Investing in mutual funds in India can be done in two ways: directly or regularly. The former involves bypassing intermediary commissions, which can lead to increased returns on investments. This option is suited for investors who have adequate knowledge of the market and can make informed decisions about their financial goals and risk tolerance. Online platforms, KYC requirements, and fund selection based on individual objectives are all part of the process. On the other hand, the regular plan involves seeking help from a mutual fund distributor or agent, which may be beneficial for new and inexperienced investors who need guidance.

| Characteristics | Values |

|---|---|

| Investment Options | Direct Plan, Regular Plan |

| Intermediaries | None (Direct Plan), Distributor/Agent (Regular Plan) |

| Expense Ratio | Lower (Direct Plan), Higher (Regular Plan) |

| Net Asset Value (NAV) | Higher (Direct Plan), Lower (Regular Plan) |

| Investment Style | Do-it-Yourself (DIY) (Direct Plan), Assisted (Regular Plan) |

| Investment Process | Online, Offline |

| Online Investment Steps | Choose a Platform, Registration, Complete KYC, Bank Account Linking, Explore Mutual Funds, Investment Selection, Specify Amount and SIP, Payment, Confirmation and Statements, Monitor and Review |

| Offline Investment Steps | Visit Fund House or Registrar Office, Collect Application Form, Complete Application Form, Attach KYC Documents, Make Payment, Submit Form, Receive Confirmation, Check Account Statement, Monitor and Review |

What You'll Learn

Online vs offline investment

Investing in mutual funds in India can be done through online and offline modes. Both methods have their own set of advantages and considerations. Here is a detailed comparison of the two:

Online Investment

Online investment in mutual funds offers several benefits to investors. Here are some key advantages:

- Cost Savings: Direct mutual funds typically have lower expense ratios compared to regular funds as there are no distributor commissions involved. This can result in cost savings for investors over the long term.

- Higher Returns: With lower expense ratios, direct mutual funds may potentially provide higher returns to investors. More of the fund’s returns remain with the investor, leading to enhanced overall portfolio performance.

- No Distribution Commissions: Since investors directly deal with the fund house, there are no intermediary distribution commissions involved. This can lead to increased transparency and a more direct relationship between the investor and the fund.

- Ease of Online Transactions: Investing in direct mutual funds online is convenient and user-friendly. Investors can easily browse through fund options, make investments, and monitor their portfolio all from the comfort of their homes.

- Flexibility and Control: Direct investors have greater control over their investment decisions. They can choose funds based on their financial goals, risk tolerance, and investment preferences without the influence of intermediaries.

- Instant NAV: Online platforms provide real-time Net Asset Value (NAV) updates. This allows investors to know the exact value of their investments at any given time, enabling informed decision-making.

- Access to Information: Investors have direct access to detailed information about the mutual funds, including historical performance, portfolio holdings, and fund manager details. This transparency empowers investors to make well-informed decisions.

- Online Tools and Resources: Many online platforms offer tools and resources to help investors analyze their portfolios, track performance, and plan for their financial goals.

- Paperless Transactions: Investing in direct mutual funds online often involves paperless transactions, reducing paperwork and streamlining the investment process.

Offline Investment

Offline investment in mutual funds involves a more traditional approach. Here are the key considerations for offline investment:

- Physical Visit: Offline investment requires a physical visit to the nearest office of the Asset Management Company (AMC) or the registrar and transfer agent (RTA) associated with the mutual fund.

- Documentation: Investors need to collect and submit various documents, including application forms, KYC documents, and payment cheques or drafts.

- Time and Effort: The offline process can be more time-consuming and cumbersome compared to online investment, as it involves physical visits and manual documentation.

- Limited Fund Options: Offline investment may provide limited access to mutual fund schemes compared to the wide range of options available online.

- Repeat Processes: With offline investment, investors may need to repeat the registration and documentation processes for each new investment or AMC, whereas online platforms allow investors to use their KYC details across multiple investments and platforms.

In conclusion, both online and offline investment methods have their advantages and considerations. Online investment offers convenience, flexibility, and access to a wide range of fund options, while offline investment may be preferred by those who are uncomfortable with digital platforms or prefer a more traditional approach. Ultimately, the choice between online and offline investment depends on an individual's preferences, comfort with technology, and specific investment goals.

Malaysia Fund Investment: A Beginner's Guide to Getting Started

You may want to see also

Know Your Customer (KYC) requirements

KYC or Know Your Customer is a critical process for investments, including mutual funds. It ensures transparency, regulatory compliance, and the prevention of financial crimes such as money laundering.

