Currency fluctuations can significantly impact foreign investment, presenting both challenges and opportunities for investors. As exchange rates fluctuate, the value of foreign investments can change rapidly, affecting the returns and overall profitability of international ventures. Understanding these dynamics is crucial for investors to make informed decisions and navigate the complexities of the global investment landscape. This paragraph sets the stage for an exploration of the intricate relationship between currency movements and foreign investment strategies.

What You'll Learn

Currency Volatility: Impact on Investment Decisions

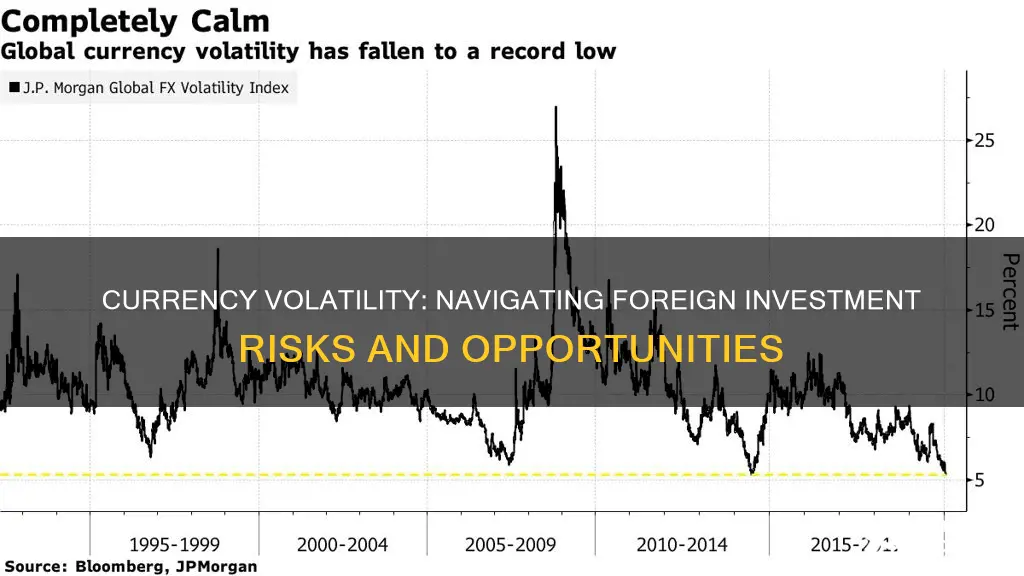

Currency volatility, a phenomenon characterized by rapid and significant fluctuations in exchange rates, has a profound impact on investment decisions, particularly in the realm of foreign investment. This volatility introduces a layer of complexity and risk that investors must carefully navigate to make informed choices. When assessing the potential of an investment in a foreign market, currency movements can either enhance or diminish the attractiveness of the opportunity.

For investors, currency fluctuations can be a double-edged sword. On the positive side, a weakening domestic currency can make foreign assets more affordable, potentially increasing the returns on investment. For instance, a U.S. investor might find that their currency has strengthened against the euro, making European real estate investments more cost-effective. This scenario could lead to higher potential returns, especially if the investment appreciates in value while the currency exchange rate remains favorable.

However, the same currency movements can also introduce substantial risks. A sudden appreciation of the domestic currency against a foreign market's currency can significantly reduce the value of an investment. This is particularly critical for investors who have already committed funds and are now facing a potential loss due to currency shifts. For example, a Japanese investor might find that their yen has strengthened against the U.S. dollar, making their technology startup investment in the U.S. less valuable in yen terms.

The impact of currency volatility is especially significant in the long term. Investors often make decisions based on the potential for sustained growth and profitability. However, if currency fluctuations are frequent and unpredictable, it becomes challenging to forecast the true value of an investment over time. This uncertainty can deter investors, especially those seeking stable and predictable returns.

