Fidelity offers a range of options for customers looking to invest their cash. These include savings accounts, money market funds, certificates of deposit (CDs), short-term bonds, and more. One of their products, the Fidelity Cash Management Account, is a brokerage account designed for convenient spending and saving, offering competitive rates on cash. It provides customers with two options for their cash: the Fidelity Government Money Market Fund and the FDIC-Insured Deposit Sweep Program, allowing customers to maximize their earnings or prioritize protection.

| Characteristics | Values |

|---|---|

| Name | Fidelity Cash Management Account |

| Type | Brokerage account |

| Investment options | Fidelity Government Money Market Fund (SPAXX); FDIC-Insured Deposit Sweep Program; Taxable Interest Bearing Cash Option (FCASH) |

| Interest rate | 2.32% (FCASH) |

| Account fees | No account fees or minimums to open an account |

| ATM fees | Unlimited global reimbursement on ATM withdrawals |

| Account protection | Customer Protection Guarantee |

What You'll Learn

Money market funds

Fidelity offers its customers a range of money market funds, including government, prime, and municipal options. These funds provide investors with easy access to their cash and potential income through interest earnings. While money market funds are not insured by the FDIC, they are subject to federal regulations that mandate investments in short-term, low-risk assets, making them less susceptible to market fluctuations.

Understanding Investment Impacts on Cash Flow Statements

You may want to see also

Savings accounts

Fidelity offers a range of savings account options, including the Fidelity Cash Management Account. This account is designed for convenient spending and saving and offers competitive rates on your cash. There are no account fees or minimums to open an account. The account also offers a range of features, including ATM fee reimbursement, a digital wallet-compatible debit card, mobile check deposit, and payment apps integration.

Another option is the Fidelity Government Money Market Fund, which invests in US government securities and repurchase agreements. This fund is intended for investors seeking a high level of current income while also preserving capital and liquidity.

Fidelity also offers a Taxable Interest Bearing Cash Option, which is a free credit balance payable to you on demand. Fidelity may use this free credit balance in connection with its business and may pay interest on this balance, which is based on a schedule set by Fidelity.

When deciding where to put your cash, it is important to consider your goals, time frame, attitude, and needs. A Fidelity investment professional can work with you to develop a plan to help you invest your cash for the long term.

Journaling a Large Cash Investment: A Step-by-Step Guide

You may want to see also

Certificates of deposit (CDs)

When shopping for a CD, it's important to compare different offers by considering the term, interest rate, and penalty for early withdrawal. The interest rate on CDs is usually fixed, but there are also variable-rate CDs available. While CDs offer higher interest rates than savings accounts, they provide less flexibility in terms of accessing your money. If you withdraw your funds before the maturity date, you will be charged an early withdrawal penalty.

CDs can be purchased directly from banks or through brokerage firms, known as "brokered CDs." Brokered CDs typically have minimum investment requirements and may offer higher interest rates than traditional CDs.

CDs are suitable for savers who want to earn higher interest rates than those offered by savings or money market accounts without taking on more risk. They are also a good option for those who want to invest conservatively and achieve lower risk and volatility compared to the stock and bond markets.

Zinser Investment: Relevant Cash Flows and Their Impact

You may want to see also

Short-term bonds

Short-term bond funds primarily invest in corporate and other investment-grade fixed-income securities and generally have durations of one to three and a half years. These portfolios are attractive to more conservative investors because they are less sensitive to interest rate volatility than portfolios with longer durations.

Fidelity offers several short-term bond investment options as part of an overall diversified portfolio. These include the Fidelity® Conservative Income Bond Fund (FCNVX), the Fidelity® Short-Term Bond Fund (FSHBX), and the Fidelity® Limited Term Bond Fund (FJRLX).

Compared to long-duration bond funds of similar credit quality, short-term bond funds are generally less sensitive to rising rates but have lower yields. If interest rates rise within a short period, shorter-term bonds may experience lower price volatility relative to longer-term bonds.

Understanding Non-Cash Investing and Financing Activities

You may want to see also

Fidelity Cash Management Account

The Fidelity Cash Management Account is a brokerage account designed for cash management, spending, and investing (excluding options and margin trading). It is intended to complement your existing brokerage account by letting you separate your spending activity from your investment activity.

