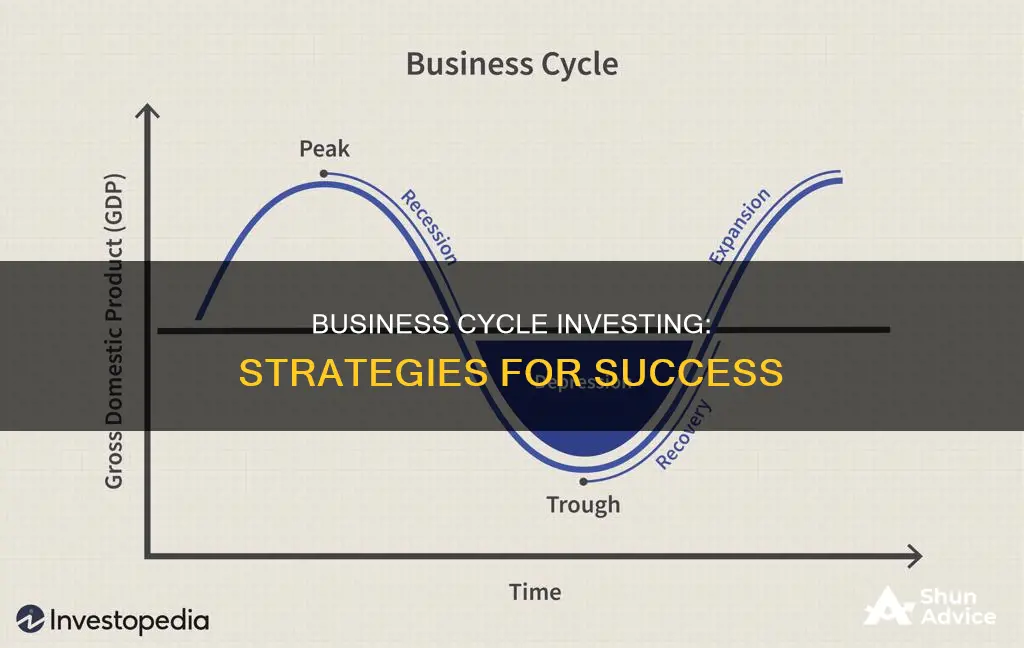

Understanding the business cycle can help investors make informed decisions about buying or selling assets. The business cycle refers to the periodic expansion and contraction of a nation's economy, which can be further broken down into four stages: early, mid, late, and recession. Each stage of the business cycle may prompt different investment tactics to capitalise on the economy's phase and direction. For example, during the early phase, economically sensitive sectors like technology, industrials, and financials tend to perform well. In contrast, during a recession, defensive sectors like consumer staples, healthcare, and utilities typically perform better. By knowing which stage the economy is in, investors can adjust their portfolios to maximise returns and minimise risks. However, it is important to note that business cycle investing is not an exact science, and the ability to predict changes in the business cycle can be challenging.

What You'll Learn

Understanding the business cycle

The four stages of the business cycle are:

- Early Cycle: This is the sharp recovery phase after a recession, with economic indicators moving from negative to positive. Low interest rates and increased credit availability aid profit growth, and sales grow significantly. This phase generally lasts about a year.

- Mid-Cycle: Typically the longest phase, with moderate growth and strong credit growth. Economic activity gathers momentum, and profitability is healthy as monetary policy becomes more neutral. This phase tends to last around three years.

- Late Cycle: Economic activity reaches its peak, and while growth remains positive, it starts to slow. Rising inflation and a tight labor market may lead to higher interest rates, impacting profits. This phase usually lasts around a year and a half.

- Recession: Economic contraction occurs, with declining profits and scarce credit. Interest rates and inventories fall, setting the stage for recovery. This is typically the shortest phase, lasting slightly less than a year on average.

Each phase of the business cycle is characterized by different economic indicators and has a unique impact on investment performance. For example, stocks tend to perform well during the early and mid-cycle, while bonds are more stable during recessions.

