J.P. Morgan Self-Directed Investing is a commission-free investment platform that is great for beginners looking to learn how to buy and sell investments. It offers a highly integrated app, which makes it a solid choice for individuals who want to trade their own investments — especially existing Chase customers. The platform offers unlimited $0 commission online trades and access to thousands of investments — all in the Chase Mobile app.

J.P. Morgan Self-Directed Investing is available within the Chase mobile app, allowing users to view all of their Chase accounts, from checking to investments, in one location. The platform offers stocks (including fractional shares), bonds, funds (including some exchange-traded cryptocurrency funds) and options.

The signup experience is smooth, although it can take a while to fund an account as J.P. Morgan does not have an instant deposit feature. The platform is also lacking in terms of available assets and tools for more advanced investors.

| Characteristics | Values |

|---|---|

| Account options | General investment and retirement accounts (Traditional and Roth IRAs) |

| Investment products | Stocks, ETFs, Options, Mutual Funds, Fixed Income, Treasuries, Money Market Funds, and other securities |

| Pricing structure | $0 commission online trades, including stocks, ETFs, mutual funds, and options. Options contract and other fees may apply. |

| Minimum investment | No account minimum |

| Mobile app | Chase Mobile® app |

| Website | chase.com |

| Customer support | Phone and in-person support available Monday-Friday, 8 a.m.-9 p.m. Eastern, and Saturday 9 a.m.-5 p.m. |

| Research and analysis | Morningstar analyst ratings, CFRA reports, and news feeds from Benzinga, Midnight Trader, and Comtex |

| Tools | Watchlists, screeners, calculators, and J.P. Morgan Wealth Plan® |

What You'll Learn

How to access Chase You Invest

Chase You Invest, also known as J.P. Morgan Self-Directed Investing, is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell their own investments.

- Sign Up for a J.P. Morgan Self-Directed Investing Account: If you are an existing Chase customer, you can access J.P. Morgan Self-Directed Investing through the Chase mobile app. If you are not a Chase customer, you can still open a Self-Directed Investing account. The signup process is generally smooth, but it can take some time to fund your account as instant deposits are not available.

- Understand the Fees: J.P. Morgan Self-Directed Investing offers commission-free stock trades. For options, you won't pay a per-trade commission, but there is a $0.65 fee per contract. There is no account minimum, so you can start investing with any amount. A $75 fee is charged for full account transfers of assets, while partial transfers are free.

