Index funds are a type of investment portfolio that tracks a market index, such as the S&P 500 or the ASX200. They are a popular choice for investors as they offer low fees, diversification and performance.

Index funds are considered a form of passive investing, where fund managers are not actively buying or selling assets to try to outperform the market, but instead, follow it. This means that index funds have lower costs than other types of funds.

There are two main types of index funds: exchange-traded funds (ETFs) and managed funds/mutual funds. ETFs are listed on a stock exchange and traded like shares, while managed funds are traded off-market through fund issuers.

When investing in index funds, it is important to consider your financial goals, risk tolerance and investment horizon. Additionally, it is crucial to research the different types of index funds available, as they can vary in terms of fees, credibility, and performance.

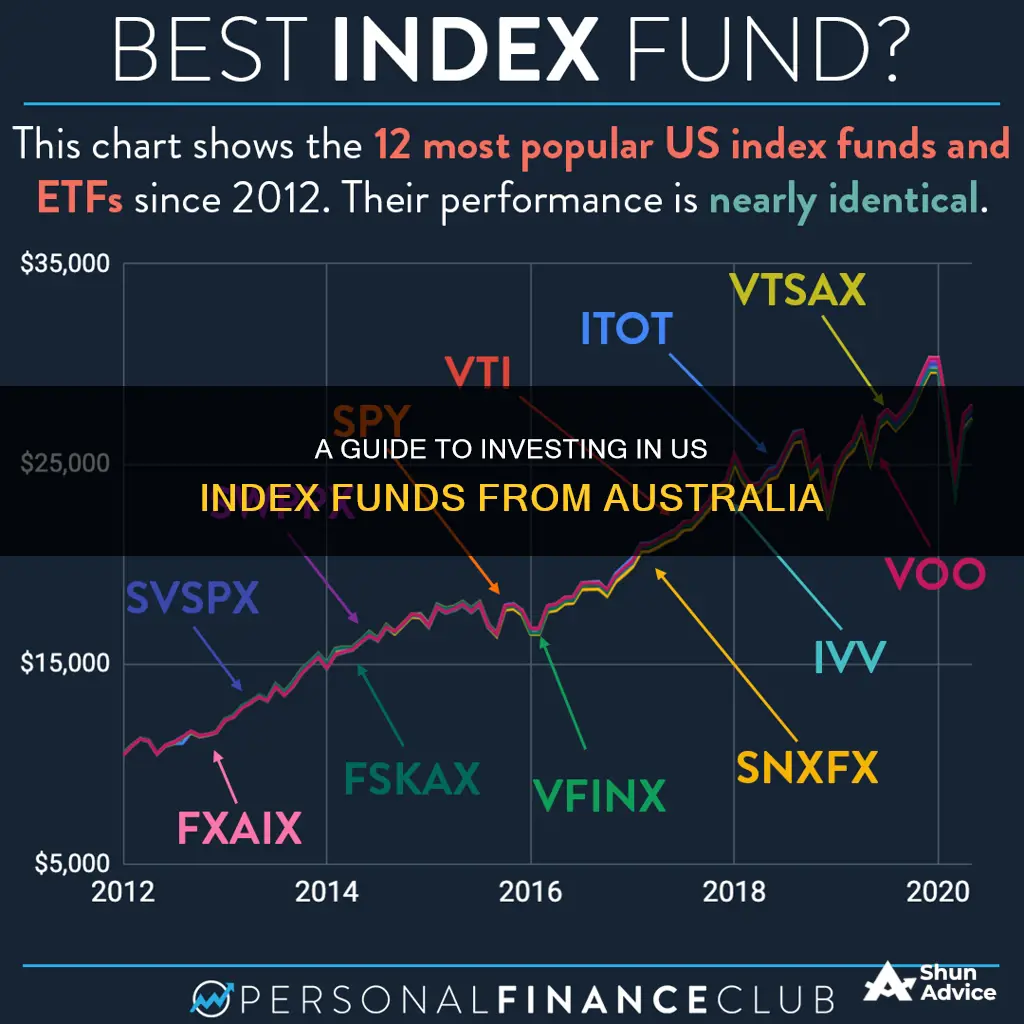

For Australian investors looking to gain exposure to the US market, investing in index funds that track the S&P 500 can be a good option. This can be done directly by purchasing shares in the companies that constitute the index, or indirectly through ETFs and managed funds.