To mitigate the risks associated with currency volatility, investors often employ various strategies. These include hedging, where they use financial instruments to protect their investments from adverse currency movements. Additionally, investors might diversify their portfolios across multiple currencies and markets to reduce the impact of any single currency's volatility. A well-diversified portfolio can provide a more stable investment environment, even in the face of currency fluctuations.

In conclusion, currency volatility is a critical factor that investors must consider when making decisions about foreign investments. While it can present opportunities for enhanced returns, it also introduces significant risks that can erode the value of investments. Understanding the dynamics of currency movements and implementing appropriate risk management strategies are essential for investors to navigate this complex landscape effectively.

A Beginner's Guide to ETF Investing with Fidelity

You may want to see also

Exchange Rates: Foreign Investment Strategies

Understanding the impact of exchange rates on foreign investment is crucial for investors and businesses looking to expand internationally. Currency fluctuations can significantly influence the profitability and risk profile of foreign investments, making it essential to develop effective strategies to navigate these dynamics. Here's an overview of how exchange rates can shape foreign investment decisions and some strategies to consider:

Impact of Exchange Rates on Foreign Investment:

- Return on Investment (ROI): Currency fluctuations directly affect the ROI of foreign investments. When a country's currency depreciates against the investor's home currency, the value of the investment returns increases, providing a higher return. Conversely, if the host country's currency appreciates, the investment's value in the home currency decreases, potentially reducing the overall return.

- Competitiveness: Exchange rates play a vital role in a country's competitiveness in the global market. A weaker domestic currency can make a country's exports more competitive, attracting foreign investors. For instance, a country with a depreciating currency might see an influx of foreign direct investment (FDI) as investors seek to capitalize on the potential for higher returns.

- Operational Costs: For businesses investing abroad, exchange rate volatility can impact operational costs. If a company's expenses in the host country are denominated in a foreign currency, fluctuations can significantly affect profitability. A sudden appreciation of the host country's currency could lead to increased costs, potentially impacting the investment's viability.

Strategies for Managing Exchange Rate Risks:

- Currency Hedging: Investors can employ hedging techniques to protect their investments from adverse currency movements. This involves using financial derivatives like forward contracts, options, or swaps to lock in exchange rates. By hedging, investors can ensure that their investment returns are not significantly eroded by currency fluctuations.

- Diversification: Diversifying investments across multiple countries and currencies can help mitigate the risks associated with exchange rates. By holding a portfolio of international assets, investors can balance the impact of currency movements. This strategy allows for a more stable overall return, as gains in one investment may offset losses in another due to currency variations.

- Local Currency Operations: For businesses, conducting operations in the local currency can reduce the impact of exchange rate volatility. This approach minimizes the risk of currency fluctuations affecting profitability. However, it requires careful financial management and may not be feasible for all types of businesses.

- Long-Term Investment Horizon: Adopting a long-term investment perspective can help investors weather short-term currency fluctuations. Over time, exchange rates tend to stabilize, and the impact of temporary movements diminishes. This strategy is particularly useful for investors looking to build a substantial international portfolio.

- Country-Specific Analysis: Conducting thorough research on the economic and political environment of the host country is essential. Understanding the factors that influence exchange rates can help investors make informed decisions. For instance, countries with stable economies and low inflation rates may offer more predictable currency behavior, reducing investment risks.

In summary, exchange rates are a critical consideration for foreign investors, impacting profitability, competitiveness, and overall investment strategies. By implementing these strategies, investors can effectively manage currency risks and make informed decisions when expanding their operations or investments internationally. Staying informed about economic trends and seeking professional advice can further enhance the success of foreign investment endeavors.

Using Bitstamp Invest: A Step-by-Step Guide

You may want to see also

Currency Fluctuations: Risks and Rewards for Investors

Currency fluctuations can have a significant impact on foreign investment, presenting both risks and rewards for investors. Understanding these effects is crucial for making informed decisions in the global investment landscape. Here's an analysis of how currency movements influence foreign investment:

Risks of Currency Fluctuations:

- Volatility and Uncertainty: Currency markets are inherently volatile, and sudden fluctuations can create uncertainty for investors. When a country's currency depreciates rapidly, it may lead to increased costs for foreign investors, especially those holding assets in that currency. This volatility can deter investors, particularly those seeking stable returns.