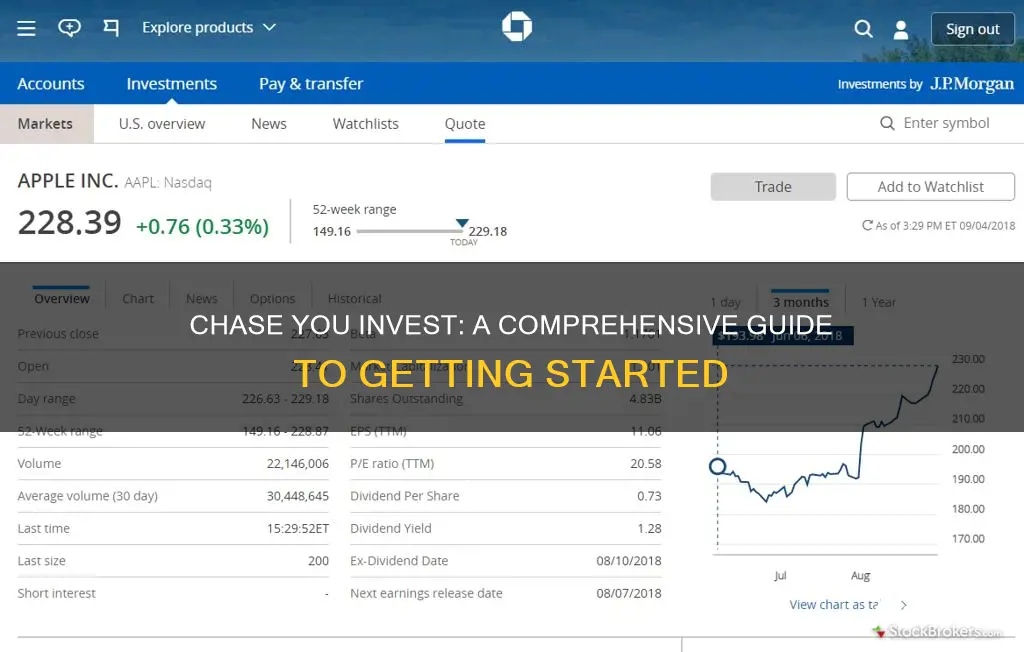

- Utilize the Trading Platforms and Apps: The Chase mobile app allows users to trade stocks, bonds, mutual funds, and ETFs, as well as access charting tools, screeners, J.P. Morgan research, and more. The app is available for both iOS and Android and has received positive reviews.

- Explore the Investment Selection: J.P. Morgan Self-Directed Investing offers a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and options. However, it does not support investing in futures, forex, or initial public offerings (IPOs).

- Access Customer Support: J.P. Morgan provides customer support via phone and in-person at branches Monday through Friday from 8 am to 9 pm Eastern, and on Saturdays from 9 am to 5 pm. Support is also available via Facebook and Twitter on weekdays from 7 am to 11 pm and weekends from 10 am to 7 pm.

- Take Advantage of Educational Resources: J.P. Morgan offers an extensive educational content hub called "The Know", featuring thousands of articles and videos, as well as newsletters and webinars.

- Consider the Benefits for Chase Customers: If you are a Chase customer, you can conveniently view and manage all your Chase accounts, including credit cards, bank accounts, and investments, in one place through the Chase mobile app.

By following these steps, you can access and utilize the features of Chase You Invest to start building your investment portfolio.

Cash or Invest: Where Should Your Money Go?

You may want to see also

How to use the Chase Mobile app to trade

The Chase Mobile® app is a secure and convenient way to manage your investments on the go. Here's a step-by-step guide on how to use the app to trade:

- Sign in to the Chase Mobile® App: Open the app on your device and securely log in to your account using your credentials.

- Access Your Investment Account: Swipe left on your investment account to access trading, transferring, and other features. Tap on your investment account to view its details.

- Fund Your Account: To start investing, tap "Fund Your Account." You can transfer money or securities to fund this account. You can also move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account as often as you like.

- Explore Investment Options: Tap the search icon in the top right corner to find quotes on stocks, ETFs, and more. You can also tap "Explore" to discover investment ideas, see the latest research, and explore market trends.

- Place a Trade: Choose the “Trade” option to buy or sell stocks, ETFs, mutual funds, and more. You can trade with as little as $5 using fractional shares.

- Review and Manage Your Trades: After placing trades, you can review and manage your positions. Tap "See More" to check your portfolio's performance over time, find statements and documents, create a watchlist, and more.

- Adjust Settings: Tap the "Profile & Settings" icon to review and change your investment settings, such as choosing beneficiaries or changing your dividend reinvestment preferences.

The Chase Mobile® app also offers additional features to enhance your trading experience. These include setting up market alerts, accessing J.P. Morgan research and ratings, and utilising screeners to build a diversified portfolio.

Remember to keep your app updated to ensure you have access to the latest features and security enhancements.

Capital Investment Project: Cash Flows Strategy

You may want to see also

How to transfer money to your Chase You Invest account

You can transfer money to your Chase You Invest account in several ways, depending on whether you are transferring from a Chase account or an external bank account.

Transferring from a Chase account

If you are transferring money from a Chase account, you can do so instantly by following these steps:

- Sign in to the Chase Mobile® app and tap "Pay & Transfer".

- Tap "Transfer" and then choose "Account or Brokerage Transfer".

- Choose the accounts you want to transfer money from and to.

- Enter the transfer date and add an optional memo.

- Tap "Transfer" and confirm the automatic transfer service.

Transfers are typically instant if you submit it on a business day before 4:30 pm ET.

Transferring from an external bank account

If you are transferring from an external bank account, you can do so by following these steps:

- Go to the "Move cash" tab on the Chase website or the Chase Mobile® app.

- Choose the option to transfer from a bank account.

- Enter the amount you want to transfer and the account you want to transfer it to.

- Confirm the transfer.

Transfers from external bank accounts typically take 1-3 business days to complete.

Other ways to fund your account

In addition to transferring money, there are several other ways to fund your Chase You Invest account, including:

- Transferring investments: You can transfer investments from another financial institution or a J.P. Morgan investment account.

