RBC Direct Investing is an online service provided by the Royal Bank of Canada to help you manage your investments. RBC Direct Investing provides a range of online tools and resources to help you make smart investment decisions. The platform offers a variety of investment products and accounts, including Tax-Free Savings Accounts (TFSA), Registered Retirement Savings Plans (RRSP), and non-registered cash accounts. RBC Direct Investing also provides tutorials and videos to help users navigate the platform, transfer funds, buy and sell stocks, and more. Users can also practice placing trades and building their confidence through a practice account.

| Characteristics | Values |

|---|---|

| How to open an account | Complete an application online, by phone, in person, or through the RBC Royal Bank online banking service |

| How to access your account | Single sign-on using your RBC Royal Bank online banking account |

| How to fund your account | With cash, stocks, or Avion points |

| How to transfer funds | Through the online investing site, or by contacting an investment services representative |

| How to buy and sell stocks | Through the RBC Direct Investing website or mobile app |

| How to read a stock quote | Through the RBC Direct Investing website or mobile app |

| How to transfer assets | By transferring investments, RESP, or pension plan from another financial institution |

| How to place orders | Through the RBC Direct Investing Trading Dashboard or mobile app |

| How to search for a quote | Through the RBC Direct Investing Trading Dashboard or mobile app |

What You'll Learn

How to open an RBC Direct Investing account

To open an RBC Direct Investing account, you can either apply by phone, in person, or online.

Applying by Phone

You can complete the application over the phone with a customer service representative at 1-800-769-2560. Your printed application will then be forwarded to you for you to sign and return with any other required documentation.

Applying in Person

You can make an appointment with your local RBC Royal Bank branch to complete the application with a Branch Officer.

Applying Online

You can complete the online form through Online Banking and submit it to RBC Direct Investing for review. Your printed application will then be forwarded to you for you to sign and return with any other required documentation. Alternatively, you can download and print the application form for completion. To access the application through Online Banking, from your Account Balances page:

- From the "Research, Purchase & Apply" menu, select "Investments & retirement"

- In the right-hand menu, click on "Invest with RBC Direct Investing"

- Select "Open an RSP account" or "Open an Investment Account," and follow the instructions for completing and submitting the application

Along with your completed application, please enclose a legible copy of one of the following pieces of identification:

- National Identity Card

- Birth Certificate (if under 21)

- Government-Issued Age of Majority Card

Once you have completed the application, simply drop it off at any RBC Royal Bank branch or mail it to RBC Direct Investing at the following address:

> RBC Direct Investing Inc.

> 260 East Beaver Creek Road,

> Suite 404 Richmond Hill

> ON L4B 3M3

If you are transferring assets from an existing investment or registered account, the required transfer forms are also available through the options listed above. Please be sure to include the completed transfer forms with your account application for ease of processing. As well, a recent statement from the delivering institution can assist with efficient processing of your transfer request.

Credit Card Investing: A Guide to Mutual Funds

You may want to see also

How to access your RBC Direct Investing account

There are several ways to access your RBC Direct Investing account. Firstly, you can access your account with single sign-on using your RBC Royal Bank online banking account. Alternatively, you can access your account through the RBC Mobile Banking app, where you can switch between your Personal, Business, and Direct Investing profiles in just a few steps.

If you are unable to access your account through the mobile app, you can call 1-800-769-2560 and a Technical Support Representative will assist you.

What is Levered Free Cash Flow?

You may want to see also

How to transfer funds to/from your RBC Direct Investing account

There are several ways to transfer funds to/from your RBC Direct Investing account. You can do it by phone, in person, or online.

By Phone

Call 1-800-769-2560 to complete the application over the phone with a customer service representative. Your printed application will then be forwarded to you for you to sign and return with any other required documentation.

In Person

Make an appointment with your local RBC Royal Bank branch to complete the application with a Branch Officer.

