The equity method of accounting is a technique used to record profits earned by a company through its investment in another company. It is generally used when the investor company holds significant influence over the company it is investing in, usually owning 20% or more of the company's stock. When applying the equity method, the investor recognises income as it is earned by the investee and increases its investment account to reflect the growth in the size of the investee company. At the time of disposal, the difference between the carrying value and the sale proceeds is recognised as income or expense. For example, if an investor sells an investment for more than its carrying value, a gain on the sale is recorded.

What You'll Learn

Recognising gains and losses

The equity method is an accounting technique used when a company has significant influence over another company but lacks full control. It is employed for investments that are not subsidiaries, as the investor wields the power to exert notable influence over the investee's affairs. This method is distinct from the consolidation method, which is utilised when a company exerts complete control over another entity.

The equity method is typically applied when an investor owns between 20% and 50% of the investee company's shares, indicating significant influence without reaching full control. In such cases, the investor company records the investment as an asset on its balance sheet and adjusts the carrying value based on changes in the investee company's net income or losses. This adjustment is recorded as a gain or loss on the investor company's income statement.

To calculate the gains or losses on an investment, it is essential to know the cost basis, which is the initial purchase price paid for the investment. This information can be found on the order execution confirmation form or the brokerage account statement from the purchase date. By comparing the cost basis with the selling price, investors can determine the gains or losses per share and then multiply this value by the number of shares to arrive at the total dollar amount of the transaction.

It is worth noting that the tax implications of the investment should also be considered, particularly if the stock was held in a non-retirement account. According to the US tax code, short-term capital gains or losses, which apply to stocks held for less than a year, are treated as ordinary income for tax purposes. On the other hand, profitable stocks held for more than a year are subject to a standard capital gains tax of 15%.

Additionally, investors should adjust their cost basis in the event of a stock split. For instance, if the original purchase price was $25 and the stock splits 2 for 1, the adjusted cost basis would become $12.50 per share.

In summary, recognising gains and losses on investments involves calculating the difference between the purchase price and the selling price, determining the gains or losses per share, and then multiplying by the number of shares. This process is essential for companies using the equity method to accurately reflect the financial health of their investments and make informed decisions about resource allocation.

Managing Risk: Investing for Retirement

You may want to see also

Journal entries for recording sale

Journal entries are a crucial aspect of accounting for investments using the equity method. This method is employed when an investor company holds significant influence over the company it is investing in, typically owning 20-50% of the investee company's stock. The equity method reflects the substantive economic relationship between the investor and the investee, accounting for the investor's share of the investee's earnings and losses.

When it comes to recording the sale of an investment, the journal entries will depend on the nature and extent of the investment, as well as the initial recognition and ongoing accounting practices. Here are the detailed steps and examples of journal entries for recording the sale of an investment using the equity method:

- Initial Investment Purchase: When an investor company purchases shares of another company, it records the initial investment at its historical cost. For example, if Company A buys 25% of Company B's shares for $200,000, it records a debit of $200,000 to "Investment in Company B" and a credit of $200,000 to Cash.

- Income Recognition: Throughout the holding period, the investor company recognizes its share of the investee company's income. If Company B reports a net income of $50,000 for a given year, and Company A owns 25%, it will record a debit of $12,500 to "Investment in Company B" and a credit of $12,500 to Investment Revenue.

- Dividend Treatment: When the investee company pays dividends, the investor company records a debit to Cash and a credit to "Investment in Company B." For instance, if Company A receives $2,500 in dividends (25% of Company B's $10,000 dividends), it will record a debit of $2,500 to Cash and a credit of $2,500 to "Investment in Company B."

- Sale of Investment: When the investor company sells its investment, it compares the carrying value of the investment to the sale proceeds. If Company A sells its 25% stake in Company B for $210,000, it will record a debit of $210,000 to Cash, a credit of $200,000 to "Investment in Company B", and a credit of $10,000 to "Gain on Sale of Investment."

It is important to note that the specific journal entries may vary depending on the complexity of the investment and the accounting practices of the investor company. Additionally, tax considerations and other regulatory requirements may also impact the journal entries.