When investing in US index funds from Australia, it is important to consider the additional costs and risks associated with currency exchange rates and tax implications.

| Characteristics | Values |

|---|---|

| Investment type | Index funds |

| Investment vehicle | Exchange-traded funds (ETFs) or managed funds/mutual funds |

| Investment aim | To replicate the returns of a specific index on a stock exchange |

| Investment strategy | Passive |

| Investment diversification | Access to a wide range of indices, including stocks and bonds, as well as global stocks |

| Investment performance | Historically, index funds have delivered better returns than professional fund managers over a longer timeline |

| Investment fees | Low fees compared to active funds |

| Investment suitability | Suitable for beginners and long-term investment strategies |

| Investment risks | Market risk, limited upside, lack of flexibility, tracking error, inflation risk |

| Investment accessibility | Available through online brokers or directly through fund providers |

What You'll Learn

How to choose a brokerage platform

When it comes to choosing a brokerage platform, there are several factors to consider to ensure you select the best one for your needs. Here are some key considerations:

- Fees and Costs: Be mindful of the various fees associated with different brokerage platforms. These can include brokerage fees, which are charged every time you buy or sell stocks or ETF units, and may be higher for US stocks. Some platforms also charge inactivity fees if you don't make a certain number of trades per year. Additionally, consider the foreign exchange fees, as converting between currencies can add up quickly.

- Features and Functionality: Different brokerage platforms offer varying features. Some may provide ETF screeners to help you find ETFs based on specific criteria. If you want any index fund dividends reinvested, ensure your chosen platform offers this option. Also, check if the platform offers access to the US markets and the specific indexes you're interested in.

- Usability and Customer Experience: Choose a platform with a user-friendly interface that is easy to navigate and suits your level of investment experience. Consider the platform's search tools, mobile app availability, and the overall user experience to ensure it aligns with your needs and preferences.

- Reputation and Reliability: Research the reputation and credibility of the brokerage platform. Look into their history, size, and customer reviews to gauge their reliability and performance track record.

- Minimum Investment Requirements: Different brokerage platforms have varying minimum investment requirements. Some may require higher minimum investments for US stocks or specific indexes, so ensure you understand the requirements before committing.

- Dividend Reinvestment Plans: If you plan to reinvest dividends, check if the platform offers a dividend reinvestment plan (DRP) and the process for enrolling in such a plan.

- Customer Support: Opt for a brokerage platform that provides responsive and knowledgeable customer support. This is crucial if you're new to investing or encounter any issues with your account or transactions.

- Security and Regulation: Ensure the brokerage platform is regulated and prioritises the security of your personal and financial information. Look for platforms that use encryption and two-factor authentication to protect your data.

- Additional Services: Some brokerage platforms offer additional services such as investment advice, portfolio management tools, or educational resources. Consider whether you would benefit from these extra services and factor them into your decision.

Remember to carefully review the terms and conditions of each brokerage platform before making your decision. It's also a good idea to consult with a financial advisor or seek guidance from experienced investors to help you navigate the different options and make an informed choice.

A Smart Guide to Investing in Dow Jones Index Funds

You may want to see also

Understanding the risks and the playbooks

Before investing in index funds, it is important to familiarise yourself with the risks and the playbooks. Here are some key considerations:

- Learn how indices are designed: Different types of indices exist, tracking various assets and using different methodologies. Common types include broad-based indices, sector-based indices, and market-cap or emerging market-based indices. Understand the specific index your chosen fund tracks and its underlying composition.

- Research index funds: Compare different index funds based on management fees, company credibility, and tracking error. Consider the fund's performance over time and how closely it has matched its underlying index. Read the Product Disclosure Statement (PDS) to understand all the risks and fees associated with the investment.