In India, the Securities and Exchange Board (SEBI) has prescribed certain requirements under the Prevention of Money Laundering Act, 2002, for financial institutions, including mutual funds, to know their customers.

To invest in any mutual fund, an investor must be KYC compliant. The KYC process establishes an investor's identity and address through relevant supporting documents. These typically include:

- Prescribed photo ID (e.g., PAN card)

- Address proof (e.g., passport, utility bills, bank statements)

- Passport-sized photograph

The Mutual Fund Industry has appointed CDSL Ventures Limited (CVL) to carry out the KYC compliance procedure. CVL will accept KYC Application Forms, verify documents, and provide a KYC Acknowledgement. This KYC Acknowledgement must be produced to the fund where the investor desires to invest.

From 1 February 2008, any investor investing Rs. 50,000 and above was required to be KYC compliant. However, starting 1 January 2011, KYC compliance became mandatory for all categories of investors, irrespective of the amount invested.

It is important to note that KYC is a one-time process. Once an investor has completed the KYC process with a SEBI-registered intermediary, they need not undergo the same process again with another intermediary.

For Non-Resident Indians (NRIs), the KYC process involves obtaining and filling out the KYC application form, which is available on mutual fund companies' or KYC registration agencies' websites. In addition to the form, NRIs must submit a copy of their passport, a recent photograph, proof of overseas address, and a copy of their PAN card. They may also need to provide proof of their NRI status, such as a copy of their visa or work permit.

The documents must be attested by authorised entities, such as the Indian Embassy, Consulate, Notary Public, or officials from overseas branches of scheduled commercial banks registered in India. Once the form and documents are duly filled and attested, they can be submitted to the designated KYC registration agencies for verification and updating of the KYC status.

To check the KYC status, investors can visit the website of the KYC Registration Agency (KRA) where they completed their KYC registration. They will need to enter their PAN (Permanent Account Number) or other identifying details. The website will then display the KYC status, such as verified, under process, or rejected.

It is crucial to keep KYC information updated, especially with the introduction of new regulations. From the 2024-25 fiscal year, mutual fund investors must update their KYC information with their Aadhaar to purchase new mutual fund units. This is mandated by SEBI to ensure uninterrupted access to mutual fund investments.

Additionally, investors who initially invested before the widespread use of Aadhaar and provided bank account statements or utility bills as proof of address must now update their KYC details with their 12-digit Aadhaar number.

To summarise, completing the KYC process is essential for investing in mutual funds in India. It is a one-time process that enhances transparency, security, and compliance in the mutual fund investment journey.

A Guide to Investing in Indian Mutual Funds from UAE

You may want to see also

Choosing a Mutual Fund

When choosing a mutual fund, it is important to understand the differences between direct and regular mutual funds. Direct mutual funds are purchased directly from the fund house or asset management company (AMC) without involving intermediaries like brokers, distributors, or financial advisors. This eliminates the need to pay commissions or distribution fees, resulting in a lower expense ratio compared to regular plans. On the other hand, regular mutual funds are obtained through intermediaries who offer investment advice, portfolio evaluation, and transaction assistance. The fund house pays a commission or distribution fee to these intermediaries, which slightly increases the expense ratio.

- Expense Ratio: The expense ratio represents the annual fees and operating costs of a mutual fund. Direct mutual funds typically have a lower expense ratio since they exclude distribution expenses and commissions. This results in higher returns for investors.

- Investment Goals: Consider your financial goals, risk tolerance, and investment horizon. Different mutual funds cater to different investment objectives, such as growth, income, or capital preservation. Choose a fund that aligns with your financial objectives and risk profile.

- Fund Performance: Evaluate the past performance of the mutual fund, including historical returns and fund manager expertise. Consider factors such as the fund's track record, consistency, and performance relative to its peers.

- Investment Strategy: Understand the investment strategy and asset allocation of the mutual fund. Look into the types of securities the fund invests in, such as equities, bonds, or money market instruments. Ensure that the investment strategy aligns with your goals and risk tolerance.

- Fees and Charges: In addition to the expense ratio, consider other fees and charges associated with the mutual fund, such as entry and exit loads, management fees, and transaction costs. These fees can impact your overall returns.

- Reputation and Regulation: Research the reputation and regulation of the fund house or AMC. Ensure that they are registered and compliant with relevant regulatory bodies, providing an extra layer of security for your investments.

- Investor Services: Evaluate the level of investor services and support provided by the fund house. Consider factors such as customer service, accessibility, and the availability of educational resources to help you make informed investment decisions.

