When it comes to investing, the question of whether diversification is more crucial for short-term or long-term investments is a key consideration for investors. Diversification, the practice of spreading investments across various assets, is often associated with long-term strategies, as it aims to reduce risk and provide stability over extended periods. However, in the short term, market volatility and rapid changes in asset prices can make diversification a critical factor in managing risk and protecting capital. This introduction sets the stage for a discussion on the strategic importance of diversification in different investment horizons.

What You'll Learn

- Market Volatility: Diversification's Impact on Short-Term Fluctuations

- Risk Management: Long-Term Benefits of Asset Allocation Strategies

- Historical Data: Past Performance Supports Diversification in Both Time Frames

- Investor Behavior: Short-Term Focus May Neglect Diversification's Long-Term Rewards

- Asset Allocation: Balancing Risk and Return Over Time with Diversification

Market Volatility: Diversification's Impact on Short-Term Fluctuations

The concept of diversification is a cornerstone of investment strategy, often advocated to mitigate risk and stabilize returns over the long term. However, when considering short-term market fluctuations, the impact of diversification takes on a different dimension. Short-term investments are inherently more volatile, and diversification strategies can play a crucial role in navigating these turbulent waters.

In the short term, markets can experience rapid and unpredictable changes, often driven by news, events, or sentiment shifts. These fluctuations can significantly impact investment portfolios, especially those heavily concentrated in a single asset or sector. Diversification, in this context, involves spreading investments across various assets, industries, or geographic regions to reduce the impact of any single negative event. By holding a diverse range of investments, investors can limit the potential losses associated with short-term market swings.

For instance, consider a portfolio dominated by technology stocks. A sudden regulatory change or a tech industry-specific crisis could lead to a sharp decline in the value of these stocks. However, if the same portfolio includes investments in healthcare, consumer goods, and financial services, the overall impact of such a downturn would be buffered. The healthcare and consumer goods sectors might experience a boost due to increased demand, while the financial services industry could benefit from a shift in investor sentiment, thus offsetting the losses in technology stocks.

Additionally, diversification can help investors maintain a more consistent short-term performance. By holding a variety of assets, investors can benefit from the positive performance of other holdings during periods of downturn in specific sectors or markets. This strategy allows for a more stable and consistent return, which is particularly important for short-term investors who may be more sensitive to market volatility.

In summary, while diversification is often associated with long-term investment strategies, its importance extends to short-term investments as well. Short-term market volatility can be effectively managed through a diversified portfolio, ensuring that investors can weather the storms of rapid market fluctuations and potentially benefit from the stability and consistency it provides. This approach allows investors to maintain their long-term investment goals while adapting to the unique challenges of short-term market dynamics.

Mastering Short-Term Investing: Strategies for Quick Profits

You may want to see also

Risk Management: Long-Term Benefits of Asset Allocation Strategies

Asset allocation strategies are a fundamental component of risk management in investing, and they play a crucial role in the long-term success of an investment portfolio. Diversification, a key principle within asset allocation, involves spreading investments across various asset classes, sectors, and geographic regions to reduce risk and enhance potential returns. While the importance of diversification is often discussed, its long-term benefits are particularly significant, especially in the context of risk management.

In the short term, diversification may not yield immediate results, as individual asset performances can vary. However, over the long haul, it becomes a powerful tool to navigate market volatility and economic cycles. By allocating investments across different asset classes, investors can smooth out the impact of market downturns and benefit from the growth potential during upswings. For instance, during a recession, stocks might underperform, but a well-diversified portfolio could include bonds, real estate, or commodities, which may hold up better, thus mitigating overall portfolio risk.

Long-term asset allocation strategies are designed to withstand the test of time, market fluctuations, and economic changes. This approach involves a careful selection of asset classes based on an investor's risk tolerance, goals, and time horizon. For retirement planning, for example, a long-term strategy might allocate a significant portion of the portfolio to stocks, taking advantage of their historical growth potential over extended periods. This strategy is complemented by a more conservative allocation to bonds and other fixed-income securities, ensuring a steady income stream and capital preservation.

The benefits of long-term asset allocation and diversification are twofold. Firstly, it enables investors to ride out short-term market volatility, which can be particularly challenging for risk-averse investors. By maintaining a consistent allocation strategy, investors can avoid the temptation to make impulsive decisions based on short-term market movements. Secondly, this approach allows for the potential of long-term wealth accumulation. Historical data shows that well-diversified portfolios have consistently outperformed non-diversified ones over extended periods, demonstrating the power of this strategy in risk management.