Additionally, specific industries may prosper during each stage. During the early cycle, consumer-oriented sectors like retail and leisure, and industries benefiting from increased investment, such as construction, tend to thrive. In the mid-cycle, information technology and energy companies often perform well as they deploy more capital. Late-cycle investments favor utilities and energy companies, while recession-resistant sectors include healthcare, consumer staples, and utilities.

Understanding these cycles can help investors make more informed decisions, evaluate their exposure to different investments, and adjust their portfolios accordingly. However, it is important to remember that business cycle investing is not an exact science, and market volatility and other factors can also influence investment performance.

Smart Guide to SIP Investment with SBIMF

You may want to see also

How to invest during a recession

A recession is a challenging time for investors, but there are strategies to help you navigate this difficult period. Here are some tips on how to invest during a recession:

Cash is King:

As economic activity slows and uncertainty rises, having cash on hand becomes crucial. It is advisable to maintain a certain portion of your portfolio in cash or highly liquid assets, such as a money market mutual fund. This strategy ensures you have the financial flexibility to seize opportunities or weather unexpected challenges.

Focus on Defensive Stocks:

During a recession, consumer discretionary stocks, which are closely tied to economic cycles, tend to underperform. Instead, consider investing in defensive stocks within non-cyclical sectors like utilities, consumer staples, and healthcare. These sectors offer essential goods and services that remain in demand regardless of economic conditions.

Dollar-Cost Averaging:

This strategy involves investing a fixed amount in a particular investment at regular intervals, regardless of the price. In a recession, this approach allows you to buy more shares as prices decline, helping you take advantage of lower prices without trying to time the market.

Seek Quality Assets:

Look for companies that can thrive regardless of economic conditions. These "all-weather businesses" often have low beta, high returns, and low leverage. They tend to have high recurring revenue, such as subscription-based sales, and are less sensitive to economic downturns.

Avoid Growth Stocks:

Growth stocks, particularly those without profits and tied to high growth prospects, tend to underperform during recessions. Instead, consider income-producing investments and dividend-paying stocks, which can provide a cushion for your portfolio.

Invest in Dividend Stocks:

Dividend-paying companies often continue to distribute dividends even during recessions. These dividends can be reinvested to dollar-cost average and reduce the impact of market volatility on your portfolio.

Consider Actively Managed Funds:

Research shows that actively managed funds tend to outperform their peers in down markets. These funds can be a good option during a recession as they provide more flexibility to adjust to changing market conditions.

Explore Bonds and Uncorrelated Assets:

Bonds, particularly investment-grade bonds, tend to perform well during recessions. Additionally, consider truly uncorrelated asset classes, such as royalties, insurance-linked securities, and carbon credits, which may perform well when traditional assets struggle.

Don't Overreact:

Remember that no one can predict the duration or full impact of a recession. Often, the best strategy is to remain invested and focused on your long-term goals. Avoid making impulsive decisions based on short-term market movements.

Invest in Broad Funds:

Investing in broad funds, such as exchange-traded funds (ETFs) and low-cost index funds, can reduce your risk through diversification. These funds give you exposure to a basket of securities, helping you invest in resilient sectors without concentrating your risk in any one company.

While investing during a recession can be daunting, these strategies can help you make more informed decisions. Remember that every recession is unique, so staying informed about economic indicators and market news is crucial for successful investing.

Investing Cash During Inflation: Strategies for Success

You may want to see also

What to invest in during the early cycle

The early cycle is the second stage of the business cycle, following a recession. During this phase, the economy tends to recover sharply as growth begins to accelerate. The stock market tends to rise the most during this stage, which generally lasts about a year. Low-interest rates and loose monetary policies by the central bank allow businesses and consumers to borrow more money for growth and investment, which in turn increases the GDP.

During the early cycle, stocks have delivered their highest performance, returning an average of more than 20% per year. Stocks that benefit the most from low-interest rates, such as those in the consumer discretionary, financials, and real estate industries, tend to outperform the broader market. Other industries that benefit from increased borrowing, including diversified financials, autos, and household durables, also tend to be strong performers. High-yield corporate bonds have also averaged strong annual gains during the early cycle.

Consumer-oriented sectors, such as retail and leisure, also tend to do well during the early cycle. Industries that benefit from increased business investment, such as construction and manufacturing, thrive during this phase.

