for investors.

Index funds are popular with investors, especially beginners, because they offer a wide variety of stocks, greater diversification, and lower risk, usually at a low cost. They provide immediate diversification, as one share of an index fund based on the S&P 500 can provide ownership in hundreds of companies. This diversification reduces risk compared to owning a few individual stocks.

Additionally, index funds tend to have lower fees than actively managed funds, as they require less work. Actively managed funds rarely beat the market, and it is highly unlikely that they will do so consistently over the long term. On the other hand, index funds match the performance of the market and typically bring better returns to investors over time.

Index funds are also easy to invest in. They can be purchased directly from a mutual fund company or a brokerage, or on an exchange for ETFs. When choosing an index fund, it is important to consider factors such as company size and capitalization, geography, business sector or industry, asset type, and market opportunities.

Overall, index funds are a good option for beginners as they provide a low-cost, diversified, and relatively safe way to build wealth over time without requiring active management or a deep understanding of financial markets.

Investment Funds: Exploring Their Investment Opportunities

You may want to see also

Index funds are safer than stocks

Index funds are generally considered safer than stocks because they offer greater diversification at a lower cost. While both stocks and index funds carry risk, index funds are less risky than owning a few individual stocks because they are diversified across many stocks. Here are some reasons why index funds are considered safer than stocks:

- Diversification: Index funds provide instant diversification by allowing investors to own a wide variety of stocks across different sectors and industries. For example, an S&P 500 index fund provides ownership in 500 large US companies, so if a few companies in the index underperform, it will have a minimal impact on the overall fund.

- Lower Risk: Investing in an index fund is lower risk than investing in individual stocks because your fortunes are not tied to the outcome of a few companies. Instead, your investment is spread across a broad range of companies, reducing the impact of any single stock's performance.

- Lower Cost: Index funds are cheaper to run than actively managed funds because they are automated to follow the shifts in value of an index. This means lower fees for investors, which can add up to significant savings over time.

- Better Performance: Historically, index funds have outperformed actively managed funds over the long term. According to SPIVA, only 40% of actively managed funds beat or matched the returns of the S&P 500 in 2023.

- Passive Management: Index funds are passively managed, meaning they don't require a team of analysts and portfolio managers to decide which investments to buy or sell. This passive management strategy helps keep costs low and reduces the impact of market volatility on the fund's performance.

- Long-Term Performance: Index funds are designed for long-term investing, and over time, indexes have made solid returns. For example, the S&P 500 has had an average annual return of about 10% over the long term.

- Simplicity: Index funds are easy to invest in and don't require a lot of knowledge about investing or financial markets. They are a good option for beginners who want to participate in the overall growth of the economy and build wealth over time.

While index funds are generally safer than stocks, it's important to remember that they are not risk-free. It is still possible to lose money in an index fund, especially in the short term. Additionally, not all index funds are created equal, and some may be safer than others. When choosing an index fund, it's important to consider factors such as the fund's expense ratio, long-term performance, and the underlying index it tracks.

High-Yield Funds: Risky Business or Smart Investment Strategy?

You may want to see also

Frequently asked questions

An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the S&P 500. Index funds are passively managed, meaning they don't require active decision-making and are therefore cheaper to run.

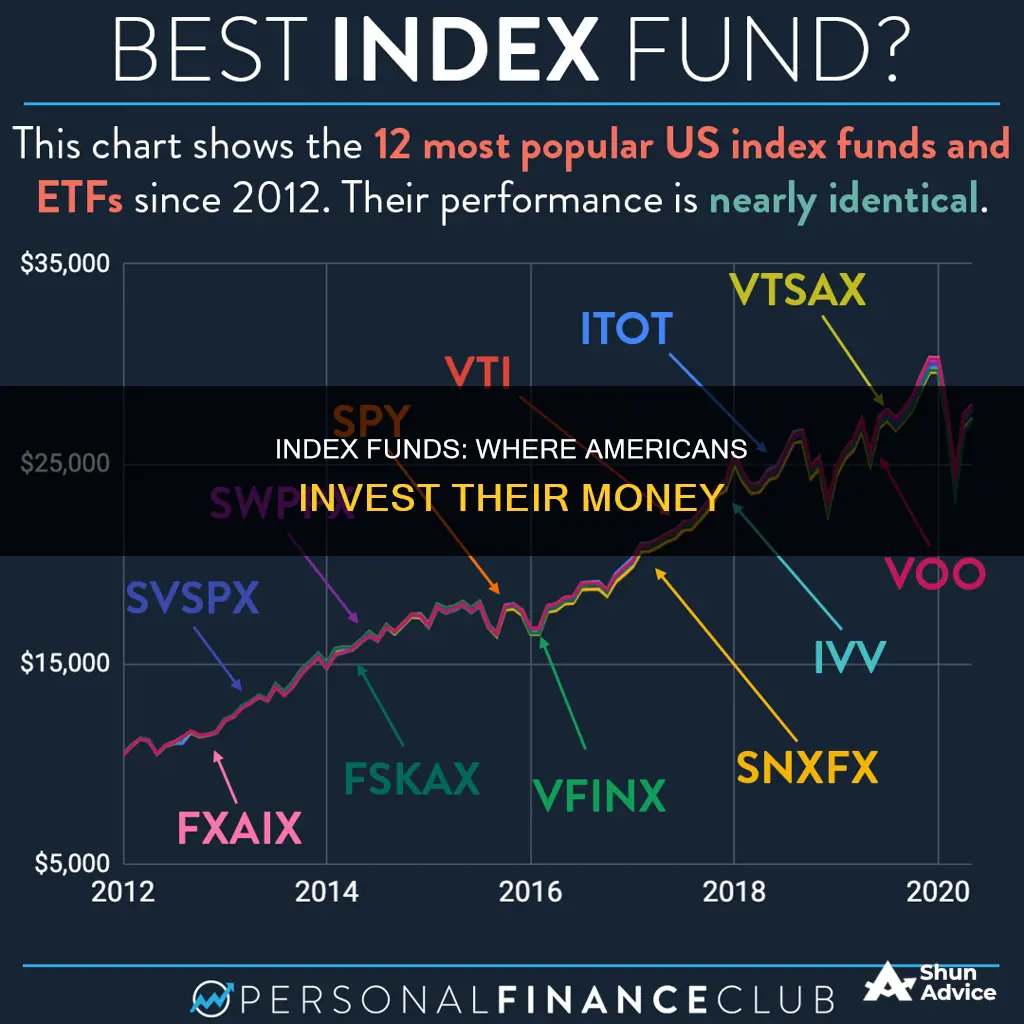

Index funds are very popular with investors. In 2023, passive index funds made up about half of all U.S. fund assets. This is a significant increase from 2012, when they accounted for just 21% of the U.S. equity fund market.

Index funds are a low-cost, easy way to build wealth. They are also less risky than investing in individual stocks because they are diversified.

It is unclear what percentage of Americans invest specifically in index funds. However, according to a Gallup survey, about 62% of U.S. adults, or 162 million people, own stock. Most Americans hold stocks indirectly through mutual funds, index funds, or retirement accounts.

Index funds are generally considered a good investment, especially for beginners. They offer a simple, cost-effective way to hold a broad range of stocks that mirror a specific market index. They also tend to outperform actively managed funds.