- Rolling over retirement assets: You can roll over retirement assets from a previous employer's retirement plan or an IRA.

- Contributing to an IRA: You can set up one-time or repeating contributions to your IRA.

For more information on funding your Chase You Invest account, you can visit the Chase website or contact their customer support.

Understanding Cash Flow from Sales of Investments

You may want to see also

How to use Chase You Invest tools and insights

Chase offers a range of tools and insights to help you make informed investment decisions and build your investment portfolio. Here's a step-by-step guide on how to use the Chase You Invest tools and insights:

- Get started with the Chase Mobile App or Website: Download the Chase Mobile® app or visit the Chase website to access your account and begin using the investment tools. The app provides a 360-view of your J.P. Morgan investments, Chase banking, and credit card accounts, enabling easy transfers between them.

- Fund your account: You can fund your J.P. Morgan Self-Directed Investing account in several ways. Instantly move cash from your Chase checking or savings account, transfer investments from another financial institution using their online tool, or use Chase QuickDeposit℠ to deposit checks directly into your investment account via the mobile app.

- Place your first trade: With Chase, you can start investing with as little as $5 using fractional shares. Choose from a wide range of investment options, including stocks, ETFs, mutual funds, options, and fixed-income securities.

- Utilize screeners and research: Chase provides investment screeners to help you find prospective investments that fit your criteria. You can also explore investment ideas, such as active stocks and ETFs, and access J.P. Morgan research, stock ratings, and price targets to make informed decisions.

- Set up notifications and alerts: Create custom notifications to stay informed about price changes, volume, and other market movements for specific stocks or ETFs.

- Discover market trends: Stay updated with today's news, market movers, and events. Take advantage of pre-market, midday, and market close briefings to make timely investment decisions.

- Manage your portfolio: Keep an eye on your investments and set up your portfolio to align with your financial goals. Track your gains, losses, contributions, and withdrawals over time, and compare your portfolio's performance to major indices.

- Use watchlists: Create watchlists to monitor the performance of your favourite stocks and view J.P. Morgan's price targets, ratings, and potential upsides or downsides.

- Utilize retirement tools: If you're planning for retirement, Chase offers retirement calculators to help you understand how your choices impact your goals.

- Connect with advisors (optional): If you prefer personalized guidance, you can work one-on-one with a J.P. Morgan advisor to build a financial strategy tailored to your needs and goals.

By following these steps and utilizing the tools and insights provided by Chase, you can make more confident and informed investment decisions, helping you work towards your financial objectives.

Strategies for Investing Surplus Corporate Cash: A Comprehensive Guide

You may want to see also

How to use Chase You Invest to create a custom watchlist

To use Chase You Invest to create a custom watchlist, follow these steps:

Firstly, you will need to have a J.P. Morgan Wealth Management account. If you don't already have one, you can open an account on the Chase website or the Chase Mobile® app. Once you have an account, you can access all your J.P. Morgan investment and Chase banking accounts anywhere, anytime, using the Chase Mobile® app or by logging in at chase.com.

Now, you can start creating your custom watchlist. On the Chase Mobile® app, tap "See More" to check your positions, track your portfolio's performance over time, find statements and documents, and create a watchlist. You can also use the app to fund your account, search for quotes on stocks, ETFs and more, and trade or transfer stocks, ETFs, mutual funds, etc.

You can also use the website to create a watchlist and perform other functions. Using the website, you can move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account as often as you want. You can also use screeners to help you find stocks that fit your criteria and easily add them to your portfolio.

Dividends: Cash Flow from Investing?

You may want to see also

Frequently asked questions

You can open a J.P. Morgan Self-Directed Investing account by downloading the Chase Mobile app or by visiting the Chase website.

J.P. Morgan Self-Directed Investing offers unlimited $0 commission online trades, access to thousands of investments, and powerful tools to help you navigate the markets.

You can transfer money to your J.P. Morgan Self-Directed Investing account by moving cash instantly from a Chase checking or savings account. You can also transfer investments from another financial institution using their simple online tool.

With a J.P. Morgan Self-Directed Investing account, you can invest in stocks, ETFs, mutual funds, options, money market funds, treasuries, and other fixed-income securities.