An emergency fund is a crucial financial safety net to prepare for unforeseen circumstances such as medical bills, car repairs, or job loss. It is recommended to have three to six months' worth of living expenses set aside in a dedicated emergency fund, separate from your daily bank account. This fund should be easily accessible and relatively low risk, typically in a savings account or money market fund. However, with inflation, some are considering alternative investment options for their emergency funds to achieve better returns. This includes Ginnie Mae bond funds, TIPS mutual funds, dividend aristocrats, and tiered emergency funds. While investing an emergency fund may offer higher returns, it's important to carefully consider your risk tolerance and financial situation before making any investment decisions.

| Characteristics | Values |

|---|---|

| How much to save | 3-6 months' worth of living expenses |

| Where to put it | High-yield savings account, money market account, certificate of deposit (CD), Ginnie Mae bond funds, TIPS mutual funds, Betterment's Smart Saver, dividend aristocrats, Roth IRA, tiered emergency fund |

| When to use it | True emergencies, e.g. car breaking down, losing your job, the roof starting to leak, or a large medical bill |

What You'll Learn

Liquidity and safety

- Keep your emergency fund in a liquid account: Choose a savings account or money market account that allows you to withdraw your funds at any time without penalty. This ensures that you can access your money immediately in case of an emergency.

- Avoid investing in volatile assets: Emergency funds should be invested in low-risk, safe assets. Avoid investing in stocks or other volatile assets, as you may be forced to sell at a loss when you need the money.

- Consider a high-yield savings account: While traditional savings accounts offer ease of access, high-yield savings accounts can provide higher interest rates, helping to protect your money from the effects of inflation.

- Money market accounts: These accounts offer a mix between a checking and savings account and are considered low risk. They can provide annual percentage yields (APYs) of about 3% to 4% and are often insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA).

- Certificates of Deposit (CDs): CDs can offer higher interest rates than a regular checking account, but there is usually a penalty for early withdrawal. Consider creating a CD ladder to increase liquidity and avoid early withdrawal penalties.

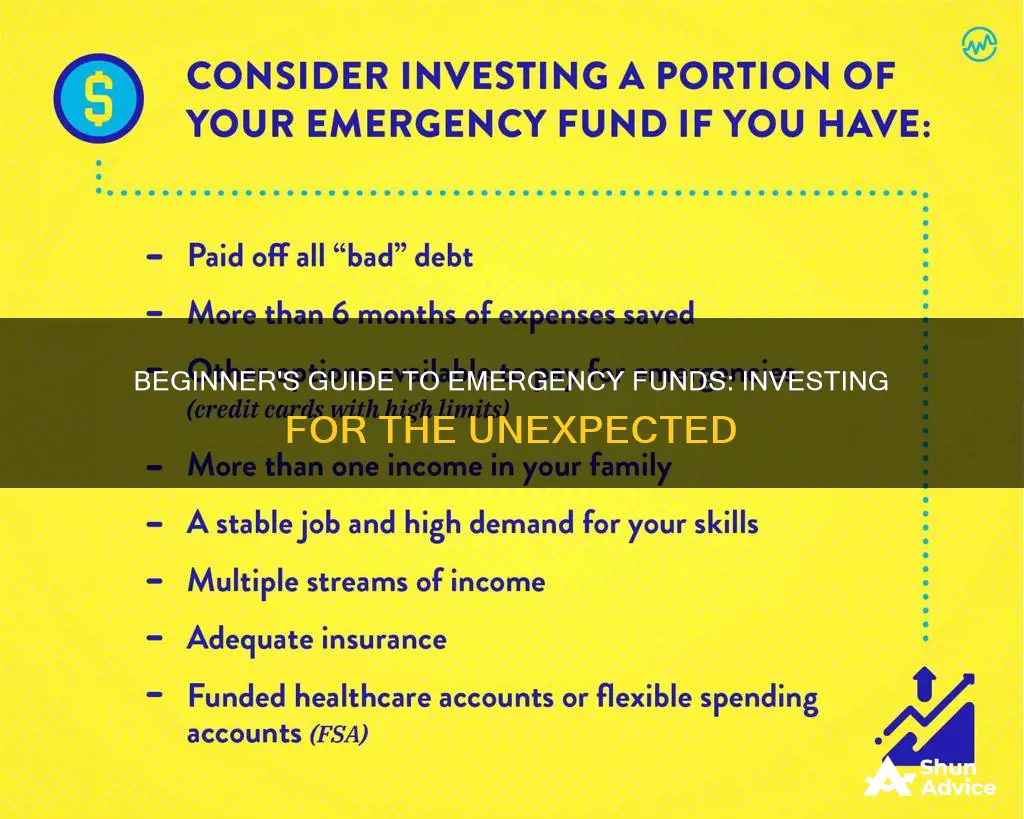

- Diversification: While safety and liquidity are important, you may also want to consider investing a portion of your emergency fund in a diversified portfolio to boost returns and beat inflation. This approach may involve a higher level of risk, so it's important to carefully consider your personal financial situation and risk tolerance before investing.