Remember that investing in mutual funds carries risks, and past performance does not guarantee future results. Conduct thorough research, consider your financial situation, and seek professional advice if needed before making any investment decisions.

Cocolife Fixed Income Fund: A Smart Investment Strategy

You may want to see also

Lump sum vs Systematic Investment Plan (SIP)

When considering investing in mutual funds, individuals may opt for either a Systematic Investment Plan (SIP) or a lump sum investment. Both methods have their advantages and suit different financial goals and preferences. Here is a detailed comparison between the two:

Lump Sum Investment

A lump sum investment involves investing a large amount of money in a mutual fund in a single payment at the beginning of the investment period. This method is suitable for short-term investment goals and individuals with a high-risk tolerance. It offers the potential for higher returns if the market timing is favourable. However, it also carries increased risk due to market fluctuations. Lump sum investments are ideal for those with a significant amount ready for investment and who are comfortable with market fluctuations.

Systematic Investment Plan (SIP)

A Systematic Investment Plan (SIP) is a popular investment plan where investors make regular, fixed contributions to a mutual fund. SIPs are suitable for long-term investment goals and individuals who want to build wealth over time. This method promotes investment discipline and helps investors average out market fluctuations. SIPs offer more flexibility, allowing investors to start with a small amount and gradually increase their contributions. Additionally, SIPs benefit from rupee-cost averaging, where investors buy more units when prices are low and fewer units when prices are high. This averages out the cost per unit over time.

Both lump sum and SIP investments have their advantages and suit different investor profiles. Lump sum investments are ideal for those seeking short-term gains, willing to take on higher risk, and having a substantial amount ready for investment. On the other hand, SIPs are better suited for long-term financial goals, offering a disciplined and flexible approach to investing. SIPs help investors mitigate market timing risks and benefit from cost averaging. Ultimately, the decision between lump sum and SIP depends on an individual's financial objectives, risk tolerance, and investment horizon.

Hedge Fund Investment Guide for Australians: Getting Started

You may want to see also

Direct Plan vs Regular Plan

Every mutual fund scheme in India has two versions: direct and regular plans. The main difference between them is that regular plans are purchased through an intermediary such as a broker, financial advisor, or distributor, while direct plans are bought directly from the Asset Management Company (AMC) without any intermediary.

How to Purchase

Direct plans can be purchased online through the AMC's website or by visiting the AMC or registrar's office. They can also be bought through SEBI Registered Investment Advisors (RIAs), who charge a fee for their services.

Regular plans are purchased through mutual fund distributors, who advise investors on which scheme to invest in, submit Know Your Client (KYC) documents, help with the investment process, and provide ongoing services such as generating account statements and handling redemption requests. Distributors receive commissions from the AMC for these services, which are added to the total expense ratio (TER) of regular plans.

Price and Ongoing Costs

The TER is a fee charged to the investor to cover the fund's operating expenses, such as management fees, registrar's fees, trustee fees, marketing costs, and distribution costs. The TER is charged against the assets of the scheme and is adjusted in the price or Net Asset Value (NAV) of the unit.

Since direct plans do not involve intermediaries, they do not incur distribution expenses (distributor's commissions). Therefore, direct plans have lower TERs than regular plans. This results in direct plans having higher NAVs than regular plans, as the TER is deducted from the NAV.

