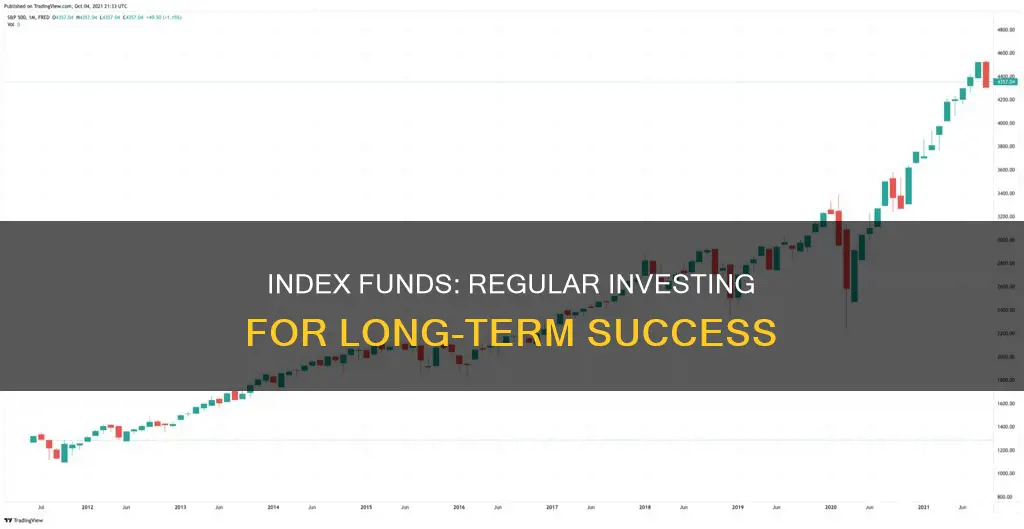

Index funds are a great way to build wealth over time, especially for retirement. They are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. Index funds are passively managed, meaning they don't require active decision-making, and are therefore a low-cost investment option with low fees and tax advantages. While index funds are generally considered safe, they are still subject to market volatility and underperformance, and investors should be aware of the potential risks involved.

| Characteristics | Values |

|---|---|

| Investment type | Mutual funds or ETFs |

| Investment objective | Match the performance of the market |

| Management | Passively managed |

| Investment selection | Automated investment strategy |

| Investment diversification | Lowers overall risk |

| Investment risk | Low |

| Fees | Low |

| Tax advantages | Generate less taxable income |

| Returns | Consistently high |

What You'll Learn

Choose a low-cost fund

Low-cost index funds are a great way to diversify your portfolio without incurring high fees. Index funds are passively managed, meaning they are automated to follow the shifts in value in an index. This means they don't require professional investment managers, resulting in lower costs.

When choosing a low-cost index fund, there are a few categories to consider:

- Total U.S. stock market funds: These funds track indexes that include all publicly traded U.S. companies, offering broad-based exposure to the U.S. stock market.

- S&P 500 index funds: Funds that track the S&P 500 offer diversified exposure to the 500 largest U.S. companies.

- Index funds by market segment: You can invest in ETFs by market segment, such as large-cap, mid-cap, or small-cap companies, to tailor your portfolio according to your risk tolerance.

- Other index funds: There are also index funds that focus on specific sectors, such as technology, or types of stock, such as value or growth stocks.

- Vanguard Total Stock Market Index Fund ETF: This fund invests in the total U.S. stock market, including large-, mid-, and small-cap companies, with a low 0.03% expense ratio.

- Vanguard S&P 500 ETF: Tracks the S&P 500, which includes 500 of the largest U.S. companies, with a competitive 0.04% expense ratio.

- Vanguard Mid-Cap ETF: Invests in companies with mid-range market values, with a 0.04% expense ratio.

- Vanguard Small-Cap ETF: Focuses on small-cap companies with high growth potential, but performance can be more volatile.

- BNY Mellon US Large Cap Core Equity ETF: Tracks the Solactive GBS United States 500 Index TR and charges a true 0% expense ratio.