- Exchange Rate Risks: Foreign investors often face exchange rate risks when their investments are denominated in a foreign currency. If the value of the investment currency drops, the overall return on investment may decrease, even if the underlying asset performs well. This risk is particularly relevant for long-term investments and those with significant exposure to international markets.

- Impact on Exporters and Importers: Currency fluctuations can significantly affect the profitability of multinational corporations. For exporters, a weaker domestic currency can make their products more expensive in international markets, potentially reducing sales. Conversely, importers may benefit from a stronger currency, as it makes their purchases cheaper. These dynamics can influence investment decisions, especially in industries heavily reliant on international trade.

Rewards and Opportunities:

- Diversification and Currency Hedge: Currency fluctuations offer opportunities for diversification. Investors can strategically allocate their portfolios across different currencies to mitigate risks. By holding assets in various currencies, investors can balance potential losses in one currency with gains in another. Additionally, currency hedging strategies can be employed to protect investments from adverse exchange rate movements.

- Attractive Investment Destinations: Currency fluctuations can make certain countries or regions more attractive for foreign investment. For instance, a country with a depreciating currency may become a more affordable investment destination for foreign buyers, as their purchasing power increases. This can stimulate foreign direct investment and create opportunities for various sectors, including real estate, manufacturing, and technology.

- Long-Term Growth Potential: Currency movements can sometimes reflect underlying economic fundamentals. Investors who carefully analyze these factors can identify currencies with long-term growth potential. Investing in such currencies may lead to substantial gains over time, especially if the economic conditions improve, and the currency strengthens.

In the complex world of international finance, currency fluctuations are a critical consideration for investors. While they introduce risks, such as volatility and exchange rate exposure, they also present opportunities for diversification and strategic investment. Investors who stay informed about currency trends and economic factors can navigate these risks effectively and potentially reap significant rewards.

Best Places to Invest Your Cash Today

You may want to see also

Global Investment Trends: Currency Influence

Currency fluctuations can have a significant impact on global investment trends, influencing the decisions of foreign investors and shaping the dynamics of international markets. When a country's currency value experiences sudden or prolonged volatility, it can create a ripple effect across various sectors and industries. Here's an analysis of how currency movements influence foreign investment:

Risk and Reward Assessment: Foreign investors closely monitor currency fluctuations as they directly impact the profitability and risk associated with their investments. A stronger domestic currency can make foreign assets more expensive, reducing the overall return on investment. For instance, if a foreign investor from the Eurozone invests in a company based in the United States, a stronger US dollar would decrease the value of their return when converted back to Euros. This dynamic encourages investors to carefully evaluate the potential risks and rewards, often leading to a shift in investment strategies.

Portfolio Diversification: Currency volatility often prompts investors to diversify their portfolios across multiple currencies and markets. By spreading investments, investors can mitigate the risks associated with currency fluctuations. For example, an investor might allocate a portion of their portfolio to currencies that are expected to strengthen, thereby reducing potential losses from other investments. This approach allows investors to navigate currency-related risks while maintaining a balanced and resilient investment strategy.

Impact on Emerging Markets: Currency fluctuations can have a more pronounced effect on emerging markets, where foreign investment is crucial for economic development. A sudden depreciation of an emerging market currency can attract foreign investors seeking higher returns, as the value of their investments increases in local currency terms. However, this influx of investment might also lead to concerns about inflation and economic stability, potentially causing a flight of capital if investors perceive the market as risky. Balancing the benefits of increased investment with the need for long-term economic sustainability is a challenge for these markets.

Strategic Investment Timing: Currency movements can provide opportunities for strategic investment timing. Investors may anticipate currency trends and make decisions accordingly. For instance, if an investor expects a currency to weaken, they might delay investments in that market to avoid potential losses. Conversely, a strengthening currency could signal a good time to invest, as the value of returns will be more favorable. This strategic approach requires a deep understanding of market dynamics and currency trends.