Now, let's illustrate the journal entries for recording the sale of an investment using the equity method through a comprehensive example:

Example:

On January 1, 2026, Company A purchases a 30% stake in Company B for $30 million. Over the next two years, Company B's performance results in a carrying value of $34 million for Company A's investment. On December 31, 2027, Company A decides to sell its entire stake in Company B for $32 million.

To record the sale of the investment, Company A would make the following journal entry:

Dr. Loss on Investment in Company B ($2 million)

Dr. Investment in Company B ($34 million)

Cr. Cash ($32 million)

In this example, Company A recognizes a loss on the sale of its investment in Company B. The loss is calculated as the difference between the carrying value of the investment ($34 million) and the sale proceeds ($32 million).

By utilizing the equity method of accounting, the investor company can accurately reflect the changes in the value of its investment and properly recognize gains or losses upon the sale of the investment.

Traders' Transparency: Publicly Sharing Their Investment Portfolios

You may want to see also

Dividend collections

For example, let's consider a scenario where Big Company buys 40% of Little Company's outstanding stock for $900,000. During the year, Little Company reports a net income of $200,000 and pays a total cash dividend to its shareholders of $30,000. As per the equity method, Big Company initially recognises its portion of Little Company's net income, recording an increase of $80,000 (40% of $200,000) in its own income. This increase in income is reflected in Big Company's investment account, indicating the growth of Little Company.

Now, when Big Company receives the $30,000 cash dividend from Little Company, it does not record this as revenue. Instead, it records a reduction in its investment account. In this case, the investment account is reduced by $12,000 (40% of $30,000), reflecting the decrease in the size of Little Company due to the cash payout. This approach ensures that the income is not double-counted and provides a more accurate representation of the economic relationship between the two companies.

The handling of dividend collections under the equity method is an important consideration for investors, as it impacts the recognition of income and the valuation of their investment accounts.

Wealth and Investment Management: Global Strategies for Success

You may want to see also

Unrealised gains and losses

Unrealized gains and losses are important concepts in the context of investments and accounting. They refer to the changes in the value of an investment that has not yet been sold. When an investment increases in value, it is considered an unrealized gain, and when it decreases in value, it is considered an unrealized loss. These gains and losses are reflected in the financial statements of companies and can provide insights into the performance of an investment portfolio.

Unrealized gains and losses are calculated by subtracting the original purchase price or book value of an investment from its current market value. For example, if an investor purchases shares at $10 per share and the market value rises to $15 per share without selling, they have an unrealized gain of $5 per share. This gain becomes realized when the shares are sold, locking in the profit. Conversely, if the share price drops to $8 per share, the investor has an unrealized loss of $2 per share, which becomes a realized loss if the shares are sold.

It is important to note that unrealized gains and losses are not taxed as they are not considered actual profits or losses until the investment is sold. However, they can be useful for tax planning purposes as they provide an estimate of potential capital gains taxes if the investment is sold. Additionally, investors may use unrealized losses to offset capital gains or taxable income through a strategy called tax-loss harvesting.

The accounting treatment of unrealized gains and losses depends on the type of security and the company's financial reporting practices. For securities held for trading, unrealized gains and losses are recorded on the income statement and impact the company's net income and earnings per share. For securities available for sale, the unrealized gains and losses are recorded in comprehensive income on the balance sheet.

Balancing Your Investment Portfolio: Strategies for Success

You may want to see also

Equity method vs fair value method

The choice of accounting method depends on the amount of ownership a company has over another entity. If a company owns less than 20% of another company's shares, it can be assumed that it does not exert significant influence and therefore uses the fair value method (also known as the cost method). If a company owns between 20% and 50% of the shares, it qualifies for the equity method.

The fair value method is used when an investor does not exert significant influence over the investee. The investment is initially recorded at the purchase price of the shares, and the book value is updated periodically to reflect the fair value—the price the shares would sell for on the open market. If the shares are publicly traded, the fair value is the market price. Private shares may be harder to evaluate, and revaluation should only be done if there are good reasons. Under the fair value method, unrealized gains and losses are booked as income.