When choosing a low-cost index fund, it's important to consider factors such as market capitalization and sector focus. Additionally, compare the expense ratios and investment minimums of different funds to find the most cost-effective option. Remember, the lowest-cost fund may not always be the best-performing one.

Unlocking Tax Lien Investments: Funding Strategies Revealed

You may want to see also

Decide on a brokerage or fund provider

When deciding on a brokerage or fund provider, there are several factors to consider. Firstly, it is important to assess your investment goals and objectives. Different brokerages and fund providers may offer different types of index funds, so you should ensure that the one you choose aligns with your financial goals. For example, if you are interested in investing in a specific sector or industry, you should look for a brokerage with funds that focus on those areas.

Another crucial aspect to consider is cost. Index funds are known for their low fees, but it is still important to compare the expense ratios and management fees charged by different providers. Some funds may have higher management costs than others, which can impact your long-term investment returns. It is also worth considering if the brokerage charges any additional trading costs or commissions for buying or selling index funds.

Additionally, you should evaluate the convenience and accessibility of the brokerage or fund provider. Consider choosing a provider that can accommodate all your investment needs and offers a user-friendly platform or website. If you plan to invest in multiple types of funds or stocks, look for a provider that offers a diverse range of investment options.

Furthermore, if you are interested in investing in specific types of funds, such as exchange-traded funds (ETFs), ensure that the brokerage or fund provider offers those options. Some providers may have a more limited selection of funds, while others provide access to a wider range of fund families.

Lastly, consider the impact of your investments. If you want your investments to align with specific values or causes, look for providers that offer impact investing options, allowing you to support environmental or social justice initiatives through your investments.

By carefully evaluating these factors, you can make an informed decision when choosing a brokerage or fund provider that best suits your needs and investment strategy.

A Smart Guide to Investing in Dow Jones Index Funds

You may want to see also

Understand the tax advantages

Index funds are considered to be tax-efficient for a few reasons. Firstly, they have a low turnover ratio, which is the percentage of a fund's holdings that have been replaced in the previous year. This means that there are fewer "taxable events", and so taxes are minimized for the holder of the fund.

Index funds also have a low expense ratio, which is an annual charge levied on investors to cover the expenses of running a fund. As per regulations set by the Securities and Exchange Board of India, fund houses can charge a maximum expense ratio of 1% on index funds.

Additionally, because index funds simply replicate the holdings of an index, they don't trade in and out of securities as often as an active fund would. This means that constant buying and selling by active fund managers, which tends to produce taxable gains, is avoided.

Finally, when you sell shares of an ETF (a type of index fund), you're selling to another buyer, not the fund company. This means the fund itself usually isn't involved in the transaction and doesn't have to sell any securities, potentially triggering capital gains.

Large-Cap Growth Fund: A Smart Investment Strategy

You may want to see also

Know the risks

Index funds are a great investment for building wealth over the long term. However, as with any investment, there are risks involved that you should be aware of before investing. Here are some key points to consider regarding the risks of investing in index funds on a regular basis:

Risk of Market Downturns

Index funds are designed to track the performance of a specific market index, such as the S&P 500. This means that when the index your fund is tracking experiences a downturn, your index fund will also plunge. For example, during the 2008 financial crisis, the S&P 500 lost roughly 38%, and any S&P 500 index fund would have seen similar losses. It is important to remember that index funds will participate in any market downturn, and there is no chance of outperforming the benchmark.

Concentration Risk

Index funds that track market-cap-weighted indices, such as the S&P 500, will have larger allocations to the largest companies in the index. This can create concentration risk, where a small number of companies dominate the index and the fund. For example, as of October 2023, seven stocks, known as the "Magnificent Seven", accounted for about 28% of the S&P 500. This concentration can impact the diversification benefits of the index fund and expose investors to the performance of a small number of companies.

Tracking Error

Tracking error refers to the difference between the returns generated by an index fund and its benchmark index. A high tracking error indicates that the index fund is not effectively tracking the performance of its underlying index. This could be due to various factors, such as changes in the index composition or fund management strategies. It is important to monitor the tracking error to ensure that your index fund is performing as expected.