Returns

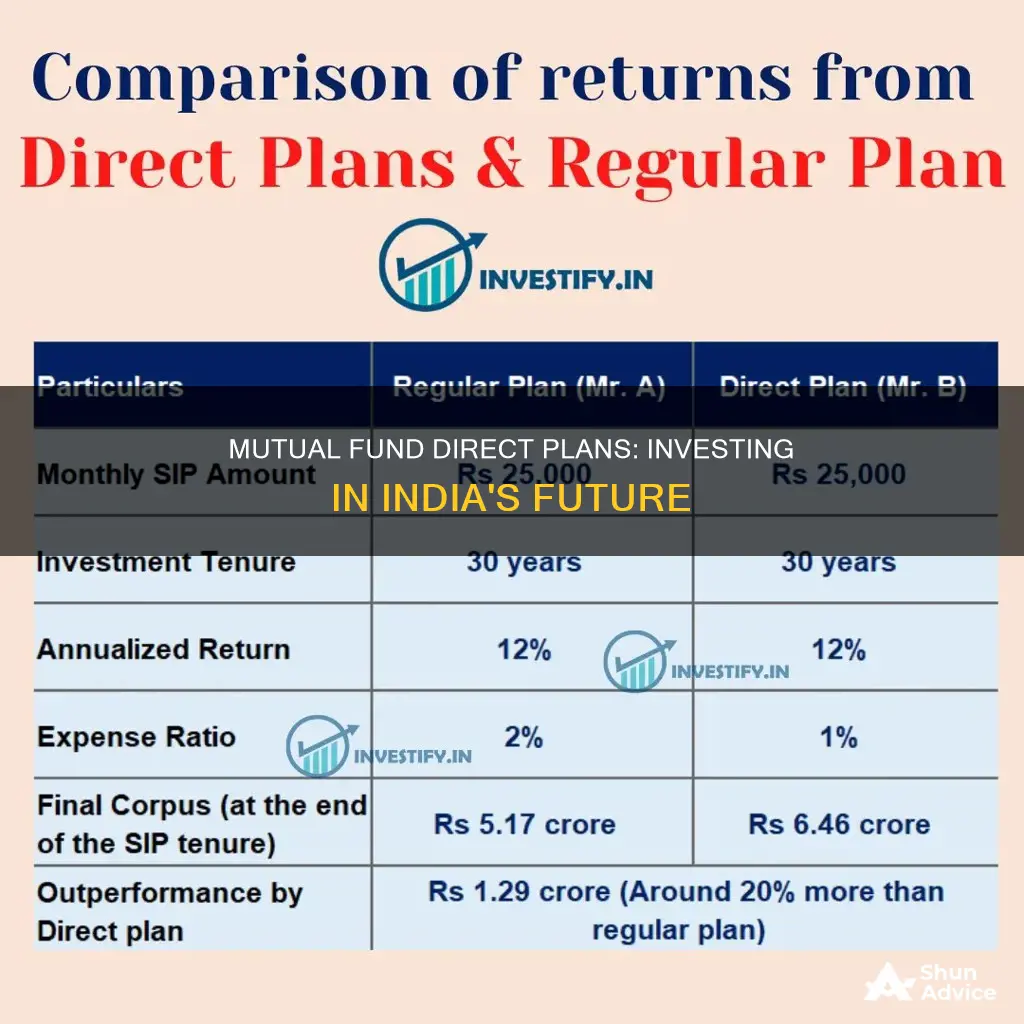

The lower expense ratio of direct plans translates into higher returns on investments, which compounds over the years. Thus, over a long investment horizon, the difference in returns between direct and regular plans can be substantial.

Role of Financial Advisor

Direct plans are suited for investors who are knowledgeable and capable of making their own investment decisions without the assistance of a financial advisor. These investors are comfortable with independent decision-making and research and prefer the cost efficiency and higher returns offered by direct plans.

Regular plans, on the other hand, are suitable for investors who need continuous support and guidance from financial advisors. These investors are willing to pay higher expense ratios to receive personalized advice, regular monitoring, and goal-based planning.

Recognizing the Type of Plan

To determine whether a mutual fund is a direct or regular plan, investors can check the name of the fund, the expense ratio, the NAV, and the Consolidated Account Statement (CAS). Regular plans typically have the term 'Regular' or 'Reg' in the name, while direct plans have 'Direct' or 'Dir'. Regular plans generally have a higher expense ratio and lower NAV compared to direct plans. In the CAS, a regular plan will have 'ARN' followed by a number in the 'Advisor' field.

How Do Funds Benefit from Investing in CDs?

You may want to see also

Frequently asked questions

A direct plan is a type of mutual fund where investors put money in directly, without involving or routing the investment through any distributor or agent.

Direct plans and regular plans are both part of the same mutual fund scheme and have the same portfolio and fund manager. However, direct plans have a lower expense ratio as there is no distributor or agent involved, which results in higher returns for investors.

You can invest in direct mutual funds in India through the online or offline mode. Online, you can use the website of the Asset Management Company (AMC) or a fund house, or a Registrar and Transfer Agent (R&TA). Offline, you can visit the branch office of the AMC or R&TA and submit the required forms and documents.

First, choose a platform and create an account. Second, complete your KYC (Know Your Customer) requirements. Third, choose the mutual fund you want to invest in based on your financial goals and risk tolerance. Fourth, decide on the investment amount and type (lump sum or SIP). Fifth, make the payment using your linked bank account. Finally, monitor your investment and review it periodically.

Investing in direct mutual funds offers benefits such as cost savings due to lower expense ratios, higher returns, ease of online transactions, flexibility and control, and instant Net Asset Value (NAV) updates.