Investing with term life insurance can be a strategic financial move, offering both protection and potential growth. This approach involves utilizing the death benefit of a term life insurance policy to invest in various financial instruments, such as stocks, bonds, or mutual funds. By doing so, you can potentially grow your money over the policy's term while still having a safety net in place should an unforeseen event occur. This method requires careful consideration of the policy's terms, the chosen investment options, and the potential risks and rewards associated with each. Understanding these aspects can help individuals make informed decisions about how to best utilize their term life insurance for both protection and investment purposes.

What You'll Learn

- Understand Policy Details: Review coverage, benefits, and exclusions

- Assess Financial Goals: Determine investment options based on your objectives

- Choose Investment Vehicles: Select from stocks, bonds, or mutual funds

- Monitor Performance: Regularly review and adjust investments for optimal returns

- Plan for Long-Term: Ensure investments align with your long-term financial strategy

Understand Policy Details: Review coverage, benefits, and exclusions

When considering how to invest with term life insurance, it's crucial to thoroughly understand the policy details. This involves a comprehensive review of the coverage, benefits, and any exclusions that may apply. Here's a step-by-step guide to help you navigate this process:

Review the Policy Document: Start by obtaining a copy of your term life insurance policy document. This document is a legal contract between you and the insurance company, outlining the terms and conditions of your coverage. Carefully read through the entire document, as it will provide essential information about your policy. Look for sections that describe the policy's coverage, benefits, and any limitations or restrictions.

Understand Coverage and Benefits: Term life insurance provides financial protection for a specified period, known as the 'term.' During this term, the policy offers a death benefit, which is a lump sum amount paid to the designated beneficiaries if the insured individual passes away. Review the policy to understand the coverage amount, which is the financial benefit you and your beneficiaries will receive. Additionally, check for any additional benefits, such as accelerated death benefits, which allow you to access a portion of the death benefit early in the event of a critical illness or terminal diagnosis.

Identify Exclusions and Limitations: Insurance policies often have specific exclusions and limitations that define what is not covered. These may include pre-existing medical conditions, high-risk activities, or certain causes of death. For example, some policies might exclude coverage for deaths resulting from accidents or suicide during the initial years of the policy. Understanding these exclusions is vital to ensure you are aware of any potential gaps in coverage. It's also important to note if there are any waiting periods before benefits become payable.

Verify Policy Accuracy: Double-check the policy details to ensure accuracy. Pay attention to any discrepancies or inconsistencies in the information provided. If you have any doubts or concerns, contact your insurance provider or a financial advisor to clarify any ambiguous terms. They can assist in interpreting the policy and addressing any specific questions you may have.

By thoroughly reviewing the policy details, you can make informed decisions about how to utilize your term life insurance effectively. This process ensures that you understand the extent of your coverage, the benefits available, and any potential limitations, allowing you to explore investment opportunities with confidence.

Understanding Short-Term Investments: Expense or Asset?

You may want to see also

Assess Financial Goals: Determine investment options based on your objectives

When considering how to invest with term life insurance, it's crucial to start by assessing your financial goals. This process involves a deep understanding of your current and future financial needs, which will guide you in choosing the right investment options. Here's a step-by-step approach to help you determine the best course of action:

- Identify Your Short-Term and Long-Term Goals: Begin by making a comprehensive list of your financial objectives. Short-term goals might include building an emergency fund, saving for a down payment on a house, or funding your child's education. Long-term goals could involve retirement planning, saving for a child's future, or investing for wealth creation. Prioritize these goals and understand the time frame associated with each. For instance, short-term goals may require more liquid assets, while long-term goals might benefit from long-term investments.

- Evaluate Risk Tolerance: Your risk tolerance is a critical factor in investment decision-making. It refers to your ability and willingness to withstand fluctuations in the value of your investments. If you have a higher risk tolerance, you might be more inclined to invest in stocks or mutual funds, which can offer higher returns but also come with greater volatility. Conversely, lower-risk investments like bonds or fixed-income securities might be more suitable if you prefer a more conservative approach. Consider your financial situation, age, and the potential impact of market fluctuations on your goals.

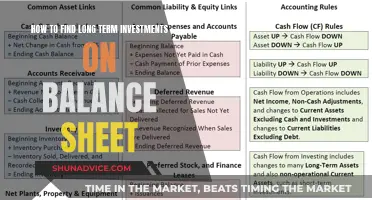

- Understand the Investment Options: Term life insurance policies can be utilized for various investment purposes. One common strategy is to invest the cash value of the policy, which grows tax-deferred. This can be done through various investment options offered by the insurance company, such as mutual funds, stocks, or bonds. Another approach is to use the death benefit of the policy as a financial safety net, ensuring that your beneficiaries receive a lump sum upon your passing. Research and understand the different investment vehicles available to you and their associated risks and potential returns.