Online

Complete the online form through Online Banking and submit it to RBC Direct Investing for review. Your printed application will then be forwarded to you for you to sign and return with any other required documentation. Alternatively, you may download and print the application form for completion. To access the application through Online Banking, from your Account Balances page:

- From the "Research, Purchase & Apply" menu, select "Investments & retirement"

- In the right-hand menu, click on "Invest with RBC Direct Investing"

- Select "Open an RSP account" or "Open an Investment Account," and follow the instructions for completing and submitting the application

Along with your completed application, please enclose a legible copy of one of the following pieces of identification:

- National Identity Card

- Birth Certificate (if under 21)

- Government-Issued Age of Majority Card

Once you have completed the application, simply drop it off at any RBC Royal Bank branch or mail it to RBC Direct Investing at the following address:

> RBC Direct Investing Inc.

> Royal Bank Plaza

> 200 Bay Street, North Tower

> P.O. Box 75

> Toronto, ON M5J 2Z5

If you are transferring assets from an existing investment or registered account, the required transfer forms are also available through the options listed above. Please be sure to include the completed transfer forms with your account application for ease of processing. As well, a recent statement from the delivering institution can assist with efficient processing of your transfer request.

Transferring funds between your RBC Direct Investing account and your RBC Royal Bank account

Through the online investing site:

- From the "Select a View" menu, choose "Funds Transfer".

- Click on the word "GO!".

- Ensure that all fields are completed according to the transfer you would like to perform.

- Click on the "Submit" button.

- Review the detailed transfer recap and confirm your transaction.

Funds transfer requests received weekdays prior to 2:30 pm EST will generally be available in your account the next business day. Requests received after 2:30 pm EST, or on weekends or holidays, or through the Online & Telephone Banking service, will generally be available on the second business day following the request.

Contact an investment services representative at 1-800-769-2560 for assistance.

Alternatively, you may select Option 3 from the automated telephone service menu and simply follow the prompts.

Please note that transferred funds will not be available for same-day settlement. For same-day trades, you may wish to settle from your "Bank Account on File" rather than completing a funds transfer.

Cash and Sweep Investment: Maximizing Your Money

You may want to see also

How to place a trade with RBC Direct Investing

To place a trade with RBC Direct Investing, you can either use the RBC Mobile app, the RBC online investing site, or call an Investment Services Representative over the phone.

Using the RBC Mobile App:

- Download the free RBC Mobile app to your device.

- From the Place an Order menu, select Stocks & ETFs, Options, Mutual Funds, or Fixed Income.

Using the RBC Online Investing Site:

Access your RBC Direct Investing account through RBC Online Banking.

Over the Phone:

- Call 1-800-769-2560 and follow the prompts to reach an Investment Services Representative.

- Representatives are available Monday to Friday, 7 am to 8 pm ET.