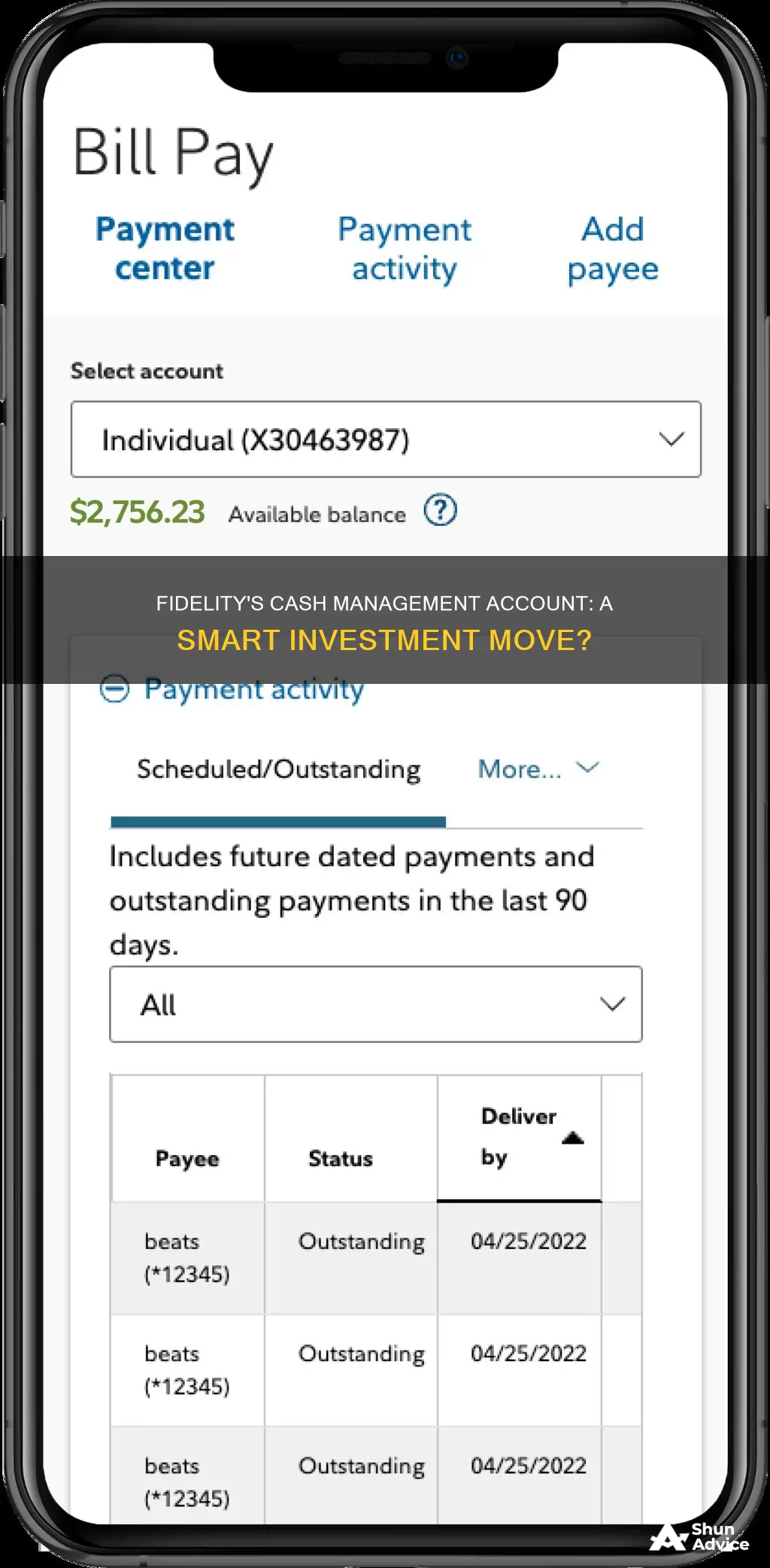

The account offers competitive rates, as well as spending and money movement features, including a free debit card, check writing, Bill Pay, and more. There are no account fees or minimums to open an account.

The account has two competitive options for your cash:

- Fidelity® Government Money Market Fund: Your cash is automatically held in a money market fund (SPAXX).

- FDIC-Insured Deposit Sweep Program: Your cash (up to $5 million) is insured by the Federal Deposit Insurance Corporation (FDIC). Cash is automatically placed in an account at one or more program banks.

The account also offers a Cash Manager feature, which lets you automatically move cash to your account when you need it and actively invest extra cash when you have it.

Cash and Sweep Investment: Maximizing Your Money

You may want to see also

Frequently asked questions

Fidelity offers a range of cash investment options, including savings accounts, money market funds, certificates of deposit (CDs), short-term bonds, and more.

Fidelity's cash management products help you spend and save smarter so you can reach your financial goals. They offer competitive rates on your cash, unlimited global ATM reimbursement, no account fees or minimums, and protection against unauthorized activity through their Customer Protection Guarantee.

You can open a Fidelity Cash Management Account, which is a brokerage account designed for spending, saving, and investing. There are no account fees or minimums to open an account. You can also explore their other account options, such as a Fidelity Roth IRA, to find the one that best suits your needs.

It's important to consider your financial goals, time horizon, risk tolerance, and investment options. Fidelity offers resources and tools to help you make informed decisions about your investments, including their Mutual Fund Evaluator and industry-leading investment analysis.