- Study the risks, fees, and dividends: Evaluate the fund's underlying assets, risk profile, and whether they align with your risk tolerance. Consider the Net Asset Value (NAV) of the fund and how it affects the value of each share. Understand the dividend policy and whether it aligns with your investment strategy.

- Choose your investment approach: You can invest in index funds through actively managed funds by applying directly to the investment management company or using a full-service stockbroker. Alternatively, you can invest in exchange-traded funds (ETFs) via online brokers, which offer more flexibility but may incur brokerage costs.

By understanding the risks and following a well-informed playbook, you can make more confident decisions when investing in index funds.

Obtaining Your Mutual Fund Investment Statement: A Guide

You may want to see also

How to buy US shares in Australia

Home to a vast array of globally dominant companies, it's no surprise that many Australian investors want to add US shares to their portfolios.

US markets are indexed in several ways, the most famous of which is the Dow Jones Industrial Average, which tracks 30 of the largest US companies. However, the S&P 500, which tracks the largest 500 listed US companies by market cap, has overtaken the Dow as the most widely used and tracked index.

The NASDAQ Composite Index is another popular index, with its top 100 holdings making up the NASDAQ-100. Many newer companies choose to list on the NASDAQ, so this index is attractive for investors looking for exposure to the tech sector.

There are several ways to buy US shares in Australia. The most direct method is to use an online broker or share trading platform to purchase shares in individual companies. The big four Australian banks all offer this service, but there are also many other providers to choose from.

Another option is to buy shares in an exchange-traded fund (ETF) that tracks a US index, such as the S&P 500 or NASDAQ-100. ETFs are a simple, cheap, and effective way to add overseas exposure to your portfolio.

Before buying US shares, it's important to be aware of the tax implications. US shares are not subject to Australia's dividend imputation system, and dividends may be subject to a 15% withholding tax. US shares are also subject to Australian capital gains tax.

Another thing to keep in mind is that US shares are traded in US dollars, so you'll need to convert your Australian dollars and be aware of any foreign exchange fees charged by your broker.

When choosing a broker, consider factors such as brokerage fees, foreign exchange fees, and whether the platform offers the features you need, such as mobile apps or advanced charting tools. It's also important to be aware of any account inactivity fees that may apply.

Finally, don't forget to fill out a W8BEN form, which allows foreign investors to claim a special tax status and avoid paying a 30% tax on share sales and dividends.

Invest in ASX Index Funds: A Comprehensive Guide

You may want to see also

Pros and cons of investing in the S&P 500

The S&P 500 is one of the most renowned stock market indices globally, offering exposure to a broad range of leading companies across various industries. Here are some of the key pros and cons of investing in the S&P 500:

Pros:

- Diversification: The S&P 500 provides instant diversification by encompassing 500 large-cap U.S. stocks from various sectors, reducing the risk associated with investing in individual stocks.

- Long-Term Growth: Historically, the S&P 500 has shown strong long-term growth potential, outperforming many other investment options. While short-term fluctuations may occur, the underlying trend has been upward, driven by the growth of the U.S. economy.

- Accessibility: The S&P 500 is accessible to a wide range of investors through index funds, exchange-traded funds (ETFs), or mutual funds, making it suitable for both individual investors and those with limited investment knowledge.

- Professional Management: The S&P 500 is professionally managed by a committee that ensures the index accurately represents the U.S. large-cap stock market. This committee regularly reviews and adjusts the index constituents, providing investors with confidence in the index's composition.

Cons:

- Market Volatility: While the S&P 500 has shown long-term growth, it is not immune to market volatility and downturns, which can result in significant declines in index value.

- Lack of Individual Stock Selection: Investing in the S&P 500 means giving up control over individual stock selection, potentially missing out on gains from stocks that outperform the broader market.

- Concentration in U.S. Stocks: The S&P 500 is heavily weighted towards U.S.-based companies, resulting in limited exposure to international markets and reduced diversification benefits from global investments.