- Create a Diversified Portfolio: Diversification is a key principle in investing to manage risk. Consider spreading your investments across different asset classes, sectors, and geographic regions. For example, you might allocate a portion of your policy's cash value to stocks for potential capital appreciation, another part to bonds for stability, and a small portion to alternative investments like real estate or commodities. Diversification helps reduce the impact of any single investment's performance on your overall portfolio.

- Regularly Review and Adjust: Financial goals and circumstances can change over time. It's essential to periodically review and assess your investment strategy. Life events like marriage, the birth of a child, or a career change might require adjustments to your financial plan. Regularly evaluating your investments ensures that they remain aligned with your evolving goals and risk tolerance. This process may involve rebalancing your portfolio, making additional contributions, or adjusting the policy's investment options.

Supplies: Short-Term Investment or Long-Term Strategy?

You may want to see also

Choose Investment Vehicles: Select from stocks, bonds, or mutual funds

When it comes to investing the proceeds from your term life insurance policy, one of the key decisions you'll need to make is choosing the right investment vehicles. This decision will significantly impact your financial goals and risk tolerance. Here's a breakdown of the options available and how to select the best fit for your needs:

Stocks:

Investing in stocks means purchasing shares of individual companies. This can be a powerful way to build wealth over time, as stocks have historically provided higher returns compared to other asset classes. Here's how to approach it:

- Research and Due Diligence: Choose stocks from companies you understand and believe in. Analyze their financial health, competitive advantage, and growth prospects. Diversify your portfolio by selecting stocks from different sectors to mitigate risk.

- Risk Tolerance: Stocks are generally considered riskier than bonds or mutual funds. Assess your risk tolerance – how comfortable are you with potential short-term fluctuations in stock prices? If you're risk-averse, consider a more conservative approach or diversify your portfolio.

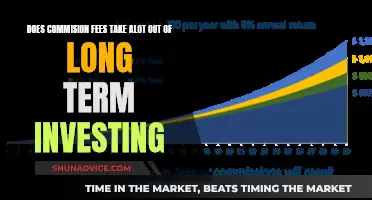

- Long-Term Perspective: Investing in stocks is typically a long-term strategy. Avoid making impulsive decisions based on short-term market fluctuations. Focus on your long-term financial goals and the potential for compound growth.

Bonds:

Bonds are essentially loans made to governments or corporations. They offer a more conservative investment option compared to stocks.

- Fixed Income: Bonds provide a fixed rate of return over a specified period. This makes them attractive for those seeking a steady income stream. Government bonds are generally considered less risky than corporate bonds.

- Risk and Return: Bonds typically offer lower returns than stocks but are less volatile. They are a good hedge against market downturns. Consider your risk tolerance and financial goals when deciding on bond types.

Mutual Funds:

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. This offers instant diversification and professional management.

- Diversification: Mutual funds are an excellent way to diversify your investments without the hassle of picking individual stocks or bonds. They are managed by fund managers who research and select investments on your behalf.

- Types of Mutual Funds: There are various types, including equity funds, bond funds, and balanced funds. Choose based on your risk tolerance and investment goals. For example, equity funds focus on stocks, while bond funds invest primarily in fixed-income securities.

- Expense Ratios: Be mindful of the expense ratios associated with mutual funds, as these can eat into your returns over time. Lower expense ratios generally indicate more cost-effective funds.

Making the Decision:

When choosing investment vehicles, consider your financial goals, risk tolerance, and time horizon. Diversification is key to managing risk. You can allocate a portion of your insurance proceeds to each investment type or explore a mix of strategies. Regularly review and adjust your portfolio as your financial situation and goals evolve. Remember, investing is a long-term journey, and making informed decisions will contribute to your financial success.

Long-Term Trading: Balancing Risk and Reward in Securities

You may want to see also

Monitor Performance: Regularly review and adjust investments for optimal returns

When it comes to investing with term life insurance, monitoring the performance of your investments is crucial to ensure you're getting the most out of your policy. Here's a detailed guide on how to approach this:

Understand Your Investment Options: Before you begin monitoring, it's essential to grasp the various investment avenues available within your term life insurance policy. These may include investment accounts, such as cash value accounts or investment-linked whole life policies. Each option has its own set of features and potential returns. Research and understand the specific investment vehicles you've chosen to maximize your policy's growth.

Set Regular Review Periods: Establish a consistent schedule for reviewing your investments. This could be annually, semi-annually, or even quarterly, depending on your risk tolerance and financial goals. Regular reviews allow you to track the performance of your investments over time and make informed decisions. During these reviews, analyze the returns, fees, and overall growth of your investment accounts.