Large-Value Mutual Funds: A Smart Investment Strategy

You may want to see also

High-yield savings accounts

When choosing a high-yield savings account, consider the interest rates offered, any fees or rules regarding withdrawals, and whether the account meets your overall banking needs. Some accounts may also offer additional perks, such as a debit card or check-writing capabilities. It's important to note that some high-yield savings accounts are online-only, so you won't be able to access your funds at a branch location.

Overall, high-yield savings accounts are a great option for beginners looking to invest their money in an emergency fund. They offer higher interest rates, easy access to funds, and federal insurance for your peace of mind.

Best Tracker Funds: Where to Invest Your Money

You may want to see also

Certificates of deposit (CDs)

A certificate of deposit (CD) is a type of savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years. CDs are offered by banks and credit unions, and they pay a fixed interest rate on money held for an agreed-upon period. The interest rates on CDs are usually higher than those of savings accounts, but there is less withdrawal flexibility. If you withdraw your funds from a CD early, you will be charged a penalty.

CDs are considered to be one of the safest savings options. They are insured by the Federal Deposit Insurance Corporation (FDIC) for bank accounts and the National Credit Union Administration (NCUA) for credit union accounts, with up to $250,000 of funds protected per account. CDs are a safer and more conservative investment option than stocks and bonds, but they offer a lower opportunity for growth.

When opening a CD, you will need to consider the interest rate, term, principal, and financial institution. The interest rate is usually fixed, but there are also variable-rate CDs that could earn a higher return if interest rates rise. The term is the length of time that you agree to leave your funds deposited without incurring a penalty. The principal is the amount that you agree to deposit when you open the CD, and the financial institution will set factors such as early withdrawal penalties (EWPs) and whether the CD will default to being automatically reinvested at maturity.

One strategy to consider when investing in CDs is building a CD ladder. This involves dividing your total investment across multiple CDs with different maturity dates, allowing you to access the higher rates offered by longer-term CDs while maintaining some liquidity.

Mutual Funds: Investing in Government Treasury

You may want to see also

Ginnie Mae bond funds

When considering investment options for an emergency fund, it is important to aim for liquid assets that can be converted into cash quickly and easily without a withdrawal penalty. While Ginnie Mae bond funds are not as liquid as cash accounts, they are still accessible and can be a good option for those looking for a safe, effective way to invest their emergency funds.

Invest Wisely: Graphene Mutual Funds for Beginners

You may want to see also

Money market accounts

However, one potential drawback is that some money market accounts have minimum balance requirements to open an account or earn the highest APY. Therefore, it is important to read the fine print and understand the requirements and limitations of the account before opening one.

When choosing a money market account, consider comparing the interest rates, fees, and features offered by different banks. Online banks often provide higher interest rates and lower fees due to their lower overhead costs. Additionally, look into the service limitations, ATM availability, and the ratings of the bank's online banking and mobile app functionality.

In summary, money market accounts are a great option for beginners looking to invest their money in an emergency fund. They offer a good balance of accessibility, low risk, and the potential to earn interest on your savings.

Small-Cap Funds: Smart Investment, Big Returns

You may want to see also

Frequently asked questions

It is recommended to save enough to cover three to six months' worth of living expenses. However, the specific amount you need depends on your financial situation. For example, if you have a family to support and only one income, you may want to save up to eight months' worth of expenses.

It is best to keep your emergency fund in a separate account from your daily expenses, such as a savings account or money market account. This ensures that the money is easily accessible when needed and is not spent on non-emergencies.

While a traditional savings account is a safe and liquid option, you may want to consider alternatives that offer higher returns, such as Ginnie Mae bond funds, TIPS mutual funds, dividend aristocrats, or a Roth IRA. These options may provide better returns but come with varying levels of risk and liquidity.