- Inclusion of Underperforming Stocks: Despite periodic reviews, there may be instances where underperforming stocks remain in the index for a period, impacting overall performance.

How to Invest in US Index Funds from Australia

To invest in US index funds, such as the S&P 500, from Australia, you can follow these general steps:

- Choose a Platform: Select an investing platform that aligns with your goals. Compare fees, advanced features, and trading strategies offered by different platforms.

- Open an Account: Sign up with your chosen platform, providing personal and financial details and completing any necessary KYC procedures.

- Research Index Funds: Understand the financial markets and determine which index funds match your investment strategy. Consider factors such as administration fees, active or passive management, market capitalization, and historical performance.

- Fund Your Account: Once you've chosen a specific index fund, fund your investment account through the available deposit methods.

- Place an Order: Select your desired order type and amount to purchase shares in the index fund.

- Track Performance: Regularly monitor the performance of your investment to optimize your strategy, as index fund investing is typically a long-term strategy.

Renaissance Rief Fund: A Smart Investment Strategy

You may want to see also

How to invest in the S&P 500 from Australia

The S&P 500 is an index representing 500 of the largest US companies, measured by market capitalisation. It is a crucial indicator of the US stock market's health, accounting for about 80% of the total market value of US publicly traded companies.

There are two main ways to invest in the S&P 500 from Australia: directly or indirectly.

Investing directly in the S&P 500

Direct investment involves purchasing shares in the companies that constitute the index. This strategy closely aligns with the index's performance but comes with challenges. Firstly, the financial commitment is substantial, as is the case with trading fees. Secondly, maintaining a portfolio that reflects the S&P 500's composition requires frequent rebalancing, incurring additional costs and demanding significant time and resources. Lastly, for Australian investors, currency exchange risk adds another layer of complexity.

Investing indirectly in the S&P 500

Indirect investment offers a streamlined and cost-effective route. This approach involves using financial instruments such as index funds and exchange-traded funds (ETFs) to gain diversified exposure to the index's performance.

Investing via an Index Fund

Index funds are designed to replicate the performance of a benchmark index, such as the S&P 500, by holding all or a representative sample of the index's securities. These funds are 'passive' investments, following a computer algorithm's strategy rather than relying on active fund management. As a result, they have significantly lower annual management fees compared to active funds.

Investing via an ETF

ETFs offer a similar passive investment strategy to index funds but with the added flexibility of being traded on stock exchanges. This means investors can buy and sell shares of ETFs throughout the trading day at market prices. Various S&P 500 ETFs are available, including those that hedge the foreign exchange risk between the AUD and USD, eliminating currency concerns for Australian investors.

Investing via Trading Derivatives

Financial derivatives like spread betting and contracts for differences (CFDs) offer a higher-risk, higher-reward alternative. These instruments allow investors to speculate on the index's price movements without owning the underlying assets. While offering the potential for substantial profits, derivatives also carry a heightened risk of losses and are only suitable for sophisticated traders.

Steps to Invest in the S&P 500 from Australia

- Choose a broker that offers US stocks or S&P 500 ETFs.

- Provide ID and fund your account.

- Research the different ETFs and stocks available, considering your investment goals and risk tolerance.

- Select your S&P 500 index fund or stocks.

- Purchase your ETF or stocks using a "buy" order, "market order", or "limit order".

- Monitor your investment and keep an eye on the long-term performance.

A Beginner's Guide to Gold Exchange-Traded Funds

You may want to see also

Frequently asked questions

US index funds are investment vehicles that aim to replicate the returns of a specific US stock market index, such as the S&P 500. They are called passive investments because the fund manager builds a portfolio in line with an index rather than actively picking individual stocks.

US index funds offer investors a simple and cost-effective way to gain exposure to a diverse range of US companies and sectors. They are also relatively low-risk and have historically delivered better returns than professional fund managers over the long term.

Australians can invest in US index funds by purchasing shares in exchange-traded funds (ETFs) that track a US stock market index, such as the S&P 500 or the NASDAQ-100. These ETFs are available on many Australian online share trading platforms, including those run by the big four banks.