No Cash for Investments? Here's Why and What to Do

You may want to see also

What to invest in during the mid-cycle

The mid-cycle phase is typically the longest phase of the business cycle, with moderate growth throughout. On average, the mid-cycle phase lasts three years. During this phase, monetary policies shift toward a neutral state: interest rates are higher, credit is strong, and companies are profitable.

At this stage, economic activity reaches its highest point, and while growth continues, its pace decelerates. Monetary policies become tight due to rising inflation and low unemployment, making it harder for people to borrow money. The GDP rate begins to plateau or slow.

During the mid-cycle, some industries may start to see slowing growth or declining profits. These include industries sensitive to changes in consumer demand or highly competitive sectors, such as technology and media. However, some industries perform well during the mid-cycle, like information technology and energy, as companies in these areas deploy capital to help them grow.

The mid-cycle is a good opportunity to reset the asset allocation to avoid losing some of the gains made by previous growth. The average return during the mid-cycle has been about 14%.

No single category of investments has outperformed the broader market more than half of the time during the mid-cycle.

TFL's Mixed-Use Development Investment Strategies

You may want to see also

What to invest in during the late cycle

The late cycle is a phase of the business cycle where economic activity reaches its peak and growth slows down but remains positive. It is important to note that the late cycle is not the same as a recession. During this phase, rising inflation and a tight labour market may lead to higher interest rates, and corporate earnings may decline.

Review your portfolio:

The late cycle can be a good time to review your investment portfolio. Ensure that it aligns with your financial goals, risk tolerance, and time horizon. If needed, consider rebalancing your portfolio based on historical trends during late cycles and recessions.

Be cautious about making changes:

The late cycle is typically characterised by volatile markets. Thus, it is important to be cautious about making significant changes to your portfolio in pursuit of short-term opportunities. The stock market tends to be unpredictable during this phase, with stocks making sizable moves up and down.

Consider defensive and inflation-protected categories:

During the late cycle, consider investing in defensive and inflation-protected sectors such as materials, consumer staples, healthcare, utilities, and energy. These sectors tend to be more resilient during economic slowdowns and can provide stability to your portfolio.

Shift away from economically sensitive assets:

As inflation and interest rates rise, investors typically shift away from economically sensitive assets. These include stocks of companies that produce non-essential consumer goods and big-ticket items like cars and houses.

Explore commodities:

Historically, commodities such as oil, wheat, iron ore, and copper have been popular during the late cycle as their prices tend to rise with inflation. However, recent events such as global trade wars and the COVID pandemic have distorted the relationship between commodity prices and the business cycle.

Focus on long-term asset allocation:

Instead of trying to time the market, consider developing a long-term asset allocation plan as part of your financial strategy. This plan should include a mix of stocks, bonds, and cash that aligns with your goals, risk tolerance, and time horizon.

Look for stocks that do well during volatility:

During the late cycle, some stocks may perform well during volatile market conditions. These could be stocks in sectors that are less sensitive to economic fluctuations or those that provide essential products and services.

Prepare for the eventual recession:

Late cycles typically precede recessions. Thus, it is important to prepare your portfolio for the eventual downturn. Recessions are usually short-lived, and the early cycle that follows often presents fruitful investment opportunities.

In summary, when investing during the late cycle, it is crucial to understand the historical trends, remain cautious about significant portfolio changes, focus on defensive and inflation-protected sectors, and maintain a long-term perspective.

Understanding Your Cash Available to Invest

You may want to see also

Frequently asked questions

The business cycle refers to the periodic expansion and contraction of a nation's economy. It tracks the different stages of growth and decline in a country's gross domestic product (GDP) and economic activity. The business cycle typically consists of four phases: early, mid, late, and recession.

Different types of investments perform better or worse during different stages of the business cycle. For example, stocks tend to perform better during the early and mid-cycle, while bonds are considered safer investments during a recession.

Identifying the correct stage of the business cycle can be challenging. It involves monitoring various economic indicators such as monetary policy, credit availability, inventory levels, corporate profits, and employment numbers.