In summary, while diversification is a critical concept in investing, its long-term advantages are where it truly shines in risk management. Asset allocation strategies, when implemented over an extended period, provide a robust framework to navigate market challenges and economic uncertainties. This approach empowers investors to stay committed to their investment plans, benefiting from the power of compounding and the potential for long-term wealth creation.

UK Short-Term Savings: Strategies for Quick Growth

You may want to see also

Historical Data: Past Performance Supports Diversification in Both Time Frames

The historical data and past performance of investment portfolios strongly support the idea that diversification is beneficial in both short-term and long-term investments. This concept is a cornerstone of modern investment strategy, and its importance is evident across various market cycles and economic conditions.

In the short term, diversification can act as a hedge against market volatility. By holding a variety of assets, investors can reduce the impact of sudden price fluctuations in any one asset class. For instance, during a market downturn, a well-diversified portfolio might include a mix of stocks, bonds, and alternative investments. While the overall portfolio value may decline, the impact of any single asset's poor performance is mitigated by the positive contributions of other holdings. This strategy is particularly useful for risk-averse investors who want to protect their capital during turbulent times.

Long-term investors also benefit significantly from diversification. Over extended periods, markets tend to reward investors who adopt a long-term perspective and maintain a well-diversified portfolio. Historical data shows that during prolonged bull markets, a diversified approach can lead to substantial gains. For example, an investor who allocates their assets across different sectors and asset classes (such as technology, healthcare, and energy) is more likely to benefit from the growth of multiple industries, even if some sectors experience temporary setbacks. This approach ensures that the overall portfolio growth is not overly reliant on the performance of a single sector or asset type.

Additionally, diversification can help investors manage risk more effectively. By spreading investments across various assets, the risk of significant losses due to any single event or market shock is reduced. This strategy is especially crucial for long-term wealth accumulation, as it allows investors to weather short-term market volatility and focus on long-term goals. Historical data from various financial crises and market recoveries supports the idea that a diversified portfolio can provide stability and resilience during challenging economic periods.

In summary, the historical performance of investment portfolios underscores the value of diversification in both short-term and long-term strategies. Diversification provides a safety net during market downturns and volatility, while also offering the potential for substantial gains during bull markets. Investors who embrace this strategy can better manage risk and work towards their financial objectives, regardless of the economic cycle they find themselves in.

Decades of Dedication: Unlocking the True Potential of Long-Term Investing

You may want to see also

Investor Behavior: Short-Term Focus May Neglect Diversification's Long-Term Rewards

In the realm of investing, the concept of diversification is often emphasized as a key strategy to manage risk and optimize returns. However, many investors tend to overlook this fundamental principle when their investment horizons are limited. This short-term focus can lead to a myopic view of the market, potentially hindering long-term success. Here's an exploration of why a short-term mindset may cause investors to neglect the benefits of diversification.

The pressure to show immediate results can be a significant factor in this behavior. Investors often face scrutiny from those who expect quick profits, especially in today's fast-paced financial markets. As a result, some investors may prioritize short-term gains over a well-rounded investment approach. They might opt for high-risk, high-reward strategies, believing that such moves will yield substantial returns in a short period. This mindset, however, often leads to a lack of proper asset allocation and diversification, which are essential for long-term wealth creation.

Additionally, the fear of missing out (FOMO) can drive investors to make impulsive decisions. When the market experiences a surge, short-term investors might feel compelled to jump in, sometimes without a comprehensive understanding of the underlying assets. This can result in a portfolio that is heavily concentrated in a few high-risk, high-reward investments, leaving the investor vulnerable to market fluctuations. Diversification, which involves spreading investments across various asset classes, sectors, and regions, is a powerful tool to mitigate the impact of such market volatility.

Long-term investors, on the other hand, are more likely to embrace diversification. They understand that markets are inherently unpredictable, and a well-diversified portfolio can provide a more stable and consistent return over time. By allocating assets across different sectors and asset classes, investors can reduce the impact of any single investment's performance on their overall portfolio. This strategy allows investors to weather market downturns and benefit from the long-term growth potential of the markets.