Expense Ratio and Other Costs

The expense ratio is an annual fee charged by fund houses to cover the expenses of running the fund, including management fees and advertising costs. A high expense ratio can eat into your investment returns over time. Additionally, index funds may have other costs, such as trading costs and account minimums, that can impact your overall returns. It is important to carefully review the fees and costs associated with the index fund before investing.

Lack of Active Management

Index funds are passively managed, meaning they are designed to mirror the performance of an index rather than actively select stocks. While this can be a benefit in terms of lower fees, it also means that index funds may not be able to take advantage of market opportunities in the same way that actively managed funds can. Actively managed funds have the potential to outperform the market, although this is rare and usually does not occur over the long term.

Sector or Industry Risk

Index funds that focus on a specific sector or industry, such as technology or healthcare, can be subject to risks associated with that particular sector or industry. If the sector or industry underperforms, your index fund returns may be negatively impacted. Diversification across different sectors and industries can help mitigate this risk.

In conclusion, while index funds offer a range of benefits, including low costs and instant diversification, it is important to be aware of the potential risks involved. By understanding these risks and conducting thorough research, you can make more informed investment decisions and better manage your portfolio.

Gilt Funds: When to Invest for Maximum Returns

You may want to see also

Compare to other funds

Index funds are a great investment option for those looking to build wealth over time. They are a low-cost, easy way to invest, and are especially popular with retirement investors.

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a stock market index, such as the S&P 500 or the Nasdaq-100. They are designed to mirror the performance of the index they track, and as such, they are considered passive investments. This means that a portfolio manager is not actively involved in the investment decisions and instead selects a combination of assets intended to mimic the index. Due to this passive nature, index funds tend to have lower fees than actively managed funds.

Index funds are also more diversified than other funds, as they track an underlying market index. This means that they provide investors with broad market exposure or exposure to an overall sector. For example, an S&P 500 index fund will hold the stocks that make up the S&P 500 index. This diversification is a benefit to investors as it lowers the risk of investing.

However, not all index funds are as diversified as those tracking broad indexes like the S&P 500. Some index funds may only hold a few components, and this lack of diversification can expose investors to higher risk. Additionally, some index funds may not track the underlying index exactly, resulting in tracking errors or variances between the fund and the index.

When comparing index funds to other types of funds, it's important to consider the fees and expenses associated with each. Index funds tend to have lower fees than actively managed funds, but the fees can vary among index funds. The expense ratio, which represents the percentage of expenses compared to the average annual assets under management, is an important factor to consider when choosing an index fund. Lower fees are often found with larger, more established funds, as they are able to take advantage of economies of scale.

In summary, index funds offer a low-cost, diversified investment option for those looking to build wealth over time. When compared to other types of funds, index funds tend to have lower fees and provide broader market exposure. However, it's important to carefully research and analyze index funds before investing, as there can be variations in the fees and diversification offered by different funds.

Hayman Capital Master Fund: A Smart Investment Strategy

You may want to see also

Frequently asked questions

An index fund is a mutual fund or exchange-traded fund (ETF) that invests in a specific index, such as the S&P 500, and aims to mirror its performance. Index funds are passively managed, which means they have low fees and don't require active trading decisions.

When choosing an index fund, consider the fund's investment objective, tracking error, and expense ratio. Ensure the fund's objective aligns with your financial goals, and look for funds with low expense ratios to maximize your returns.

You can purchase index fund shares through a brokerage account or directly from a mutual fund or index fund provider. Consider the fund selection, convenience, trading costs, and impact investing options when deciding where to buy.

You can invest in index funds on a regular interval through a systematic investment plan (SIP). This enables you to allocate a fixed sum to the index fund at regular intervals, such as monthly or quarterly.

Index funds offer broad diversification, low fees, and tax advantages. They are also easy to invest in and have consistently outperformed actively managed funds in terms of total returns over the long term.