Compare Performance to Benchmarks: To gauge the success of your investments, compare their performance against relevant benchmarks. For instance, you can compare your investment returns to the performance of a diversified stock market index or a fixed-income index. This comparison will help you understand how your investments are performing relative to the market and identify areas that need improvement.

Adjust Your Strategy: Based on your performance reviews, be prepared to make adjustments to your investment strategy. If certain investments are underperforming, consider reallocating your funds to more promising options. Diversification is key, so ensure your portfolio is well-balanced across different asset classes. Additionally, review and update your risk tolerance assessment periodically to align your investments with your changing financial circumstances.

Stay Informed and Educated: Keep yourself updated on market trends, economic conditions, and changes in the insurance industry that may impact your investments. Regularly educate yourself about investment strategies, tax implications, and any new features or benefits offered by your insurance provider. Being well-informed will enable you to make more strategic decisions and adapt your investment approach as needed.

Remember, investing with term life insurance is a long-term strategy, and monitoring performance is an ongoing process. By regularly reviewing and adjusting your investments, you can optimize your returns and ensure that your policy works in harmony with your financial objectives.

Maximizing Returns: The Power of Long-Term Investment Strategies

You may want to see also

Plan for Long-Term: Ensure investments align with your long-term financial strategy

When considering how to invest with term life insurance, it's crucial to align your investments with your long-term financial strategy. This ensures that your financial decisions are not only secure but also contribute to your overall financial goals. Here's a detailed guide to help you navigate this process:

Understand Your Financial Goals: Begin by clearly defining your long-term financial objectives. Are you saving for retirement, your child's education, or a specific financial milestone? Understanding your goals will help you determine the type of investments that are most suitable. For instance, if your goal is retirement, you might consider investments that offer long-term growth potential, such as stocks or mutual funds.

Risk Assessment: Evaluate your risk tolerance. Term life insurance policies typically offer a fixed death benefit, and the investment options associated with them can vary in risk. If you're comfortable with higher risk for potentially higher returns, you might opt for more aggressive investment strategies. Conversely, if risk aversion is a priority, consider more conservative investments like bonds or fixed-income securities.

Diversification: Diversification is a key principle in investing. Spread your investments across different asset classes to minimize risk. For example, you could allocate a portion of your term life insurance investment to stocks, another part to bonds, and a small percentage to alternative investments like real estate or commodities. This approach ensures that your portfolio is not overly exposed to any single market or asset class.

Regular Review: Financial planning is an ongoing process. Regularly review your investment strategy to ensure it remains aligned with your long-term goals. Market conditions and personal circumstances can change, and adjustments may be necessary. For instance, if you've achieved a significant milestone, you might want to rebalance your portfolio to reflect your new financial situation.

Consult a Financial Advisor: Consider seeking advice from a financial advisor who specializes in insurance and investment strategies. They can provide personalized guidance based on your unique financial profile and goals. A professional can help you navigate the complexities of investing with term life insurance and ensure that your investments are optimized for long-term success.

By following these steps, you can effectively utilize term life insurance as a tool for long-term investing, ensuring that your financial strategy is robust and tailored to your needs. Remember, a well-planned investment strategy can provide the financial security and growth you desire.

Understanding Cash Equivalents: Short-Term Liquid Investments Explained

You may want to see also

Frequently asked questions

Term life insurance is a financial product designed to provide coverage for a specific period, typically 10, 20, or 30 years. While it primarily serves as a safety net for your loved ones in the event of your untimely death, it can also be utilized as a strategic investment tool. By investing in certain types of term life insurance policies, you can potentially build cash value over time, which can be used for various financial goals.

Investing with term life insurance involves understanding the different policy types and their associated investment options. Some term life insurance policies offer an investment component, allowing you to allocate a portion of your premium payments into an investment account. This investment account can grow tax-deferred, and you can make withdrawals or borrow against the cash value. It's essential to review the policy details and consult with a financial advisor to determine the best investment strategy for your needs.

As with any investment, there are risks involved. The performance of the investment component of a term life insurance policy is not guaranteed and can fluctuate. Market volatility, investment fees, and policy charges may impact the growth of your investment. It's crucial to carefully review the policy's investment features, understand the associated risks, and consider your risk tolerance before making any investment decisions.

Yes, depending on the policy, you may have the option to withdraw funds from the investment portion. However, there are typically restrictions and penalties associated with withdrawals, especially if done early in the policy's term. It's essential to understand the policy's terms and conditions regarding withdrawals, including any fees, surrender charges, and potential tax implications. Consulting with a financial advisor can help you navigate these complexities and make informed decisions regarding your term life insurance investment.