To illustrate, consider a portfolio that includes a mix of stocks, bonds, real estate, and commodities. During a market downturn, the performance of one asset class might suffer, but the overall impact on the portfolio can be minimized due to the positive performance of other asset classes. This is the power of diversification, which short-term investors might overlook due to their focus on immediate gains. In contrast, long-term investors recognize that diversification is a key component of risk management and can lead to more consistent and sustainable returns.

In summary, while short-term investments might offer the allure of quick profits, they often come with a higher risk of market volatility and a lack of diversification. Long-term investors, who adopt a more patient and strategic approach, tend to benefit from diversification, which is a critical tool for managing risk and optimizing returns. Understanding the importance of diversification can help investors make more informed decisions, ensuring their portfolios are well-prepared for the long road to financial success.

Maximize Returns: Strategies for Short-Term Investing Over 18 Months

You may want to see also

Asset Allocation: Balancing Risk and Return Over Time with Diversification

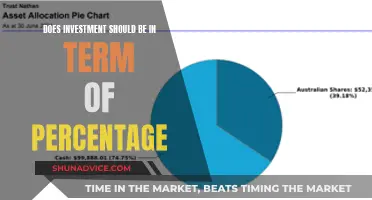

Asset allocation is a fundamental concept in investing, and it involves distributing your investment portfolio across various asset classes to achieve a balance between risk and return. Diversification is a key strategy within asset allocation, aiming to reduce the impact of individual asset volatility on the overall portfolio. This approach is particularly crucial when considering the time horizon of your investments.

In the context of short-term investments, diversification might seem less critical. Short-term investments often focus on capital preservation and quick returns. By nature, these investments are more liquid and less exposed to long-term market fluctuations. For instance, holding a diversified portfolio of short-term government bonds or money market instruments can provide a safe haven for capital. Here, the primary goal is to minimize risk and ensure a steady income stream, making diversification less about spreading risk and more about maintaining a stable investment environment.

However, as the investment time horizon extends, the importance of diversification becomes more apparent. Long-term investments are inherently riskier due to their exposure to market volatility and economic cycles. Over an extended period, asset prices can fluctuate significantly, and a well-diversified portfolio can act as a buffer against these swings. For example, a long-term investor might allocate a portion of their portfolio to stocks, which historically provide higher returns over time, but also carry higher risk. Simultaneously, they could hold a significant amount of bonds or other fixed-income securities to balance the portfolio and reduce overall risk.

The key to successful long-term investing is to maintain a consistent asset allocation strategy that aligns with your risk tolerance and financial goals. This strategy involves regularly reviewing and rebalancing your portfolio to ensure it remains diversified. For instance, if the stock market experiences a significant surge, an investor might reallocate some funds to bonds to reduce the overall portfolio risk. Conversely, during a market downturn, they could buy more stocks to take advantage of lower prices, thus maintaining the desired asset allocation.

In summary, while diversification might not be the primary concern in short-term investments, it becomes a critical tool for long-term investors. By allocating assets across different classes, investors can manage risk and optimize returns over extended periods. This approach ensures that the portfolio is resilient to market volatility, providing a more stable and secure investment journey. Understanding the role of diversification in asset allocation is essential for anyone looking to build a robust and sustainable investment strategy.

Maximize Your 150K: Short-Term Investment Strategies for Quick Wins

You may want to see also

Frequently asked questions

Diversification is a strategy that involves spreading your investments across various assets to reduce risk. While it is a fundamental principle in investing, its importance can vary depending on the investment horizon. In the short term, diversification might be more crucial as markets can be more volatile, and individual asset performance can significantly impact overall returns. By diversifying, investors can mitigate the impact of market swings and potential losses in a specific asset class.

The time horizon is a critical factor in determining the necessity and effectiveness of diversification. For long-term investments, such as retirement planning or buying a property, diversification is often less critical in the short term. This is because long-term investors can ride out market fluctuations and benefit from the potential for compound growth. However, as the investment period shortens, the impact of individual asset performance becomes more pronounced, making diversification a more essential strategy to manage risk.

In long-term investments, diversification's role shifts towards a more passive approach. Over an extended period, historical data suggests that markets tend to trend upwards, and individual asset performance becomes less critical. While diversification can still provide benefits, such as reducing the impact of specific company or sector-related risks, it is not as necessary as in the short term. Long-term investors often focus on asset allocation and strategic asset selection to achieve their financial goals.