The equity method is used when an investor holds significant influence over the company it is investing in. The investment is initially recorded at the historical cost, and adjustments are made based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income of the investee company increases the investor's asset value, while loss or dividend payout decreases it. The investor records their share of the investee's earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

The equity method acknowledges the substantive economic relationship between two entities. When the investor has significant influence over the operating and financial results of the investee, this can directly affect the value of the investor's investment. The investor records their initial investment at historical cost, and the investment's value is periodically adjusted to reflect changes in value due to the investor's share in the company's income or losses. Adjustments are also made when dividends are paid out to shareholders.

Using the equity method, a company reports the carrying value of its investment independent of any fair value changes in the market. The investor bases their investment value on changes in the value of the investee's net assets from operating and financial activities and the resulting performance, including earnings and losses.

For example, when the investee company reports a net loss, the investor company records its share of the loss as "loss on investment" on the income statement, which also decreases the carrying value of the investment. When the investee company pays a cash dividend, the investor company records an increase in its cash balance but reports a decrease in the carrying value of its investment.

In summary, the fair value method is used when an investor owns less than 20% of another company's shares and does not exert significant influence. The equity method is used when an investor owns between 20% and 50% of the shares and has significant influence over the investee. The equity method provides a more complete and accurate picture of the economic interest that one company has in another.

Understanding Investment Managers' Fiduciary Duties and Responsibilities

You may want to see also

Frequently asked questions

The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. It is generally used when the investor company holds significant influence over the company it is investing in.

The equity method is used when an investor company has a significant influence over the operating and financial results of the company it has invested in. This usually occurs when the investor company owns 20% or more of the company's stock.

The initial investment is recorded at its historical cost, which includes the consideration paid and transaction costs directly related to the acquisition.

The value of the investment is adjusted periodically to reflect changes in the investee company's income, losses, and dividend payouts. Net income increases the investor's asset value, while losses and dividend payouts decrease it.

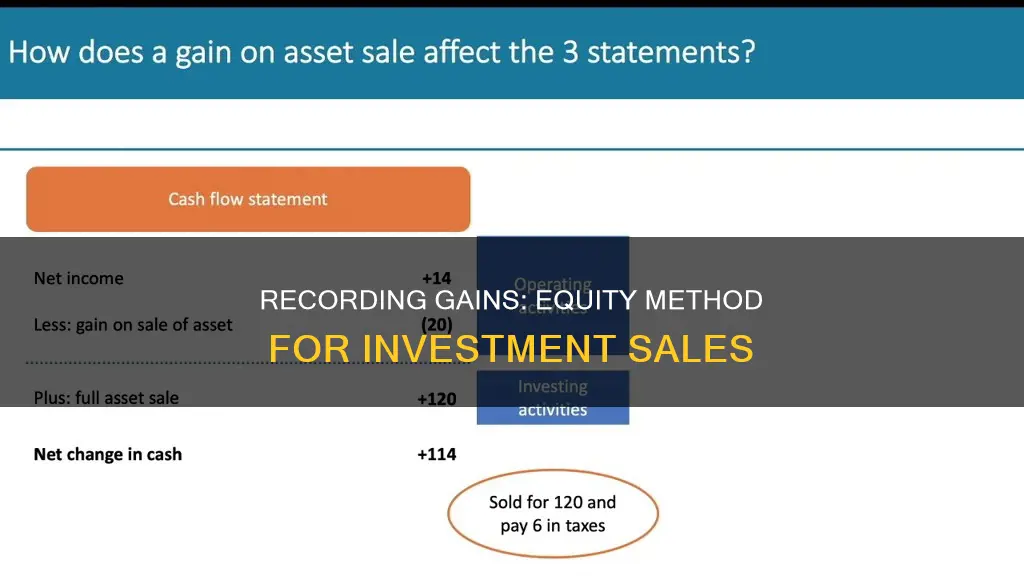

The sale of an investment using the equity method is treated as a disposal, and the difference between the carrying value of the investment and the sale proceeds is recognized as income or loss.