In summary, currency fluctuations are a critical factor in global investment decisions, influencing the allocation of capital, risk assessment, and market participation. Foreign investors must stay informed about currency movements to make informed choices, ensuring their investments are aligned with their financial goals and risk tolerance. Understanding these trends is essential for investors and policymakers alike to navigate the complex world of international finance.

Monthly Investment Strategies: Formula for Success

You may want to see also

Currency Policy: Attracting Foreign Capital

Currency fluctuations can significantly impact foreign investment decisions, and understanding this relationship is crucial for policymakers when designing strategies to attract foreign capital. When a country's currency depreciates, it can make the country's exports more competitive in international markets, potentially increasing foreign direct investment (FDI) as businesses seek to take advantage of lower production costs. However, this effect is often temporary, and prolonged depreciation may lead to inflation, which can erode the value of foreign investments and reduce the attractiveness of the country as an investment destination.

On the other hand, a strong currency can have both positive and negative consequences for foreign investment. A strong currency can make imports cheaper, reducing the cost of living for residents but potentially increasing the cost of doing business for foreign investors. This can deter FDI, especially in industries that rely on raw materials or components sourced from abroad. Moreover, a strong currency can also lead to capital outflows as investors seek higher returns in other markets, further reducing the availability of foreign capital.

To attract foreign capital, governments can implement various currency policies. One approach is to maintain a stable exchange rate, which provides a predictable environment for investors. This stability can be achieved through various means, including intervention in the foreign exchange market, setting interest rates, or implementing fiscal policies. For instance, central banks often use monetary policy to influence the value of their currency, aiming to keep it within a target range. This stability encourages investors by reducing the risk associated with currency fluctuations, making it easier to plan and execute business strategies.

Another strategy is to offer incentives that directly address the concerns of foreign investors. For example, a government might provide tax breaks or subsidies to companies that invest in specific sectors or regions, helping to offset the impact of currency movements. Additionally, simplifying regulatory processes and providing clear guidelines can reduce the administrative burden on foreign investors, making the country more attractive.

In summary, currency policy plays a critical role in attracting foreign capital. A country's ability to manage its currency's value and volatility can significantly influence investment decisions. While a depreciating currency may initially attract FDI, prolonged depreciation can lead to inflation and capital outflows. Therefore, policymakers should focus on maintaining currency stability, offering targeted incentives, and creating a favorable business environment to ensure a steady flow of foreign investment.

Is Buying Furniture an Investment or Cash Flow Expense?

You may want to see also

Frequently asked questions

Currency fluctuations can significantly influence foreign investment choices. When a country's currency depreciates, it can make exports more competitive and attract foreign investors seeking higher returns. However, for foreign investors, a weaker currency may also increase the cost of doing business, potentially impacting profitability.

Yes, currency volatility can be a significant deterrent for foreign investors. Unpredictable exchange rate movements can introduce uncertainty and risk, especially for long-term investments. Investors may be hesitant to commit capital if they cannot accurately forecast the value of their investment in the local currency over time.

Currency fluctuations can have a direct impact on the profitability of foreign investments. For investors, a stronger local currency can reduce the value of their investment when converted back to their home currency. Conversely, a weaker currency can lead to higher returns but may also increase operational costs for foreign businesses.

Absolutely. Foreign investors often employ various strategies to manage currency risks. These include using currency hedging techniques, such as forward contracts or options, to lock in exchange rates for future transactions. Diversification across multiple currencies and markets can also help reduce the impact of currency volatility.

Central banks and governments may intervene to stabilize currency fluctuations and create a more favorable environment for foreign investors. This can involve adjusting interest rates, implementing exchange controls, or providing incentives to attract foreign capital. Such measures aim to reduce currency volatility and enhance the attractiveness of a country for international investors.