Screening for Value: Strategies for Finding Profitable Investments

You may want to see also

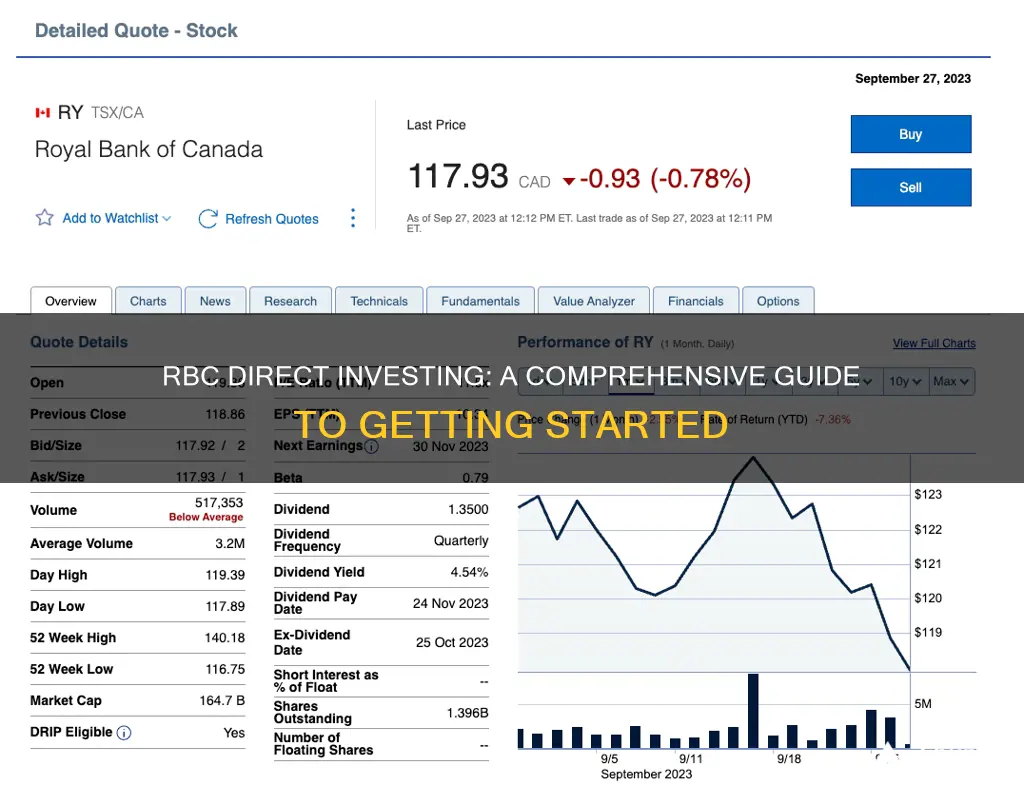

How to buy and sell stocks with RBC Direct Investing

RBC Direct Investing offers a platform for trading and investing, with a range of tools and research to help you make informed decisions. You can buy and sell stocks on the RBC Direct Investing Online Investing platform, the RBC Mobile app, and the Trading Dashboard. You can also place orders by phone with an investment services representative. Here is a step-by-step guide on how to buy and sell stocks using RBC Direct Investing:

Buying Stocks with RBC Direct Investing:

- Open an Account: If you don't already have an account, you can open one on the RBC Direct Investing website. Your application will typically be approved within 24 hours.

- Log In: Access the RBC Direct Investing platform or RBC Mobile app and log in to your account using your credentials.

- Search for a Stock: Use the quote search bar to enter the stock symbol or company name to find the stock you want to buy.

- Place a Buy Order: Once you have found the stock, enter the number of shares you want to purchase, choose your order type (e.g., market order or limit order), and specify any other relevant details. Review your order details carefully before placing the buy order.

- Confirm the Transaction: After placing your order, you will receive a confirmation message. Check this message to ensure that your trade went through successfully.

Selling Stocks with RBC Direct Investing:

- Log In to Your Account: Access the RBC Direct Investing platform or RBC Mobile app and log in to your account.

- Go to Your Trading Platform: Navigate to your trading platform or portfolio page to view your holdings.

- Select the Stock to Sell: Choose the stock you wish to sell by either typing its name or symbol in the platform or selecting it from your account.

- Place a Sell Order: Click on the 'Sell' or 'Trade' button and provide the details of your order, including the number of shares you want to sell, the order type, and the duration.

- Review and Confirm: Carefully review the details of your sell order before finalizing the transaction.

- Finalize the Sale: Press the 'Sell/Trade' button to execute your order. Check the acknowledgement message to verify that your trade was successfully placed.

Please note that when selling stocks, you may incur trading fees or commissions, and there may be settlement and withdrawal periods before you can access the funds from your sale. Additionally, don't forget to consider the tax implications of any profits made from buying and selling stocks.

Understanding Cash Equivalent Investments: Basic Features Explained

You may want to see also

Frequently asked questions

There are three ways to open an RBC Direct Investing account: by phone, in person, or online. By phone, you can complete the application with a customer service representative, who will forward the application to you for your signature. In person, you can make an appointment with your local RBC Royal Bank branch to complete the application with a Branch Officer. Online, you can complete the online form through RBC Online Banking and submit it for review.

Transferring funds between your RBC Direct Investing account and your RBC Royal Bank account can be done through the online investing site. From the "Select a View" menu, choose "Funds Transfer", then click "GO!". After this, fill out the necessary fields, click "Submit", review the transfer, and confirm your transaction.

You can place a trade with RBC Direct Investing through their online investing site, their automated telephone service, or by calling an investment services representative to take your investment instructions over the phone.

From your Account Balances page, under "Investments", select one of your RBC Direct Investing accounts. You can also select the "Go to site" link beside each of your RBC Direct Investing accounts. If your RBC Direct Investing account is not listed on your Account Balances page, you can call RBC Direct Investing for assistance.